CFTC approved the emergence of options based on Bitcoin-ETF. What will the new instruments change?

The Commodity Futures Trading Commission (CFTC) has published a formal notice that “paves the way” for the approval of options-based spot Bitcoin-ETFs. According to Bloomberg analyst Eric Balchunas, this is an important step towards the emergence of new derivatives. The latter should make digital assets more accessible to more and more investors.

Bitcoin-ETF-based options are financial derivatives that give traders the right to buy or sell shares of cryptocurrency exchange-traded funds at a predetermined price and timeframe. They allow investors to speculate on Bitcoin price fluctuations, hedge risk, or use more sophisticated investment strategies without having to directly own the cryptocurrency.

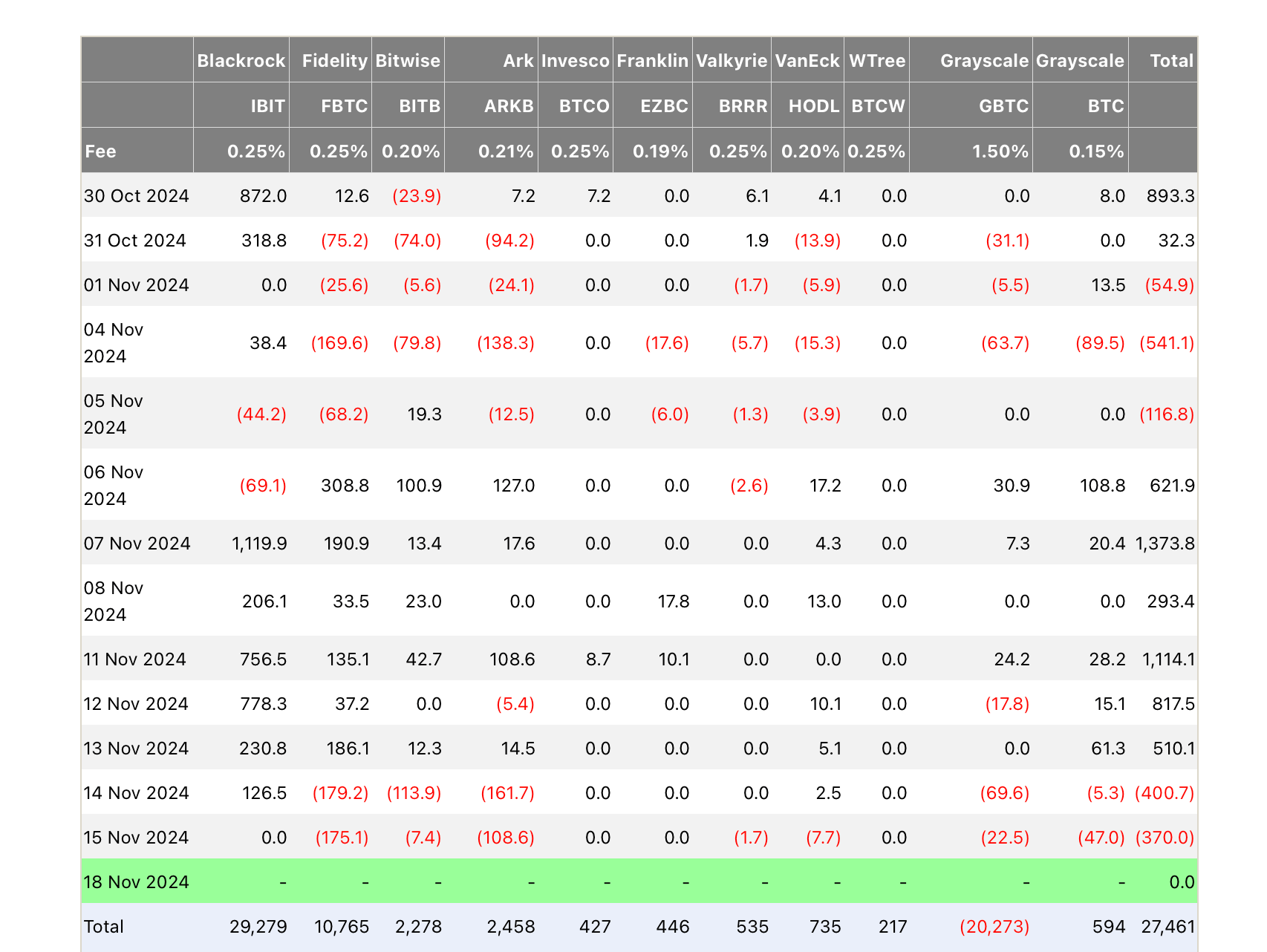

ETFs on the two largest cryptocurrencies in the U.S. themselves aren’t feeling the worst. In particular, Bitcoin exchange-traded funds have recorded net inflows of $27.4 billion since their launch on 11 January 2024.

