Major investors are testing Bitcoin-based instruments. What does this say about their interest in cryptocurrencies?

It’s been a little over half of November, and this month has already been hailed as the best month in the history of Bitcoin futures trading. These instruments were launched on the Chicago Mercantile Exchange (CME) back in 2017. And now its analysts have stated that there are serious changes in the dynamics of trading, which allow us to draw certain positive conclusions. The situation tentatively indicates the emergence of more particularly large players, meaning that so-called institutional players are testing the ground to inject capital into the coin industry.

There are more and more reasons for investors to get involved with cryptocurrencies. For example, Punchbowl News sources reported last night that newly elected US President Donald Trump plans to nominate Howard Lutnick as Secretary of Commerce.

Cantor Fitzgerald executive Howard Lutnick on CNBC

We are talking about the current head of Cantor Fitzgerald, who has repeatedly spoken out in favour of the digital asset industry and highlighted the fundamental advantages of Bitcoin. For example, in September, he spoke about the desire of many large companies to get involved with crypto while highlighting the key obstacles to doing so.

Of course, such a person in the position of Secretary of Commerce will have a good effect on the overall situation in the coin industry.

Who is investing in cryptocurrencies?

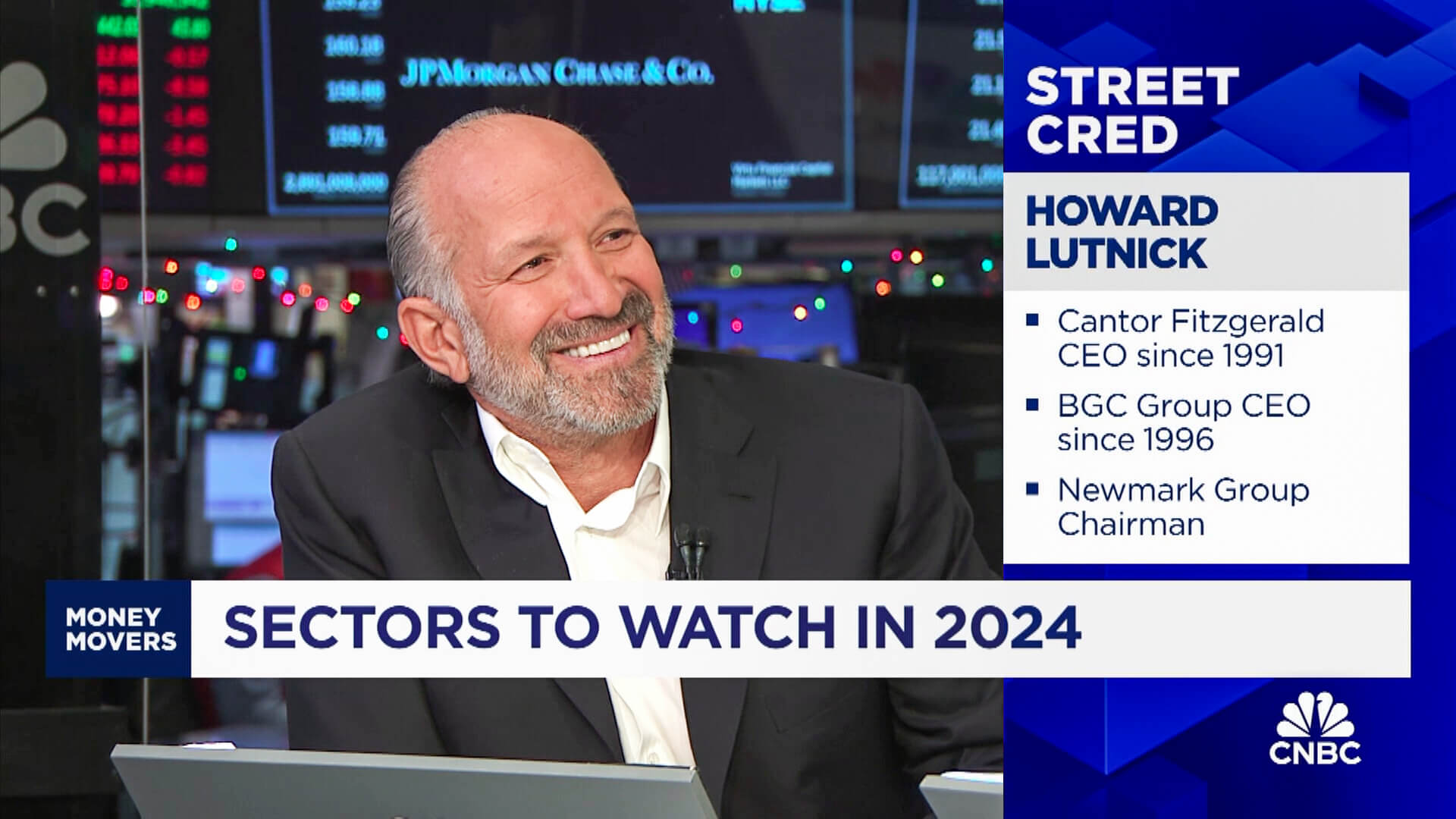

In an interview with Blockworks reporters, Gio Vicioso, head of digital assets at the CME, noted that futures contract transaction volumes on the platform are hitting the $10 billion per day mark. Here’s a comment on the matter.

