A cryptocurrency investor has been appointed as Trump’s digital asset advisor. What does he think of the coin industry?

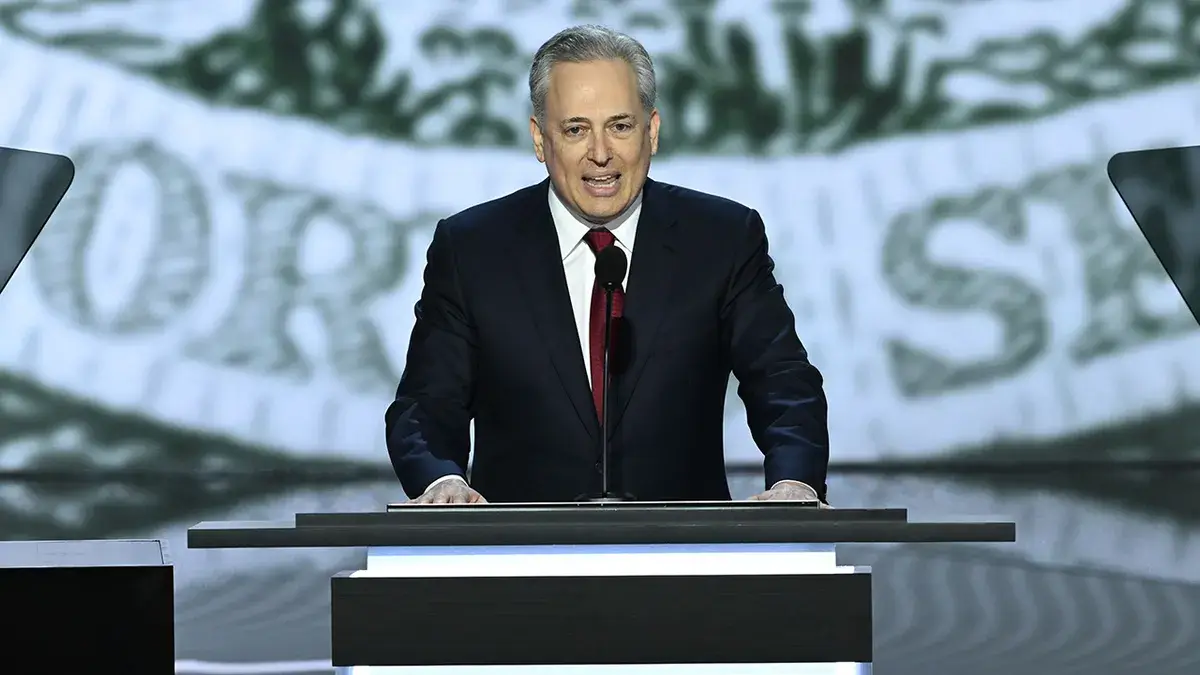

US President-elect Donald Trump will be inaugurated on 20 January 2025, but in the meantime he continues to assemble a team of high-profile individuals. Last week, the politician appointed former PayPal COO David Sachs to be in charge of artificial intelligence and cryptocurrency policy. Industry participants received the news favourably and believe that the new appointment carries long-term benefits for Bitcoin.

David Sachs is an American entrepreneur, investor and politician. He previously held positions at giants such as PayPal and Yammer, the latter of which Sachs founded and later sold to Microsoft. He has also invested heavily in startups through his Craft Ventures fund.

What will happen to cryptocurrencies in the U.S.

According to Cointelegraph’s sources, Sachs shared a positive view of Bitcoin in his fresh interview. The newly appointed official believes that the cryptocurrency has the potential to make a revolutionary impact on the sphere of global finance. Here is his comment on the matter.

Church and state used to be inextricably linked and united. You couldn’t think of them without them being together. Now they are separate entities. I believe history will repeat itself with regard to money and the state. We can’t imagine money without the state, but Bitcoin is kind of like a science fiction future where said two things can be separated.

David Sachs is the new executive in charge of artificial intelligence and cryptocurrency policy

On 5 December, Trump announced the appointment of David Sachs to the position of the so-called “cryptocurrency czar” and promised that the future advisor will help create a clear regulatory framework for the regulation of digital assets. This is what representatives of the blockchain industry have been demanding from the SEC, other regulators and the Joe Biden administration for several years. This is how they wanted transparency for the coin industry, but SEC officials instead advised them to follow the Securities Act from the first half of the last century.

