Trump’s new policies have the potential to boost Bitcoin to $1 million. What exactly will the president do?

Arthur Hayes, the former head of crypto exchange BitMEX, has published a new post on his blog about the realities of the economy and the crypto market after Donald Trump’s victory in the US presidential election. This election also allowed the Republicans to dominate the Congress. According to Hayes, this scenario will lead to a significant weakening of the dollar, potentially helping to boost Bitcoin’s value up to a million dollars in the long term.

Note that the possible growth of Bitcoin to millions of dollars is not new. In particular, MicroStrategy co-founder Michael Saylor made a similar prediction for 2045 this summer.

Three scenarios for Bitcoin’s growth in 2045 according to MicroStrategy co-founder Michael Saylor’s prediction

According to his version, the jump of BTC to $3 million in the specified period can be considered a bearish scenario, that is, the worst possible scenario. Well, the best prospect will be the growth to 49 million, which the entrepreneur described in detail in this material.

MicroStrategy itself continues to be the largest holder of bitcoins among public companies. Today, it holds 279,420 coins equivalent to $24.5 billion.

The largest holders of Bitcoin among public companies

Well under 12 billion was invested, meaning the unrealised profit on the position exceeds the 100 percent level.

What will happen to the Bitcoin exchange rate?

According to The Block’s sources, during his election campaign, Trump shared a lot of promises with cryptocurrency enthusiasts. In particular, he said that he would change the leadership of the SEC, a regulator that has been actively pressuring the industry for several years now. In addition, Donald promised to create a national crypto reserve in Bitcoin.

Drawing parallels between Trump’s proposed policies and China’s long-standing economic development strategy, Hayes predicted a shift to “American capitalism with Chinese features.” It would be aimed at stimulating the domestic economy and retooling the most important production sectors.

