10 top 2024 crypto events: launch of Bitcoin-ETF, success of Hamster Kombat and BTC at $100k

The passing year of 2024 was very eventful for the cryptocurrency industry. Still, the market definitely moved to the growth phase or so-called bullrun, because of which many popular coins set new price records – including Bitcoin. However, it didn’t end with the rate hikes. A lot of interesting things happened in the digital asset sphere, and we’ll look back at the key stories here.

Contents

- 1 Approval of spot Bitcoin-ETFs in the US

- 2 A $1.2 million Bitcoin mistake

- 3 The verdict for Sam Bankman-Fried

- 4 The fourth halving in Bitcoin’s history

- 5 FBI warning about cryptocurrencies

- 6 The launch of Hamster Kombat and the success of Telegram clickers

- 7 Norwegian residents’ fight against miners

- 8 Bankrupt Mt.Gox’s delayed payouts

- 9 Donald Trump’s victory in the US presidential election

- 10 MicroStrategy purchases billions of dollars worth of BTC

Approval of spot Bitcoin-ETFs in the U.S.

On 11 January 2024, the Securities Commission approved the launch of spot Bitcoin-ETFs. This gave large funds, companies and just ordinary retail investors the opportunity to connect with the world of cryptocurrencies by buying familiar BTC-based exchange-traded fund shares on US exchanges.

There were eleven such instruments in total – from Ark Invest/21Shares, Bitwise, BlackRock, Fidelity, Franklin Templeton, Grayscale, Invesco, Valkyrie, VanEck and WisdomTree. And the release was more than successful.

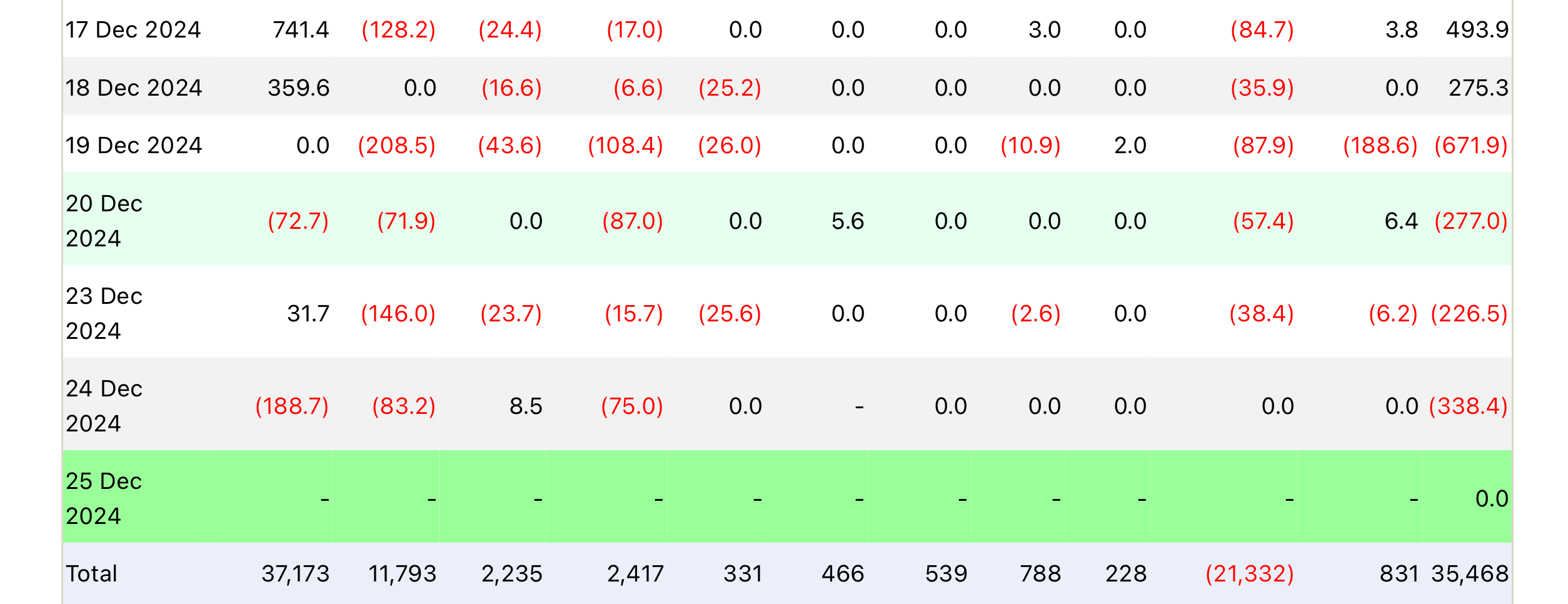

Total net capital inflows into spot Bitcoin-ETFs

As of today, such exchange traded funds have recorded net inflows of $35.4 billion, while BlackRock’s iShares Bitcoin Trust (IBIT) has become the fastest-growing ETF in the history of the market.

A $1.2 million bitcoin mistake

In the same month, a very strange event occurred: an anonymous user of the Bitcoin network sent 26.9 BTC equivalent to $1.2 million to a cryptocurrency address, which is the first created address in the blockchain.

