There will be a new cryptocurrency position in the Trump administration. It is needed to regulate digital assets

Cryptocurrencies are gradually gaining popularity in the world of politics. A big boost to the process of crypto adoption among officials was given by the results of the US presidential election, which was won by Donald Trump. One of the main points of his election campaign was full support for the crypto industry and the development of adequate regulation of the market. Now it is manifested in concrete actions: sources report that a special position will be allocated in the Trump administration to develop appropriate strategies.

What will happen to cryptocurrencies in 2025

Trump’s team is selecting candidates for the role of a senior policy manager for the crypto market. This was reported by journalists of The Block with reference to Bloomberg.

The information remains at the level of rumours, as it is based solely on the words of insiders. At the same time, representatives of the Trump team refused to officially comment on what is happening.

Newly elected US President Donald Trump

As we have already noted, Trump supported cryptocurrencies during the election campaign. As part of his campaign to appeal to the electorate, he promised to fire SEC chairman Gary Gensler, pardon Silk Road founder Ross Ulbricht, and even create a national Bitcoin strategic reserve.

Since the election, Trump has nominated people who support the coin industry for senior positions – including Cantor Fitzgerald CEO Howard Lutnick to head the US Department of Commerce. Meanwhile, Robert Kennedy Jr, also known for his favouring of crypto, is set to take over as US Secretary of Health after Trump’s inauguration. The procedure itself will take place on 20 January 2025, that is, there is still time for changes here.

Representatives of the Republicans are still engaged in an active dialogue with the heads of various cryptocurrency companies. For example, earlier, Ripple CEO Brad Garlinghouse said that he spoke with people from Trump’s entourage about personnel appointments. Similar rumours were shared by insiders close to the management of Circle, the issuer of USDC steiblcoin.

Coinbase CEO Brian Armstrong, on the other hand, spoke on the phone with Trump himself about cryptocurrencies in general and who will be appointed to head the Securities Commission. The latter is extremely important for the market, as the regulator seriously affects the activities of companies from this sector.

The head of the cryptocurrency exchange Coinbase Brian Armstrong

The current chairman Gary Gensler is remembered for his strong pressure on the industry through enforcement. The SEC’s strategy under his leadership is to label all cryptocurrencies except Bitcoin as unregistered securities and then sue companies for interacting with the coins. Of course, this is a terrible decision that has the effect of doing nothing more than artificially halting the industry’s growth.

Another important detail is that the aforementioned position in the administration likely has nothing to do with the appointment of Ilon Musk to head the new Department of Government Efficiency, or D.O.G.E for short.

This news previously sparked the rapid rise of the altcoin DOGE, which Musk has publicly supported since as early as 2021.

