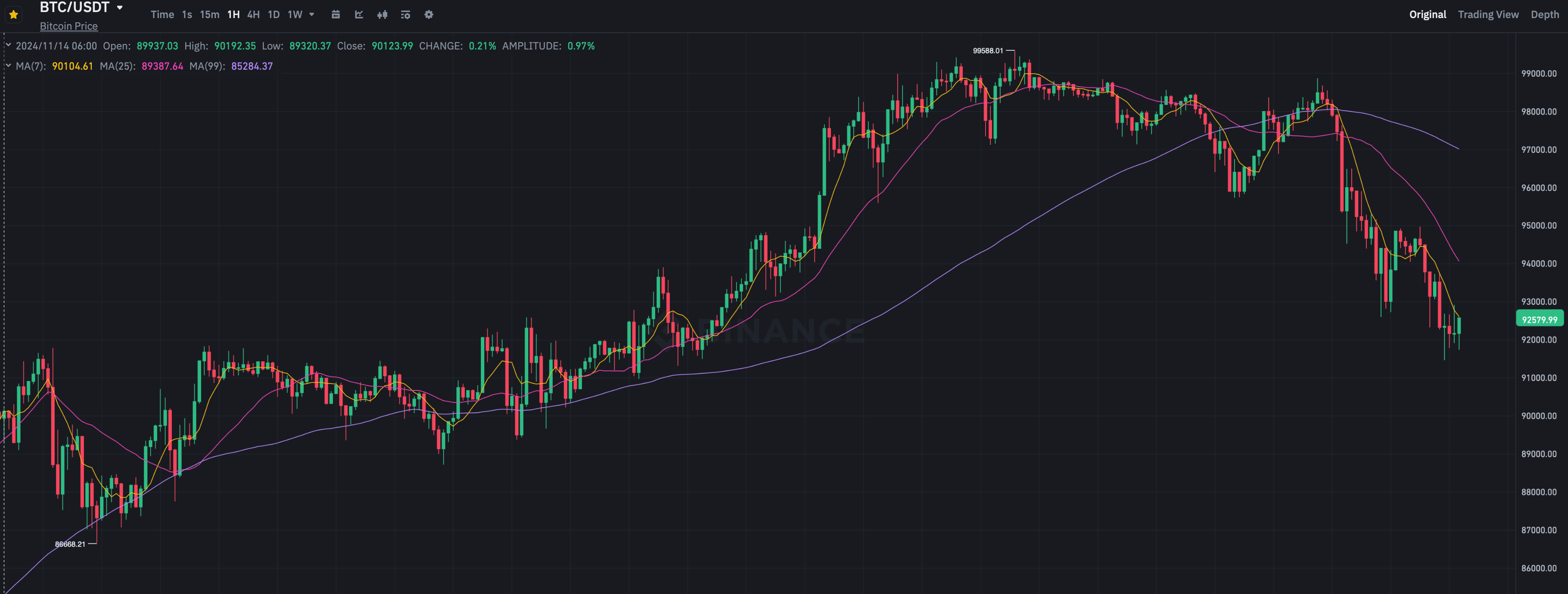

Who caused Bitcoin’s current collapse to $92,000: the blockchain version of the data

At the end of last week, Bitcoin set its next historic high. On Friday evening, the cryptocurrency reached the level of $99,588 on the Binance exchange, that is, it was not enough to reach the cherished level of 100 thousand. After that, the market turned around, and BTC became noticeably cheaper. And as analysts believe, what is happening with spot ETFs on the first cryptocurrency is not the reason for the current collapse.

