What will affect Bitcoin and the crypto market in general the most in 2025: analysts’ version

The growing global money supply and the potential decline in the value of the U.S. dollar could be key reasons for a continued bullrun in the cryptocurrency market in 2025. Bitcoin itself continues to trade within a few thousand of the six-figure exchange rate, i.e. the 100k mark. According to analysts, given what is happening, crypto is becoming an increasingly large-scale phenomenon, so that the impact of the global economy on it is stronger every day. Well, traders and investors should predictably take this into account.

Meanwhile, there are more and more people who want to get involved with Bitcoin. Today it became known that the largest publicly traded BTC mining company called MARA Holdings acquired 6,474 coins worth $615 million.

Cryptocurrency Miner

As a result, the total accumulation of cryptocurrency reached 34,794 coins, which are valued at $3.3 billion.

What to expect from Bitcoin in 2025

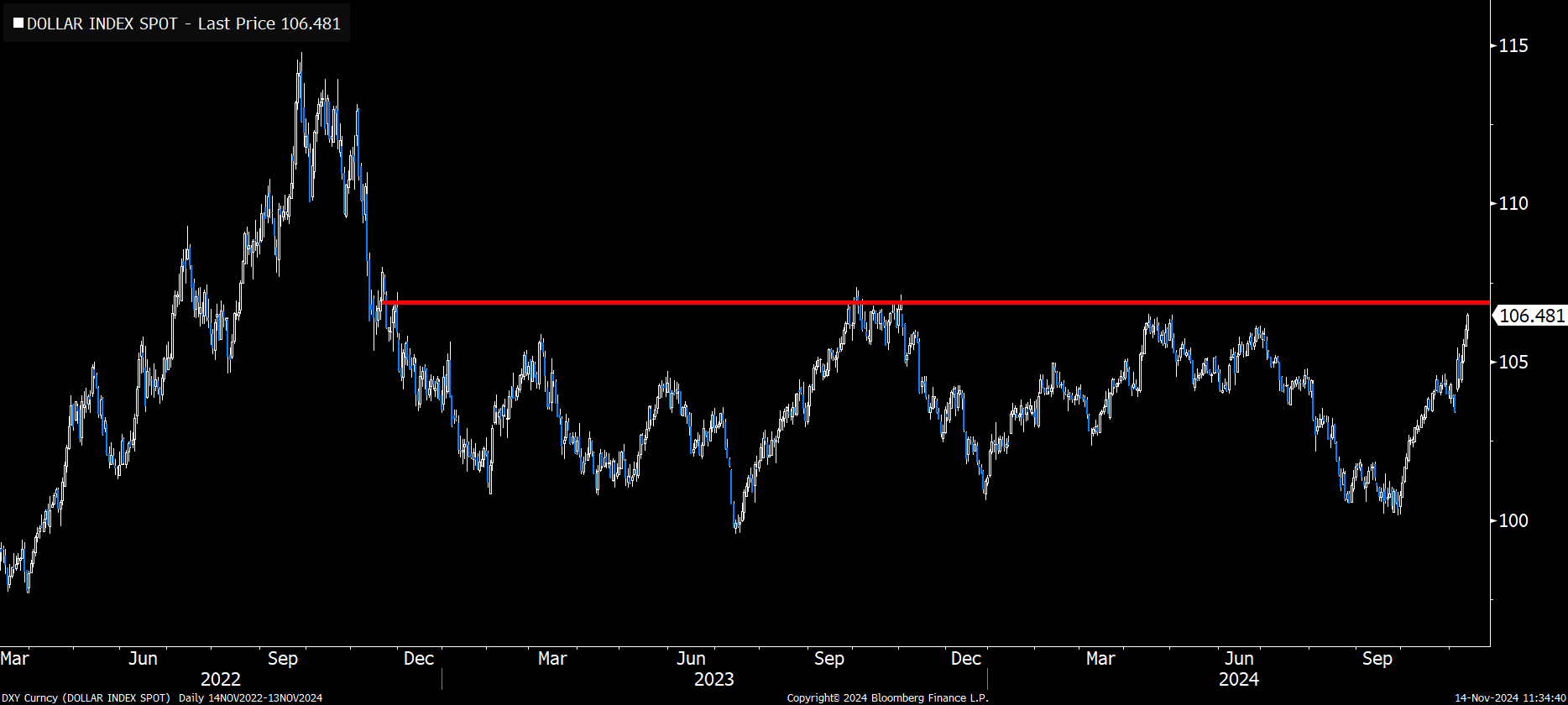

Jamie Coutts, chief analyst of the cryptocurrency division at Real Vision, bets in his forecasts on the dynamics of the dollar index (DXY), which reflects the strength of the U.S. national currency against other popular fiat. Here is his rejoinder to the market situation.

