New executive Charles Schwab regretted not buying Bitcoin sooner. Why?

Charles Schwab is one of the biggest players in the world of finance. As sources note, the investment giant has the equivalent of $9.92 trillion in assets under management as of 2024. Next year, the company will get a new head, which will be Rick Wurster. Moreover, he has already praised the cryptocurrency sphere and stated that he should have got involved with coins earlier.

The situation for the cryptocurrency sphere now seems to be more positive than ever. First of all, the US presidential election was won by Donald Trump, who promised to approve adequate regulation for digital assets and the normal development of the latter in the US.

In addition, the current chairman of the Securities Commission, Gary Gensler, will leave his position on 20 January 2025. Accordingly, the hunt for crypto-industry representatives along with constant lawsuits and fines for them will most likely be a thing of the past.

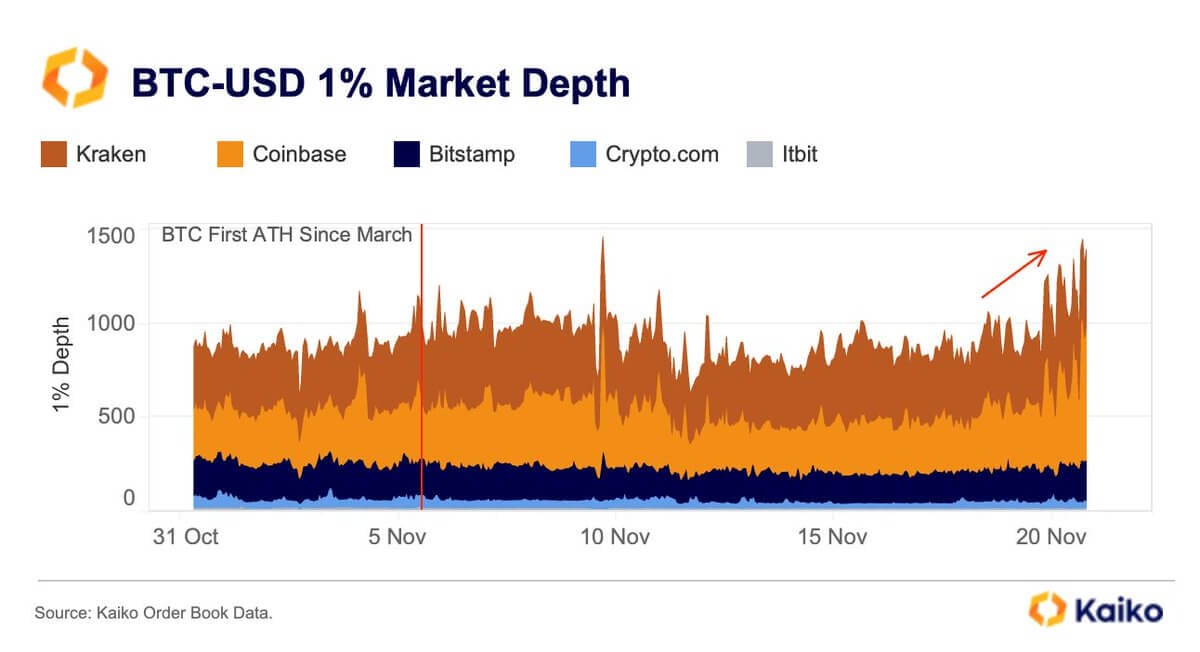

Against this backdrop, market fundamentals are also changing. In particular, the US crypto exchanges are now seeing a significant increase in Bitcoin liquidity. Accordingly, it will be much more difficult to influence its rate than before.

Changes in Bitcoin liquidity on American exchanges

As noted by Kaiko representatives, now, to change the value of BTC by 1 per cent in one direction or another, transactions with 1400 coins are required. Such allows for large transactions and makes the crypto-asset more attractive to institutional investors-professionals.

It’s no wonder that in such an environment, positive comments about digital assets are becoming more and more numerous.

