Pantera Capital executive believes in Bitcoin at 780k in 2028. What will help cryptocurrencies grow?

Bitcoin continues to balance above $90,000 today, despite the collapse of the exchange rate the day before. And although this level is noticeably ahead of the maximum of the previous bullrun in 2021, the peak of BTC value in the current growth cycle may be a long way off. This is the view of Dan Morehead, head and co-founder of the Pantera Capital investment fund. He considers Bitcoin’s growth to $780,000 by April 2028 to be realistic and lists reasons for such behaviour of the cryptocurrency.

The key reason for further growth of Bitcoin and the cryptocurrency market as a whole is the victory of Donald Trump in the US presidential election. In this case, the majority in Congress will be formed by Republicans, who traditionally have a better attitude to cryptocurrencies as opposed to Democrats.

Trump’s inauguration will take place on 20 January 2025, but the positive for the blockchain industry is noticeable already now. For example, today it became known that the Trump administration wants to make the US Commodity Futures Trading Commission (CFTC) responsible for regulating digital assets instead of the Securities Exchange Commission (SEC).

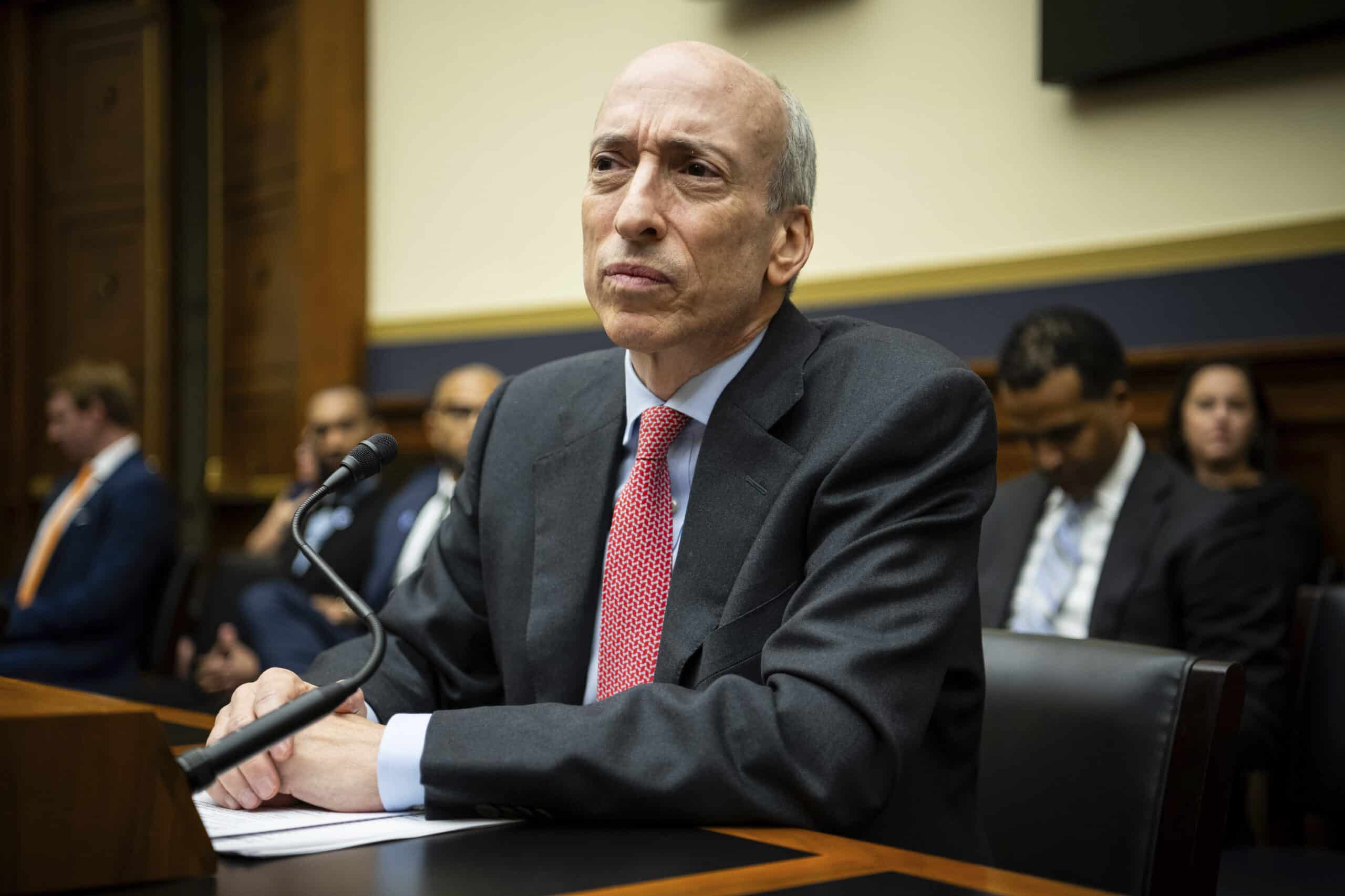

SEC Chairman Gary Gensler

The latter, under Gary Gensler’s leadership, has actively obstructed the industry in recent years. The regulator’s strategy was to call coins unregistered securities, thus claiming to control the market.

The SEC then filed lawsuits that sometimes led to the bankruptcy of some companies. The regulator hit the largest representatives of the industry, including Coinbase, Binance, Ripple, Kraken and other platforms. At the same time, the Commission was unable to prove in court that XRP cryptocurrency belonged to securities, which seriously damaged its already terrible reputation.

