YouTube competitor will buy tens of millions of dollars worth of bitcoins. Why would he want to do that?

Rumble, a platform that positions itself as an alternative to major video hosting site YouTube, will spend up to $20 million to acquire Bitcoin. Last week, Rumble CEO Chris Pawlowski asked followers about the idea of adding BTC to the company’s balance sheet on Twitter and even got a response from former MicroStrategy executive Michael Saylor. Now the platform has released an official statement about its new investment strategy.

As a reminder, Rumble is a video hosting service with approximately 67 million monthly active users. The platform is known for its softer approach to content moderation than other similar services.

Rumble video hosting homepage

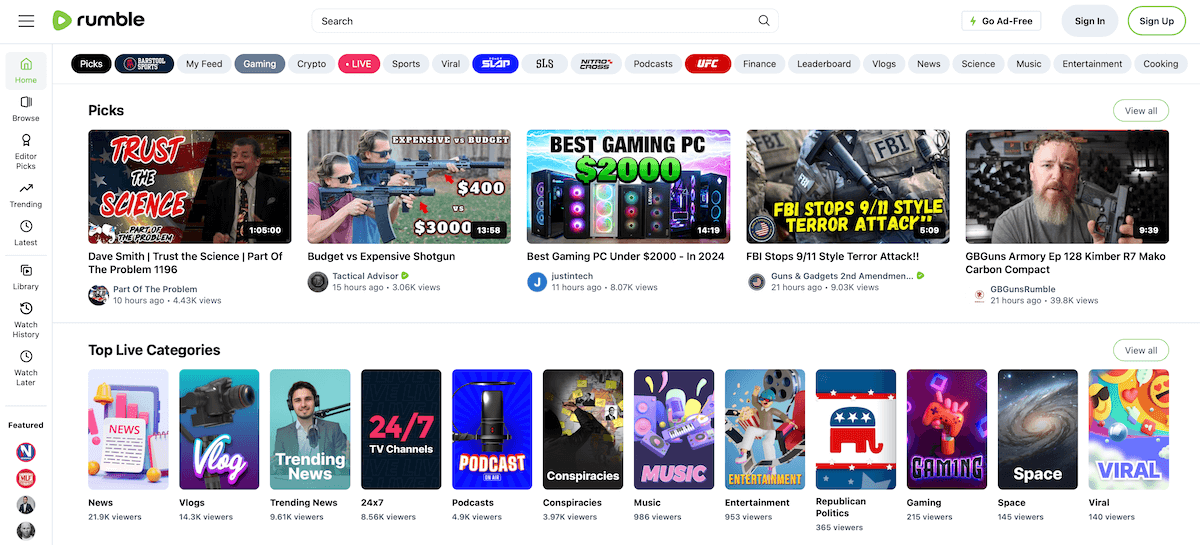

In general, buying bitcoins is a gaining popularity in the corporate world, a trend that MicroStrategy was at the origin of. Back in 2020, it started buying BTC for its balance sheet in huge quantities despite the market situation. The giant’s bold strategy paid off – against the backdrop of the bullrun, MicroStrategy’s stock returns became one of the best in the history of the US stock market.

As of today, MicroStrategy continues to be the largest bitcoin holder among publicly traded companies. The company owns 386,700 coins with $21.9 billion invested in them. Meanwhile, this amount is valued at $35.5 billion today, which is equivalent to 62 per cent growth.

Ranking of public companies by the number of bitcoins acquired

This amount translates to 1.84 percent of all bitcoins in circulation. Well, according to representatives of the analytical platform Bernstein, this volume will at least increase to 4 per cent by 2033 – we talked more about this in a separate piece.

Which companies have bitcoins

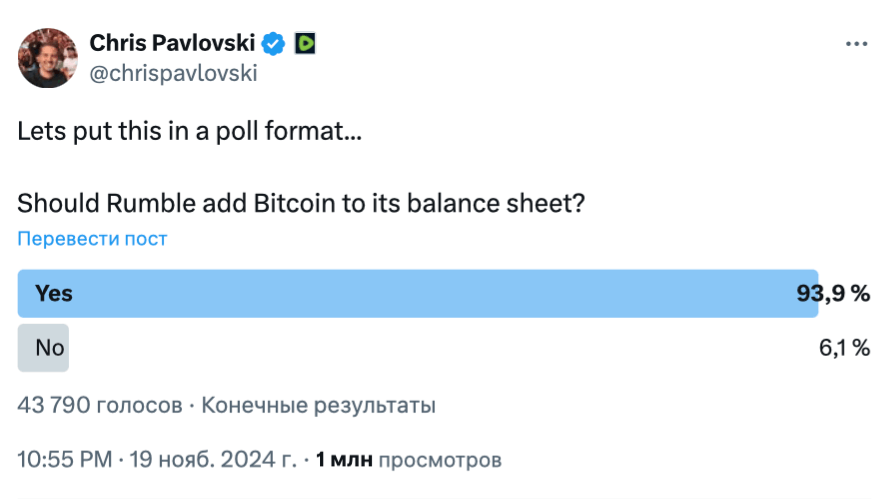

According to Cointelegraph’s sources, last week Pawlowski published a poll on his page about whether his company should add bitcoins to its balance sheet.

43,790 people participated in the poll, with 93.9 percent of them answering in the affirmative. Obviously, among the participants there were enough ordinary fans of digital assets who decided to support the industry in this way. However, the result still clearly illustrates the current popularity of the coin market.

The results of the Twitter poll

Amusingly, Michael Sailor from MicroStrategy responded to the Rumble leader’s question. He offered to host a conversation where he would talk about the reasons to buy bitcoins and the options available for such transactions. Pawlowski agreed.