How you can buy Bitcoin in 2025

Rick Wurster stated that Charles Schwab plans to launch direct spot trading of cryptocurrencies for its clients. This will happen after the coin regulation situation in the US improves.

Charles Schwab’s next president is Rick Wurster

Wurster shared his comments about the developments on Bloomberg Radio. Here’s his line, as quoted by Cointelegraph.

Cryptocurrency has definitely caught the attention of a lot of people, and they’ve managed to make some good money off of it. I didn’t buy crypto and now I feel a little silly.

Next Charles Schwab executive Rick Wurster is the next head of Charles Schwab

According to Rick, he has no plans to hold investments in cryptocurrencies anytime soon. However, the manager wants to provide such an opportunity for the investment giant’s clients after the approval of modern digital asset regulation in the US.

We also want to directly offer cryptocurrency to clients. We have been waiting for changes in the regulatory environment for something like this and we are confident that they will happen soon.

According to Wurster, the finance company’s clients are actively interested in the cryptocurrency field. They invest capital in it with the help of already available instruments from the company. First of all, we are talking about ETFs on Bitcoin and futures, which have shown themselves perfectly.

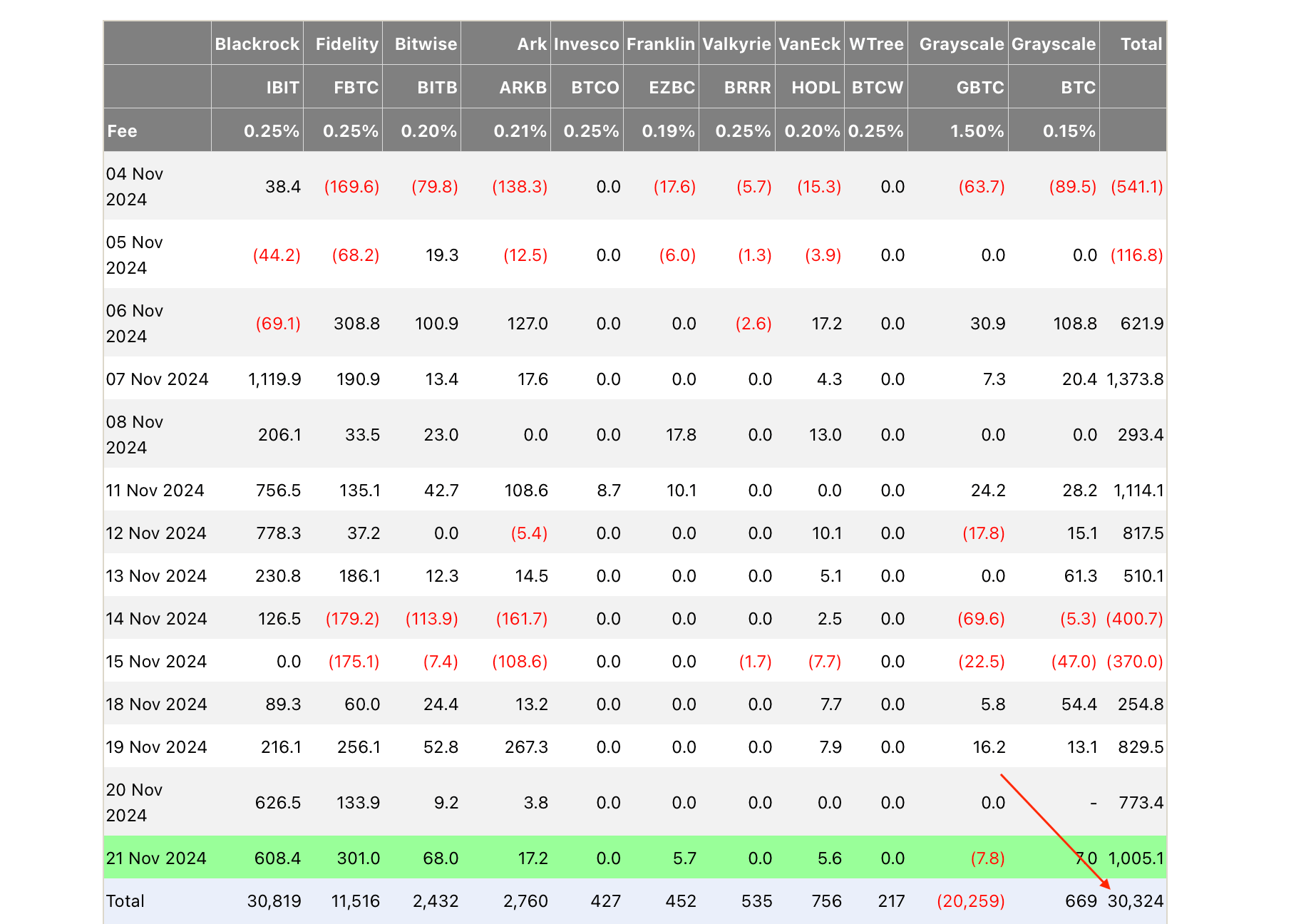

Bitcoin spot ETFs continue to perform well. Over the past 24 hours, net capital inflows into such instruments exceeded the billion dollar mark.

Taking this into account, the total inflows into exchange traded funds since their launch in January 2024 have taken the level of 30 billion. This is an excellent indicator for such young instruments on the exchange, which emphasises investors' demand for crypto.

Total net capital inflows into spot Bitcoin-ETFs in the US

With this in mind, Charles Schwab is competing with other traditional companies in the form of Fidelity, as well as newer platforms like Robinhood and Webull.

Rick Wurster also shared a positive comment on the topic of artificial intelligence. Apparently, this technology will have a significant impact on the way asset management companies do business. Here’s his rejoinder.

Our call centre staff used to spend more than three minutes searching for information to answer a client question, and this happened about 60,000 times a month. Now we’ve built an AI platform that finds the data they need in seconds.