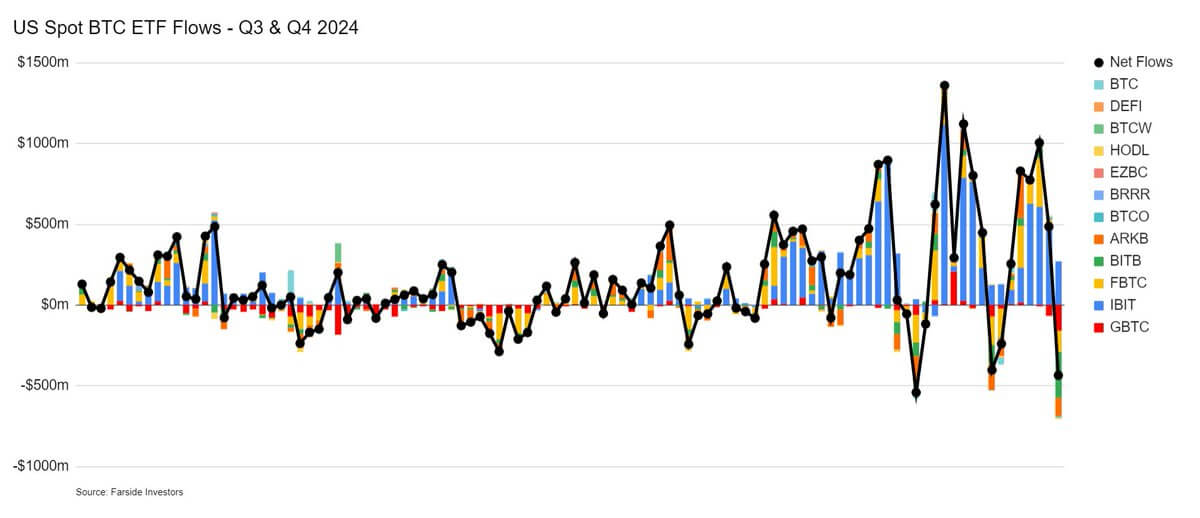

Exchange-traded funds on BTC were mentioned not by chance. The fact is that at the end of Monday they recorded a net outflow of capital at the level of 435 million dollars.

Capital flows in spot Bitcoin ETFs in the U.S.

Thus spot ETFs broke the series of net inflows for five consecutive days with a total result of 3.35 billion.

This is the largest week-on-week performance of exchange traded funds. Accordingly, investor demand for the instruments proved to be huge in November.

However, then the influx stopped, and the value of the first coin significantly sagged. Who is to blame for this?

