When the cryptocurrency market will peak: results of a fresh survey by an investment firm

Crypto has moved into a brighter bullrun phase, when rising coin rates start to attract newbie investors. With that in mind, Bernstein analysts have recommended buying literally any digital asset, and in as much volume as possible. But when the market will stop growing and move to the stage of bearish trend? MV Global survey participants shared their opinions on this issue.

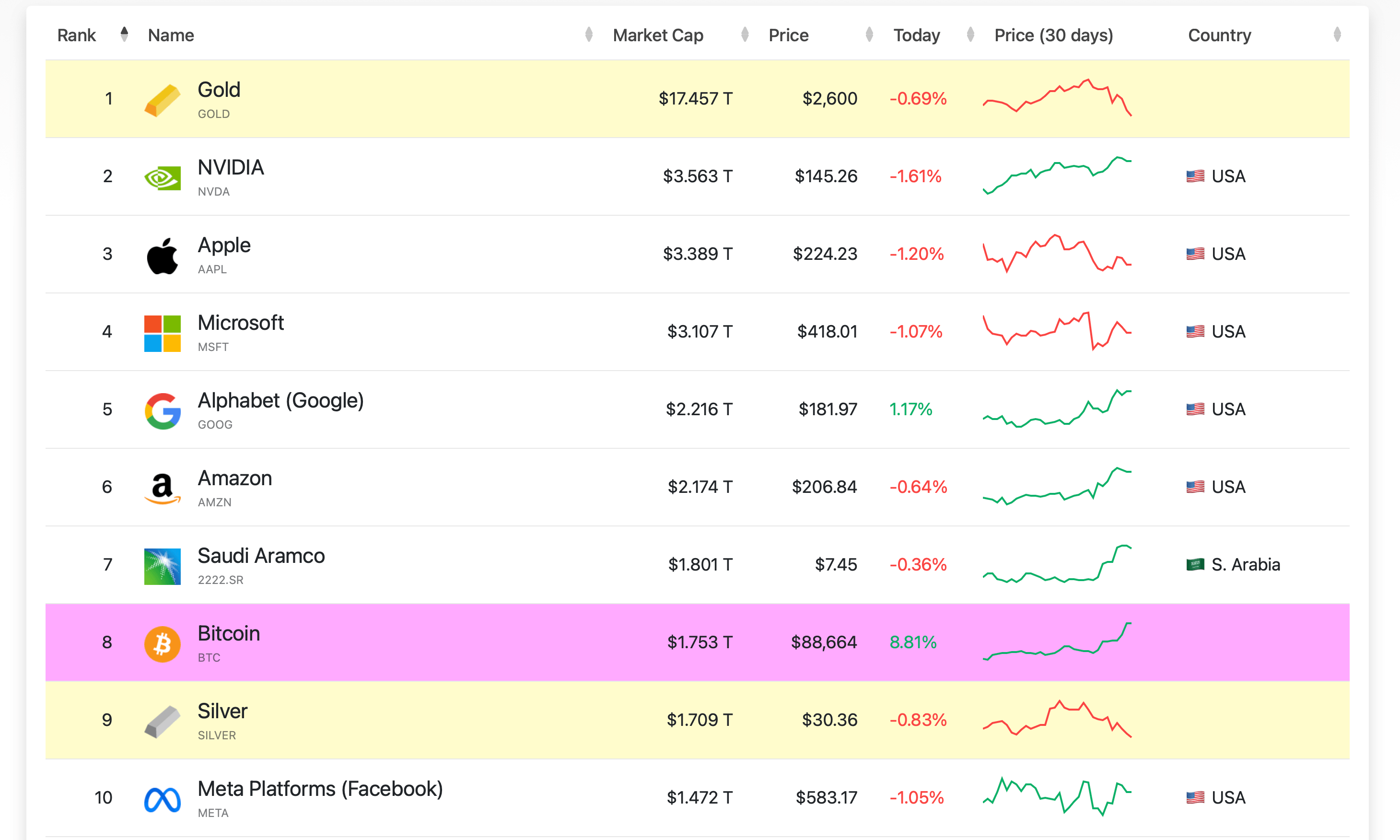

The activation of the bullrun in the crypto sphere is obvious. To make sure of it, it is enough to look at the changes in the rates of the largest coins by market capitalisation over the last week.

Actual rates of the largest cryptocurrencies by market capitalisation today

Bitcoin for this period rose in price by more than a quarter, well, and the leader of growth was the largest meme-coin DOGE. The most popular dog in the niche of digital assets jumped 124 per cent, that is, more than doubled in price in seven days.

Against the backdrop of what is happening, Bitcoin also surpassed silver in terms of market capitalisation.

Today Bitcoin surpassed silver in market capitalisation.

Well, the coins at the disposal of the government of Bhutan for the first time exceeded the mark of one billion dollars. Let us remind you that this state mines BTC and stores them.

The volume of bitcoins at the disposal of Bhutan, which have been mined

Of course, any growth of crypto sooner or later comes to an end, because of which this asset market is considered cyclical. Therefore, the approximate timing of the end of the bullrun can be thought about now.

When cryptocurrency will start to fall

According to the results of MV Global research, the peak of the current growth of the cryptocurrency market will be recorded in the second half of 2025 – this option was chosen by about half of the people surveyed.

At the same time, respondents expect the maximum Bitcoin rate at the level of 100 to 150 thousand dollars.

Expectations from the current bullrun were shared by 77 large cryptocurrency investors. Among them were venture capital companies, hedge funds and wealthy individuals.

Cryptocurrency investors during the bullrun

MV Global Managing Partner Tom Dunleavy shared a commentary on the survey results. Here’s a quote that Cointelegraph cites.

