Michael Saylor will try to convince Microsoft’s board of directors to buy Bitcoin. What will it do?

Microsoft’s board of directors is likely to get into a lecture with MicroStrategy’s executive chairman Michael Saylor. Still, during a recent online conference on Twitter, Saylor said that he is ready to tell the tech giant’s executives about the fundamental benefits of digital assets and primarily Bitcoin. Such a thing would be a very important event given the company’s executives’ approaching vote on coin purchases.

MicroStrategy continues to be the largest bitcoin holder among publicly traded companies. On Monday, the giant announced the purchase of 51,780 bitcoins for $4.6 billion.

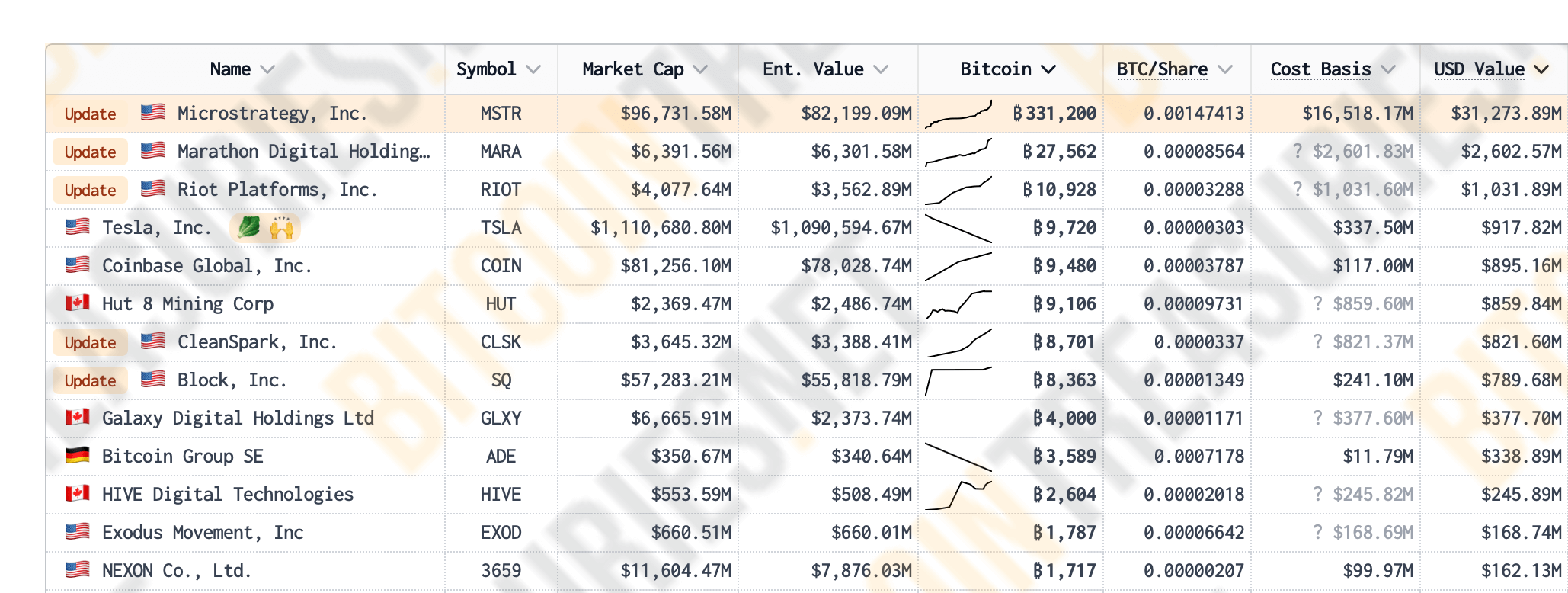

Ranking of public companies by number of accumulated bitcoins

Thus the total amount of coins at the disposal of the giant is 331,200 bitcoins. 16.5 billion dollars were invested in them, while today these BTC are valued at 31.2 billion.

At the same time, the company plans to buy crypto further. Today it became known that MicroStrategy will raise $2.6 billion through convertible bonds instead of the previously announced $1.75 billion.

The money will be used for bitcoin purchases and general business expenses.

Will Microsoft buy Bitcoin?

At the end of October, it became known that the Microsoft board of directors will vote as early as 10 December.

On it, among other items, will consider the feasibility of acquiring BTC on the balance sheet of the company. And one of the triggers for thinking about digital assets in Microsoft’s management circles was the success of MicroStrategy in cryptocurrency investments.

It is worth noting that the board of directors recommended voting against the proposal. Accordingly, the chances of allocating capital for the acquisition of BTC remain quite low. However, since Saylor is going to allocate his own time for the event, it means that he considers it possible to change the point of view of the company's management.