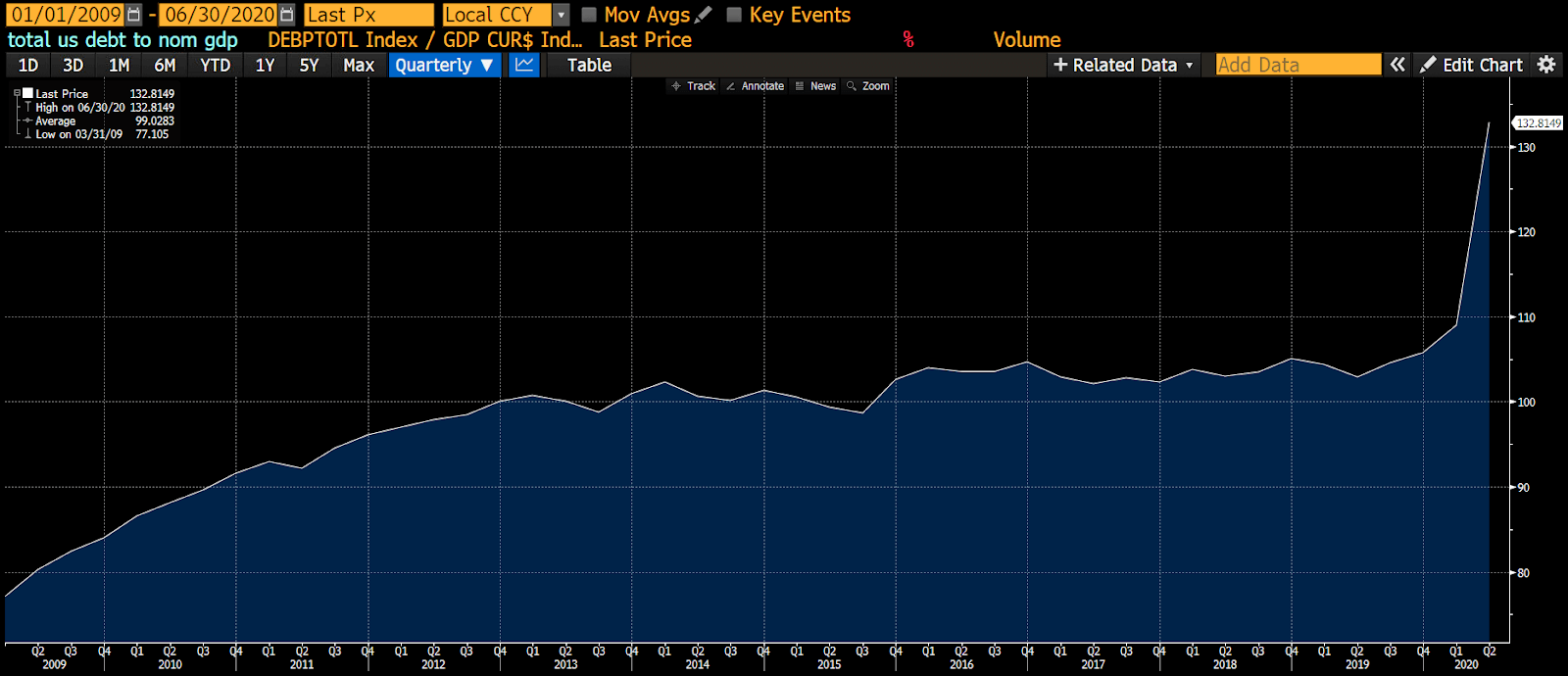

The US government debt-to-GDP ratio will rise

In other words, Trump’s economic strategy will prioritise the development of industry through government incentives, tax breaks and bank loans for companies producing “approved” goods and services, Hayes said.

This already mirrors China’s development model, which began with Deng Xiaoping’s reforms in the 1980s and fuelled the country’s rapid expansion. Trump’s approach would channel significant funds into domestic industries like shipbuilding, semiconductors and automobiles, which would eventually lead to an infusion of trillions into the U.S. economy.

