Florida’s chief financial officer is confident that cryptocurrencies aren’t going anywhere anymore. What are his arguments?

Another guest on CNBC’s Squawk Box was Florida’s Chief Financial Officer Jimmy Patronis. The official is responsible for overseeing the state’s pension funds, and he recently proposed diversifying Americans’ retirement plans by investing some of the funds in Bitcoin. With that in mind, Patronis has publicly asked the executive director of the Florida State Board of Administration (SBA) to do so. He has now commented on his own attitude towards digital assets.

Which organisations are investing in Bitcoin

On CNBC’s broadcast, the official began praising cryptocurrencies. He stated that Bitcoin along with other popular cryptocurrencies will no longer disappear. Therefore, it remains in the interest of pension funds to maximise the profitability of pension plans – including at the expense of BTC.

In the interview, Patronis said that politicians should not ignore the new asset class. Here is his rejoinder on the subject, as quoted by Cointelegraph.

Cryptocurrencies aren’t going anywhere. The market will not shrink, it will continue to grow. I think we’d be foolish if we weren’t prepared to do everything we can to capitalise on the opportunities before us.

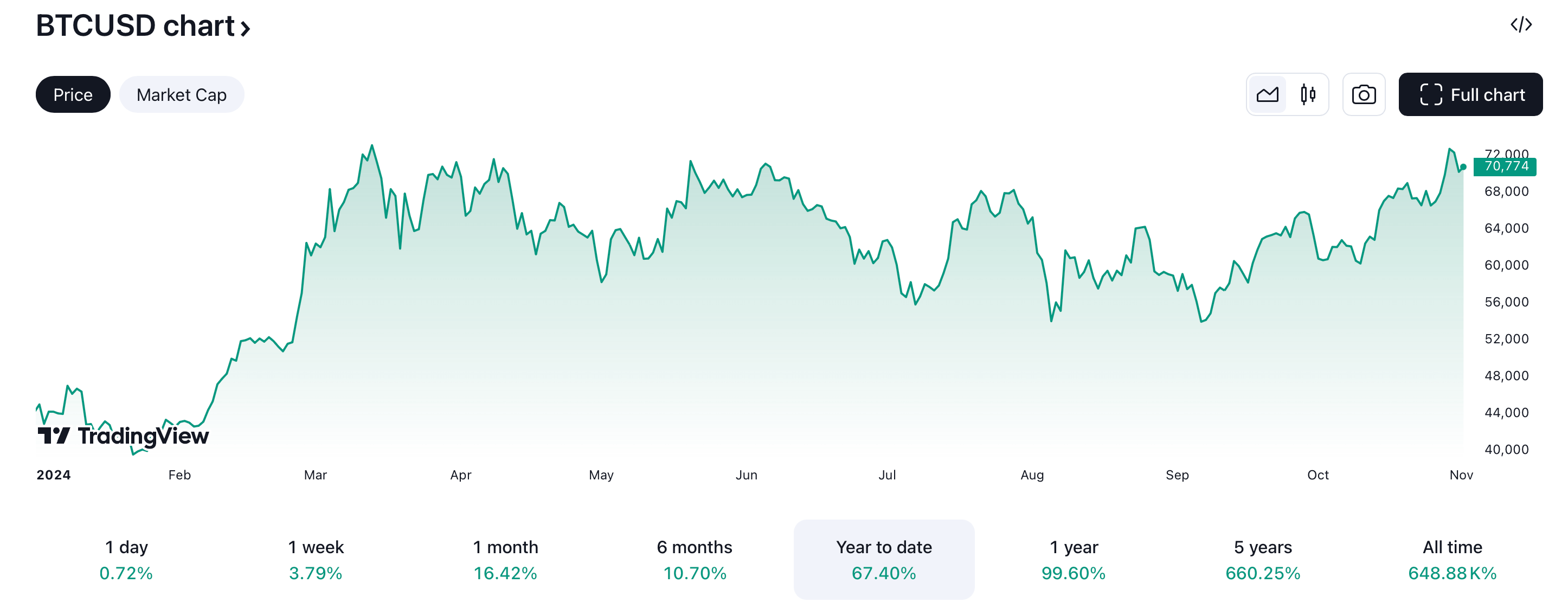

Bitcoin exchange rate changes in 2024

The official also mentioned the decentralised nature of digital assets. It allows Americans to protect their funds from excessive overreach by government agencies.

