Stacking-enabled Efirium-ETFs and other bonuses: how will the crypto market change given Trump’s victory?

U.S. exchanges may soon see a greater variety of cryptocurrency-based investment derivatives. Especially ETFs based on Etherium, the largest altcoin by capitalisation. All thanks to Republican Donald Trump’s victory in the recent presidential election – his election promises to change the paradigm of crypto regulation in the US and finally bring it back to normal.

ETFs for Efirium were launched in the US at the end of July 2024. Before that, experts assumed that exchange-traded funds on ETH would be able to generate approximately 15 per cent of the trading volumes of the corresponding Bitcoin instruments.

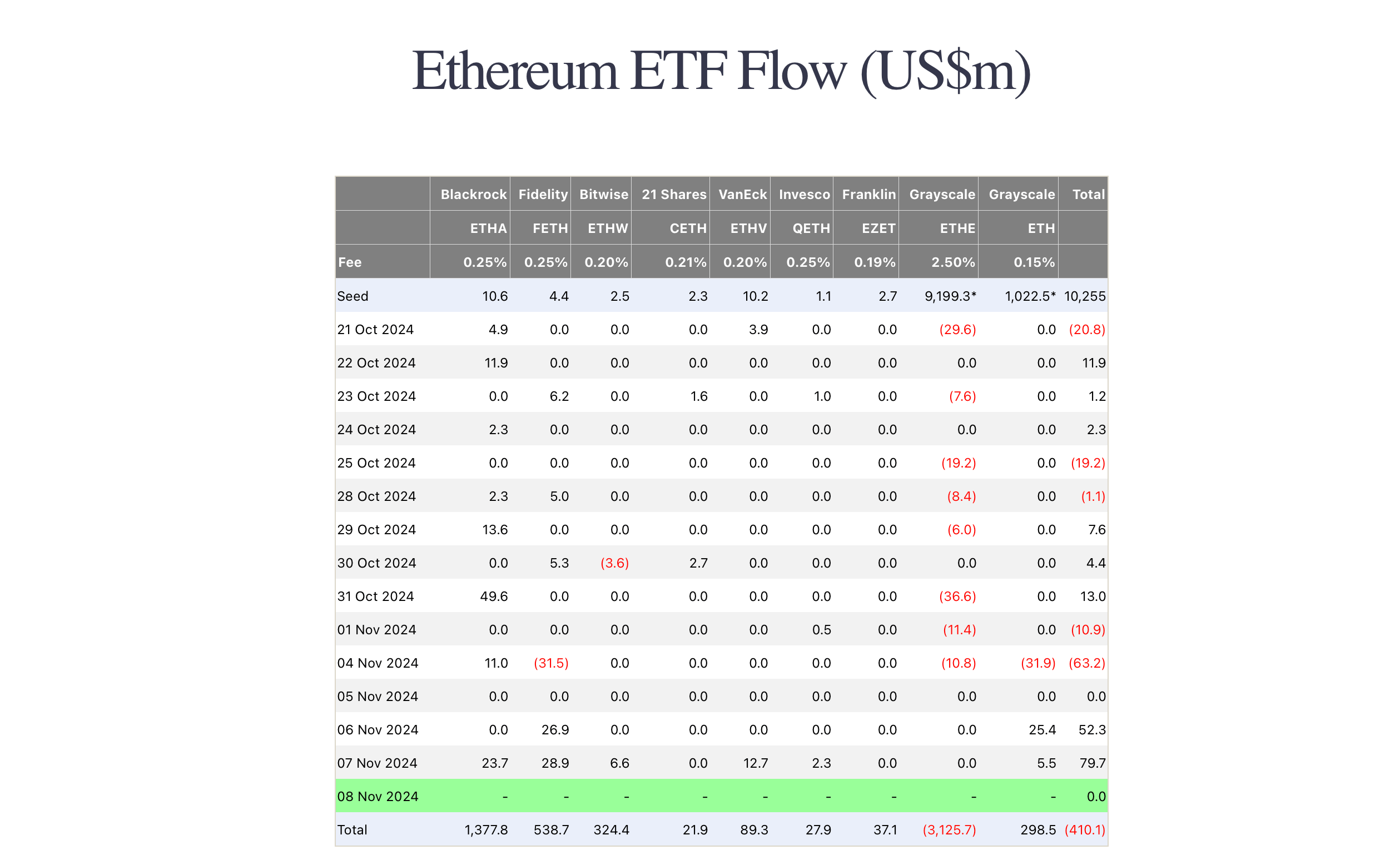

Performance of exchange-traded funds on ETH Efirium in the United States

However, in practice, the novelty release has been a failure. For example, as of today, such ETFs have recorded a net outflow of $410.1 million, which means that the money is only being withdrawn from them.