At the same time, CFTC representatives have repeatedly stated that they do not consider crypto to be securities. According to their version, coins should be classified as a commodity like gold or oil.

U.S. Commodity Futures Trading Commission building

If the administration of the newly elected president really will carry out such a reform, then American cryptocurrency platforms at least will not be afraid of unexpected lawsuits at any moment.

Well, Bitcoin will get a chance to rise to hundreds of thousands of dollars, as Dan Morehead has already stated.

How much Bitcoin will cost in the future

The version of the head of Pantera Capital is primarily based on the victory of Donald Trump, whom Morehead called “supporting blockchain technology”.

Newly elected US President Donald Trump

According to The Block, Dan commented on the interim performance of the Pantera Bitcoin Fund, which was launched in 2013. Its total return since that time was 131 thousand per cent. Here’s the entrepreneur’s cue.

That’s already three orders of magnitude higher. Another order of magnitude of growth looks quite realistic.

If Bitcoin continues to trend along the lines of recent months, then it could be valued at $740,000 by April 2028.

Morehead arrived at this level based on the average return of 88 per cent that his company’s Bitcoin fund has made every year since inception.

That doesn’t seem like such an incredible figure compared to the $500 trillion in finance. At a price of $740,000, BTC would have a capitalisation of $15 trillion.