Patronis emphasised that the United States needs to invest in cryptocurrencies to remain competitive in global markets and to stay ahead of foreign countries, which are already considering diversifying their investments in BTC and other digital assets.

Earlier, US presidential candidate Donald Trump talked about such a thing. In particular, he promised to stop selling cryptocurrencies that were previously confiscated by the US government. This, in turn, will make it possible to create a national reserve of coins - they can then be used to repay part of the national debt of the country, the politician believes.

Former US President Donald Trump

For example, back in 2021, the state pension fund for school teachers in South Korea announced its desire to invest in crypto through exchange-traded funds. This fund is one of the largest institutional investors in the country.

Also, Japan’s Public Pension Investment Fund – the largest public pension fund in the world – previously announced that it was considering placing some of its assets under management in Bitcoin.

😈 MORE INTERESTING STUFF FROM US AT YANDEX.ZEN!

That said, Bitcoin did enter the mainstream this year, meaning it has become globally popular. This is the opinion of Brian Russ, the investment director of 1971 Capital.

In an exclusive interview with Cointelegraph journalists, he spoke about his view of what is happening and the progress of crypto adoption in general. His first observation is the integration of Bitcoin into the traditional financial system.

Wealth and asset management firms will start proving to their clients that if they diversified their investments in Bitcoin or a 60/40 combination of BTC and ETH, it would significantly increase their returns.