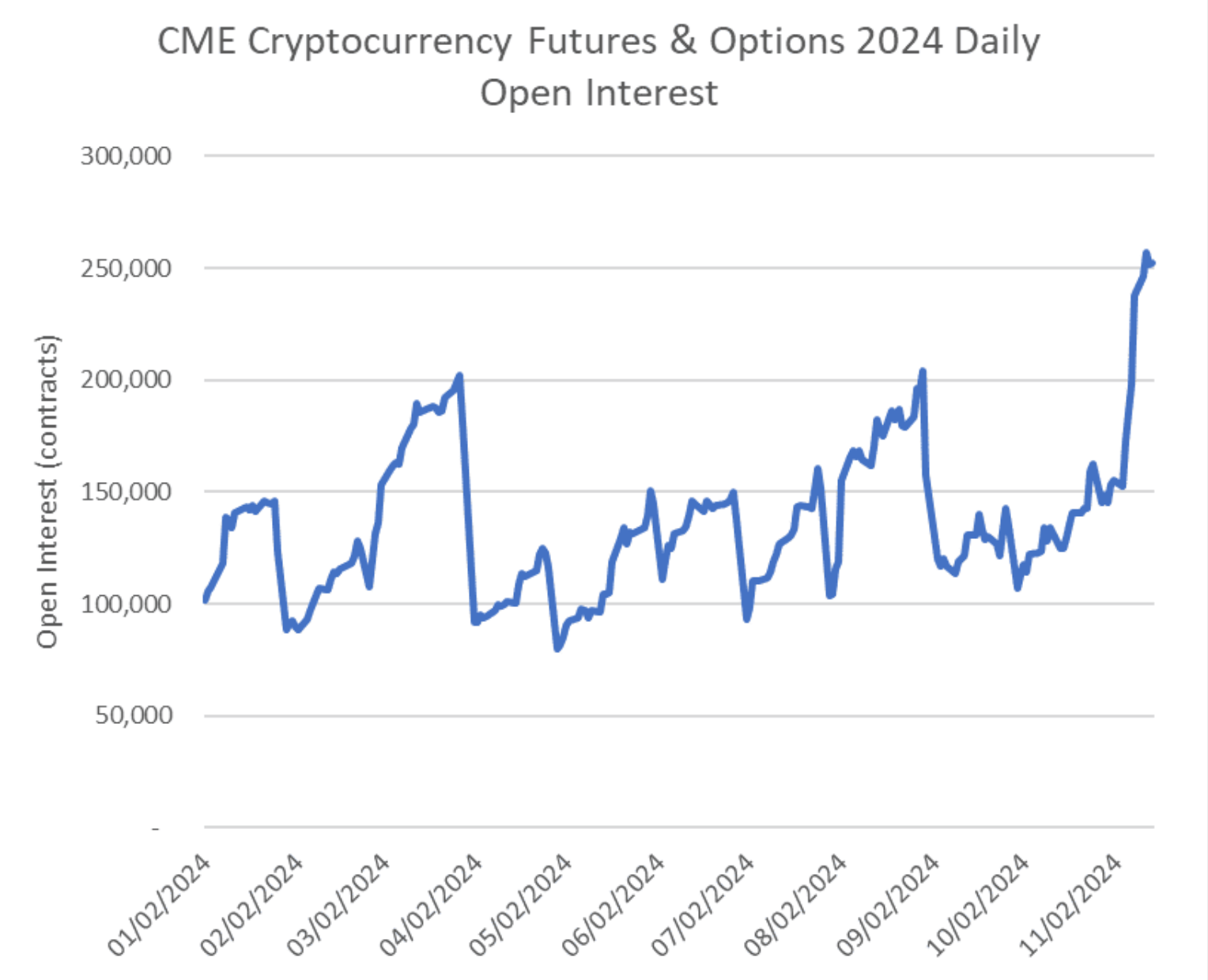

If we compare November of this year with last year, the volume and number of futures contracts have grown more than five times. In addition, we are seeing growth and new records in the volume of open positions, where November is also a record month with an average result of more than 166 thousand contracts. This is 60 per cent more than the October result and more than three times the November 2023 result.

CME trading statistics after the U.S. election

CME’s large Bitcoin-based contracts are getting so large that investors – mostly regular or so-called retail investors – are starting to get into micro-contracts. The analyst continues.

We are now seeing an increase in transaction volume with our microcontracts, with the figure topping a billion dollars a day in the last couple of weeks.

Vicioso also noted an increase in activity in microcontracts relative to large contracts. This is indicative of a general interest in digital asset-based products.

Over the last few trading sessions, we’ve seen micro contracts now make up about 15 per cent of large Bitcoin contracts. We’ve really seen growth across the board.

Changes in the volume of open positions on the CME

The composition of active participants is heterogeneous, Vicioso noted. In particular, there is a fairly even distribution of individual and institutional buyers in microcontracts, as such instruments are easier to work with in terms of capital management. In this case, large players can test new strategies with digital assets, which is what is happening right now.

On the back of such performance, there has been an increase in the volatility of both Efirium and Bitcoin. Vicioso said that this is a “normal phenomenon” and it is not a “serious concern.”

However, the expert noted that the previously observed momentum in Bitcoin has continued throughout this year. It looks like the current trend will become the market narrative for 2025 as well.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

