Florida’s chief financial officer expects the state’s crypto portfolio to grow if Trump wins. Why.

The guest of the regular edition of the Squawk Box TV show on CNBC was the head of the Florida Department of Finance, Jimmy Patronis. In the interview, he made several important statements about the potential of crypto. In addition, the official revealed important information: it turns out that the state already owns approximately $800 million in cryptocurrency-related investments.

Patronis had earlier addressed an open letter to Florida State Board of Administration (SBA) Executive Director Chris Spencer. In his message, he described plans to add Bitcoin to the portfolio of assets managed by local pension funds.

According to the expert, digital assets have managed to prove their stability, in connection with which they should be added to the balance of pension funds. In this case, the participants of the latter will receive a bonus in the form of additional profit.

Cryptocurrency investors

At the same time, Jimmy Patronis added that cryptocurrencies are not going anywhere. You can read more about his opinion here.

Which states are investing in crypto?

According to CoinDesk’s sources, the official is actively pushing for the popularisation of cryptocurrencies. And this is partly due to his dislike of central bank digital currency projects, also known by the acronym CBDC. Here’s a comment on that.

We need to be able to hedge against this massive federal government overreach with a centralised currency. I don’t want the government to know that my son went to the grocery shop to buy a bag of Doritos at 2:15 pm in the afternoon. We have to have certain protections in place.

As a reminder, CBDC or central bank digital currency is the centralised equivalent of cryptocurrencies issued and controlled by the government. Such an asset is backed by state reserves for additional stability, but decentralisation is not in the air here. CBDC promises to improve access to financial services and simplify transfers, but increases government control over citizens' finances.

Earlier, Donald Trump also touched on the topic of central bank digital currencies. He noted that if he wins the upcoming US presidential election, such a project will not be launched, because he will use his veto if necessary.

