UK pension fund Cartwright has allocated 3 per cent of its assets to Bitcoin investments. How was this explained?

British pension fund Cartwright has “implemented a scheme” through which it has managed to allocate 3 per cent of its funds under management to invest in Bitcoin. The fund’s management described the cryptocurrency as an investment with a long-term planning horizon, meaning BTC fitted perfectly into the pension plans’ strategy. Meanwhile, head of relevant investments Steve Robinson said buying blockchain-based digital assets would help “reduce reliance on employer contributions.”

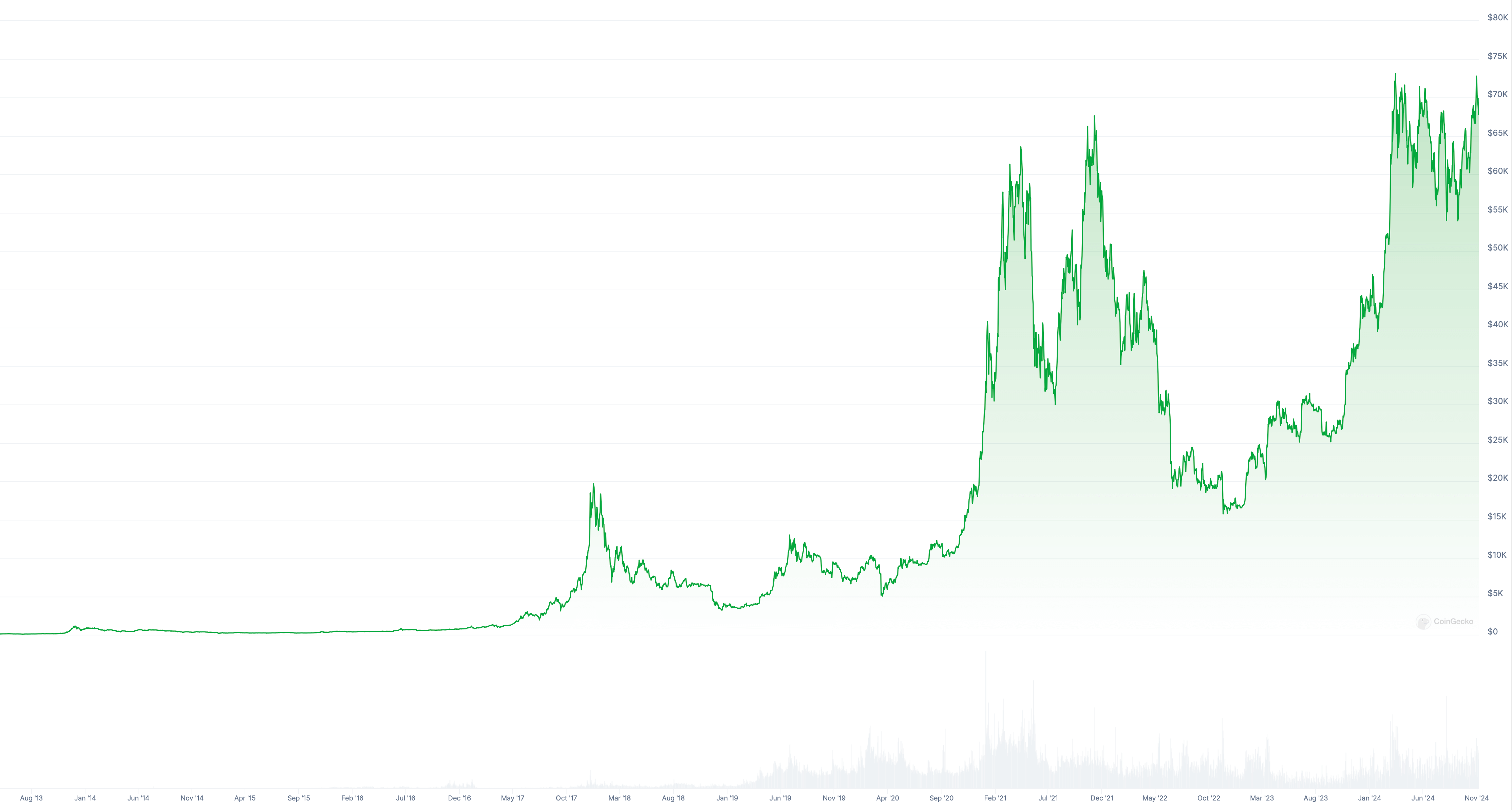

Long-term investment in Bitcoin seems like a logical choice. However, statistics show that anyone holding BTC for at least four years will make a profit on the investment.

