Vancouver’s mayor wants to integrate Bitcoin into the city’s budget. How will the cryptocurrency be useful?

Cryptocurrencies are penetrating deeper into society, and in this case it’s at the level of regional government in Canada. Vancouver Mayor Ken Sim announced a plan to acquire BTC for the balance of the city. He believes that in this way it is possible to achieve greater budget diversification and protection against inflation, as the digital asset is known for its ability to grow regardless of the situation in the world.

Bitcoin, along with other popular coins, is really gaining momentum. This is facilitated, among other things, by the predictions of famous people about the future of the crypto.

For example, co-founder and head of the investment fund Pantera Capital Dan Morehead considers the possible growth of Bitcoin to 780 thousand dollars in 2028. According to his version, the coming to power of Trump and the dominance of Republicans in Congress will ensure normal regulation of the coin sphere.

Cryptocurrency investors during the bullrun

Well, because of this, there will be significantly more buyers of crypto. And in this case, companies will not worry about the possibility of getting a fine from the Securities Commission at the most unexpected moment.

The main purpose of buying Bitcoin

At this week’s Vancouver City Council meeting, Mayor Sim presented a notice of motion that he intends to introduce on 11 December. It’s signed as “Preserving the city’s purchasing power by diversifying financial resources.” In the long term, the official plans to make Vancouver a “friendly city” for cryptocurrency adoption, with ample opportunities to interact with digital assets.

According to cryptocurrency enthusiast Jeff Booth, Mayor Ken Sim wants to make Bitcoin a reserve asset for Vancouver’s budget. However, the mayor’s representatives declined to comment on the situation in an interview with Cointelegraph reporters, so the official position on the matter is not yet known.

Vancouver Mayor Ken Sim

What is most interesting is that similar ideas have previously been heard in regional governments in the US. After the 2024 election, lawmakers in the Pennsylvania House of Representatives and the US Senate proposed that the government keep Bitcoin as a reserve asset. This idea was significantly influenced by the election campaign of newly elected President Donald Trump, who promised to solve the problem with the regulation of cryptocurrencies.

And in his election campaign, Mayor Sim’s team announced the acceptance of donations in the form of crypto. At the time, the politician stated that the move was to “demonstrate a commitment to technology.” He also noted that if elected, he would bring the issue of cryptocurrencies to the local government.

Vancouver residents elected Sims as their mayor in October 2022, and until recently, he had rarely made public statements about his acceptance of Bitcoin or cryptocurrencies in general.

That said, it’s amusing that in a 25 November interview with Global News, a copy of the book The Bitcoin Standard by Saifiddin Ammus was spotted in Sim’s office at Vancouver City Hall. It is considered one of the most famous works on the topic of digital assets in the world.

A book about Bitcoin in the Vancouver mayor’s office

It remains to be seen whether the mayor’s proposal will gain enough support to pass in Vancouver City Council. He says he has fulfilled more than 70 per cent of the 94 points of his campaign promises since taking office two years ago. Let’s hope crypto joins that list.

😈 MORE INTERESTING STUFF CAN BE FOUND AT US AT YANDEX.ZEN!