Performance of Bitcoin-based spot ETFs

Meanwhile, the iShares Bitcoin Trust fund has been the fastest growing product among all ETFs in the market.

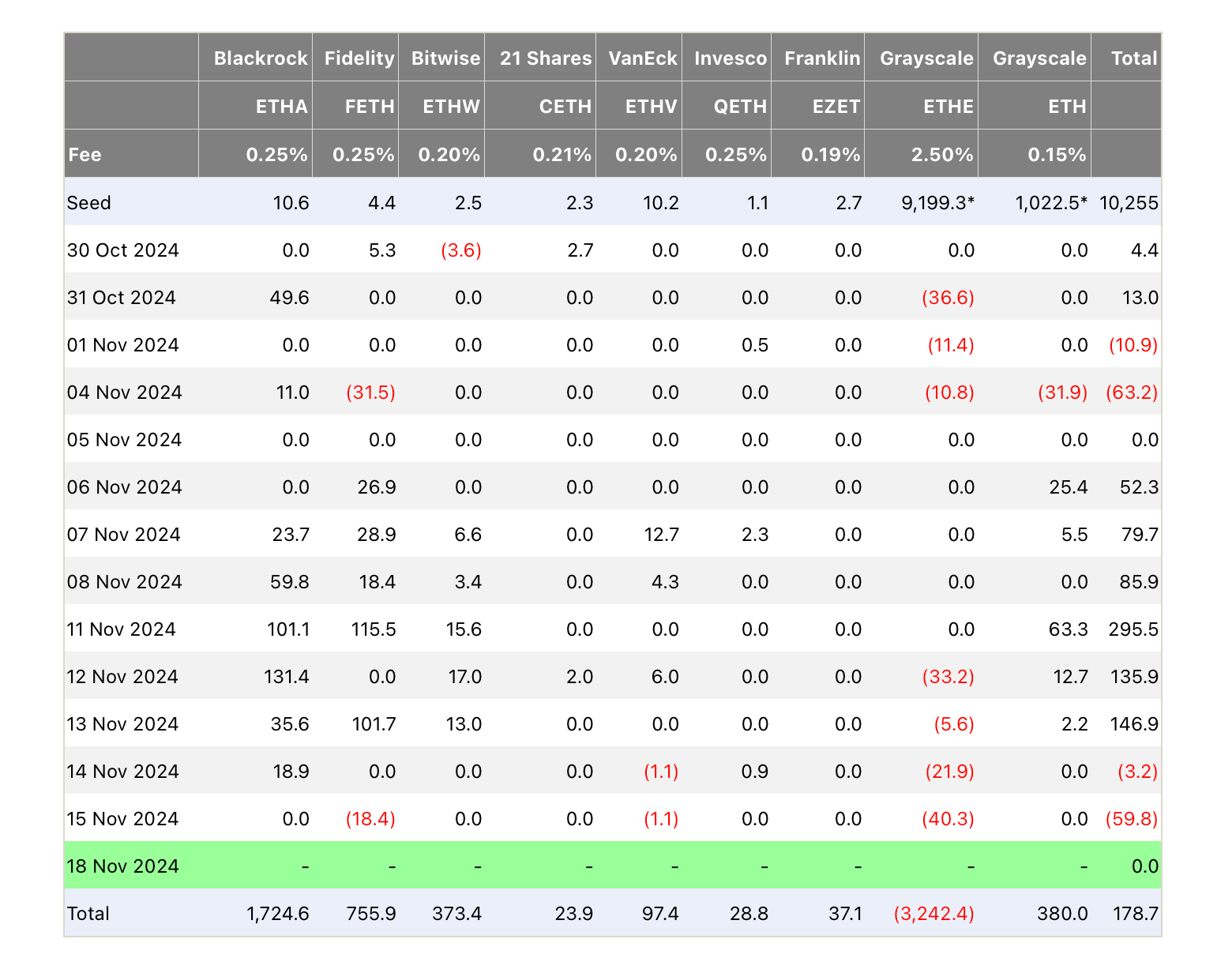

The position of Efirium ETFs is also improving. Thanks to a large influx of capital into them in the first half of November, such funds have finally seen net inflows.

The performance of spot ETFs based on Efirium

As of today, it stands at $178.7 million. Of course, this is a small result compared to the performance of Bitcoin ETFs, but the trend here is positive.

