Trump’s presidential election victory will change the approach to cryptocurrency regulation in the US. But in what ways?

Donald Trump’s victory yesterday will turn one of the crypto industry’s biggest obstacles into its advantage, analysts at brokerage firm Bernstein said. According to them, the Republicans’ success in government will pave the way for more thoughtful regulation of the crypto market. In addition, a number of government agencies are expected to undergo important personnel changes, during which more crypto-friendly people will take their places.

Bernstein analysts have also previously commented on the possible behaviour of Bitcoin in case of Donald Trump’s victory. According to their version, the cryptocurrency is able to reach a gap of 80-90 thousand dollars before the inauguration day of the new president on 20 January 2025.

The growth of the cryptocurrency market

In addition, they are still betting on the first cryptocurrency reaching the level of 200 thousand by the end of next year. Moreover, analysts call this mark “conservative” considering everything that is happening in the world.

How cryptocurrencies will be regulated in the U.S.

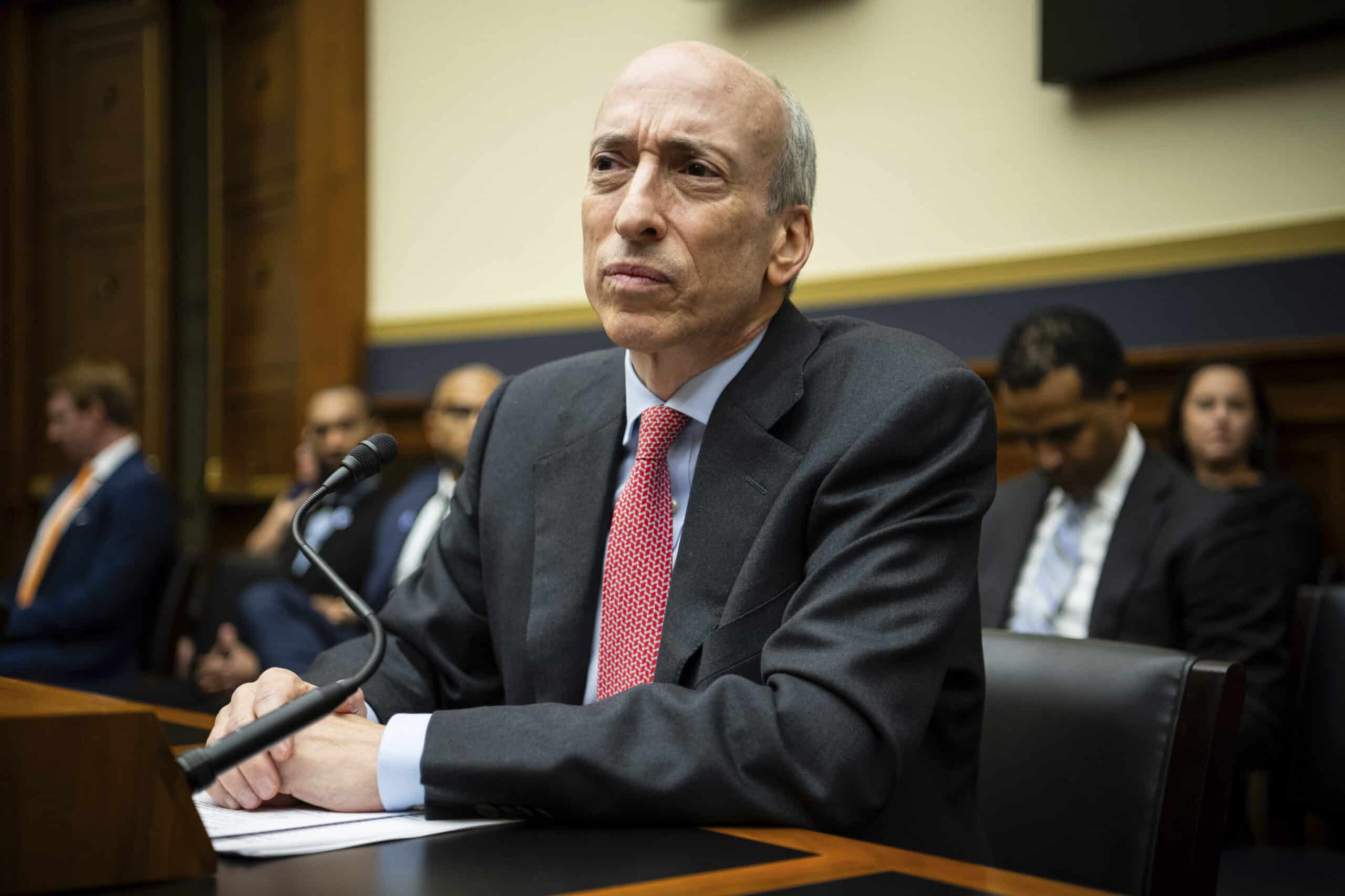

First of all, experts are waiting for the first important personnel changes in the Securities and Exchange Commission (SEC) and the Banking Committee of the U.S. Senate. In the first case, the current head of the Commission Gary Gensler is likely to resign early.

This head of the financial regulator was appointed to the post by current US President Joe Biden. Soon after, the SEC launched a slew of litigation with key industry players including Coinbase, Binance, Kraken and Robinhood.

US President Joe Biden

This approach has been called regulation by coercion and has led to serious criticism of the Commission’s behaviour. Still, in such circumstances, companies do not know at what point they will be hit with a sudden fine and how to avoid it.