According to Rumble, the date of the first BTC purchase will be “determined by management at its discretion and will depend on several factors” along the lines of overall market conditions, the price of Bitcoin and the platform’s need for cash.

Pawlowski also commented on the survey results and his decision.

We believe that the world is just beginning to discover Bitcoin, a process that has been accelerated by the election of a crypto-friendly administration in the U.S. and growing interest from institutional investors. Unlike government currencies, which are subject to endless issuance, BTC retains its value. Cryptocurrency is becoming a reliable tool to fight inflation and an ideal complement to our assets.

The company’s strategy of acquiring crypto can be suspended, terminated or changed by the company at any time for any reason. However, its representatives also emphasised that the move marks a “belief in Bitcoin as a valuable strategic planning tool”.

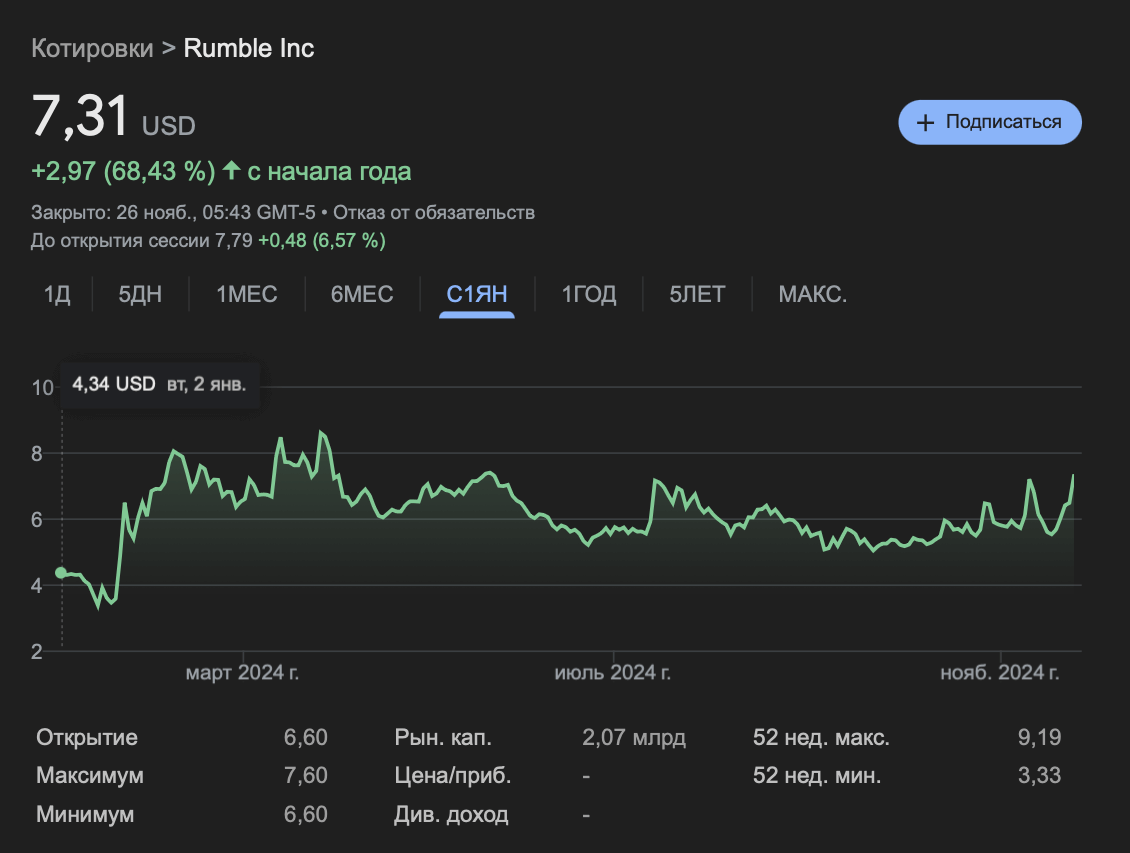

Change in Rumble’s share price from 1 January 2024

Rumble (RUM) shares rose 12.63 percent to $7.31 in a single trading session following the official announcement of the cryptocurrency purchase. In the subsequent trading session, the stock continued to rise another 5.47 percent, this time to $7.71. Accordingly, investors took such a move by the company’s management positively.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Meanwhile, the US Securities and Exchange Commission (SEC) published a financial report for 2024. According to the document, the regulator received $8.2 billion in various fines and penalties imposed on its part. More than half of the amount at 4.5 billion was received as a result of the court case against the collapsed cryptocurrency company Terraform Labs and its former head Do Kwon.

The $60 billion project ecosystem collapsed in May 2022. It was caused by the fact that the UST stablecoin lost its peg to the dollar, as a result of which investors suffered huge losses, and the head of the company Do Kwon was arrested on suspicion of fraud.

SEC Chairman Gary Gensler

Despite a 26 per cent drop in lawsuits, the regulator’s enforcement revenue is up 65.5 per cent from 2023. And while the SEC extols its enforcement actions as a victory for investor protection, members of the crypto industry are rejoicing over the impending departure of SEC Chairman Gary Gensler.

Still, shortly after Donald Trump’s re-election, Gensler announced that he would leave his post on 20 January 2025, which is the day of the newly elected president’s inauguration. Trump, who promised to fire Gensler on his first day in office, also predicted a change in the SEC leadership’s attitude towards cryptocurrencies in the long term.

The Rumble situation illustrates the changes in the world that the US election results have already triggered. Apparently, in time Bitcoin will become a ubiquitous instrument of protection against inflation. Well, its popularity will be primarily promoted by the actions of such giants.

Want to keep up with other interesting news? Join our crypto chat of future millionaires. In it, we will discuss other important news that lead to the development of the current bullrun in the niche of digital assets.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.