When Bitcoin ETF options will launch

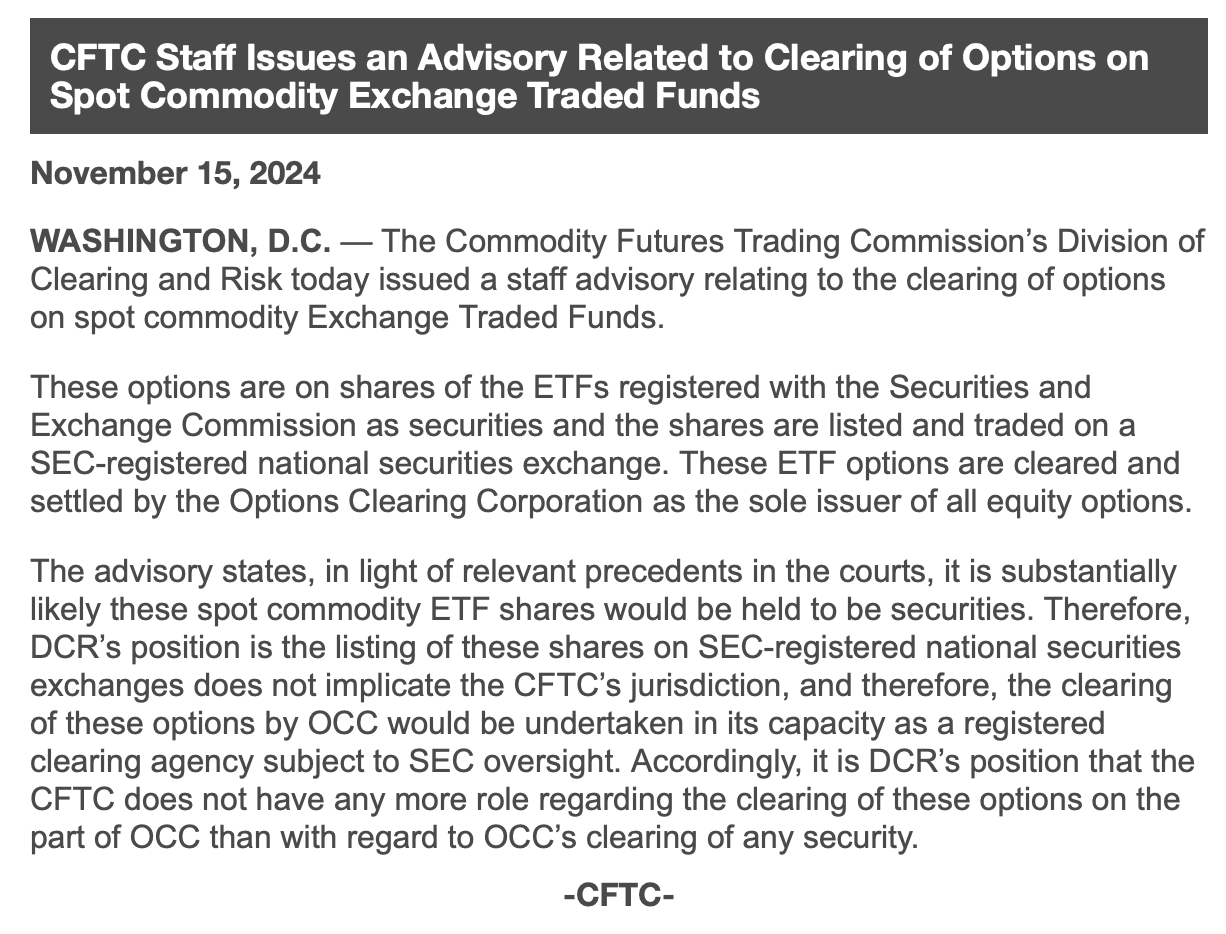

A fresh statement from the Commodity Futures Trading Commission reports the position of the Division of Clearing and Risk (DCR). According to it, “the CFTC no longer has any role with respect to the clearing of these options.” Here is a quote on the matter.

These options apply to shares of ETFs registered with the Securities and Exchange Commission as securities that are listed and traded on an SEC-registered national exchange. Clearing and settlement of these ETF options is performed by the OCC, as the sole issuer of all stock options.

Commodity Futures Trading Commission Notice Regarding Bitcoin ETF Options

According to Cointelegraph’s sources, Balchunas commented on the announcement as follows.

The CFTC just published a notice paving the way for the listing of options based on spot Bitcoin-ETFs. This is the second hurdle they had to overcome after the SEC. Now it’s all about the speed of getting the process processed inside the OCC, and they’re interested in doing that. So there is a possibility that the listing will happen very soon.

Derive founder Nick Forster also commented on the big news.

SoftBank literally pumped up the Nasdaq in 2020/2021 by buying options on several large ETFs.

Endorsement of cryptocurrency-based ETFs

At issue here is the buyout strategy of the SoftBank Vision Fund venture capital fund, which was one of the reasons for the stock index’s surge in the aforementioned time frame.

