A Hong Kong official has proposed making Bitcoin a reserve asset for the region. Why is this important?

There is a growing interest in crypto around the world, and even in the context of national governments. Now, Hong Kong Legislative Council member Wu Jiezhuang has proposed using China’s “one country, two systems” policy in a special administrative region to include Bitcoin as a reserve asset to ensure the region’s financial stability. Well, in an interview with Wen Wei Po, he said that Hong Kong could study the market impact of Bitcoin-based spot exchange-traded funds listed in the United States.

As a reminder, the approval and launch of trading in BTC spot ETFs in January 2024 was the reason for the active growth of the coin market. As a result of this, Bitcoin for the first time in its history has updated the maximum rate from the previous bullrun before the halving, which was last held on 20 April 2024 and reduced the reward per block from 6.25 to 3.125 coins.

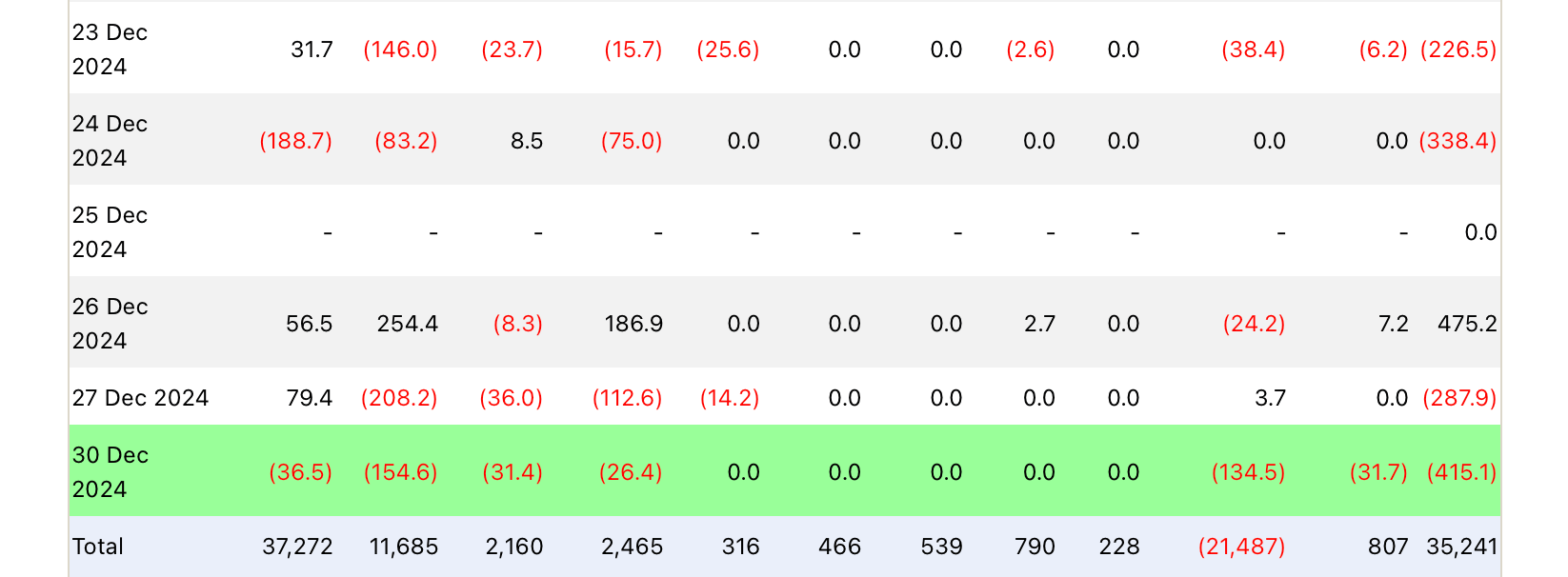

The year ends more than successfully for Bitcoin exchange-traded funds. Their total net capital inflow is $35.24 billion. This is despite an outflow of 21.48 billion from Grayscale’s GBTC instrument.

Year-to-date movement of funds within spot Bitcoin-ETFs in the US

Which countries and regions are buying bitcoins

Among other things, Jiezhuang also pointed to the experience of countries like El Salvador and Bhutan, which have previously recognised Bitcoin as a strategic asset for their economies. He added that US President-elect Donald Trump’s proposal to include BTC in the national reserve of the United States has the potential to significantly impact traditional markets.

According to Jiezhuang, Hong Kong authorities should effectively utilise the “one country, two systems” approach and first include Bitcoin in ETFs traded on local exchanges. The region could then start implementing ways to increase the share of BTC directly in its reserves.