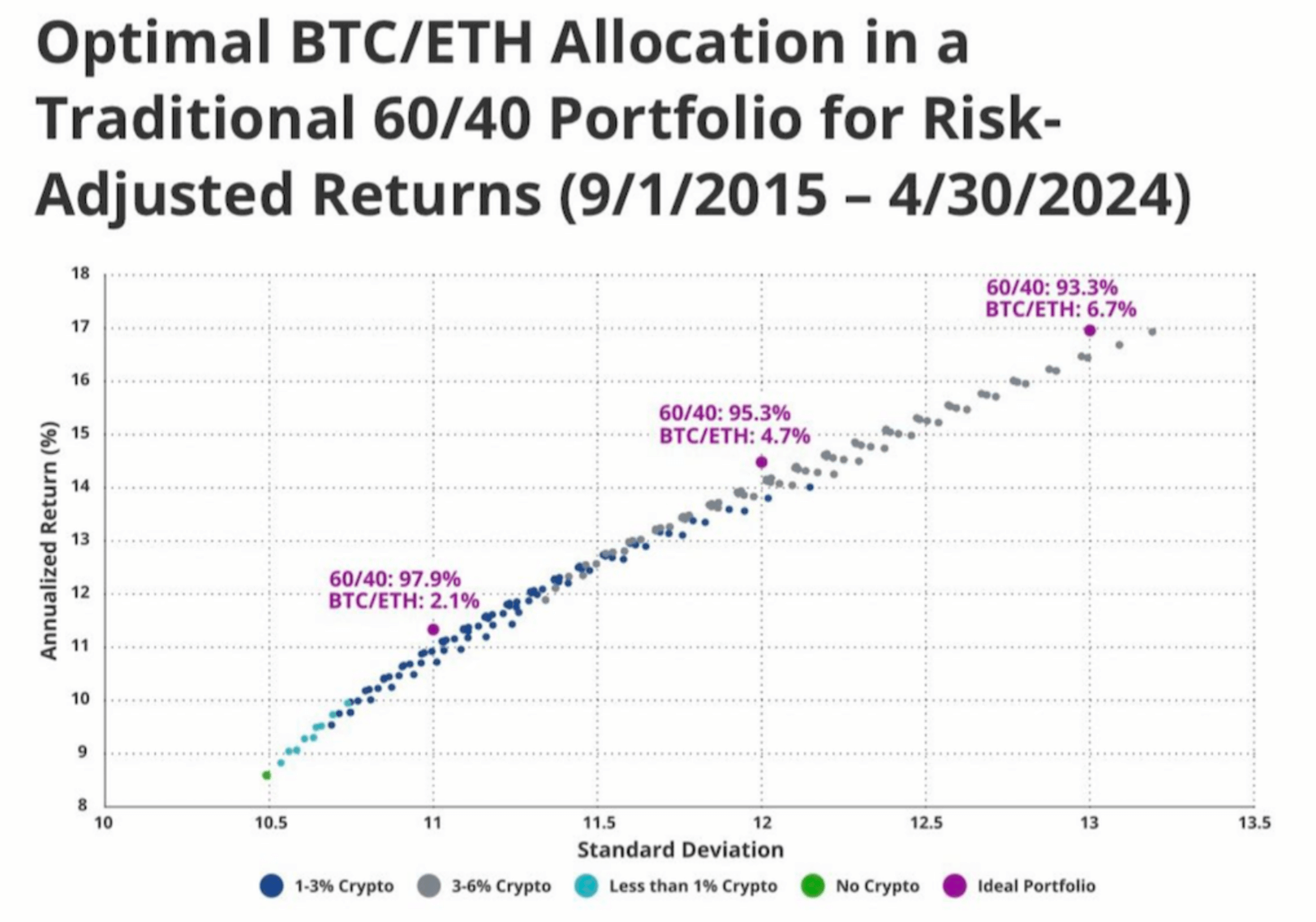

Statistics on the risk allocation of an “ideal” cryptocurrency portfolio

Russ mentioned that VanEck analysts were among the first to think about expanding crypto portfolios for clients. They conducted a study and found out that even small portions of BTC and ETH in investments can significantly raise portfolio returns over the long haul.

They looked at different allocation options and the maximum allocation was 7 per cent. So if you were to allocate 60 per cent of your money to stocks, 33 per cent to bonds and 7 per cent to a combination of Bitcoin and Etherium, you would get almost 2.5 times the portfolio’s profitability.

In addition, the expert touched on the topic of the upcoming US elections, which will be held next Tuesday. According to him, this event alone will not serve as one of the catalysts for the growth of Bitcoin’s value above the level of 100 thousand dollars. Here’s his quote.

So I think that if the outcome of the election was the determining factor, we would see the price breakout occur now rather than on the 5th or 6th of November. However, it could be something that follows the election. It could be the policies of the new administration or it could be something else.

U.S. Vice President Kamala Harris

Russ also predicts an acceleration in the future growth of the ETH exchange rate. In his opinion, the largest altcoin is still an undervalued market asset. A number of fundamental factors are in favour of its growth, including a huge ecosystem, active developers and a large community.

Benchmark analyst Mark Palmer has no doubts about the crypto industry’s prospects. He supported MicroStrategy’s fresh decision to raise $42 billion to buy Bitcoin over the next three years, which we covered in a separate article.

He said Bitcoin will be increasingly in demand from big investors. Here’s the comment.

More and more investors are now thinking about investments that can generate returns in the face of further currency depreciation, which could continue in the US regardless of the outcome of the election.

We can see that this concern is based on the belief that the country will have to continue to cover large budget deficits. This was one of the reasons for the recent rise in Bitcoin’s value. In addition, we believe that this problem will only fuel institutional investors’ interest in BTC and related assets.

Cryptocurrency investors during the bullrun

Comments like these from top state officials are further evidence of the growing popularity of Bitcoin and other cryptocurrencies. And as spot ETFs on BTC continue to attract huge sums, sooner or later pension funds will also get involved with digital assets. And given the scale of their activities, crypto investors will clearly feel it.

Look for more interesting things in our crypto chat room. Be sure to check it out to keep abreast of the situation on the digital asset market.

SUBSCRIBE TO OUR CHANNEL ON TELEGRAM TO KEEP UP TO DATE.