According to Forster, in the case of crypto, the effect of the emergence of options could be even stronger due to the limited supply of BTC. So in general, the appearance of new instruments should bring only pluses to the market.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Individual traders and investors are also waiting for the list of available spot altcoin ETFs to expand. One of the most desirable instruments in it are exchange-traded funds based on Solana.

And they are “highly likely” to appear on the stock market by the end of 2025. This opinion was shared by Matthew Siegel, head of digital assets at VanEck.

Siegel expects the SEC to approve more instruments as a result of Donald Trump’s victory in the presidential election. Here’s his comment.

We expect the SEC to approve more instruments than it has in the last four years. I think the odds are very good that there will be a Solana-based ETF by the end of next year.

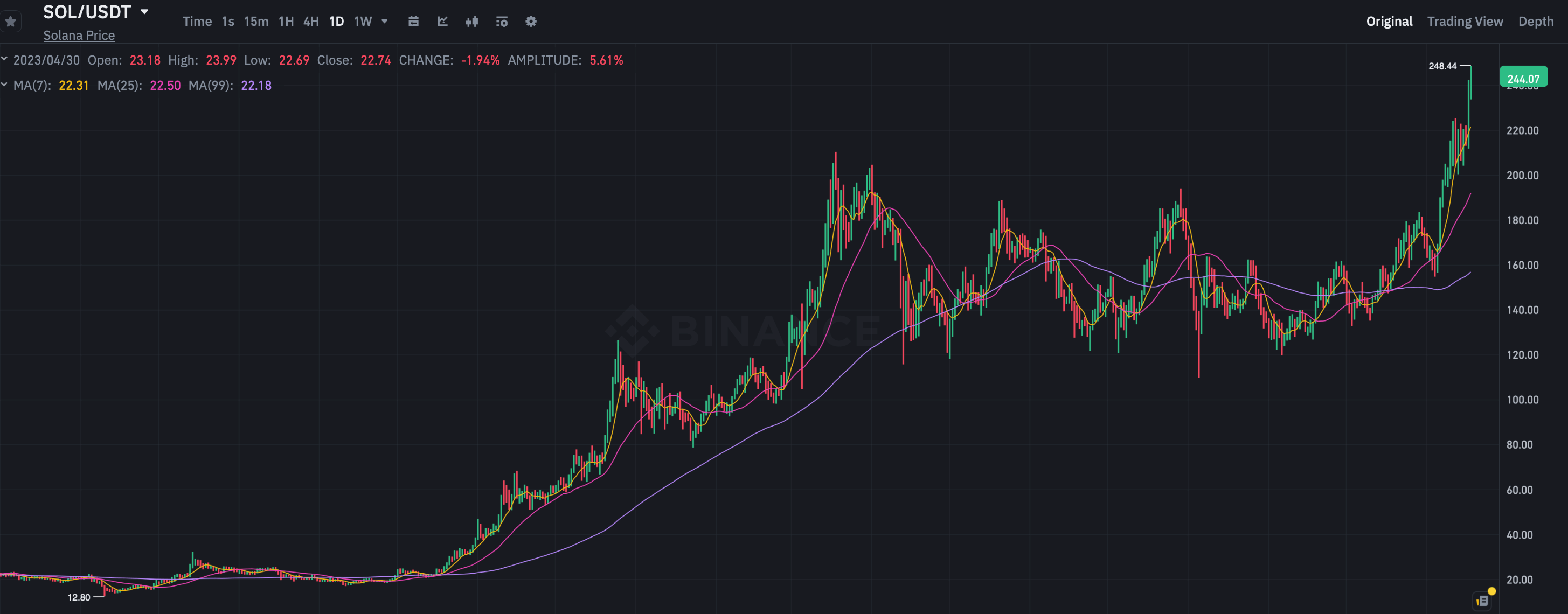

Daily chart of the Solana SOL cryptocurrency price on the Binance exchange

Trump’s victory in the presidential election is a green light for a large selection of cryptocurrency ETFs awaiting regulatory approval to list in the US.

Various asset managers have applied to list exchange-traded funds based on a host of altcoins, including Solana, XRP and Litecoin in 2024. Issuers are also awaiting approval of several planned index ETFs designed to track various baskets of tokens.

These applications were essentially “options on Trump winning” the presidential race, Balchunas said. Still, under President Joe Biden, the SEC took an aggressive stance on digital assets. Now a major reform of the regulator is expected, which will also see a change in SEC leadership represented by Chairman Gary Gensler.

The emergence of options-based spot Bitcoin-ETFs will make cryptocurrencies a much more popular choice among capital holders. Still, they will allow experienced players to use familiar tools, but still interact with the crypto market. And this will definitely have a good effect on the reputation of digital assets.

Look for more interesting things in our crypto chat. In it, we will discuss other important news that affects the course of the current bullrun in the crypto industry.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO KEEP UP TO DATE.