😈 MORE INTERESTING STUFF CAN BE FOUND AT US AT YANDEX.ZEN!

Wurster will become the head of Charles Schwab on 1 January 2025. He will replace Walt Bettinger, who has been running the giant since 2008.

Meanwhile, the development of crypto is not only happening within companies, but also the government. As noted by the head of the Satoshi Action Fund platform Dennis Porter, Texas lawmakers have begun a dialogue on the prospects of passing a law to create a strategic Bitcoin reserve.

Recall, the possible accumulation of BTC by the US government began to talk about the possible accumulation of BTC by the US government at the suggestion of the newly elected President Donald Trump, who proposed to refuse the sale of confiscated coins. Then Senator Cynthia Lummis introduced a bill for the authorities to buy a million bitcoins over several years. Although these coins will not solve the problem of the growing US national debt, this initiative can still have a positive impact on the local economy and the position of the country as a whole.

Senator Cynthia Lummis, who proposed the purchase of one million BTC by the U.S. government

According to Porter, starting negotiations to develop such regulations will benefit the state.

The implications of the state of Texas moving forward in the context of adopting strategic legislation on Bitcoin reserves cannot be underestimated.

The expert suggests that such an initiative will not only protect against inflation. It can also strengthen the position of American miners and secure them from the influence of players from other countries. Here is the quote.

A great way to protect ourselves from external pressure and influence from foreign adversaries is to actively participate in the market by buying and selling bitcoins. This allows us to become a kind of shock absorber for the many fine BTC miners who are labouring in our country.

The change of power in the US and the new head of the Securities Commission are all positive for the representatives of the crypto industry. Still, it has not happened yet, and the giants from the world of finance already want to provide access to coins for their customers. And in the future there will be more and more of them.

.

Look for more interesting things in our crypto chat. We are waiting for you there to keep up to date with the current situation on the market of digital assets.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.