Bitcoin value chart from 2013

Here it is also worth mentioning the recent initiative of the head of the financial department of the American state of Florida, Jimmy Patronis. He appealed to the leadership of the Administrative Council of the state with a request to include BTC in the pension plans of local residents.

According to him, this would significantly increase the profitability of the plans and ensure the welfare of Americans. At the same time, cryptocurrencies themselves as a separate asset class are going nowhere.

Who is investing in Bitcoin

The fund did not provide further details about the nature of the scheme or how much will be invested in the first cryptocurrency. Cointelegraph reporters reached out to Cartwright representatives for comment, but never received a response on what was going on.

Here’s a comment from Sam Roberts, director of investment advisory at Cartwright, from the official press release.

Trustees are increasingly looking for innovative solutions to ensure their investment schemes are resilient in the face of economic challenges. Investing in BTC is a strategic move that not only promotes diversification but also provides access to an asset with a unique asymmetric risk and return profile.

Our approach allows schemes to capitalise on the significant upside potential while limiting risk. Integrating Bitcoin into a pension scheme’s investment strategy is a bold and forward-thinking move, while at the same time emphasising the progressive thinking of the trustees. We are proud to be at the origin of this ground-breaking decision and hope it will start a new trend: institutional investors in the UK will be able to catch up with the growing number of peers and competitors around the world who are already actively utilising the unique features of Bitcoin.

In general, government organisations around the world are turning to cryptocurrency investments for pension funds this year. For example, in the UK, Legal and General, a pension and investment company with $1.5 trillion in assets under management, announced that it would consider offering tokenised funds.

Also, the South Korean Pension Service previously announced a $34 million investment in shares of MicroStrategy, which is the largest corporate holder of BTC.

MSTR securities may well be considered an indirect tool for making money on fluctuations in the value of Bitcoin, as the giant is the largest holder of the first cryptocurrency among public companies – the volume of its accumulations reaches 252 thousand coins.