New opportunities for the crypto market

Nansen analyst Edward Wilson believes that due to the success of the Republicans in the recent elections, the first spot Efirium ETF with support for staking will appear. However, before listing such instruments in July 2024, SEC officials ruled out the possibility of generating additional income from ETH staking under ETF management.

It was assumed that a small portion of the ethers in the underlying exchange-traded fund would be sent to steaking, allowing for additional income for investors and making ETFs more attractive.

As of today, the yield on ETH staking is just 3.22 per cent per annum. Of course, that's not a significant figure - especially considering that exchange-traded fund issuers will blockchain a small portion of all coins. However, it increases the profitability of such instruments in any case.

Actual yields of Efirium ETH staking

In an interview with Cointelegraph, Wilson shared the following view on what is happening.

With the regulatory environment likely to be more loyal to cryptocurrencies, we may even see an ETF approved early in the new presidential administration that will take full advantage of ETH as an asset. If that happens, Efirium will become an interesting one to watch. In other words, ETH will become cool again.

Efirium and other popular cryptocurrencies

Staking Efirium is the process of blocking 32 ETH on the network for the role of validators, who are in charge of approving new transactions, adding blocks, and verifying what is happening on the blockchain. In return, participants are rewarded with additional coins.

All of this became possible when the network switched to the Proof-of-Stake (PoS) consensus algorithm in the Ethereum 2.0 update in September 2022. As the project's developers noted at the time, the update reduces the network's power consumption by 99.9 per cent.

The emergence of exchange-traded funds with staking and a new wave of institutional interest could significantly help the value of ETH. Still, since the beginning of 2024, the asset has lagged behind Bitcoin, Solana and other popular crypto-assets in terms of returns.

For example, while BTC set another historic high last night and jumped 80 per cent from January 1, 2022, ETH has only risen 29 per cent. And before the election, this indicator fluctuated in the zone of 5-7 per cent.

Change in the exchange rate of Etherium ETH in 2024

According to Charles d’Aussy, CEO of dYdX Foundation, Europe may even be ahead of the US in terms of adopting new exchange-traded funds. Here is his rejoinder on this situation.

The US is probably not ready for it yet, but the European market or some related market will give us the opportunity to take advantage of the new Efirium-stacked ETFs.

As we’ve already noted, U.S. spot Efirium ETFs have long been stagnant in terms of new fund inflows. In other words, exchange-traded funds are not attracting positive capital inflows, meaning the volume of money there is decreasing every week.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Meanwhile, the so-called Coinbase premium has risen to plus values, indicating increased investor interest in Bitcoin. This was stated by Julio Moreno, head of research at CryptoQuant, whose commentary is cited by The Block.

Trump’s victory has brought back demand for Bitcoin from US investors, and the Coinbase premium has turned positive for the first time since 18 October.

The Coinbase premium is a metric that reflects the difference in the price of Bitcoin between the Coinbase and Binance exchanges. A positive premium indicates a higher price for the asset on Coinbase, which could indicate increased demand among U.S. investors, as Coinbase is popular in the U.S. - especially among institutional clients.