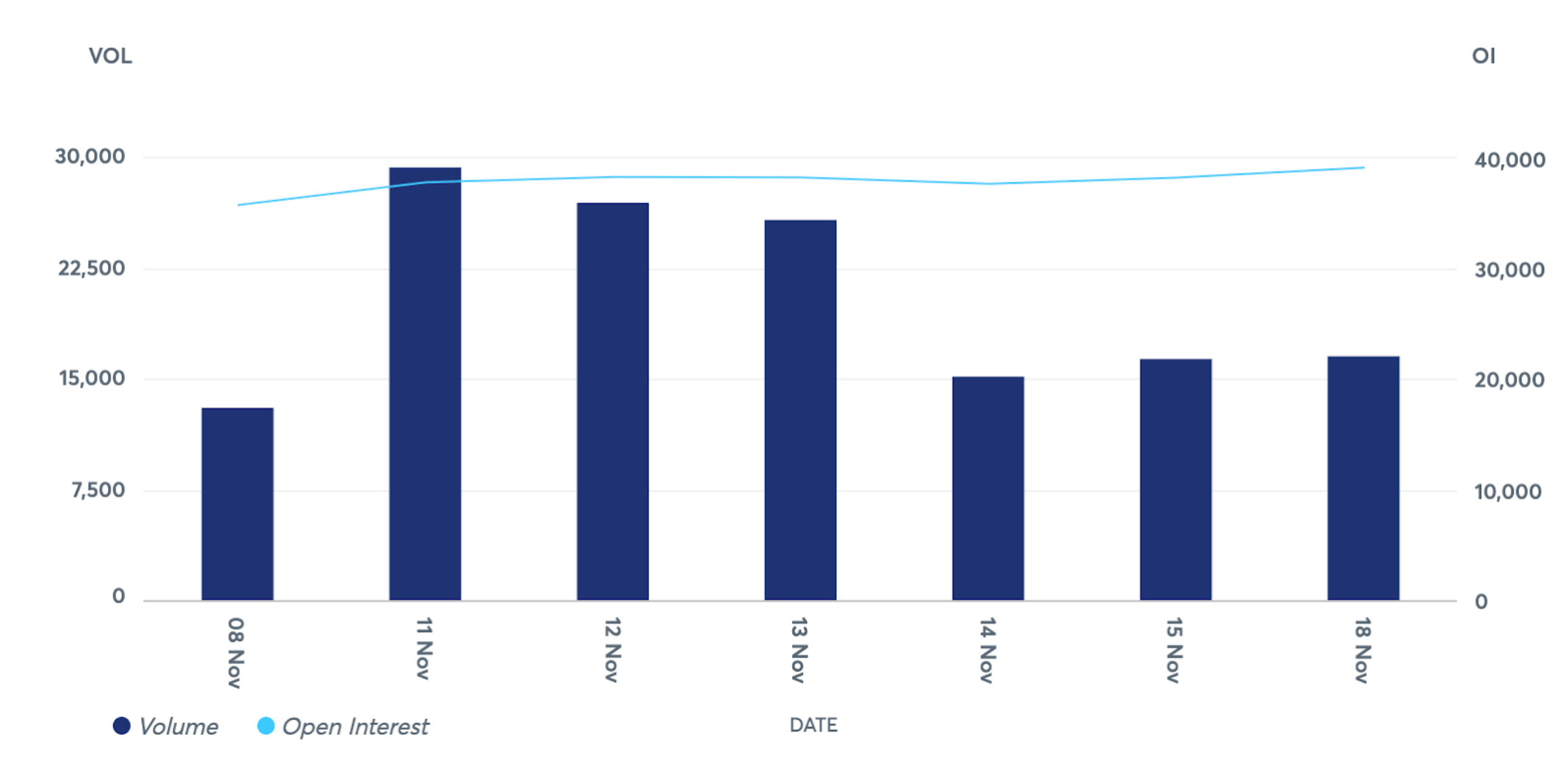

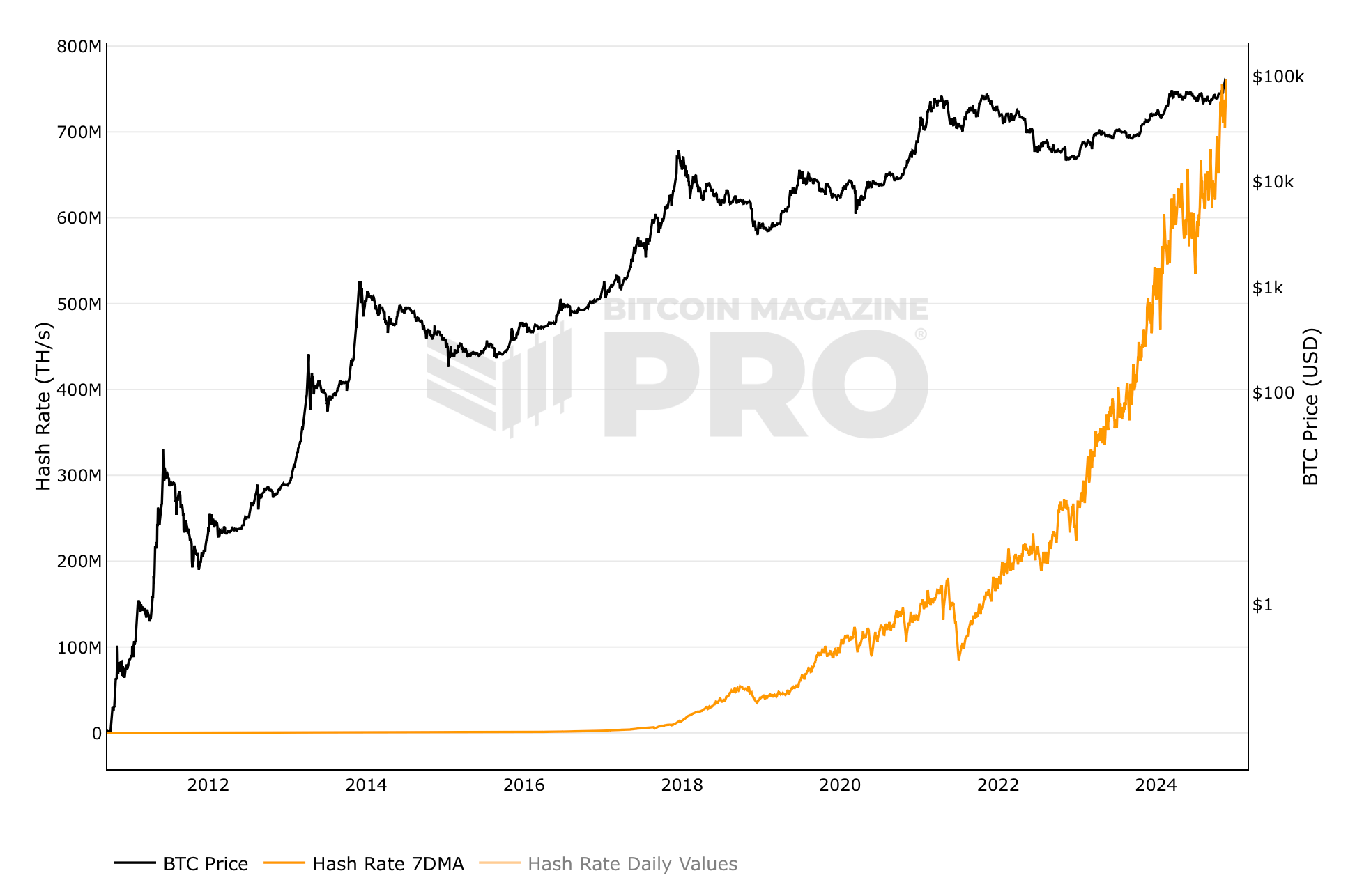

The growth of crypto-related indicators is also noted in a fresh report from analysts at JPMorgan, Coindesk reported. Experts of the banking giant said about the improvement of the situation in the field of Bitcoin mining in November. In particular, we are talking about the growth of the so-called hash price – here’s the cue.

The hash price, or a measure of a miner’s profit per unit of processing power, has risen 29 per cent since the end of October as the rise in the value of BTC outpaced the network’s hash rate and transaction fees increased as a percentage of the reward per block.

In other words, recent weeks have been unambiguously positive for ASIC miner owners. Still, the rate of the first cryptocurrency increased more actively than the overall hash rate. Accordingly, the complexity of BTC mining did not grow as fast, which gave miners the opportunity to earn more in almost the same market conditions.

Global Bitcoin network hashrate growth

The total capitalisation of mining stocks under the bank’s radar rose by 33 per cent or about $8 billion. This has happened in the period since the beginning of the month thanks to high investor optimism following the election.

