Pro investors are increasingly embracing Bitcoin: an early cryptocurrency user’s perspective

Problems and difficulties in the regulation of the crypto industry and its other components have not broken Bitcoin. Moreover, the main cryptocurrency has turned out to be so popular that large institutional investors are now interested in it. This was revealed by Blockstream CEO Adam Back in a fresh interview. According to him, the crypto is literally “ensured popularity” among professional wealth managers.

Bitcoin purchases by prominent members of the market continue. In particular, MicroStrategy, which is the largest holder of BTC among publicly traded companies, unveiled a plan called “21/21” this week. It involves raising $42 billion over three years, which will be used to buy bitcoins.

Former MicroStrategy executive Michael Sailor

Also in December, the issue of investing capital in the first cryptocurrency will be considered by Microsoft shareholders. We wrote more about it in a separate article.

Who invests in Bitcoin

According to Beck, one of the key milestones in the adoption of BTC was the approval of Bitcoin-based spot ETFs in the US. This happened in the first half of January 2024, after which these instruments recorded net capital inflows of $24.2 billion. Here’s a comment from one of the earliest users of BTC.

Financiers are interested in expanding and keeping ETFs in the market. Thus, the banking or financial institutional lobby now wants such an instrument to definitely exist.

Blockstream CEO Adam Back

Back noted that other large organisations are still interested in adopting Bitcoin. These also include entire countries.

First sovereign wealth funds and even entire countries are buying BTC or related instruments.

According to Cointelegraph’s sources, Back was one of Bitcoin’s early developers and the first person to receive an email from the cryptocurrency’s creator Satoshi Nakamoto.

Blockstream CEO Adam Back

Prior to that, Adam was actively working on the Hashcash project, and his developments are found in the key principles of Bitcoin’s functioning. This coincidence often led journalists to refer to Back as a real person who hid behind the pseudonym Satoshi Nakamoto. However, there is still no conclusive evidence of this.

In the interview, Adam mentioned the early stages of the Bitcoin network and admitted that most of the originally perceived risks to it have disappeared. Here’s that quote.

I think a lot of the initial risks associated with Bitcoin have already disappeared. Initially, it was not one hundred per cent clear whether any major country or economic area, such as Europe, China or the US, would ban BTC. This created a lot of perceived regulatory risks. However, I think Bitcoin is almost completely safe at this point.