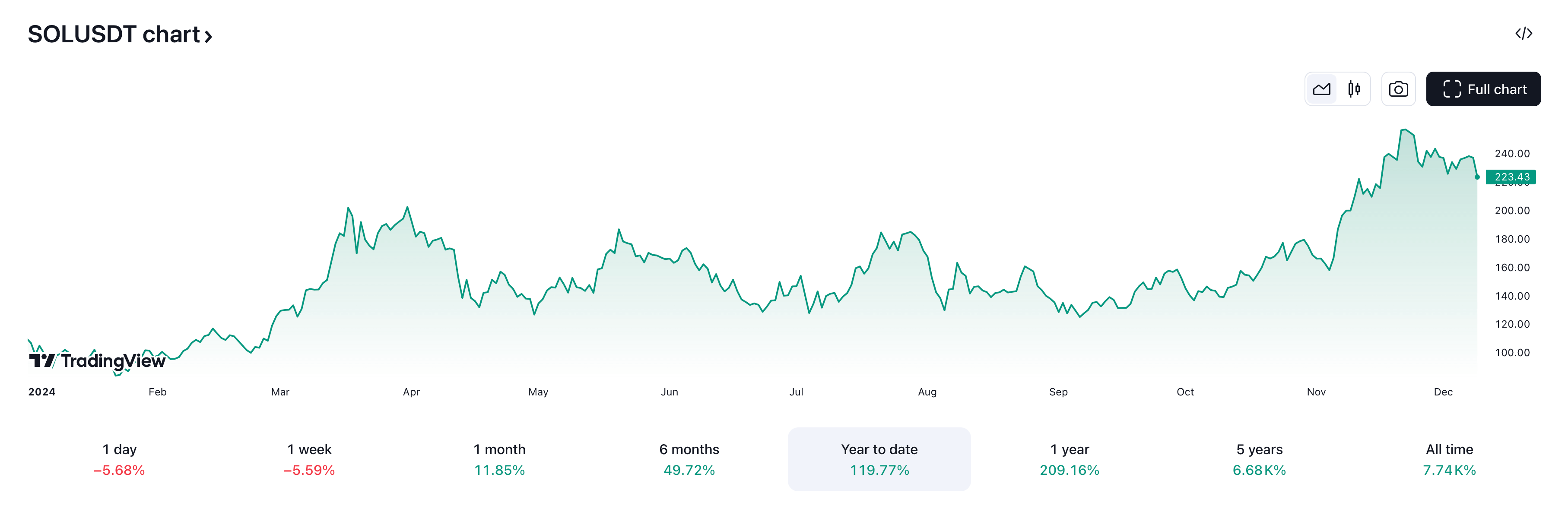

David Sachs is known as a major investor in the Solana cryptocurrency project. Earlier he said that he continues to hold his position in SOL despite the collapse of cryptocurrency exchange FTX in November 2022. Still, FTX was actively involved in the development of this ecosystem, due to which some investors decided to abandon SOL on the back of these events.

Sachs is so confident in the altcoin that he even predicts flippening – a hypothetical growth of Solana’s market capitalisation to such a level that the coin will overtake Efirium on this indicator. Here’s a rejoinder on the topic.

There are a lot of people, I’d say smart money in Silicon Valley, who are betting that Solana will eventually overtake Efirium as the preferred platform.

As a reminder, Solana is characterised by high transaction speeds and low fees, which makes this network an increasingly popular platform for launching various projects. Most importantly, products within this ecosystem like wallets are characterised by stylish and intuitive interfaces, which is also important for blockchain users.

Solana SOL cryptocurrency value change in 2024

Sachs’ appointment follows the nomination of Key Square Group hedge fund manager Scott Bessent, who is also an outspoken supporter of the coin industry, as Treasury Secretary. Moreover, he has previously characterised cryptocurrencies as a form of freedom and even stated in the media that “the cryptocurrency economy is going nowhere”.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