The DXY Dollar Index is likely to have peaked. The lagging effect now being highlighted on Twitter is still real. However, the bottom line is that the Fed is waving the bull flag for high risk assets again. I am positively bullish on 2025.

Chart of the DXY dollar index figure

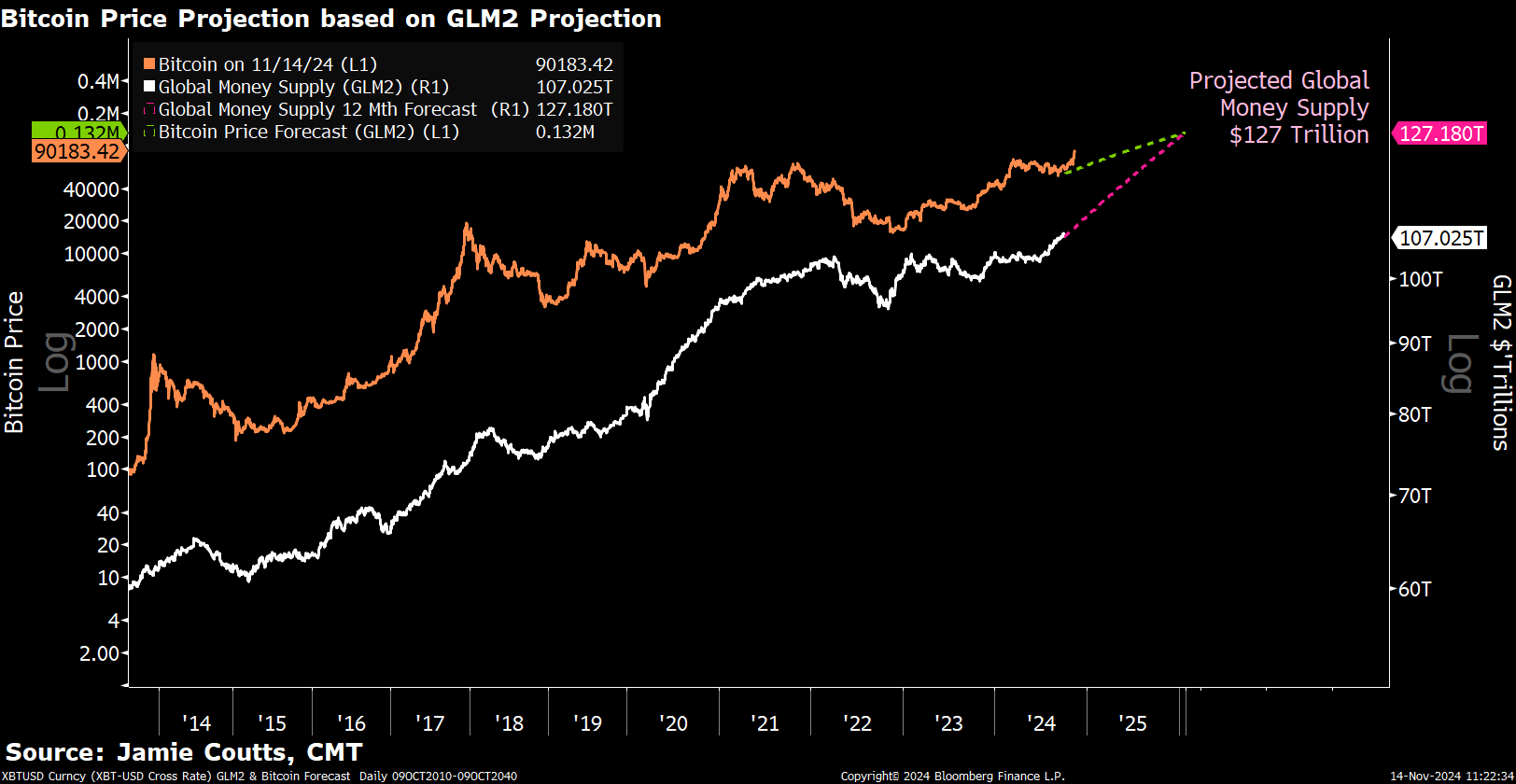

Kutts has previously cited the M2 money supply indicator as a key metric in determining Bitcoin’s next rally. This refers to a type of money supply that measures the volume of all cash and short-term bank deposits in the US.