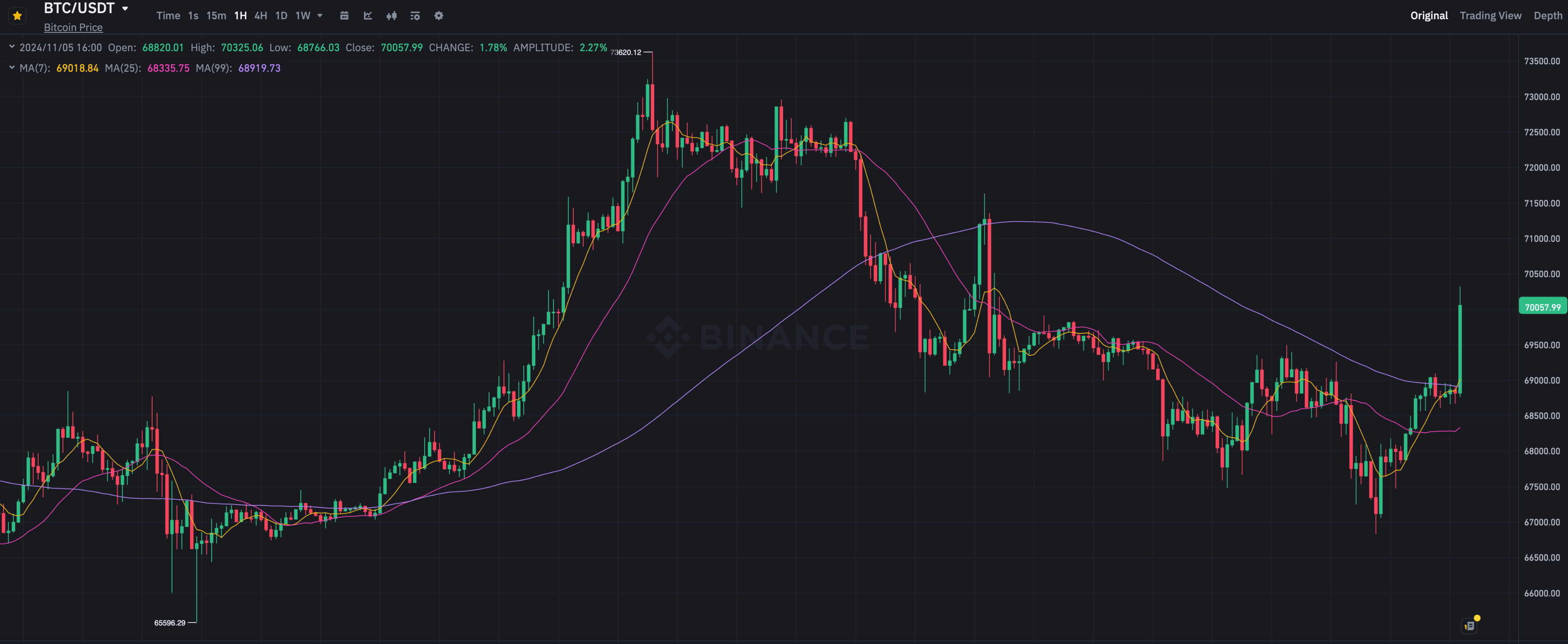

Hourly chart of the Bitcoin BTC rate on the Binance exchange

MicroStrategy’s recent initiative also comes to mind here. The giant announced a plan called “21/21”, which involves raising $42 billion over the next three years.

This money will eventually be used to buy bitcoins, whose current holdings the giant estimates at 17.6 billion.

Former MicroStrategy executive Michael Saylor said

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

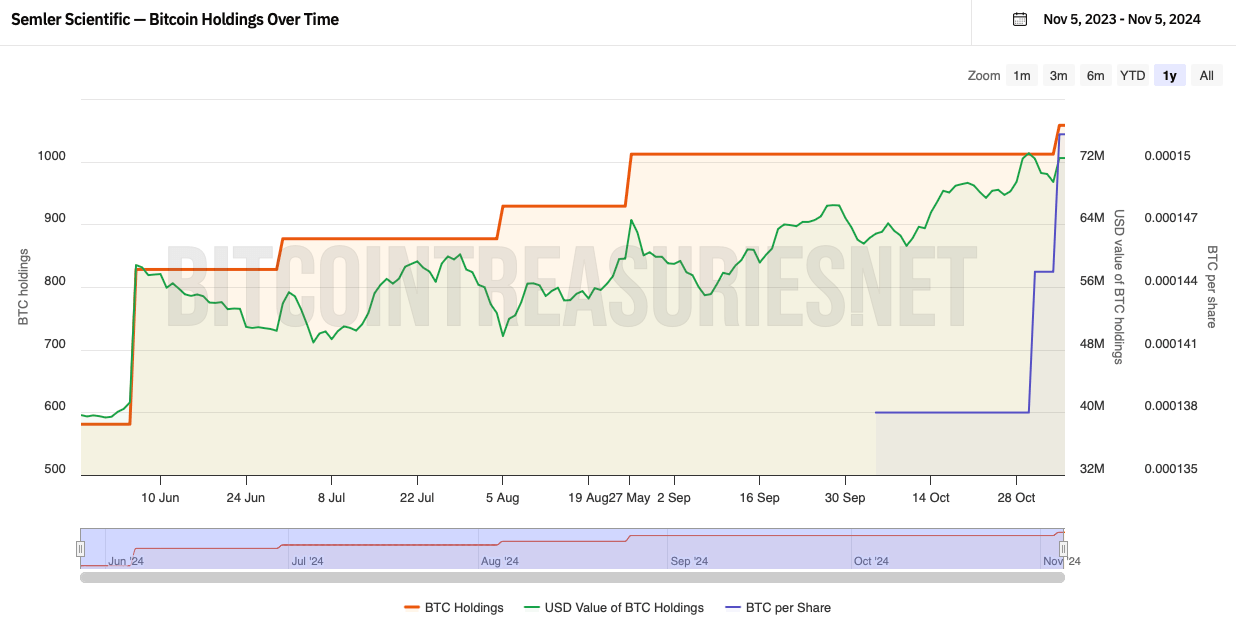

Another institutional player looking to enter the crypto market is Semler Scientific, a firm whose speciality includes medical devices.