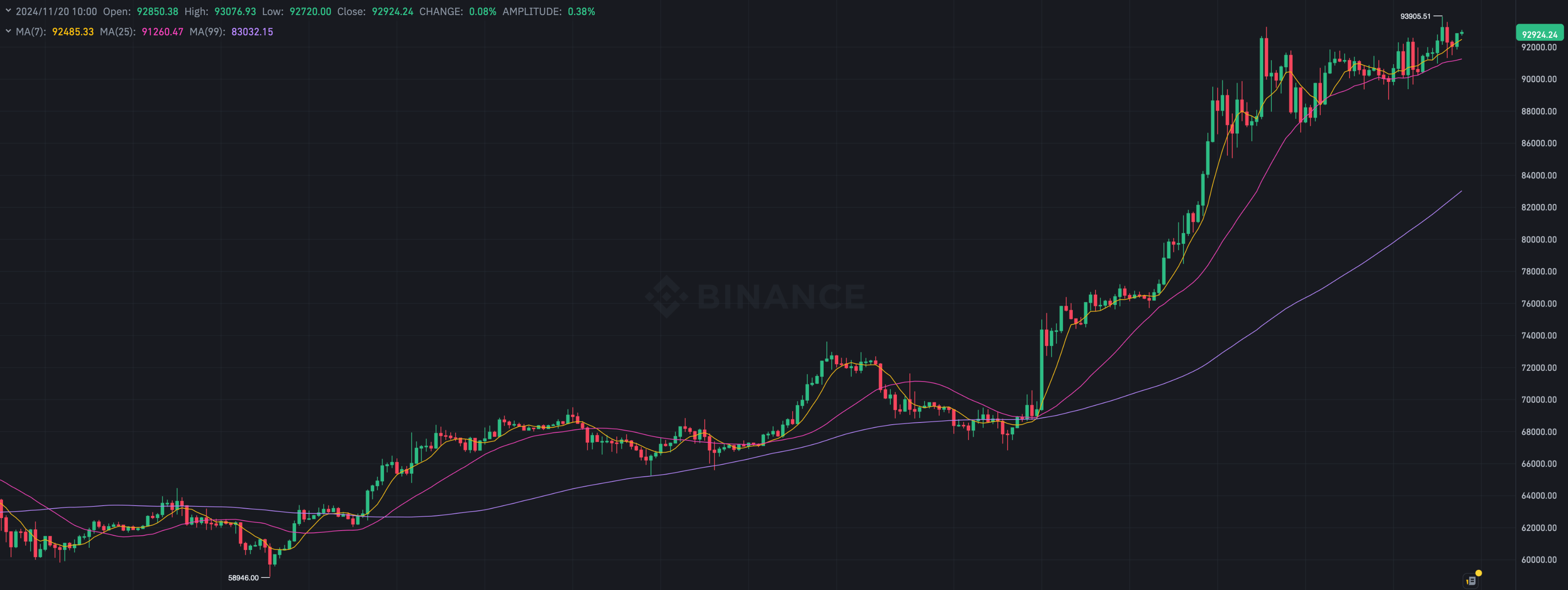

In particular, the value of Bitcoin increased by around 30 per cent to new all-time highs following Donald Trump’s victory in the US presidential election earlier this month.

A four-hour chart of the Bitcoin exchange rate on the Binance exchange

Meanwhile, the network’s hashrate has increased by 2 per cent since the beginning of the month to an average of 718 exashells per second. In general, the share of fourteen American mining companies from the corresponding list of the bank accounts for about 28 per cent of the computing power of the network of the main cryptocurrency. And their share of the blockchain’s total hashrate remains at an all-time high.

So far, everything points to the fact that major players in the financial markets are already interested in digital assets. This could be due to the victory of Donald Trump in the US presidential election, who has repeatedly promised to protect this niche from inadequate regulators. And while transaction volumes are still relatively small given the size of their capital, this is sure to change over time.

Look for more interesting things in our cryptocurrency chat room. Be sure to check it out to keep up to date with the current situation on the digital asset market.

SUBSCRIBE TO OUR CHANNEL ON TELEGRAM TO KEEP UP TO DATE.