According to Cointelegraph’s sources, in early May, the M2 money supply showed year-on-year growth for the first time since November 2023. This prompted investors to start looking for instruments to protect against inflation, with Bitcoin proving particularly popular among them.

The Bitcoin price is also able to benefit from the growth of the global M2 money supply, which is projected to increase due to the injection of liquidity from the US Federal Reserve. This figure is capable of growing to more than $127 trillion in 2025, up from the current $107 trillion.

BTC price projection on M2 money supply growth

Money supply growth is able to drive Bitcoin’s price to more than $132,000 over the next year, Coutts believes. Simply put, more money at people’s disposal will encourage them to invest some of their capital.

And in the current environment, cryptocurrencies are one of the most popular tools for this. The expert continues.

In the long term, I’m sticking with this cycle – a 12-month forecast based on a linear relationship with liquidity. Bitcoin’s growth cycles are not linear in nature, though. I think we will go much higher.

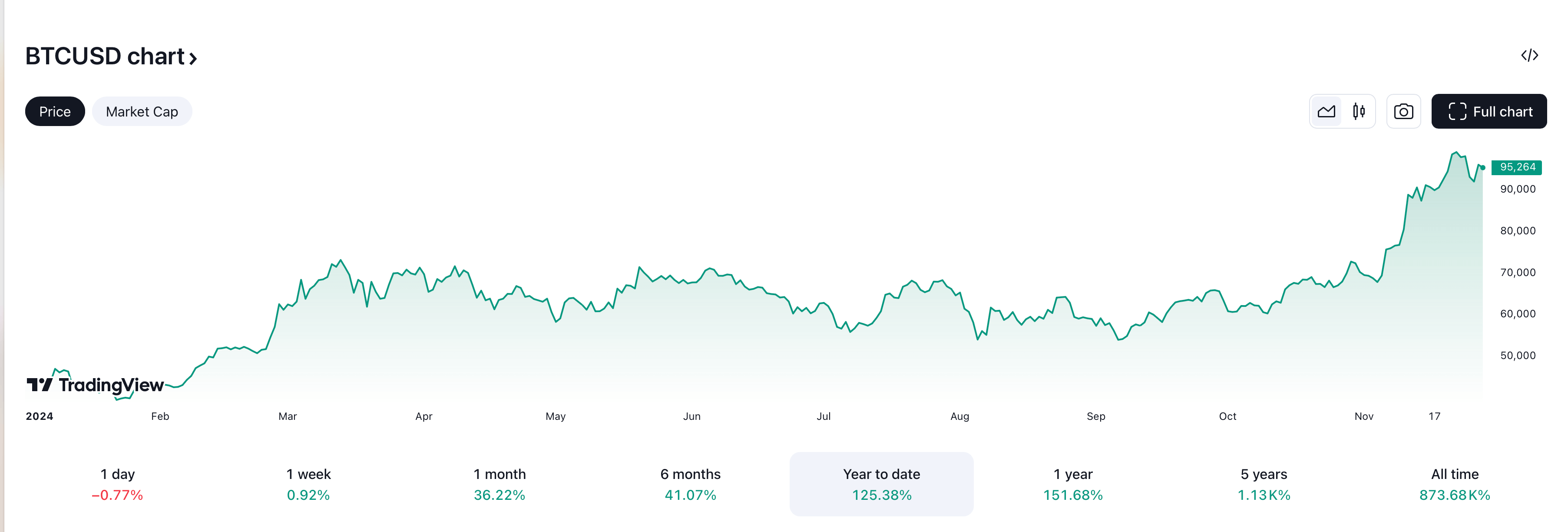

In such an environment, the weakness of the US dollar will prove to be far from the only important factor affecting Bitcoin’s price. Analysts at Bitfinex believe that Donald Trump’s victory in the recent presidential election has triggered a new wave of investor appetite for risk, which will intensify the cryptocurrency rally in 2025.

Moreover, the impact of what is happening has been visible on coin charts for the past three weeks.

We expect all crypto assets to continue to reach new highs next year once the Trump administration takes office and the industry benefits from an increasingly favourable regulatory environment.

Bitcoin BTC value change in 2024

Finally, another factor mentioned is MicroStrategy. It will continue to buy BTC after the last regular round of capital raising. This time, the giant received $3 billion. Here’s a comment.