MicroStrategy co-founder Michael Saylor

During a fresh Spaces conference tweet from investment giant VanEck, Michael Saylor made an important announcement. Its contents are cited by Cointelegraph.

The activist who prepared this proposal contacted me to present it to the board. I’ve agreed to make a three-minute presentation – that’s all I’m allowed. And I’m going to present it to the board.

Saylor added that he had previously offered to meet Microsoft CEO Satya Nadella “confidentially” to discuss the topic. However, the offer was never accepted. Michael continues.

So you’ll see me describe the benefits of this solution for Microsoft during my presentation to the board.

Ranking companies and assets by capitalisation

Along with this, Saylor believes that active involvement in the crypto industry should be a must for most large companies. Still, Bitcoin is an excellent tool for portfolio diversification, which is already used in the basis of spot ETFs on U.S. exchanges.

In this environment, ignoring a digital asset is not a good idea. Especially given its limited supply of 21 million coins and fixed issuance rate, which on top of that is reduced by 50 per cent every four years.

I think it’s not a bad idea to include crypto buying on every company’s radar. It should be on the agenda of Berkshire Hathaway, Apple, Google and Meta because they all have huge cash reserves, all while burning shareholder value.

According to Saylor, 98.5 per cent of Microsoft’s enterprise value in securities is dependent on quarterly earnings, while 1.5 per cent comes from tangible assets. He continues.

This would be a much more stable and less risky stock if half of the enterprise value was based on tangible assets or BTC-like properties. So I think that’s a great argument. I think shareholders should consider it.

Microsoft executive Satya Nadella

As we noted, Microsoft’s board of directors recommended voting against the initiative because company representatives are already “evaluating a wide range of assets for investment,” including Bitcoin. However, Ethan Peck, deputy director of NCPPR’s Free Enterprise Project, noted that the proposal could put Microsoft in a difficult position if it makes an appropriate assessment and decides not to invest in the asset.

Microsoft’s board of directors currently consists of twelve members, including Nadella. The latter is also the chairman from The Walt Disney Company, Citigroup, Wells Fargo and GSK.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Meanwhile, the Bitcoin exchange rate continues to update its all-time high: today the cryptocurrency took the level of 94 thousand dollars for the first time in its history.

At the same time, trading in options based on the spot Bitcoin-ETF from BlackRock called iShares Bitcoin Trust and ticker IBIT started on Tuesday. The respective instrument reached a daily trading volume in the $1.9 billion zone, as stated by Bloomberg analyst James Seyffarth.

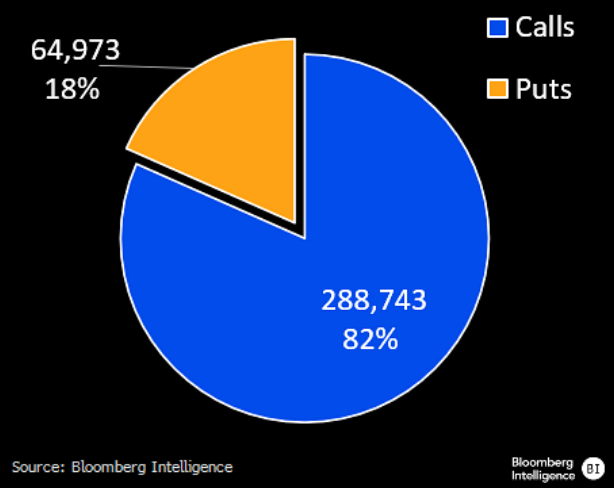

The final total for the first day of IBIT-based options is just under $1.9 billion in notional expiry across 354 thousand contracts. 289 thousand were calls and 65 thousand were puts. That’s a ratio of 4.4:1. Such options were almost certainly responsible for Bitcoin’s rise to new all-time highs today.

Ratio of options in trading

Another Bloomberg analyst, Eric Balchunas, noted that the $1.9 billion figure is a record for such a class of instruments. And he himself expects that options trading activity based on spot Bitcoin-ETFs will continue to grow in the coming weeks or months.

Michael Saylor is one of the biggest Bitcoin investors, as his personal investments in the crypto exceed a billion dollars. With that in mind, the entrepreneur can surely emphasise the key features of digital assets to those who have yet to get involved with them. But whether such a thing will lead to results will become clear in a few weeks.

Look for more interesting stuff in our crypto chat. We are waiting for you there to keep up to date with the current situation on the digital asset market.

SUBSCRIBE TO OUR CHANNEL ON TELEGRAM TO KEEP UP TO DATE.