The "one country, two systems" approach was proposed in the 1980s by Deng Xiaoping to peacefully unify China with Hong Kong, Macau and Taiwan. Under this principle, Hong Kong and Macau, after returning to PRC sovereignty in 1997 and 1999, retained a high degree of autonomy, including their own legal, economic and social systems.

However, contrary to guarantees of autonomy for 50 years, the approach has been criticised in recent years due to Beijing's growing control over the regions. At the same time, Taiwan refuses to accept this model, seeing it as a threat to its own democratic system, which makes sense given China's behaviour.

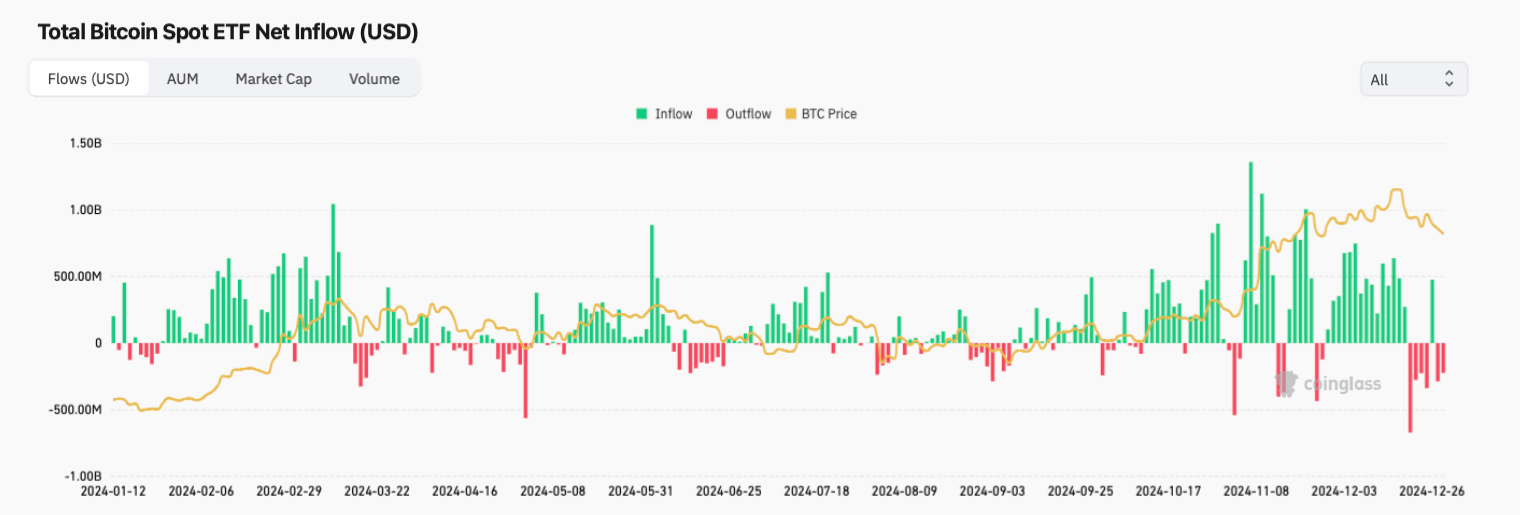

Inflows and outflows of funds from spot Bitcoin-ETFs

The official emphasised the cryptocurrency’s potential to attract talent and investment, as well as its ability to bolster financial stability amid market fluctuations. He noted that the use of Bitcoin as a reserve asset is able to reduce the impact of negative factors in the traditional economy.

According to Cointelegraph’s sources, Hong Kong’s Financial Services and Treasury Bureau will develop regulations for cryptocurrencies based on the principle of “same business, same risks, same rules.” Here’s how Jiezhuang commented on this.

If major economic nations take the initiative to include Bitcoin in reserves, the value of cryptocurrency will become more stable. This will cause other countries to follow suit and reduce the volume of traditional assets. Such a thing will cause the prices of traditional assets to fall and reduce the government’s financial reserves.

China currently holds 190,000 BTC confiscated through various means, making the country’s reserve the second largest after the US. Earlier in mid-2024, another member of Hong Kong’s Legislative Council, Johnny Eng, announced plans to work with various stakeholders to assess the feasibility and potential benefits of including Bitcoin in the financial reserves of the special administrative region.

😈 MORE INTERESTING STUFF FROM US AT YANDEX.ZEN!