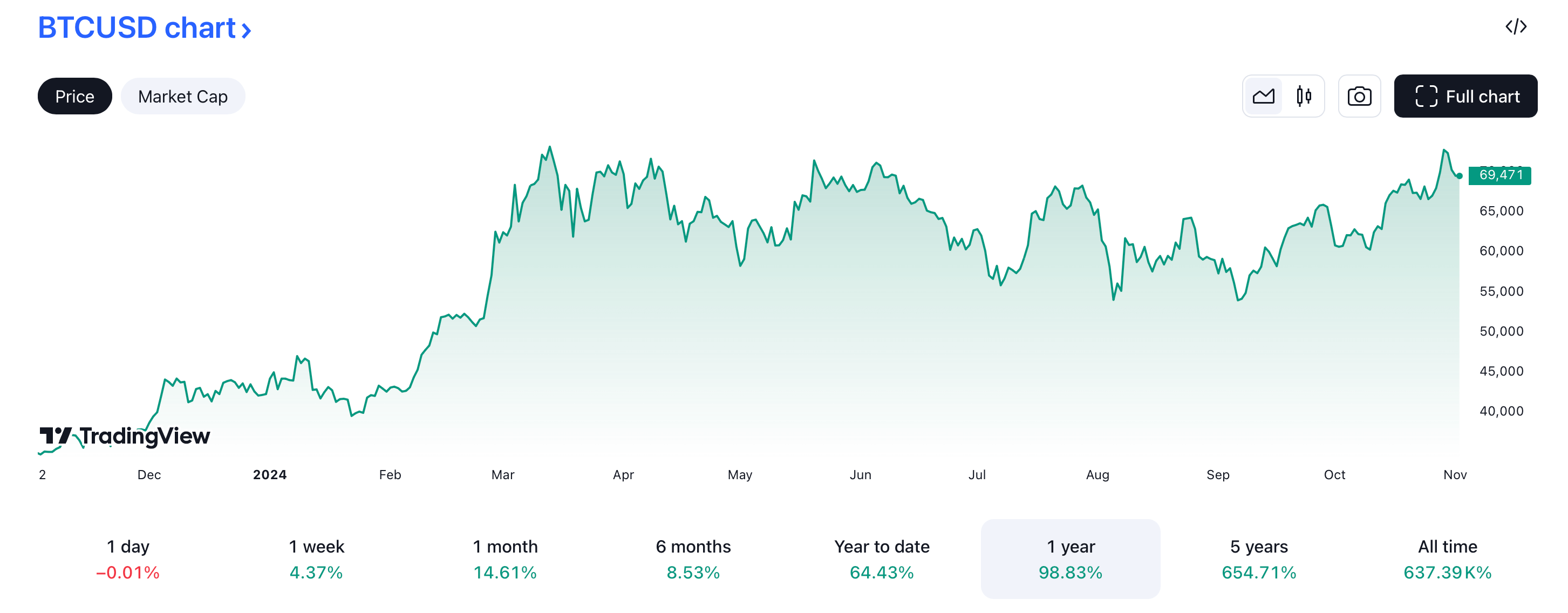

Changes in Bitcoin’s value over the past year

At the same time, the crypto still has a lot of room for innovation, the developer believes.

Scaling the blockchain is still difficult. I think there’s still room for innovation and improvements in how to do it. The Lightning Network is pretty robust and well suited for point-of-sale terminals and people-to-people payments, but there’s still room for improvement.

As a reminder, Lightning Network is a layer 2 protocol based on the Bitcoin network that allows for fast and cheap transfers. It works through a network of payment channels created between users, which reduces the load on the underlying blockchain.

In the Lightning Network, transactions are instant and with minimal fees, which makes it especially useful for micropayments and expands the network’s capabilities for regular users. However, it is impossible to call interaction with LN convenient. Earlier we got acquainted with this chain in practice, and this experience cannot be called positive. And for beginners, Lightning network cannot be recommended at all.

😈 MORE INTERESTING THINGS CAN BE FOUND IN OUR YANDEX.ZEN!

Not the best news in relation to the coin industry also shared analysts of the bank JPMorgan. They report that Bitcoin’s daily mining revenue and gross profit declined for the fourth consecutive month in October. The bank estimates that miners earned an average of $41,800 per day per exahash per second of their equipment’s capacity. And that’s down 1 per cent from September, Coindesk notes.

The profitability of BTC mining has also declined. Experts note that daily gross profit in the form of rewards for mined blocks fell 2 per cent in October to the lowest level “in recent memory”.