Monthly change in the value of Dogecoin DOGE cryptocurrency

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

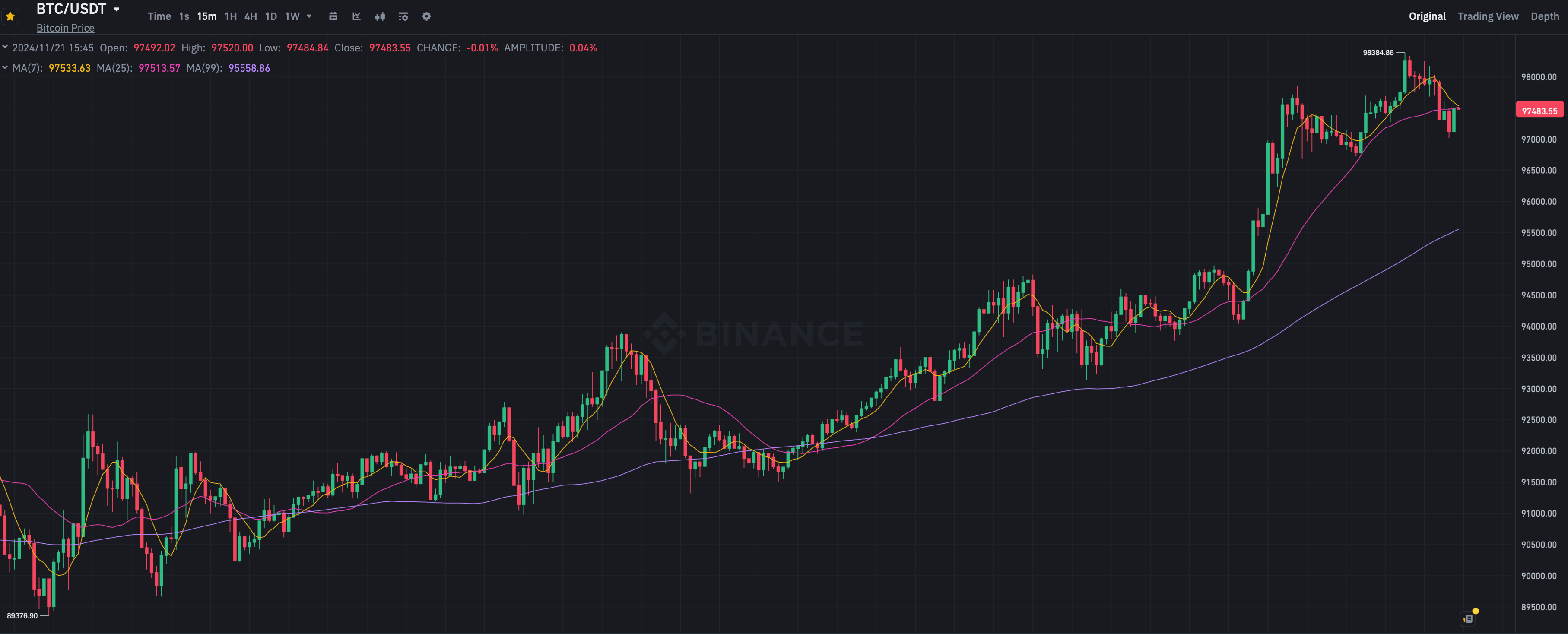

Meanwhile, the Bitcoin exchange rate on the background of all positive factors is approaching the historical mark of 100 thousand dollars. This afternoon, the price of the main cryptocurrency peaked at $98,384 in trading pair with USDT on the Binance exchange.