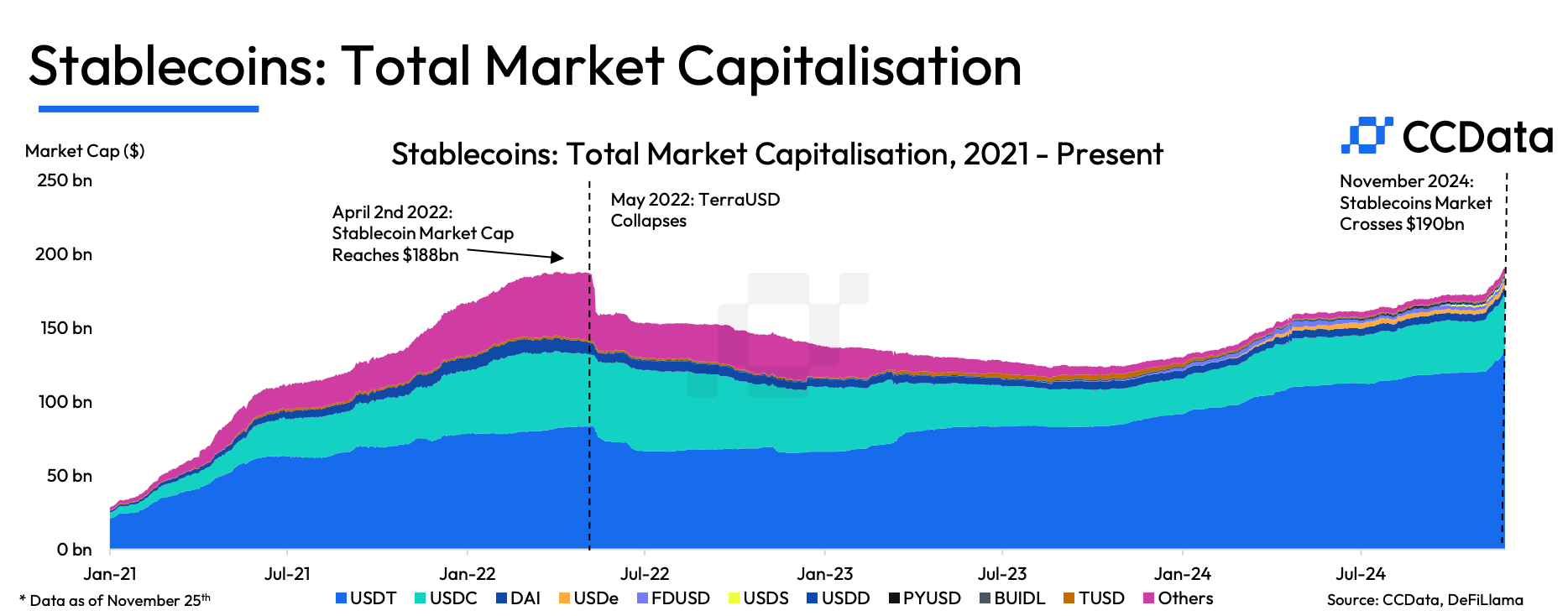

Cryptocurrencies are also now rapidly gaining popularity among institutional investors – a surge in stackablecoin transactions is testament to this. According to a report by analysts at the CCData platform, the trading volume of such tokens has grown by 77.5 percent.

As of 25 November, the figure stood at $1.81 trillion. Thanks to this increase, the monthly amount of transactions on centralised exchanges reached an annual maximum.

The total capitalisation of the stablecoin sphere rose by 9.94 percent in November, reaching a high of around $190 billion.

The last time such a high was seen was back before the spring of 2022, when the TerraUSD algorithmic stablecoin ecosystem collapsed. However, despite the growth, the share of stablecoins in total market capitalisation fell from 7.22 percent to 5.54 percent over the month as investors became more active in buying BTC and altcoins.

Capitalisations of the top steiblcoins

Tether’s USDT, the largest steiblcoin, continues to hold its position in the rankings, with its capitalisation rising 10.5 percent to $133 billion for the month. It accounts for 69.9 percent of the entire sphere, followed by Circle’s USD Coin, which increased its capitalisation by 12.1 percent to 38.9 billion in November – its highest level since February 2023.

And while USDT continues to be a leader in the stablecoin industry, not all of Tether's products are in demand. For example, yesterday the giant announced that it will stop supporting EURT, a steible linked to the euro exchange rate. Accordingly, they will no longer issue new such tokens.

The USDe token from Ethena Labs is also showing an increase in performance – its capitalisation grew by 42.2 percent to $3.86 billion. Here’s a quote on the matter.

The surge in demand for stablecoins can be attributed to increased interest in Ethena’s ecosystem following its proposal to activate revenue sharing for ENA token holders.

Tether CEO Paolo Ardoino

The USDe stablecoin was launched in February and currently offers an annualised yield of 21.2 per cent in staking.

Meanwhile, tokens First Digital USD (FDUSD) and Sky Dollar (USDS) recorded the most significant capitalisation drops in the sphere’s ranking. This figure for FDUSD fell 14.9 percent to $1.90 billion over the month, while USDS fell 8.34 percent to $950 million.

So far, it seems that everything is going towards the fact that eventually not only large global companies, but also cities and even individual countries will accumulate bitcoins. And since the maximum supply of the cryptocurrency remains limited, this could eventually lead to a rapid increase in its rate. At the very least, such a thing seems logical.

Want to keep up with other interesting news? Join our crypto chat to properly capitalise on the current bullrun.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.