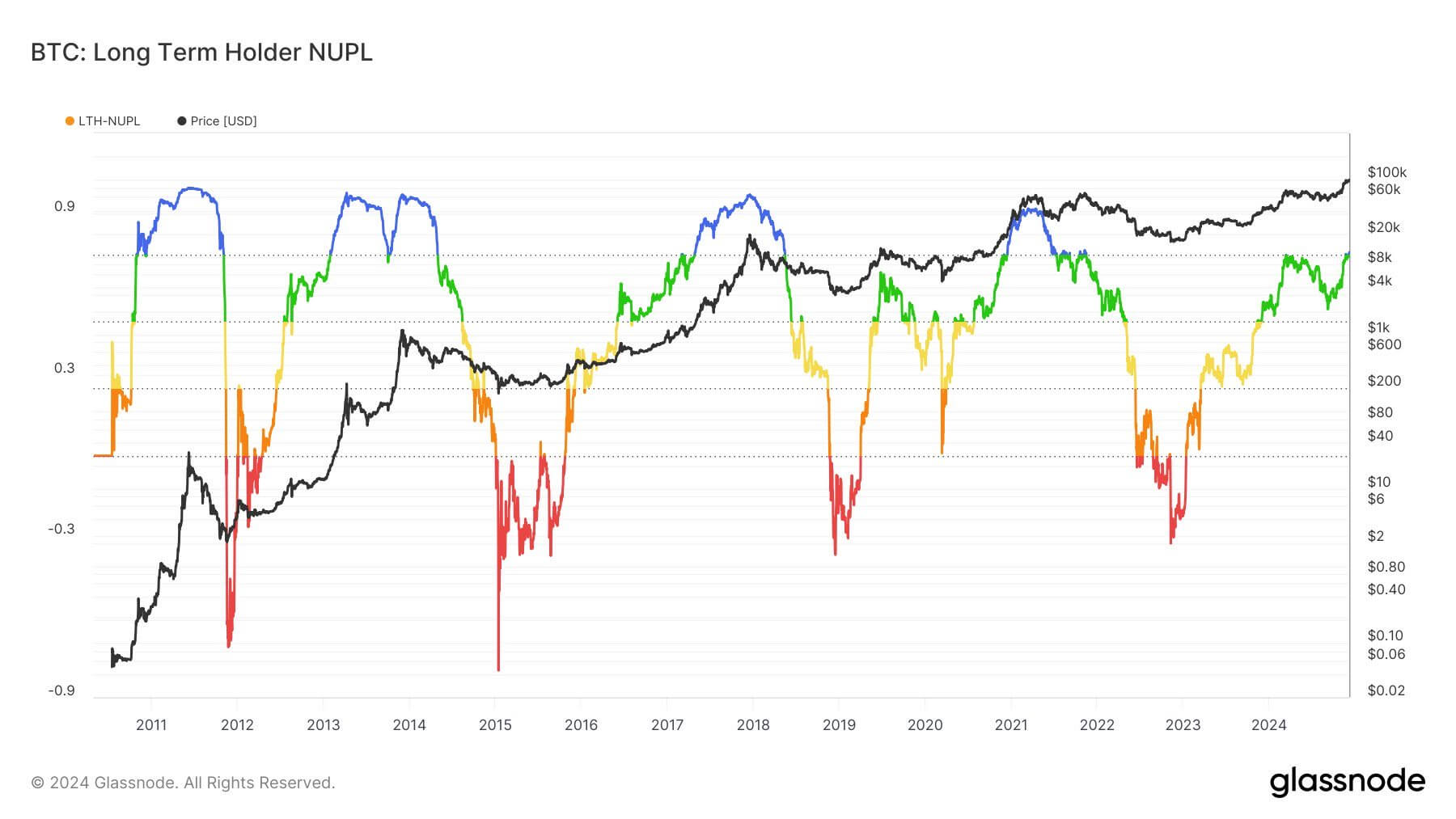

Meanwhile, analysts continue to predict a bull rally in the price of Bitcoin. According to some experts, the major cryptocurrency has entered the euphoria zone on the net unrealised profit/loss (NUPL) metric of long-term holders.

This could potentially extend the bullrun to the end of 2025, according to WeRate co-founder Quinten Francois. Here’s his rejoinder.

Bitcoin is entering a stage of euphoria. We have at most 12 months until the peak of the cycle.

NUPL chart for Bitcoin

NUPL is used to determine whether the Bitcoin network is in a state of profit or loss, based on the difference between unrealised gains and unrealised losses among BTC holders.