To fire Gary Gensler from the position of chairman of the Securities Commission, US President-elect Donald Trump promised during a speech at the Bitcoin 2024 cryptocurrency conference in Nashville at the end of July 2024. According to the politician, it will happen on the first day of his new powers. Well, the participants of the event met the news with a round of applause.

SEC Chairman Gary Gensler

In the second case, a more crypto-loyal senator and entrepreneur Bernie Moreno will take office. He is expected to replace Senator Sherrod Brown, who previously actively opposed the adoption of new rules to adequately regulate digital assets.

Senator Bernie Moreno

According to The Block’s sources, analysts are also predicting accelerated progress on stablecoin bills and market structure, which will have a positive impact on issuers like Circle and Paxos.

In the medium term, progress is expected in regulatory oversight of other areas of the crypto market. In this way, altcoins will gain more legitimacy among large investors, which will also facilitate the launch of new spot ETFs based on digital assets. So far, Ripple’s Solana and XRP have the best chances of such exchange traded funds.

😈 MORE INTERESTING STUFF FROM US AT YANDEX.ZEN!

Republicans will also become the dominant force in the House and Senate, which make up Congress. Bernstein noted that cryptocurrency PACs – lobbyist organisations that advocate for industry support among politicians – played a big role in the party’s path to victory. Here’s a rejoinder to that.

PACs were instrumental in getting the cryptocurrency industry into the Senate and House of Representatives. We are awaiting a new regime of cryptocurrency legislation, and this transformational shift is still unappreciated.

Marcus Thielen, CEO of research platform 10x Research, also announced the possible resignation of the SEC chairman. And Gensler may well resign as soon as possible.