MicroStrategy has executed only 29 percent of its 21/21 plan to buy BTC worth more than $40 billion.

As a reminder, this plan calls for the giant to raise $42 billion. Moreover, they will be directed to the acquisition of Bitcoin.

Meanwhile, for the first time since 2019, the number of active addresses in the Bitcoin network in a day is approaching the one million mark. This is a positive sign of the fundamental acceptance of the digital asset and its usefulness in the real world.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

This fact correlates with a report from French crypto wallet maker Trezor – the company recorded a 600 per cent increase in device sales in a week.

Trezor One hardware wallet

Trezor’s chief commercial officer, Danny Sanders, believes the industry owes a lot to Donald Trump’s promises to tackle proper regulation of cryptocurrencies. Here are his views on the matter.

He promises more clarity in the regulatory framework, which will lead to a better environment for companies in the sector and increased acceptance of crypto among professional institutional investors.

According to Sanders, and although the US election was a key event for cryptocurrencies, Trezor has not seen a significant change in the share of demand specifically in this region.

The difference is that the improvement in the U.S. continues to drive prices higher. This, in turn, is fuelling global demand for cryptocurrency wallets as new customers enter the industry.

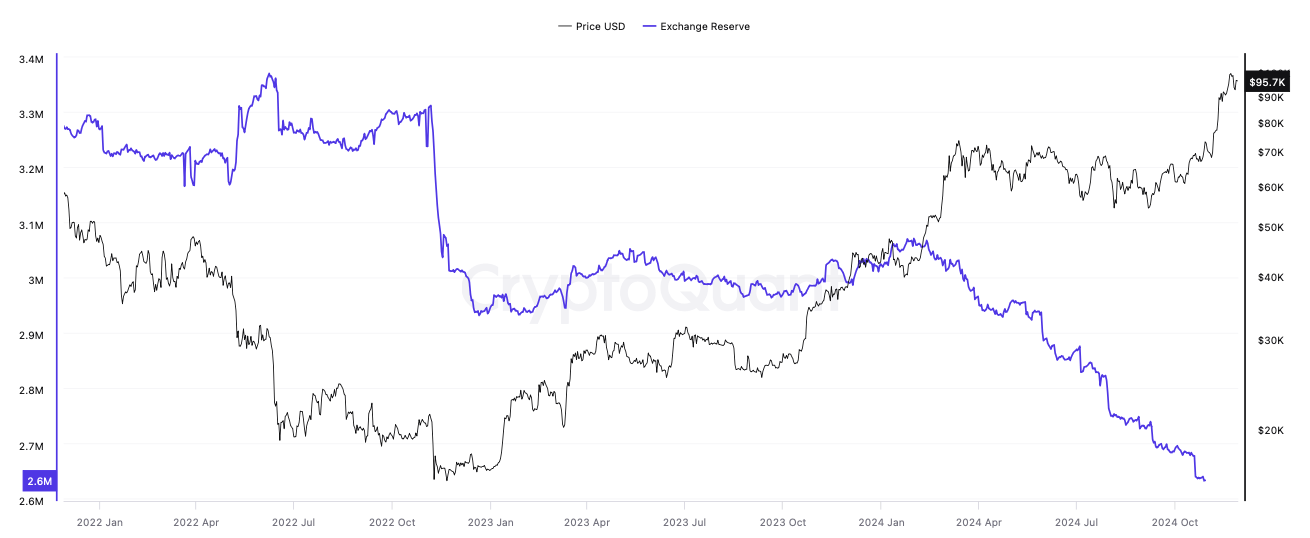

Sanders’ opinion is supported by statistics – namely the significant drop in BTC reserves on exchanges. According to CryptoQuant, Bitcoin reserves on the Binance and Coinbase platforms have fallen to their lowest level in six years.

Bitcoin reserves on centralised cryptocurrency exchanges

In 2024 alone, investors withdrew 427,000 BTC or approximately $40 billion from centralised trading platforms. This suggests that at least some portion of these coins are being transferred to cold wallets for long-term storage while waiting for the bullrun to continue.

So far, most analysts agree that 2025 will turn out to be the year of the final stage of the bullrun. However, with Donald Trump in power, cryptocurrencies in the United States will finally have a chance to be adequately regulated. And since this country is characterised by advanced financial markets, that's worth a lot.

For even more interesting stuff, check out our cryptocurrency chat. Subscribe so that you don’t miss the development of the digital asset market.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO KEEP UP TO DATE.