Michael Saylor of MicroStrategy doesn’t believe in Bitcoin’s collapse to 60k. What does he expect from the cryptocurrency?

On Wednesday, BTC set the current exchange rate high at $93,265. The jump of the cryptocurrency was very sharp: in particular, at the end of Monday 11 November, the coin grew by more than 8 thousand, which was its best result in history in dollar terms. Therefore, some analysts are waiting for a market drawdown that will allow the market to cool down. However, MicroStrategy co-founder Michael Saylor does not think that we are in for a major collapse.

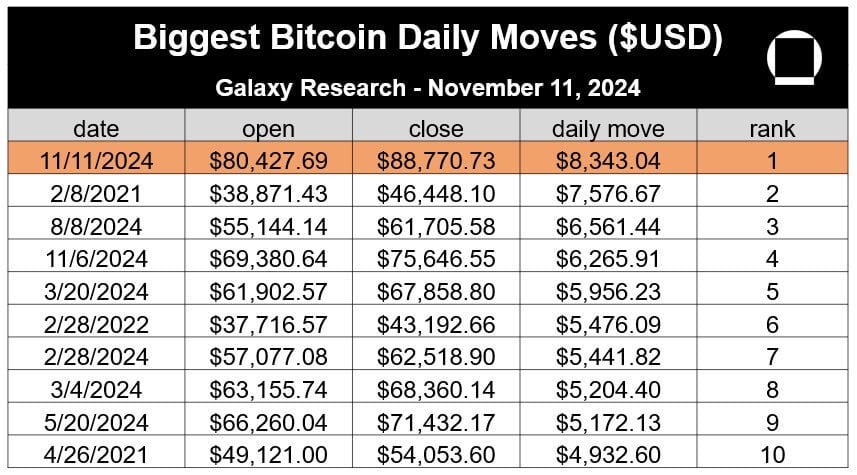

Bitcoin showed its biggest growth on Monday, but this is not the only such achievement of the cryptocurrency in 2024.

Ranking of the biggest jumps in Bitcoin’s exchange rate overnight in dollars

As you can see, the third place in the ranking falls on 8 August, during which the coin rose in price by $6.5 thousand dollars. In total, in the top ten results of BTC as many as seven positions are occupied by 2024. Which means that what’s happening in the digital asset industry right now is really exciting.

Despite this, large investors continue to invest in digital asset products.

As we learned today, Goldman Sachs bank has markedly increased its investment in shares of spot Bitcoin-ETFs. At the end of the third quarter, the financial giant held $710 million in these instruments.

Goldman Sachs bank logo

Among them are 12.7 million shares of BlackRock’s iShares Bitcoin Trust fund iShares Bitcoin Trust for 461 million, making the bank the second largest holder of this product.

And IBIT’s total shares rose 83 per cent in the third quarter compared to the second quarter’s total.

Will Bitcoin’s exchange rate fall?

This week, Michael Saylor said he was preparing for a party to celebrate Bitcoin’s rise to $100,000. Then on CNBC, the MicroStrategy co-founder confirmed that he doesn’t expect the first cryptocurrency to collapse appreciably.

Michael Saylor’s tweet about getting ready to party over Bitcoin’s rise to $100k

Here’s his comment on the matter, as quoted by Cointelegraph.

I don’t think Bitcoin is going to 60k, I don’t think it’s going to be worth 30k. In my opinion, the cryptocurrency will rise in price from current levels.

