Operation Booby Trap 2.0. How exactly are the US authorities fighting the development of the cryptocurrency industry?

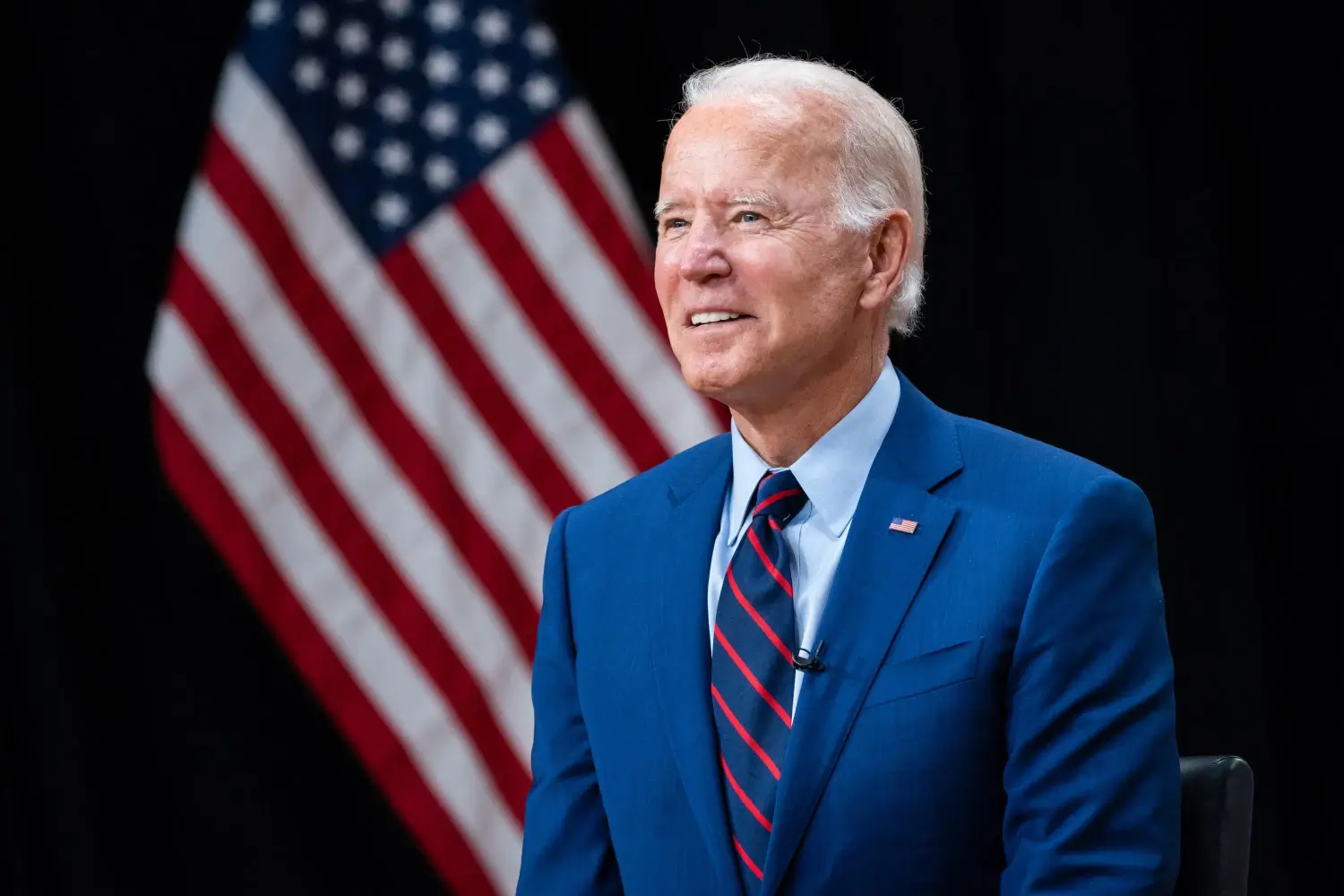

The current US government from the Democrat party is known for its dislike of cryptocurrencies. For example, the SEC under the leadership of Gary Gensler has filed a lot of pointless lawsuits against representatives of the coin niche in recent years. And some politicians like Senator Elizabeth Warren have actively promoted the narrative that digital assets are only being used to break the law. However, the presidential administration’s battle with crypto didn’t end there – new details about it were shared by Marc Andriessen of Andreessen Horowitz.

“The U.S. government’s “Uvula 2.0” – targeted actions of the U.S. authorities to create problems for the sphere of digital assets. First of all, it is about pressurising the management of banks to force the latter not to interact with representatives of the crypto world.

Thus, the latter experience difficulties in carrying out normal operations necessary for the work of companies. This ends up, among other things, with the death of projects.

Bharat Ramamurthy is believed to be one of the architects of this operation. He was previously an economic advisor to the Biden administration and has repeatedly criticised the digital asset sphere.

Along with this, Bharat was also allegedly working with the team of Kamala Harris, who was vying for the US presidency the day before.

US President Joe Biden

The chosen strategy of the US presidential administration towards crypto was confirmed by representatives of the crypto exchange Coinbase. In particular, they recorded more than twenty cases when the Federal Deposit Insurance Corporation (FDIC) recommended banks not to cooperate with cryptocurrency companies.

In addition, Ripple CEO Brad Garlinghouse separately confirmed that he had previously lost access to banking services due to his association with digital assets. Read more about this in a separate piece.

Who is hindering the development of cryptocurrencies

New details about the operation “Udavka 2.0” announced the co-founder of the investment fund Andreessen Horowitz Mark Andriessen. According to him, no less than thirty founders of various technology projects were excluded from bank users without any warning.

In addition, Andriessen directly stated that the administration of the current US President Joe Biden is using the prospect of financial exclusion as a weapon.