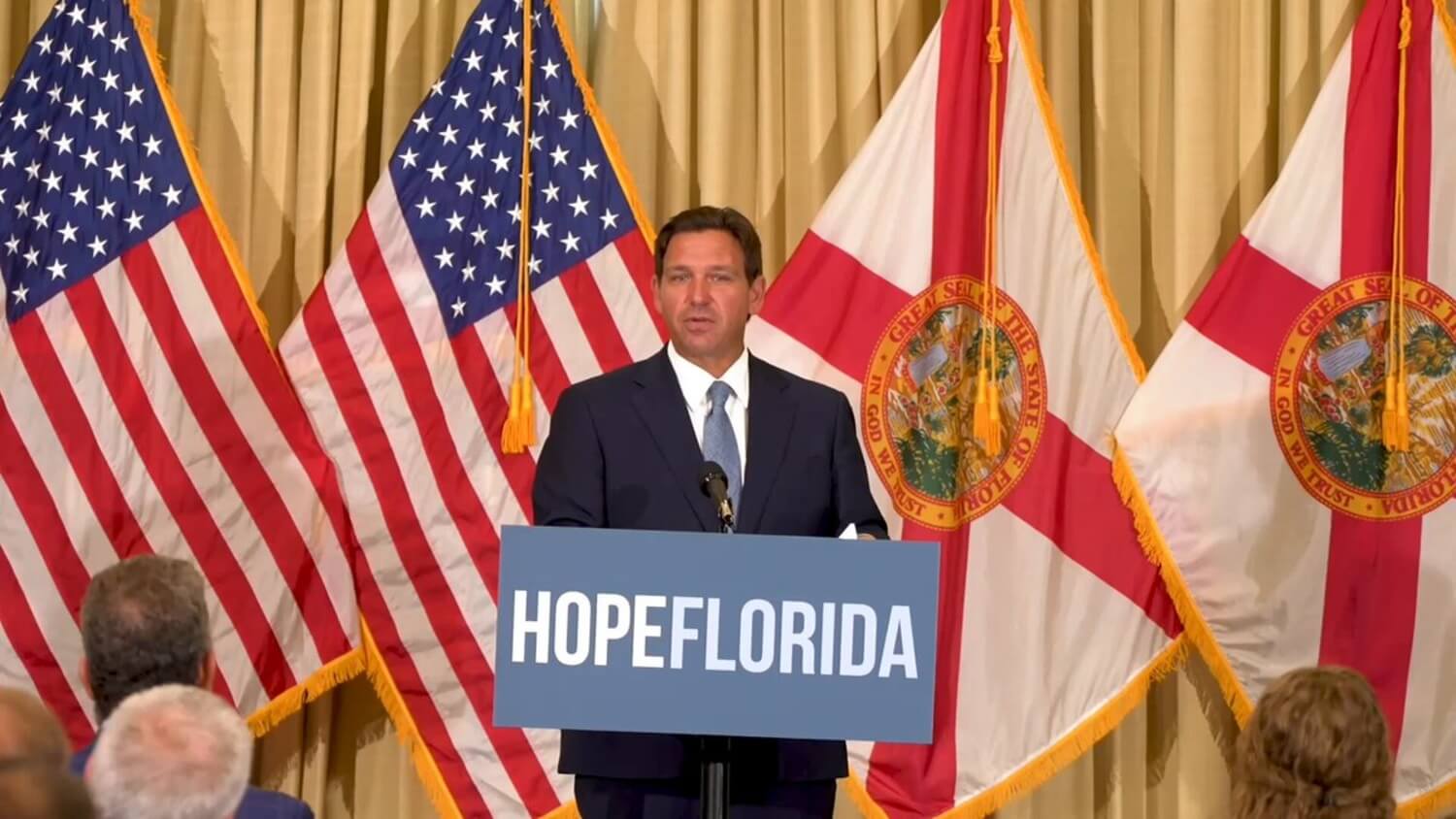

Florida finance chief Jimmy Patronis

From the interview itself, it is not clear to the end what investments the state owns and how they are connected with cryptocurrencies. Most likely, it’s not a matter of directly buying bitcoins for the balance sheet – instead, the state may have allocated funds to purchase shares of Bitcoin-based spot ETFs or securities of cryptocurrency companies like mining giants.

In general, Florida authorities are not the first US government body to invest in cryptocurrency-based financial instruments. The Wisconsin State Investment Board and Jersey City, New Jersey, represent two other similar cases. Specifically, the former indicated back in its May filing that it owns $163 million in shares of spot Bitcoin-ETFs.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Patronis also voiced positive comments towards US presidential candidate Donald Trump. The official believes that if the former president wins the upcoming election, the state’s crypto portfolio will increase significantly in the long run. Here’s his retort, as quoted by The Block.

The Chinese Communist Party is getting more and more involved in the world of cryptocurrencies every day to take control of this emerging industry. Trump has said he will create a presidential advisory council on cryptocurrencies and a national bitcoin “reserve” using crypto currently held by the U.S. government.

Former US President Donald Trump

In 2024, Donald Trump significantly changed his attitude towards cryptocurrencies, actively promoting them as part of his election campaign. For example, in July, Trump took part in a major cryptocurrency conference called Bitcoin 2024.

At this event, he discussed the prospects of Bitcoin and digital assets, and voiced a number of important promises. In particular, Donald is going to fire the current chairman of the Securities Commission, Gary Gensler, who has created a lot of problems for the coin industry on the first day.

One of Trump’s important proposals was the creation of a strategic bitcoin reserve in the US. He announced it in the same month and said he was keen to integrate cryptocurrencies into the national economy.