Changes in Coinbase’s premium indicator

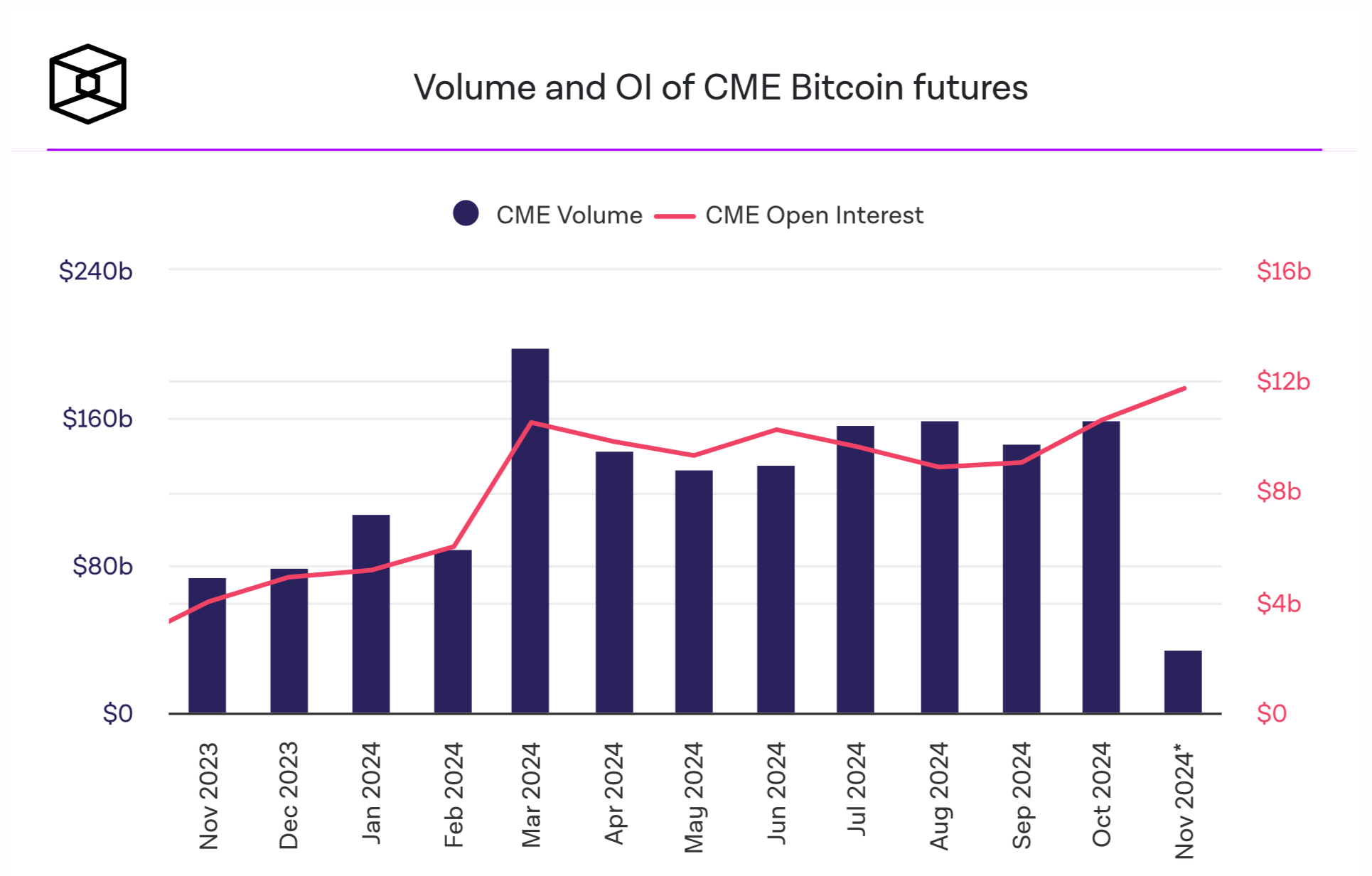

Another sign of increased demand from institutional investors is noticeable due to the daily trading volume of Bitcoin futures on the CME platform reaching an all-time high of $13.15 billion.

According to Vetle Lunde, head of research at K33, the average daily transaction volume of these instruments for 2024 is $4.56 billion. That is, the jump of the index is more than appreciable.

Volume of open positions and volume of transactions in futures

In addition, the average monthly amount of open positions in Bitcoin futures has already reached a record high of $11.73 billion in just one week in November.

Volumes of open futures positions on different exchanges

Overall, it can be argued that Donald Trump’s success in the election is already starting to have an impact on the crypto industry. Investors are buying cryptoassets and related instruments in the hope of fulfilling the promises of the new president.

Recall, he promised to promote niche development in the US, approve normal regulation of the industry, fire Gary Gensler as SEC chairman and stop selling coins that were previously confiscated by the US government.

Well, the SEC with a new head will get a chance to change the policy towards crypto. So we can assume that essentially the regulators' pursuit of big blockchain companies will end in the coming months.

Join our crypto chat room where the latest news on Bitcoin and other cryptocurrencies are discussed. We look forward to seeing you there and soon.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO STAY UP TO DATE.