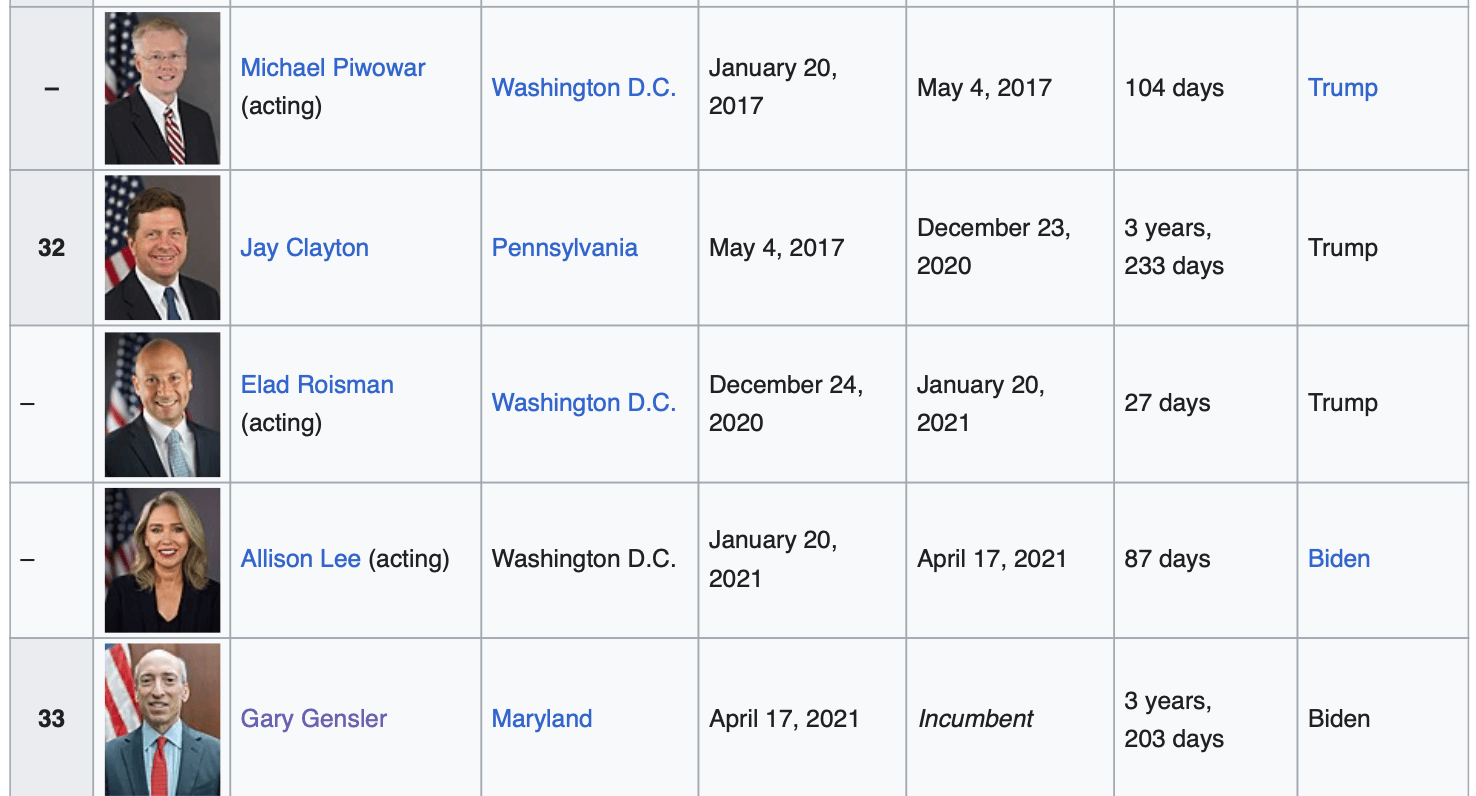

In this case, the head of the SEC will simply follow the example of his predecessors. Thielen’s commentary is cited by Decrypt.

The SEC chairman usually resigns when a new president takes office, in line with the incoming administration’s preferences.

Previous heads and acting chairmen of the SEC

This sort of thing has happened in the past. Notably, former SEC head Jay Clayton, a Trump appointee, resigned before Joe Biden’s inauguration.

Before that, Barack Obama’s handpicked Mary Jo White vacated her position on the day of President Trump’s inauguration. Experts continue.

This practice allows a new president to appoint a chairman who aligns with his policy goals. If these historical patterns continue, Gary Gensler could resign in December or January and a new SEC chairman would be confirmed in April or May.