From its fresh third-quarter earnings report, it revealed that it spent $71 million to buy 1,058 BTC. The firm later allocated another $8.4 million and $2.6 million to purchase an additional 141 and 40 coins.

Semler Scientific’s cryptocurrency portfolio

Semler Scientific CEO Doug Murphy-Chutorian commented on the firm’s strategy in an official statement on the occasion of the reporting release. Here is his comment.

We remain focused on acquiring and holding bitcoin while supporting the innovation and growth of our healthcare business.

The deal makes Semler Scientific the seventeenth largest holder of BTC among publicly traded companies, ahead of Japanese investment firm Metaplanet.

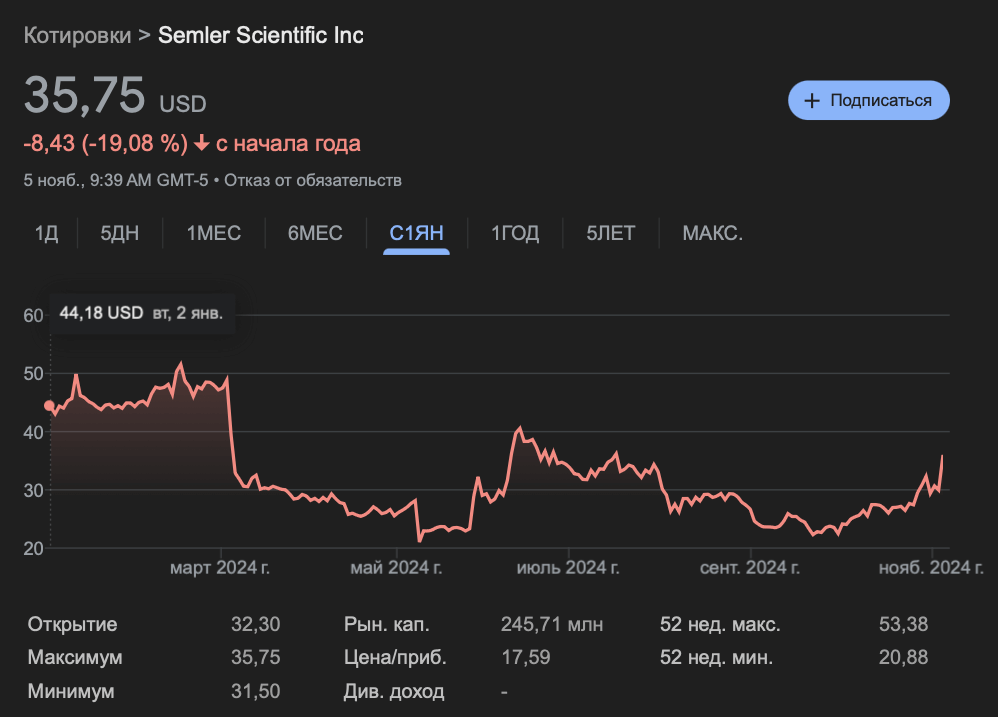

Semler Scientific’s share price as of 1 January 2024

Semler’s share price jumped 3.44 percent in after-hours trading on November 4 to $31. All told, the stock price is down 32.2 percent this year.

And here’s a comment from company chairman Eric Semler.

We are committed to maximising the benefit to our shareholders by building up our BTC holdings. In general, we plan to continue to acquire bitcoins with funds from operations as well as through proceeds from sales under the ATM programme. Moreover, new funding opportunities are being considered that will allow us to grow our cryptocurrency position even further.

Cryptocurrency investors during the bullrun

Semler’s third quarter financial results were mixed compared to the same period last year. The company’s quarterly revenue fell 17 percent to $13.5 million, while net income rose 2 percent to $5.6 million compared to the third quarter of 2023.

The news from the U.K. sounds great. Still, pension funds are traditionally low risk tolerance organisations. So Cartwright's willingness to get involved with Bitcoin is costly. Other similar funds are sure to follow suit later.

Look for more interesting information in our crypto chat room. In it we discuss other important news related to the world of blockchain and decentralised applications.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO KEEP UP TO DATE.