Andreessen Horowitz co-founder Marc Andriessen

Mark shared information about the operation in a recent episode of The Joe Rogan Experience podcast with Joe Rogan. Here is his rejoinder on the subject, as quoted by Decrypt.

More than thirty founders have been cut off from banks in the last four years.

The first version of Operation Whack-a-Mole was launched during Barack Obama's presidency. Then the authorities closed access to the financial sector to representatives of areas that were considered too risky or controversial. For example, we're talking about marijuana dispensaries and gun shops.

Representative Andreessen Horowitz accused the Biden administration of not only reviving such practices, but expanding them. The strategy is now being used to target political opponents and fans of decentralised assets.

Cryptocurrency enthusiast leaves the bank

Mark continues.

Operation Whack 1.0 was fifteen years ago against weed and guns. Its second version primarily targets political rivals and unwanted tech startups.

😈 MORE INTERESTING STUFF CAN BE FOUND AT US AT YANDEX.ZEN!

As Andriessen added, cryptocurrency companies have been denied access to banking services, payment systems, and even insurance in recent years. As a result, all of this led to the inability to conduct operations under normal conditions.

The situation was commented on by the head of the crypto exchange Coinbase Brian Armstrong. According to him, the second generation of the “Strike” can be called one of the most unethical and un-American actions that marked the Biden administration.

Here’s his commentary on it.

I think we’ll find Senator Elizabeth Warren’s fingerprints here. The Democrat party needs to realise that Warren is a liability and distance themselves from her if they want any hope of a comeback.

Senator Elizabeth Warren

Representative Andreessen Horowitz pointed out that all the restrictions within this kind of authorities action are shadowy. That is, it will not be possible to find a definite solution to this or that case. He continues.

There is no due process. None of this is prescribed. There are no rules. There is no court. There is no decision-making procedure. There’s no appeal. Who do you appeal to? Who do you appeal to in order to regain access to your bank account?

Caitlin Long, CEO of Custodia Bank, shared her company’s negative experience of being denied access to banking services.

Yes – we were repeatedly denied banking services in my company’s case. Stay tuned for our lawsuit against the Federal Reserve. Oral hearings are scheduled for 21 January.

For now, we can only hope that the situation with crypto regulation will really change for the better after Donald Trump’s inauguration. Moreover, hints of such a change are already visible now.

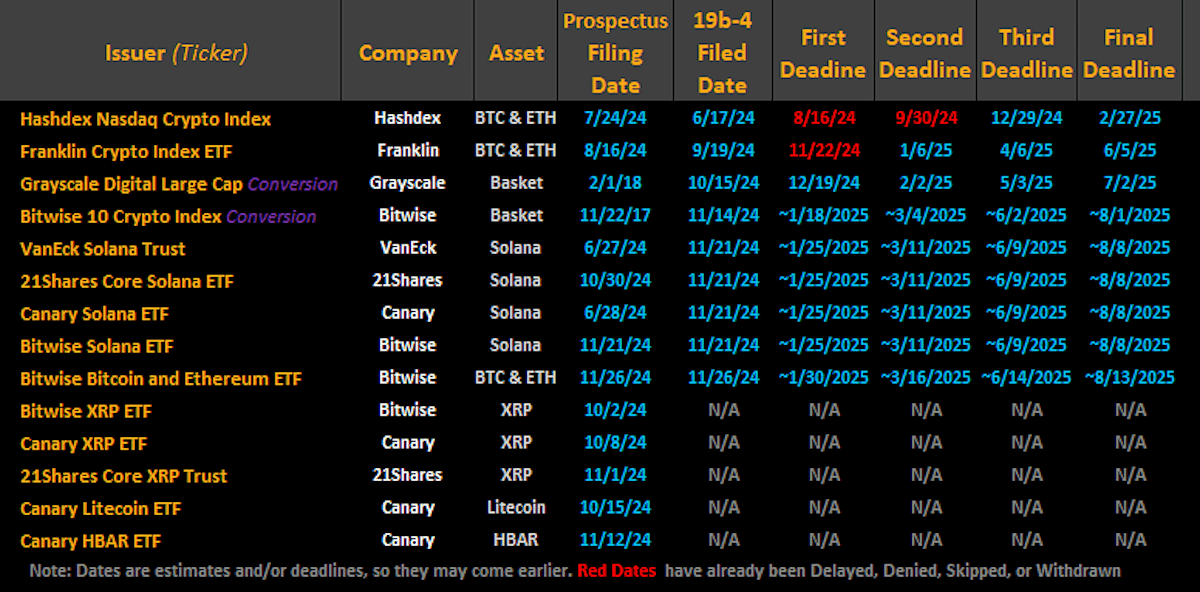

For example, Bloomberg analyst Eric Balchunas noted that four Solana-based ETFs, three XRP-based products and a Litecoin exchange-traded fund are in the queue for approval.

List of ETFs based on different cryptocurrencies that are waiting for approval

One could not count on the approval of such products under Biden and Gensler. Still, the Securities Commission required that the crypto asset at the heart of the exchange-traded fund have similar futures products. That’s why only ETFs based on Bitcoin and Etherium received SEC approval in 2024.

However, things will be changing now. As Balchunas noted, this list may well triple by the end of January 2025. This means that investment funds will strive to launch more and more ETFs on different coins.

The story of Andreessen Horowitz illustrates the importance of the U.S. presidential election in early November. If Kamala Harris had won them, the anti-coin policy would surely have remained the same. So here we can be happy with the choice of the Americans and expect that positive changes for the coin market will be visible very quickly.

Look for more interesting things in our crypto chat. We are waiting for you there to discuss the course of the current bullrun already now.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO STAY UP TO DATE.