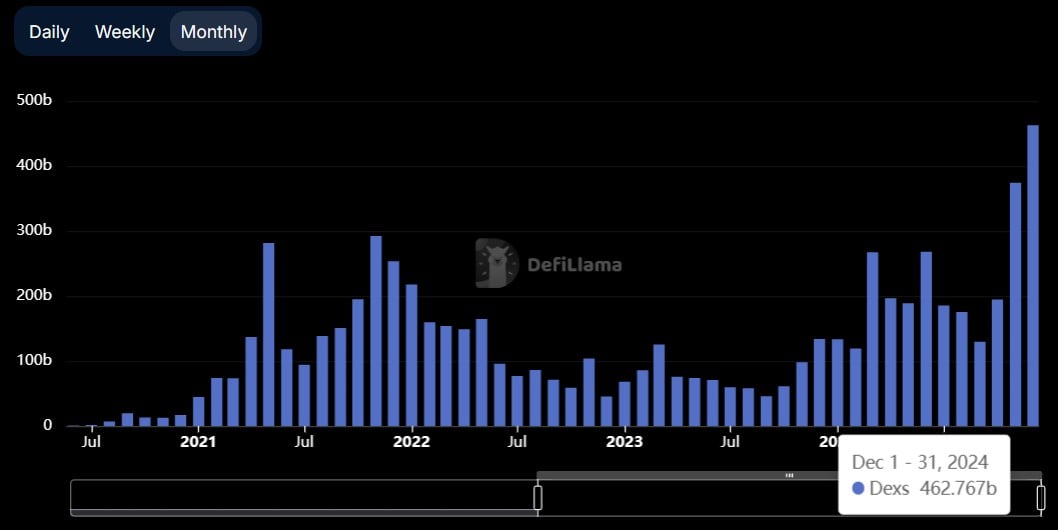

Meanwhile, monthly trading volume on decentralised exchanges (DEX) hit record highs, rising to $462 billion in December. According to a report by analytics platform DefiLlama, December was the most successful month in terms of DEX trading volume, continuing the upward trend from November.

Dynamics of trading volume on decentralised exchanges

In November, decentralised trading platforms recorded a monthly transaction volume of $374 billion. The increase in the figure was fuelled by expectations of more favourable regulation in the US following Donald Trump’s victory in the presidential election.

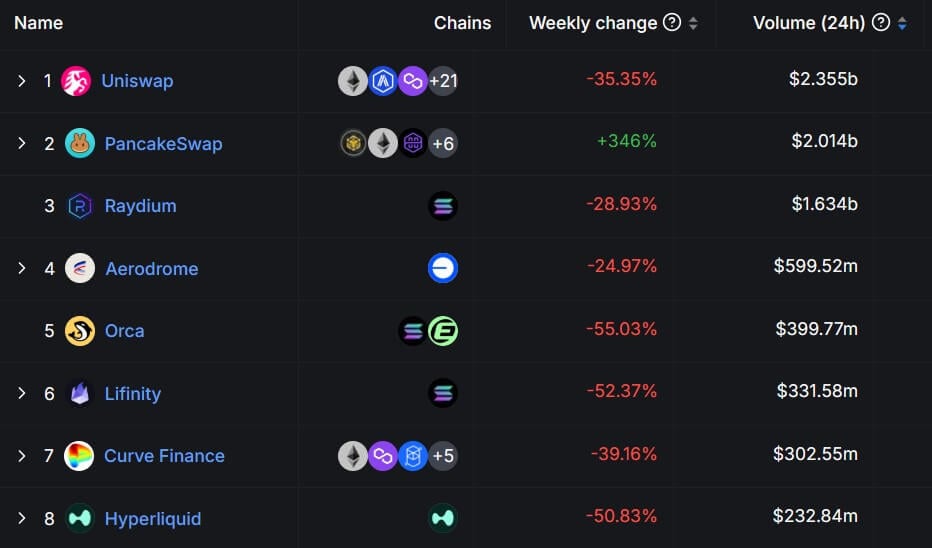

Uniswap remained the leader among DEXs in terms of trading volume, recording $106.4 billion in trades over the past 30 days. PancakeSwap ranked second with monthly volume of $96.4 billion. Meanwhile, the largest Solana-based DEX called Raydium ranked third with a volume of $58 billion over the last 30 days.

Top trading platforms in DeFi

Earlier, Syndica analysts reported that Solana-based decentralised apps generated $365 million in revenue for November, largely due to meme tokens launched on the Pump.fun platform.

Fourth and fifth places went to Aerodrome and Orca. Aerodrome reached a volume of $31 billion, while Orca had a trading volume of $22 billion. Lifinity, Curve Finance and Hyperliquid together registered a mark of 43.6 billion for the month.

Such statements to recognise Bitcoin as an asset for national reserves won't necessarily lead to instant results. However, such remarks still draw investors' attention to what is happening in the world of crypto. Therefore, sooner or later, purchases of BTC and other coins even at the level of states will turn out to be much more extensive.

Look for more interesting things in our crypto chat. Go there before the New Year.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO STAY INFORMED.