It was owned by a Bitcoin network developer under the pseudonym Satoshi Nakamoto, whose identity still remains unknown. And since Satoshi has disappeared and is not using his wallets, this crypto can essentially be considered discarded.

Dorian Nakamoto, who is often portrayed as Bitcoin creator Satoshi Nakamoto

Coinbase cryptocurrency exchange representative Conor Grogan commented on the news. Here is his retort, which Decrypt quotes.

Either Satoshi suddenly woke up, bought 27 bitcoins on Binance and sent them to his old wallet, or someone just burned a million dollars.

Sentencing for Sam Bankman-Fried

In March, the former head of cryptocurrency exchange FTX was sentenced to 25 years in prison. Sam Bankman-Fried was accused of fraud and other sins as the platform’s management and related trading firm Alameda Research used users’ funds without their knowledge.

Former FTX crypto exchange executive Sam Bankman-Fried

The money was used to conduct trades, invest in property, fund politicians’ election campaigns and more. As a result, users lost billions of dollars worth of crypto assets, for which the top of this crypto empire had to answer.

The fourth halving in Bitcoin’s history

On 20 April 2024, the Bitcoin network went through another halving. It is a procedure of reducing the miners’ rewards for each mined block within the blockchain.

The impact of Bitcoin halving on miners

Until the specified number, ASIC owners received 6.25 BTC for each block, and now the figure has decreased to 3.125 coins. Accordingly, the overall issuance rate of the first cryptocurrency has also sagged by 50 per cent.

A warning about cryptocurrencies from the FBI

In mid-spring, the topic of cryptocurrency was touched upon by FBI officials. They recommended that Americans avoid interacting with cryptocurrency platforms that are not registered as financial institutions under federal law.

In this way, citizens could avoid unnecessary financial and legal risks. On top of that, they were advised not to use platforms that do not confirm the identity of their customers through the so-called KYC process.

Here is a rejoinder on the matter.

Cryptocurrency transfer services that deliberately break the law or knowingly facilitate illegal transactions will inevitably find themselves on the radar of law enforcement. By using services that ignore their legal obligations, you risk losing access to your funds if these companies are targeted by law enforcement operations.

The launch of Hamster Kombat and the success of Telegram clickers

At the end of September, the main topic of discussion in the crypto industry was the release of the HMSTR token from the Hamster Kombat clicker project. And although the distribution was very large-scale – more than 300 million people have played the game – the amount of accrued coins was insignificant.

Hamster Kombat game

In addition, the HMSTR exchange rate dropped significantly after the launch due to the huge number of token holders. This, in turn, forced novice investors to get rid of coins, which put even more pressure on the exchange rate of the latter.

However, the Telegram Open Network (TON) proved its serious prospects thanks to an event of this size and was on the radar of many advanced crypto users.

Norwegian residents struggle with miners

Residents of the Norwegian town of Stockmarknes tried for three years to shut down a local bitcoin miner due to complaints of constant noise. Eventually, the venture, led by KryptoVault, ceased operations.

And while miners can indeed be annoying due to the high volume of operation, they are also capable of absorbing excess energy, thereby stabilising what is happening on the network and reducing costs for regular users.

Eventually, the Norwegians learnt this in practice. Still, after crypto mining stopped, the local energy company Noranett raised its rates by more than 20 per cent. The reason for this was the closure of the said company and financial losses for the giant.

Deferred payments of bankrupt exchange Mt.Gox

The bankrupt crypto exchange Mt.Gox, which was once hacked and lost 850,000 bitcoins, was supposed to make payments to creditors until 31 October 2024. And some users have already received accruals in BTC and Bitcoin Cash.

However, it was still not possible to invest in the specified terms. Therefore, the payment period was extended until 31 October 2025.

Donald Trump’s victory in the US presidential election

One of the main achievements of the coin industry was its active support of Donald Trump. Still the politician promised to provide adequate regulation for the sphere, to fire the current SEC chairman Gary Gensler, as well as to turn the US into the cryptocurrency capital of the world.

In addition, Trump became the first president to conduct a transaction in the Bitcoin network and talked about creating a national BTC reserve for the US, which involves the purchase of a million coins by the government. It is believed that this idea could even affect the standard cycles in the crypto market.

Newly elected US President Donald Trump at a Pubkey bar

Well, Donald Trump’s victory has caused the coin industry to surge. During it, Bitcoin took the $100,000 level for the first time in its history – it happened on 5 December 2024.

MicroStrategy BTC purchases worth billions of dollars

Michael Saylor’s MicroStrategy continued to be the largest holder of bitcoins and consolidated its position. For example, the company has been buying huge amounts of BTC every Monday for the past six weeks.

Thus today the giant owns 444,262 coins with $27.7 billion invested.

Public companies with the largest bitcoin holdings

On top of that, MicroStrategy unveiled a plan called “21/21”. It involves raising $42 billion to be invested in the first cryptocurrency. So the BTC purchases will continue.

Check out our crypto chat. And preferably soon.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.