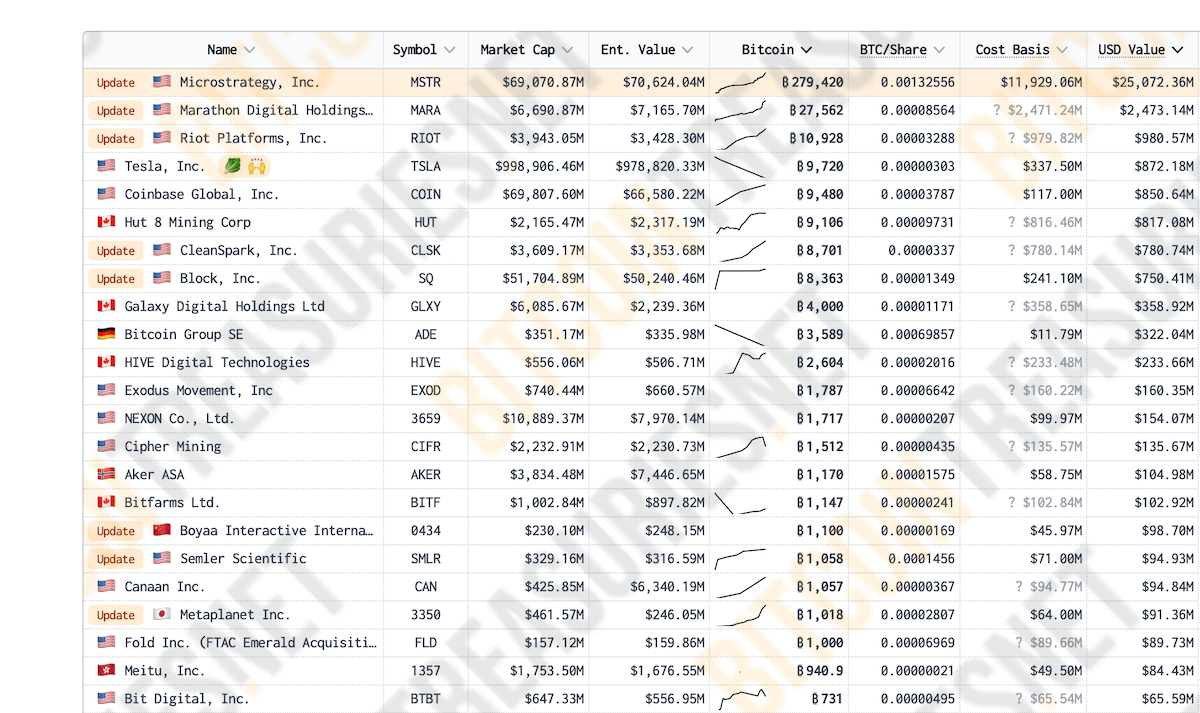

MicroStrategy is still the largest holder of bitcoins among publicly traded companies. As of today, the giant holds 279,420 BTC equivalent to $25 billion.

And the coin purchases continue. On Monday 11 November, the company announced the acquisition of an additional 27,200 coins for 2.03 billion.

Ranking of publicly traded companies by number of bitcoins purchased

According to Saylor, given the results of the US election in early November, the digital asset market is essentially no longer threatened. Still, they were won by Republicans, who predominantly oppose the Democrats’ policy towards crypto.

Donald Trump’s victory has finally determined the future of cryptocurrency and Bitcoin in the United States. In the short term, I don’t see any threats.

I’m planning a $100,000 party. I think it will most likely be held at my house on New Year’s Eve. Overall, it would surprise me if we don’t break that level as early as November or December.

Saylor also didn’t forget about the imminent replacement of SEC Chairman Gary Gensler, who is remembered for fighting the digital asset industry. According to him, the new SEC head will play the most important role in the crypto industry.

This is certainly a strong signal in favour of digital assets and a huge step forward for the crypto industry. We are in for a wave of policies in favour of coins, the formation of a clear framework for digital assets and finally the end of the war against cryptocurrencies.

Towards the end, Michael commented on the prospect of Bitcoin becoming a strategic asset for the US. We are talking about a bill that, if approved, would obligate the government to purchase one million BTC over five years, which translates to about 5 per cent of the current number of coins in circulation.

Michael Sailor at a MicroStrategy presentation

Saylor considers such a prospect “the best deal of the 21st century.” Here’s his comment.

If we don’t pass this bill and just keep existing bitcoins on the books, their value to the public will be $3 trillion. If the bill is passed in its current form, it would benefit the US to the tune of 16 trillion over 21 years.

If politicians decide to double the scale and double the reserves, the benefit would be 30 trillion.

Consensys CEO Joseph Lubin also shared positivity because of Donald Trump’s victory. We are talking about the company, which among other things is responsible for the development of the popular cryptocurrency wallet MetaMask.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Since the SEC with a new head is unlikely to cause problems for the coin niche on the same scale, it will “save the industry hundreds of millions of dollars,” Joe believes.

Here’s his quote.

My prediction is that they will find a way to resolve the cases in a way that doesn’t look awkward – either getting them dismissed or settling them. Maybe not all cases and not all aspects, but I have a feeling our industry will save hundreds of millions of dollars in the future.

Prior to this, Consensys announced the layoff of 20 percent of its employees. And the reason for such changes, among other things, was pressure from the Securities Commission, which led to litigation.

ConsenSys co-founder Joe Lubin

Judging by the behaviour of the coin market, cryptocurrencies have now moved to a more obvious stage of growth. As experienced traders point out, collapses in such periods are literally made for buying, so Michael Saylor's comment seems logical. However, everyone still has to make financial decisions on their own and not rely on other people's quotes.

.

Want to keep up with other interesting news? Join our crypto chat.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.