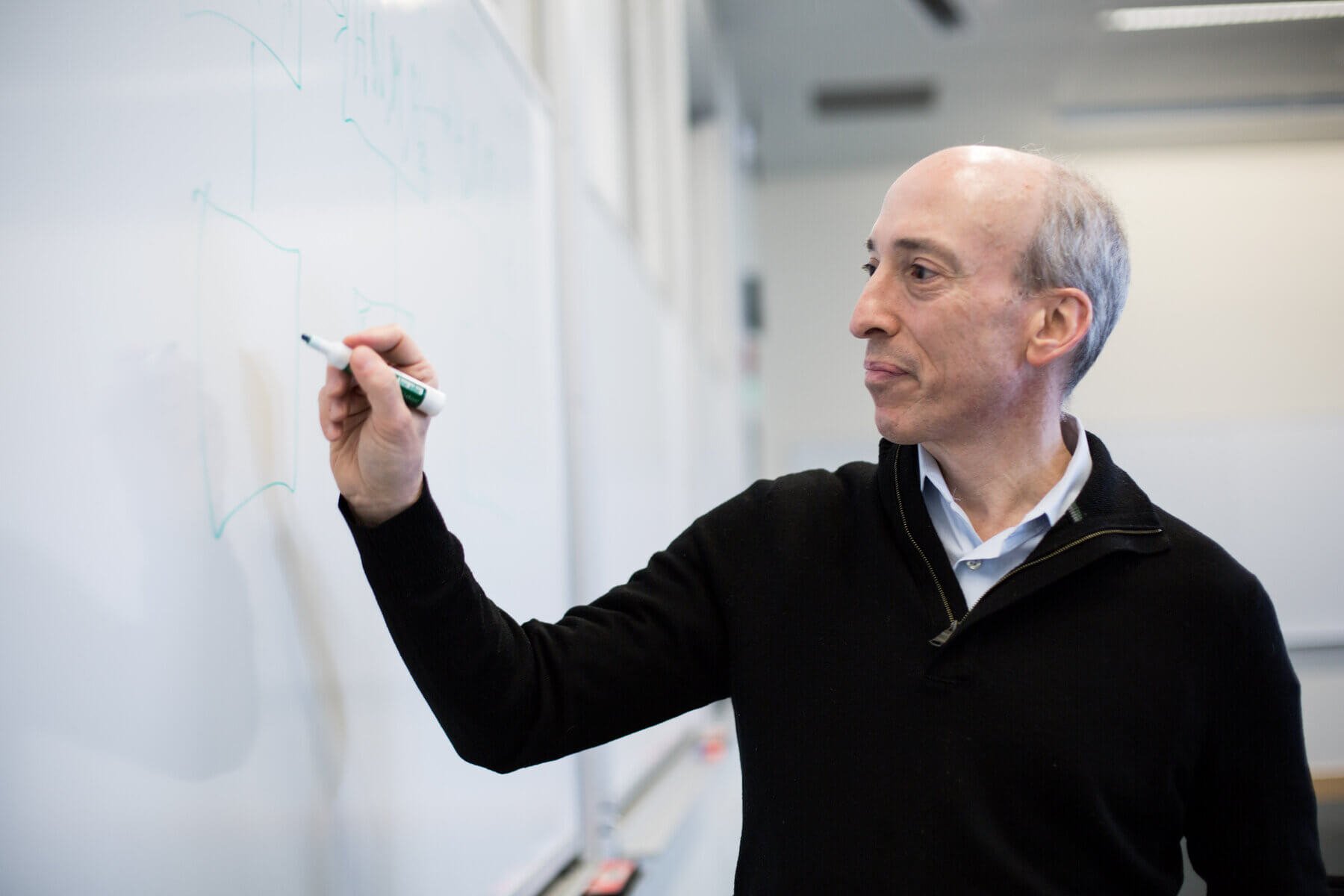

Gensler himself has led the SEC in an aggressive pursuit of US crypto exchanges, decentralised platforms and individual firms. Overall, his term runs until 2026. As we noted, Donald Trump has previously stated his willingness to fire Gensler if he wins the election.

Securities Commission Chairman Gary Gensler

Regulations state that the president cannot remove Gensler from his position without cause. However, Trump will have the power to demote him and appoint another SEC commissioner in his place. Thus it will be possible to de facto circumvent the restriction.

By the way, earlier the representative of the Republicans French Hill said that next year the SEC should have a new leadership – regardless of which party controls the White House. He said Gensler’s “fear-mongering” at the SEC is unconstitutional and an abuse of regulatory power.

Alas, such statements and active criticism of the Commission’s actions by members of the House of Representatives have done nothing to stop the regulator from stalling the development of digital assets. That is, in essence, Gensler has fulfilled his task.

As a result, we can now say that within a few weeks crypto enthusiasts will get rid of Gary Gensler as chairman of the Securities Commission. Alas, his actions have already caused significant damage to the niche. However, the current makeup of Congress is in a position to correct the downsides that have pressured the coin sphere over the past four years.

For more interesting stuff, check out our crypto chat. We look forward to seeing you there to keep you up to date with the current situation in the digital asset market.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO STAY INFORMED.