15-minute chart of the Bitcoin exchange rate

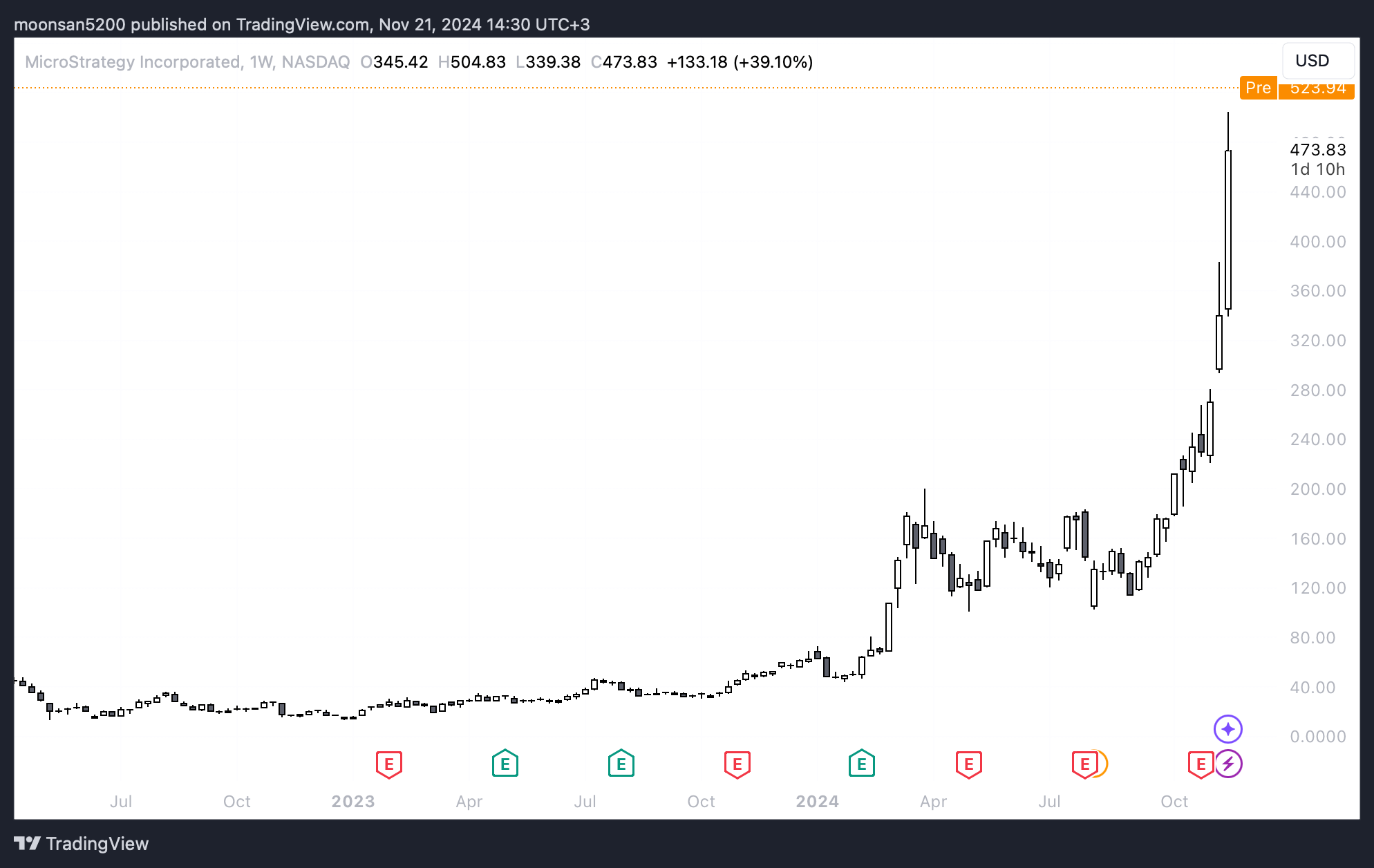

Also significant growth is seen in the shares of MicroStrategy, the largest corporate holder of BTC. Today, the rate of these securities is around the $473 line.

MicroStrategy share price

On Wednesday, MicroStrategy announced it was increasing its latest convertible bond offering from $1.75 billion to $2.6 billion due to “strong demand.” The company still sells data analytics software, but is now primarily focused on bitcoin storage. MicroStrategy stock has even become a cryptocurrency-based derivative investment vehicle in a sense.

MicroStrategy co-founder and former CEO Michael Saylor, now executive chairman, made the decision to buy BTC back in 2020.

Shares of the formerly relatively obscure MicroStrategy have soared on the back of Bitcoin’s rising price. Since its first purchase in 2020, MSTR shares have risen more than 3,900 percent, making it a favourite among tech giants, Decrypt notes.

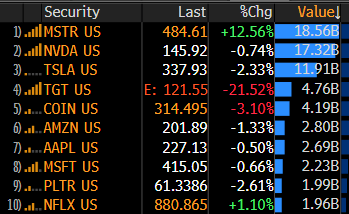

More importantly, MicroStrategy shares were the most popular asset on U.S. exchanges at Wednesday's close. As Bloomberg analyst Eric Balchunas noted, MSTR securities outperformed Nvidia and Tesla, among others, which deserves a special mention.

The most popular stocks on the U.S. exchanges at the end of Wednesday

The return on the company’s securities outperformed other players in the S&P 500 stock index. MicroStrategy now ranks 88th among the largest publicly traded companies in the US with a market capitalisation of over $109.3 billion. MSTR broke into the top 100 on Wednesday thanks to the latest round of the crypto market bullrun, so Michael Saylor’s strategy and persistence paid off.

From the looks of it, Trump's victory will benefit the coin industry even after the newly elected president is inaugurated in January. More important here, however, will still be the choice for the SEC chairmanship. The regulator has made life much harder for the industry in recent years, so the SEC's change of vector will be a key reason for positivity in the niche.

Want to stay up to date with other interesting news? Join our crypto chat. We look forward to seeing you there so you don’t miss the current bullrun in the coin niche.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.