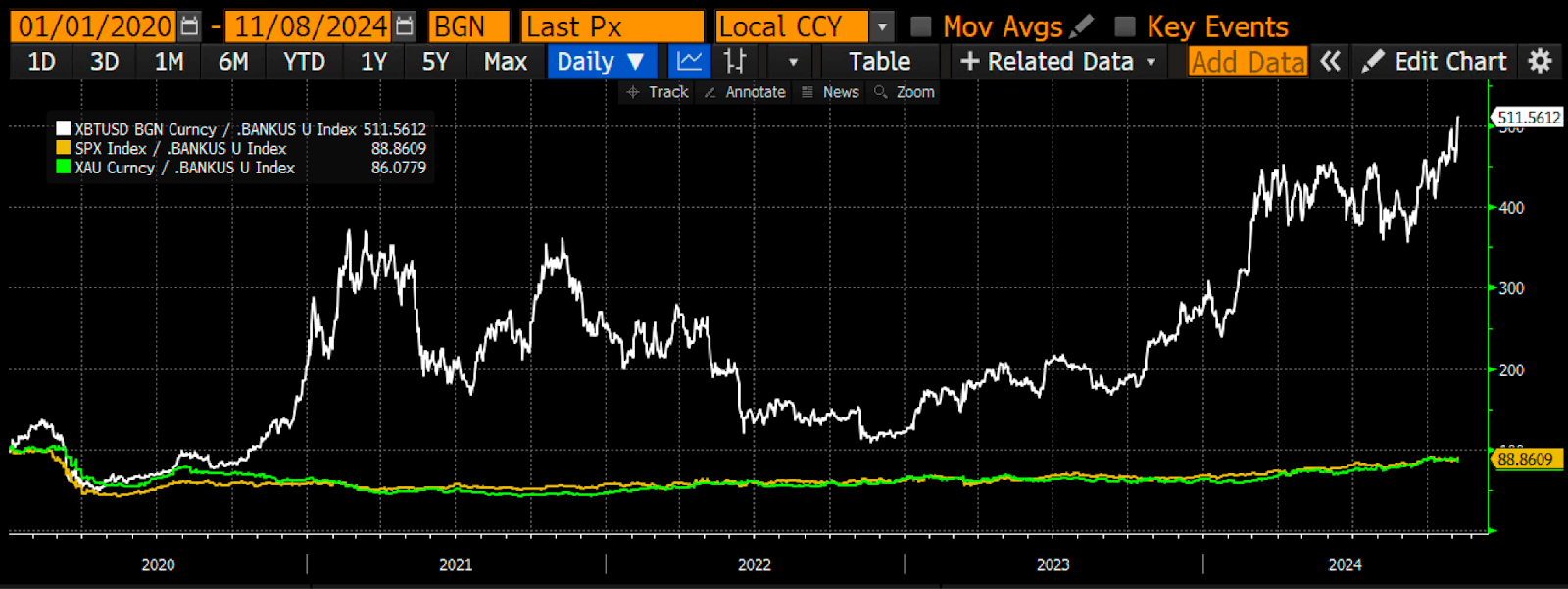

Hayes also suggested that under Trump’s strategy, the U.S. dollar could undergo a deliberate devaluation. Still, with inflation expected as a result of accelerated money supply growth, government bonds may become less attractive and investors will increasingly look to Bitcoin and gold as alternatives for their investments.

A comparison of Bitcoin, gold and the S&P 500 stock index prices

The new administration will also focus on lowering America’s debt-to-GDP ratio, stimulating growth through credit rather than austerity. This factor is also able to make BTC and crypto in general more attractive in the eyes of the majority.

The forecast of the former BitMEX chief is based on the expectation of a stable industrial policy and the continuation of quantitative easing, i.e. the reduction of the base lending rate. Ultimately, the combination of these conditions will allow Bitcoin’s price to reach the million-dollar level in the long term.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

In addition to the expected economic policies, Donald Trump’s personnel policy deserves special attention. As Cointelegraph notes, Scott Bessent, founder of Key Square Group and former investment director of Soros Fund Management, could become the next Treasury Secretary under the new administration.

Bessent is known for his loyal attitude to the crypto industry, as confirmed by Fox Business journalist Eleanor Terrett.

Scott Bessent is the new presumptive U.S. Secretary of the Treasury

According to her, Bessent has recently made a number of statements in favour of cryptocurrencies, expressing a positive stance towards them. Here’s one of his quotes about what’s happening in the coin industry.

I was thrilled to see the president embrace cryptocurrencies, and it aligns well with the Republican Party’s stance. Cryptocurrencies are freedom and the crypto economy isn’t going anywhere else.

Bessent also spoke in favour of Bitcoin, emphasising its ability to bring young investors into the financial markets.

One of the most interesting things about Bitcoin is that it attracts young people and those who have not participated in the markets before. Cultivating a market culture in the US where people believe in a system that works for them is central to capitalism.

John Paulson is another possible candidate for the position of US Treasury Secretary

Trump began the process of forming his crony team last week. The Donald will be inaugurated on 20 January, but in the meantime he has time to discuss details with Bessent and fellow investor John Paulson.

Citing two insiders close to the president-elect, news agency Reuters previously reported that Bessent and Paulson are now the two leading candidates for the key position of US Treasury Secretary.

This prediction by Arthur Hayes is just one possible version of the future, which may not come true. Still, the former head of BitMEX was wrong in his analyses earlier, when he spoke about the prospect of Efirium's growth to $10,000 by the end of 2022. In addition, some experts hold the opposite version and believe that Trump's presidency will lead to the strengthening of the dollar. So we will have to test the theory in practice.

Look for more interesting things in our crypto chat. We are waiting for you there so that you don’t miss the most interesting things in the industry of digital assets.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO STAY INFORMED.