Why Bitcoin has now fallen

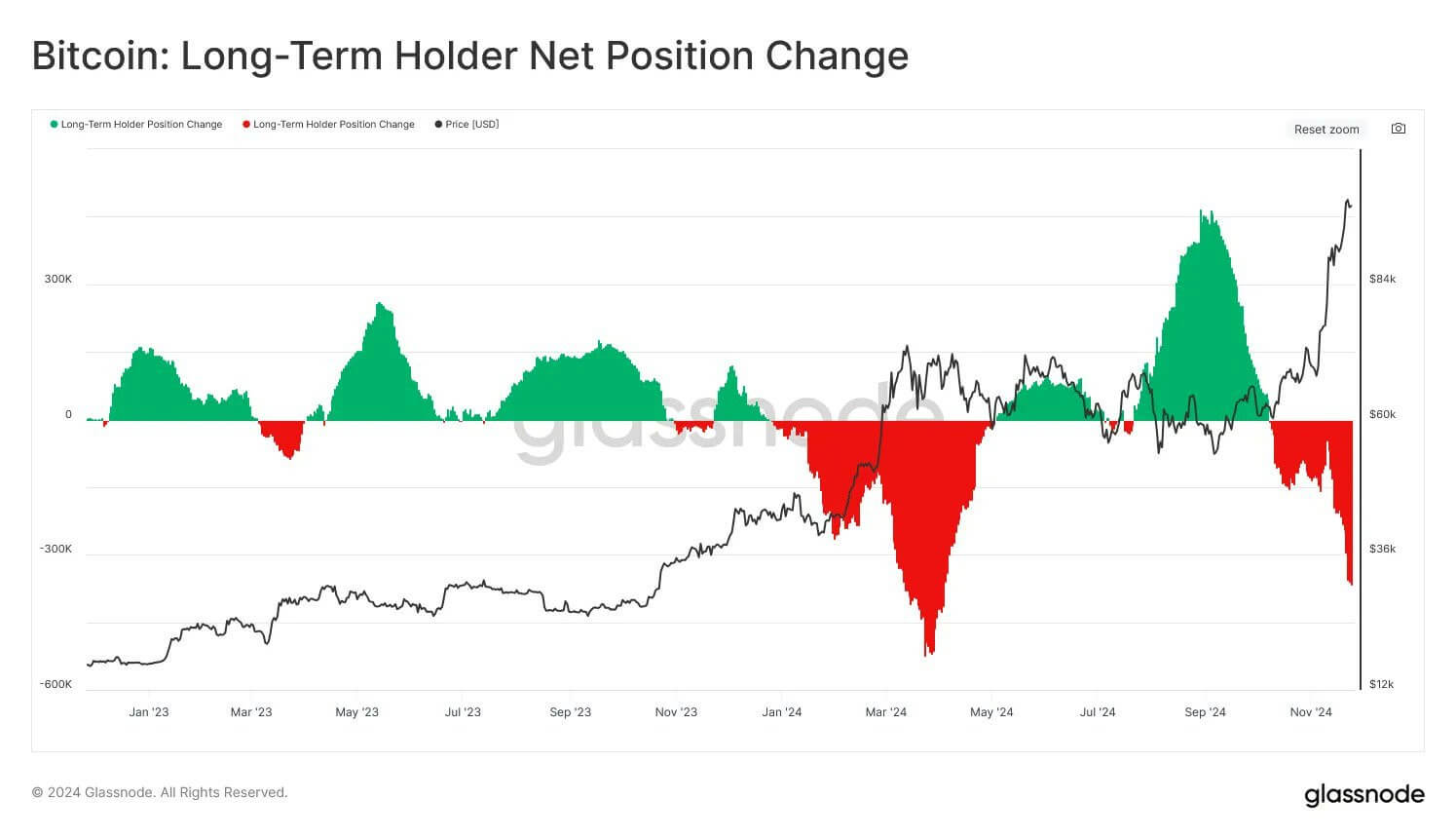

As the data in the blockchain shows, the current collapse of Bitcoin and the coin market in general was not triggered by an outflow of funds from spot cryptocurrency ETFs in the US. Instead, it was the actions of long-term investors who have been holding coins without moving them for at least six months that led to the market sag.

What is happening in the market was commented on by Bloomberg analyst Eric Balchunas. According to his data, the most active sellers now are experienced players or so-called holders.

Hourly chart of the Bitcoin BTC rate on the Binance exchange

Here’s a comment on this that Cointelegraph cites.

I see crypto enthusiasts bewildered and angry: how is it that Sailor can buy $5 billion worth of bitcoins and the price doesn’t go up? The same thing is sometimes said about ETFs after big infusions. Here’s the data supporting my theory: the reason is within the system, it’s the long-term holders.

As a reminder, yesterday MicroStrategy reported buying 55.5 thousand bitcoins worth $5.4 billion. Thus, the total accumulation of companies reaches 386,700 coins, in which 21.9 billion was invested.

Such a purchase of crypto, which is sent for long-term storage, is indeed a large-scale operation. Therefore, speculation about the reasons for the market collapse on the background of such purchases can be understood.

Glassnode analysts confirm that long-term bitcoin holders have taken to getting rid of the cryptocurrency as its value approaches $100,000. According to their data, now the rate of coin sales by this category of players is 366 thousand BTC.

Activation of bitcoin sales by long-term holders of the cryptocurrency

And this is the largest figure since April 2024.

According to analyst and trader Kyle du Plessis, spot Bitcoin-ETFs not only failed to collapse the cryptocurrency’s exchange rate amid Monday’s outflow of funds from such instruments, but also absorbed a good portion of sales by long-term players.

Here’s his cue.

Long-term Bitcoin holders got rid of 128,000 coins, with US spot ETFs taking 90 per cent of the selling pressure. Serious demand for the digital asset from institutional investors is helping the current BTC rally, bringing it closer to the coveted $100,000 level.

However, in the current correction can be found a plus for the stability of the coin market in the future. According to the head of Crypto-com platform Chris Marshalek, the growth of the industry on the previous day was accompanied by too high leverage.

Crypto.com platform manager Chris Marszalek

This means that many traders used the leverage of trading platforms to execute trades, thereby falling under the risk of forced liquidation of positions. A drawdown like the current one is able to curb the appetite of risk-taking traders, causing purchases of digital assets to be more natural.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Meanwhile, the popularity of cryptocurrencies continues to grow globally. For example, now the desire to legalise digital assets has been announced by the authorities of Morocco. This news turns out to be particularly important due to the fact that in November 2017 in the country was banned interaction with coins.

According to Reuters’ sources, the country’s central bank has prepared a bill to regulate crypto – and it is now under consideration. Well, it was inspired by the bill on comprehensive regulation of the crypto industry in the EU, also known as MiCA.

The Governor of the Central Bank of Morocco, Abdellatif Juahri, said that his colleagues are studying the prospects of launching a central bank digital currency under the acronym CBDC. Here’s a comment on the matter.

When we talk about central bank digital currencies, we are studying, along the lines of many countries around the world, the extent to which this new form of money can advance the realisation of key societal objectives – especially in the area of financial inclusion.

It should be noted that fans of decentralisation are predominantly against the popularisation of CBDCs. However, in theory, this solution will allow the authorities to control the expenditures of the population - including taking into account their actions. Well, it does not correspond to the spirit of full-fledged cryptocurrencies and is in fact their opposite.

Central Bank of Morocco

As previous bullruns in the crypto niche show, usually the growth of coins is accompanied by periodic collapses of rates, and this happens even on a large scale. Such allows to calm the market and tame traders who start using too much leverage. So, in general, the situation does not look terrible.

Come to our crypto chat. We are waiting for you there already now, because the current bullrun will not last forever.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO BE INFORMED.