2024 results on the number of hacker attacks in crypto. How many total coins were stolen by attackers?

High activity of hackers and fraudsters is an unfortunate feature of every cryptocurrency market bull cycle. Huge inflows of funds in the niche always attract scammers and other malicious actors, which is reflected in the growing statistics on losses from hackers. In total, they managed to steal more than $2.3 billion in crypto in 2024. The information was confirmed by analysts of the Cyvers platform, who voiced other interesting facts.

How many cryptocurrencies have hackers stolen?

The number of hacks of cryptoprojects the day before increased sharply, which was caused by the growth of market capitalisation after the price of Bitcoin exceeded the $100,000 mark for the first time on December 6.

As a result, hackers caused more than $2.3 billion worth of damage to the industry through 165 recorded incidents. The said amount is a 40 per cent increase compared to 2023, when the total amount of thefts was $1.69 billion.

The amount of losses in the cryptocurrency industry from hackers

The relevant data was commented on by Deddy Lavid, co-founder and CEO of Cyvers, in an interview with the journalists of Cointelegraph. Here is his rejoinder on the matter.

These incidents were often made possible by compromised private keys and weak key management systems, as the results of high-profile hacker attacks clearly demonstrate.

And while the number of thefts is increasing, the $2.36 billion figure is still 37 per cent below the record $3.78 billion recorded at the end of 2022. Looking at the statistics in more detail, cryptocurrency access control vulnerabilities accounted for $1.9 billion in losses, or more than 81 percent of total losses in 2024.

Smart contract vulnerabilities were the second largest cause of losses, leading to $456 million in thefts from 98 incidents. This represents 19 per cent of total losses.

Volume of losses from hackers by attack vector

According to Lavid, to avoid another multi-billion dollar loss in 2025, the industry needs to focus on more robust security measures. These include private key management using offline storage and threat monitoring systems.

Offline storage refers to the familiar hardware wallets. They are characterised by a special isolated storage for private keys that allow access to the contents of the address used.

Thanks to it, sensitive combinations do not leave the device and are used to sign transactions in an isolated environment. This makes it impossible to retrieve private keys online.

In addition, the threat from North Korean hackers is worth paying special attention to in cybersecurity. As it became known the day before, they accounted for the majority of stolen funds in crypto for the entire year.

😈 MORE INTERESTING CAN BE FOUND IN OUR YANDEX.ZEN!

Experts from Hacken also shared their observations on the activity of attackers. According to them, the field of decentralised finance (DeFi) has lost 40 percent fewer coins from 2023 to 2024 thanks to improved protocols, more reliable blockchain bridges and advanced cryptography measures in cyber security.

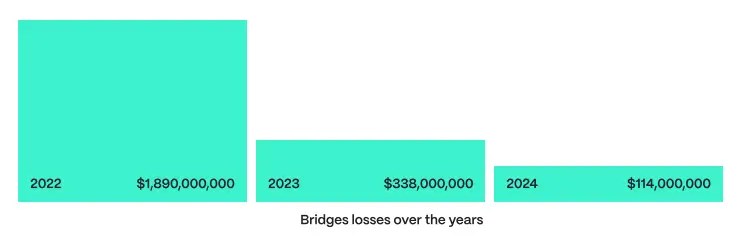

Comparing the volume of losses in blockchain bridge hacks

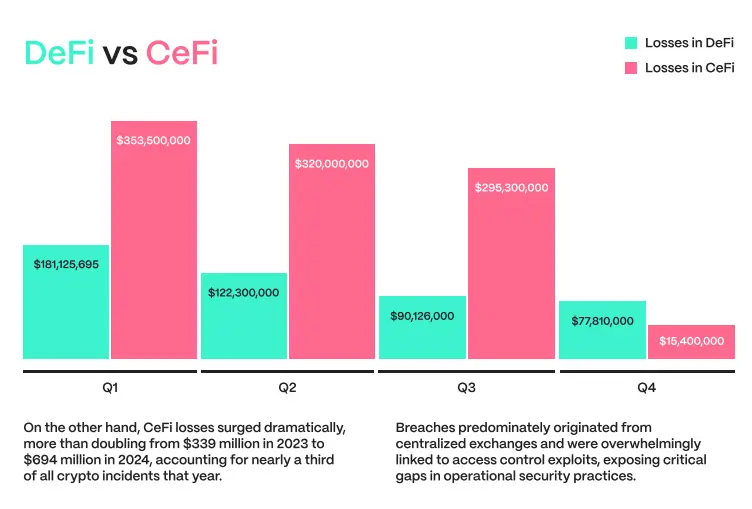

But in the centralised platform sector (CeFi), the number of hacking incidents more than doubled over the same time period, while losses rose to $694 million. Centralised exchanges have become prime targets for access control vulnerabilities and other critical security risks.

The findings of the Hacken report demonstrate the significant difference between the realms of centralised and decentralised finance. Although as we found out the day before, platforms from both categories can well coexist with each other. At the same time, the number of popular platforms will decrease over time.

For example, experts recorded a sharp decline in financial losses in 2024 for decentralised finance: from $787 million in 2023 to $474 million this year. The report notes that the volume of losses from blockchain-related hacker attacks has decreased markedly. The figure dropped from $338 million in 2023 to $114 million in 2024.

Comparison of the volume of losses in decentralised and decentralised finances

The performance of centralised finance in 2024 contrasts sharply with the improvements seen in DeFi. Since 2023, the sphere’s financial losses have more than doubled to $694 million. The surge in hacks is mainly due to vulnerabilities in wallet access controls, as well as notable incidents like the DMM exchange hack in the second quarter and the WazirX hack in the third quarter of 2024.

These statistics once again remind us that the success of long-term cryptocurrency investments depends primarily on the security of the coins. Still, there are more than enough people willing to steal digital assets. Therefore, buyers should not only pay attention to studying the advantages of this or that project, but also understand the features of cid-phrases and the rules of their storage.

.

Look for more interesting things in our crypto chat. We are waiting for you there, so don’t pass by.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.