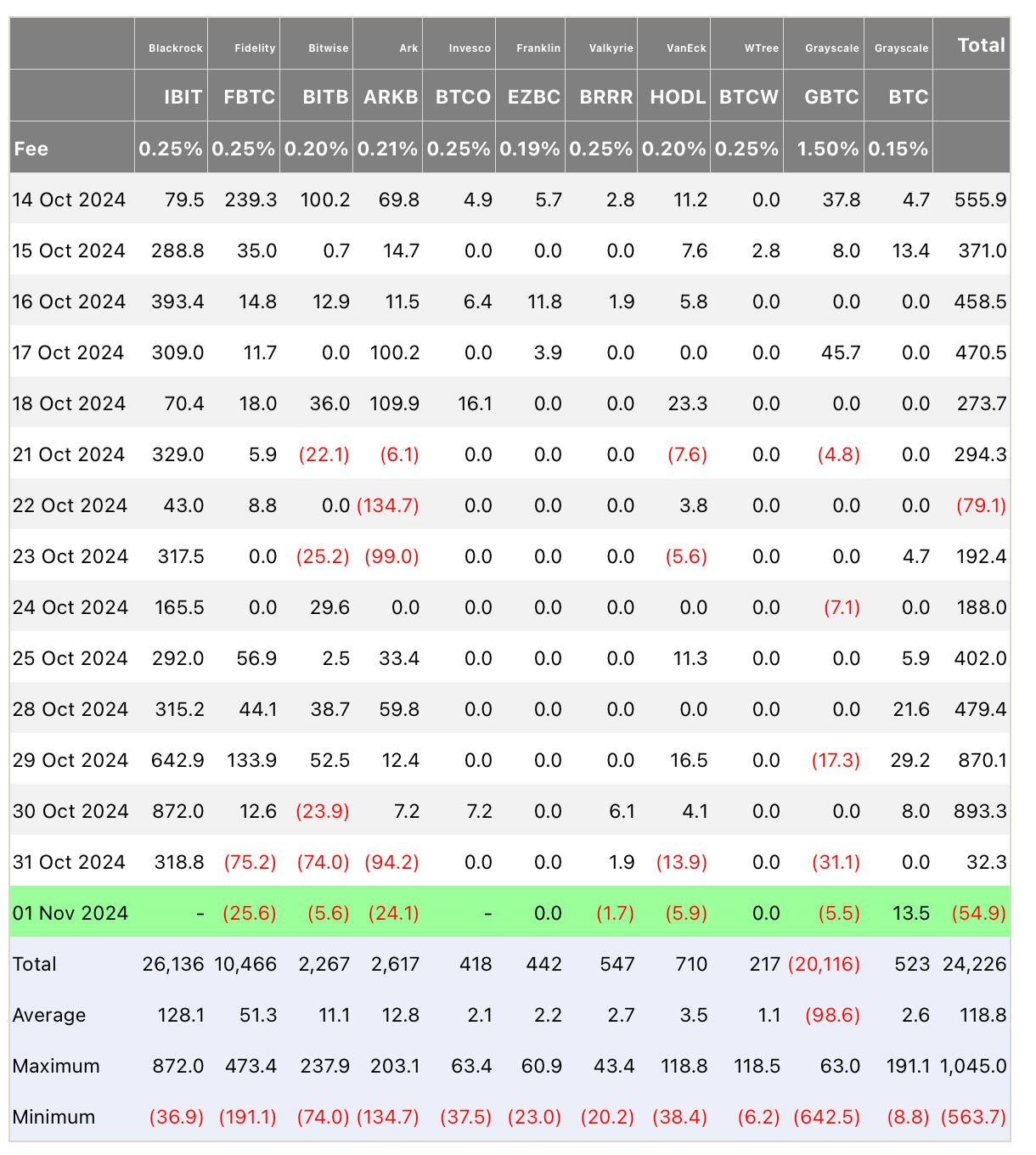

Capital inflows and outflows from spot Bitcoin-ETFs

In addition, Trump, along with his sons Donald Jr. and Eric, launched the crypto project World Liberty Financial from decentralised finance. Its goal is to “make finance great again” by promoting decentralised solutions.

However, the project has already run into problems. The sale of the WLFI token to qualified investors did not even come close to reaching the planned equivalent of $300 million. That’s why this week the representatives of the project lowered the goal to 30 million.

So far, everything goes to the fact that the possible success of Donald Trump in the US presidential election will significantly affect the cryptocurrency industry. The latter will presumably get an adequate regulatory framework and attitude of the authorities. Well, Gary Gensler will go into retirement.

Look for more interesting stuff in our cryptocurrency chat room. Be sure to stop by to keep up to date with the situation on the digital asset market.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO KEEP UP TO DATE.