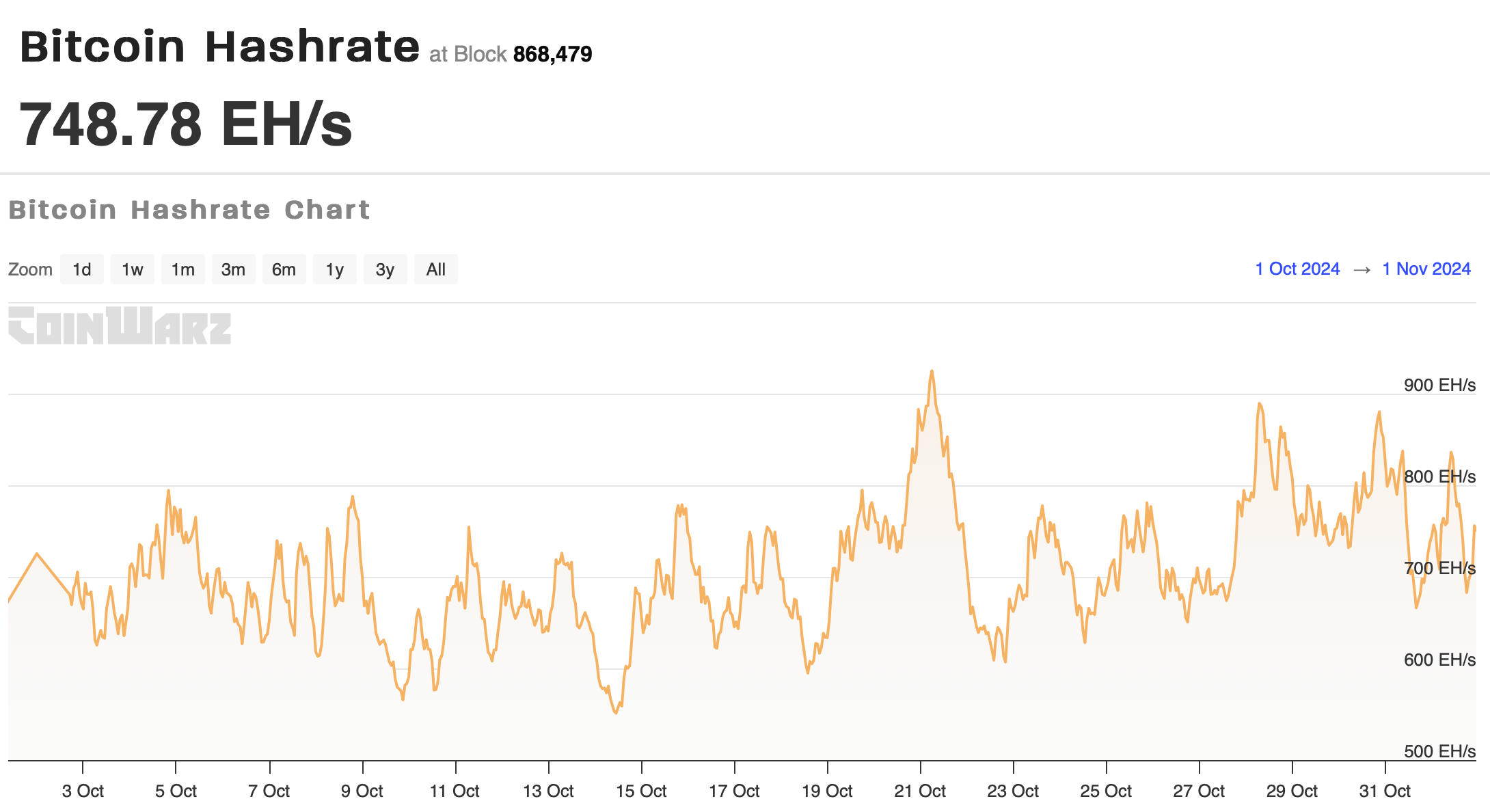

Bitcoin network hashrate changes over the past month

On a positive note, transaction fees rose to 60 per cent of block rewards at the end of the month, giving a slight boost to the daily profitability of large miners. Meanwhile, the average hash rate of the Bitcoin network in October increased to a record high of 702 exasecs per second, up 9 per cent from the previous month.

Well, on 21 October, the figure surpassed the 900 exahes per second mark for the first time in history. This level continues to be the peak of the network’s total processing power.

The Blockstream representative has no doubts about the growing popularity of Bitcoin among the big players. This is reflected in the performance of spot ETFs based on this cryptocurrency. BlackRock's iShares Bitcoin Trust fund, for example, attracted $2.28 billion in net inflows over the past week, allowing it to outperform all 13,227 ETFs. So the outlook for the crypto remains excellent.

For more interesting stuff, check out our crypto chat. Be sure to stop by to keep up to date with the current coin market situation.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO STAY INFORMED.