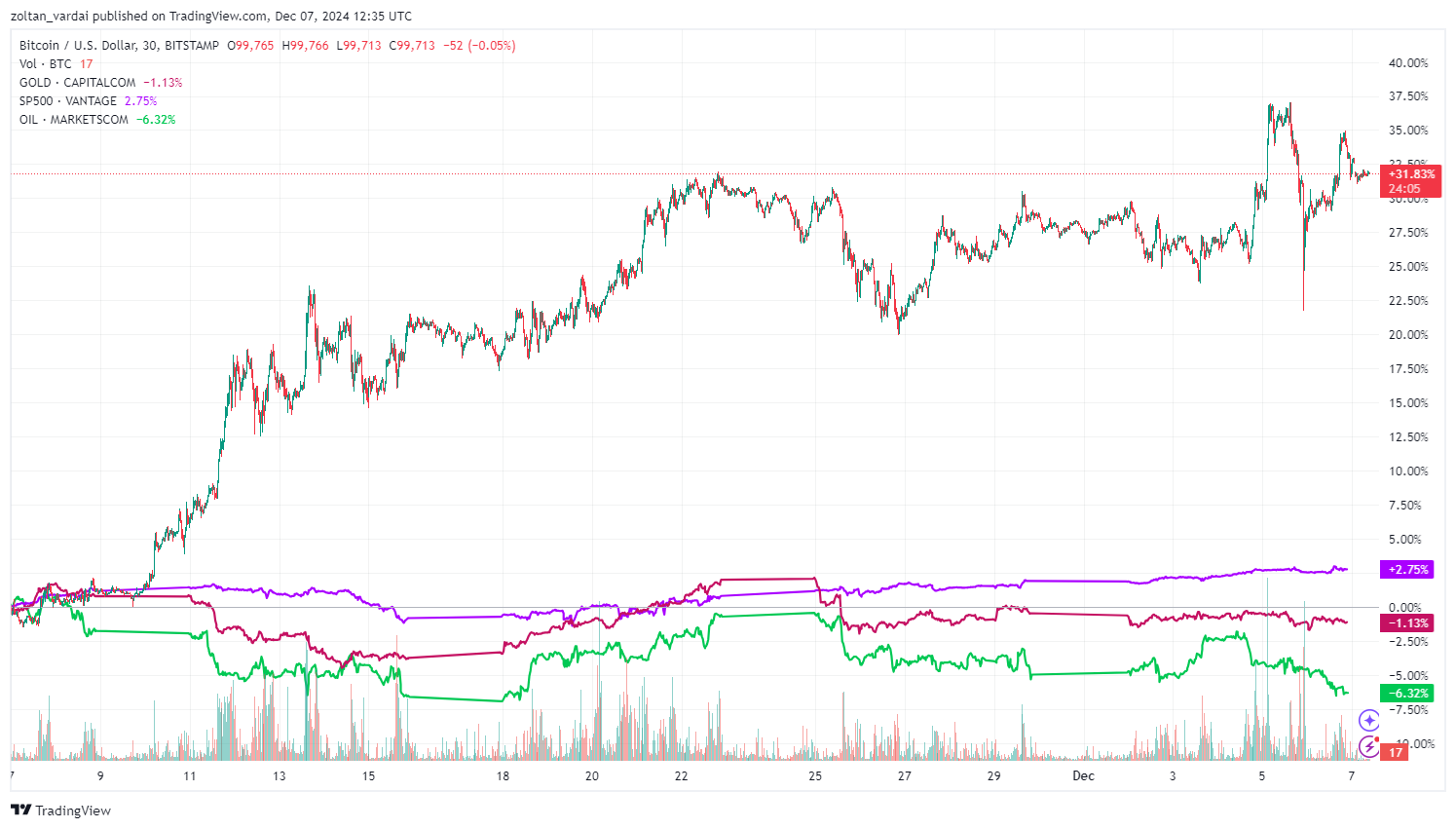

According to Real Vision chief crypto analyst James Coutts, another promising sign for Bitcoin’s price trajectory is that an all-time high has been reached despite what is happening with global liquidity. Here’s the commentary.

Bitcoin made new highs amid deteriorating liquidity. If conditions worsen, the rally, despite the euphoria, may only last for a limited time. If conditions ease, a pullback will be warranted, but then we’ll go back up.

A comparison of Bitcoin, gold, S&P 500 and oil rates

A potential bottom in global M2 money supply liquidity also suggests that Bitcoin could extend its rally in the short term before a potential correction. According to Raul Pal, founder and CEO of Global Macro Investor, based on its correlation with the liquidity index, BTC is well capable of reaching a "local top" above $110,000 by January 2025. That said, the current high for Bitcoin is 104 thousand, making the prediction seem quite likely.

Want to keep up to date with other interesting news? Join our crypto chat where we talk about other important industry events as well.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO KEEP UP TO DATE.