Pantera Capital fund CEO Dan Morehead

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

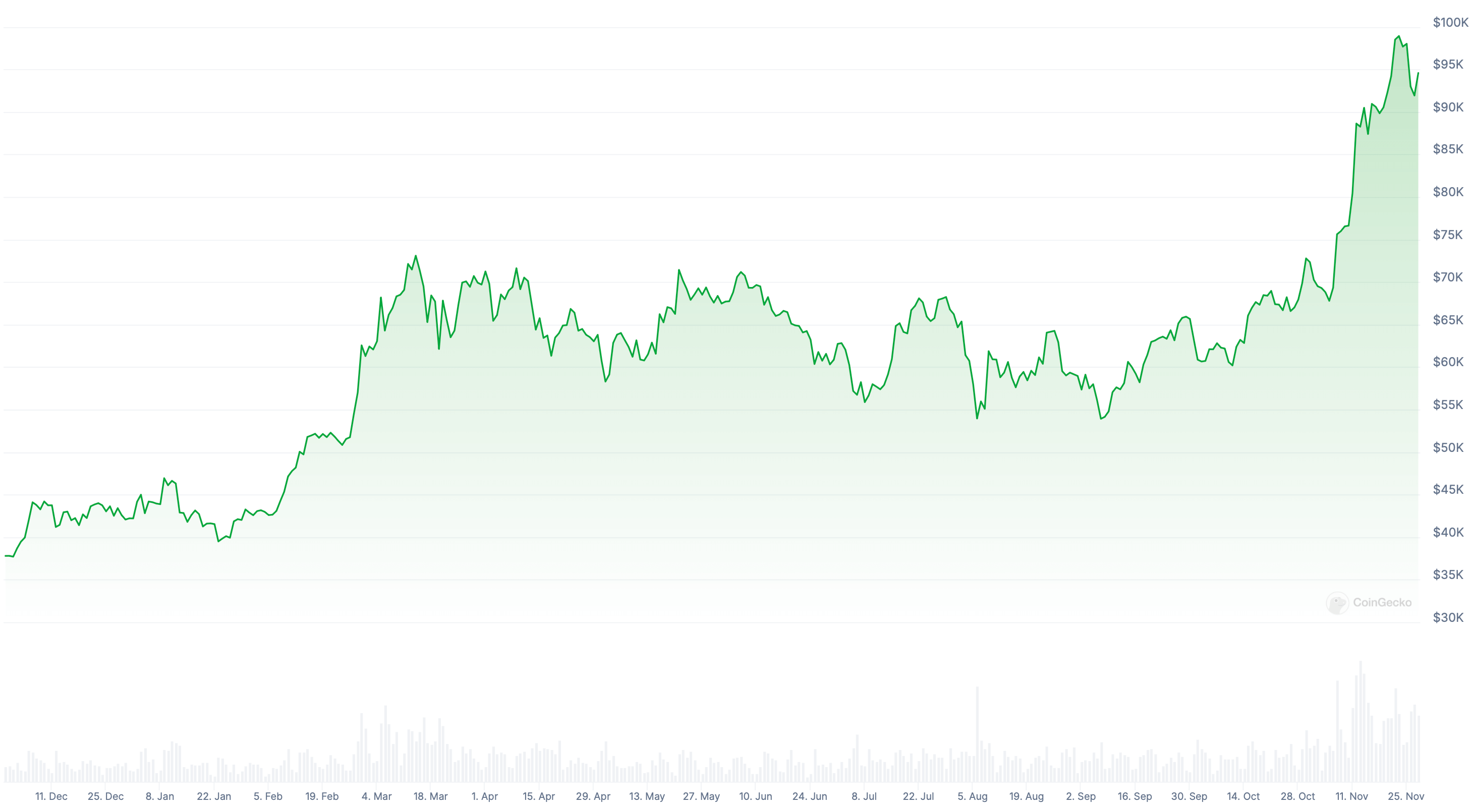

According to Dan’s version, Trump’s recent victory in the US presidential election has made crypto investors believe that adequate regulation of the industry is coming soon. Well, Bitcoin’s rise to the $99.5k level last week was investors’ reaction to the sphere’s renewed outlook.

Morehead continues.

We believe the entire industry will benefit from the first blockchain-supporting president in the US. In our view, the success of blockchain is in the best interest of the country, and so in time all members of Congress will take either a neutral or supportive stance towards the technology-it’s already starting to happen. Yes, the fifteen-year headwind of regulatory restrictions for blockchain is finally turning into a tailwind.

Dan noted that his company Pantera Capital began investing in Bitcoin at “literally the lowest price in the last eleven years.” Still at the giant’s first investment, the cryptocurrency was valued at $65.

The growth of the cryptocurrency market

After acquiring BTC in 2013, Morehead called Bitcoin “the first global currency after gold” and “the first payment system without any borders” in a letter to the company’s clients.

Meanwhile, hindering Dan’s prediction in the short term is the behaviour of long-term Bitcoin holders, who have held the cryptocurrency for at least six months.

According to CryptoQuant analysts, over the past thirty days, such market participants got rid of 728 thousand coins in the equivalent of 67 billion dollars. Accordingly, just this event has become the main source of pressure on the rate of the first cryptocurrency.

Experts note that the scale of the drain became the largest since April 2024. And so Bitcoin’s growth into the 100,000 zone last week was quite attractive for many investors.

Still, a year ago, BTC was valued at only $37,000.

Bitcoin BTC rate changes over the last year

The forecast of Dan Morehead from Pantera Capital on Bitcoin does not have to come true, because the behaviour of the asset in the past does not guarantee similar results in the future. However, the entrepreneur's analytics seem logical. Still, Donald Trump as president of the United States, along with the dominance of Republicans in Congress will definitely benefit the regulation of the field of coins.

.

Come to our crypto chat. In it, let’s talk about other topics that are shaping the course of the current bullrun.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO STAY UP TO DATE.