It seems to be a very popular opinion, which means it’s already likely being taken into account by the markets.

What the expert means is that such expectations for Bitcoin to rise above $100,000 is the general consensus among crypto investors. That's why on Monday the first cryptocurrency rose in price by more than $8 thousand - it can be considered a reflection of investors' confidence in what is happening.

The majority of respondents said they have serious expectations for the Solana cryptocurrency. With 30 per cent of respondents betting on SOL rising above the $600 level by the end of the cycle.

Dunleavy continues.

Investors are opening long positions on Solana. This is the case for virtually every capital holder we spoke to.

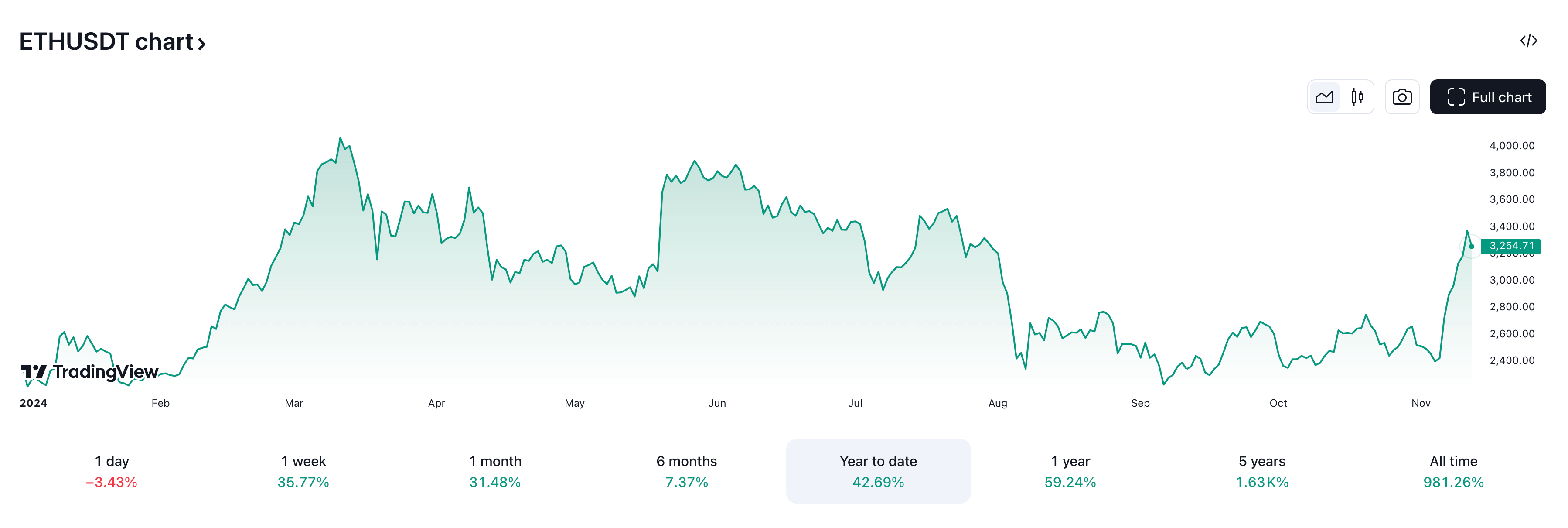

Attitudes towards Efirium are mixed right now – obviously, such a thing is caused by the cryptocurrency’s poor performance this year. While Bitcoin and SOL have risen 105 and 107 per cent respectively since the start of 2024, ETH has only jumped 42 per cent.

The change in the value of Etherium ETH in 2024

A representative from MV Global commented as follows.

Being optimistic about ETH right now is definitely a counter-intuitive bet.

Well-known trader and analyst Peter Brandt supported this prediction on the possible scale of Bitcoin’s growth. However, he expects a much faster jump in the cryptocurrency.

According to Brandt, Bitcoin has now entered a phase of pronounced price discovery, which happened for the first time since December 2020. The expert believes that it is peculiar for the first cryptocurrency to repeat its previous actions during the stages of sharp growth.

Bitcoin’s strength against fiat currencies

Peter used Bayesian probability, which determines the conditional probability of an event in the future based on data sets from the past. And if BTC repeats the four-year experience, then investors can expect the cryptocurrency to rise to the $125,000 mark before the start of 2025.

Traditionally, we remind you that even experienced traders and analysts can be wrong. Therefore, you should not believe Peter Brandt's version - it is better to take it solely as one of the probable events in the future.

.

However, other analysts earlier also supported the version about the possible growth of the crypto market until the end of 2024. This opinion was shared by representatives of the largest American crypto exchange Coinbase.

According to their version, the increase in the popularity of coins will primarily contribute to the recent victory of Donald Trump in the US presidential election. Still, during the election campaign he attracted coin lovers to his side, promising them the approval of adequate regulation of the industry.

Newly elected US President Donald Trump buys burgers with bitcoins

In addition, Trump as US president means a change in the chairman of the Securities Commission, Gary Gensler. The latter has been filing lawsuits against the industry’s biggest companies for years, calling cryptocurrencies unregistered securities. And the absence of this factor will definitely benefit the coin sphere.

Investors' opinions in such surveys are just attempts to guess the future, which may not come true. However, it is still worth to orientate on them. Still, the generally accepted duration of the bull run affects the mood of market participants, who may decide to withdraw from positions solely because of the orientation on the duration of previous such phases. And this will directly affect the assets.

.

Join our crypto chat. Be sure to join so you don’t miss the continuation of the bullrun in the coin industry and its conclusion.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO STAY UP TO DATE.