A member of the European Parliament has advocated the creation of a strategic crypto reserve in the EU. Why is it important?

Member of the European Parliament Sarah Knafo calls on the EU to create a strategic cryptocurrency reserve in Bitcoin. At the same time, she opposes the adoption of the digital euro, a central bank digital currency (CBDC) backed by the ECB. The day before, Knafo made her speech at the regular session of the European Parliament. The official believes that her colleagues should limit the ECB’s efforts to centralise and seize power in financial markets, as this would benefit the inhabitants.

The topic of creating a national cryptocurrency reserve in Bitcoin has become particularly popular in 2024. Newly elected US President Donald Trump, who talked about such a prospect in his election programme, should be thanked for this.

Then Senator Cynthia Lummis introduced a bill that suggests the purchase of a million BTC by the US government. And ideally, these coins should not move for twenty years, which could significantly affect the supply and demand ratio within the blockchain industry.

Senator Cynthia Lummis, who proposed the purchase of one million BTC by the U.S. government

So far, such projects are still in the preparation stage. However, we can assume that next year will prove to be an ideal period to introduce such initiatives at the country level.

Where will the cryptocurrency reserve appear?

The video of her speech in the European Parliament was published by Knafo herself on Twitter. And the following caption was added to the recording.

No to the digital euro, yes to Bitcoin’s strategic reserve.

In her speech, Knafo compared the development of cryptocurrency regulation in different parts of the world, citing El Salvador’s adoption of Bitcoin in 2021 and US President-elect Donald Trump’s market-friendly programme.

Member of the European Parliament Sarah Knafo

She also mentioned that US Federal Reserve Chairman Jerome Powell called Bitcoin “digital gold” in early December, comparing the cryptocurrency to the world’s premier asset and precious metal at the same time.

Europe, meanwhile, has taken a different approach to regulating cryptocurrencies, according to Knafo. Local regulators are mainly focused on oversight, taxation and stifling innovation. Here’s the rejoinder.

It’s time for a paradigm shift. It’s time to protect our people from inflation and the poor economic choices of our states. It is time to say no to the totalitarian temptations of the European Central Bank, which wants to impose a digital euro that is entirely in its hands.

It is important to note that the Securities Commission in the US under the current president has also engaged in a pronounced fight against the coin industry. The regulator did not provide transparent rules of operation while constantly filing lawsuits against crypto companies. Therefore, the overall situation with the management of digital assets in the world remains far from the best.

Sarah Knafo also insisted that the ECB now has too much power. Well, this in turn threatens the financial security and independence of European citizens.

We don’t want this dystopian world where a European bureaucrat can tomorrow ban certain transactions and even exclude us from the banking system with a click of a mouse for a simple comment made on social media or for an opinion we don’t like. It is time to bet on freedom.

ECB building

According to Cointelegraph’s sources, the ECB has been formally studying the CBDC concept for more than four years, although the EU still hasn’t made a decision on whether to launch a digital euro. The European Central Bank published one of its first reports on the potential launch of the digital euro in October 2020, kicking off a lengthy study of its potential and risks.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Meanwhile, in the context of crypto in Europe, an important date is approaching: on 30 December 2024, the Markets in Crypto-Assets Regulation (MiCA) bill officially comes into full force. MiCA was approved by the European Parliament in April 2023 and establishes uniform rules for the crypto industry in the EU, including requirements for issuers of stablecoins and crypto service providers. All of the above are needed for the sake of increasing transparency, protecting consumers and preventing financial crime.

The problem is that the popular shakecoins currently available on exchanges will not dock with MiCA’s terms. For example, trading platform Coinbase previously announced the delisting of its most popular steiblcoin USDT for its European clients. While other popular exchanges represented by Binance, Crypto.com and Kraken still support trading involving the digital asset as usual.

And while Coinbase has been considering USDT as a MiCA-restricted stablecoin since at least October, European authorities have not given a clear answer as to whether it should be considered non-compliant with local laws.

USDT on the OKX exchange for European customers

Other exchanges operating in Europe have not been active in removing USDT from the list of trading pairs, and only a few of them are about to do so. In response to journalists’ enquiry about the past or potential delisting of USDT, representatives of the OKX trading platform said that it carried out the procedure back in March 2024, referring to the transition to trading pairs in euros.

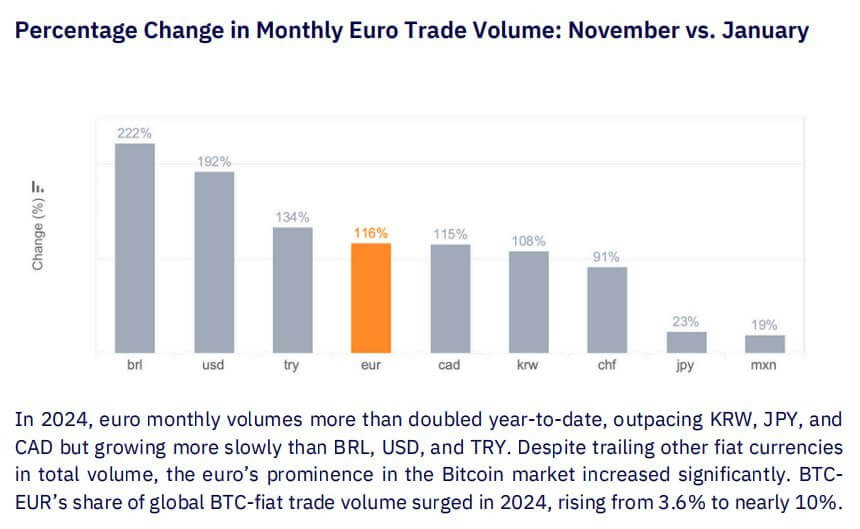

By the way, since the beginning of 2024, the volume of trading operations with cryptocurrencies using the euro has doubled. Thus, fiat currency has surpassed other popular participants of the list – the Korean won, the Japanese yen and the Canadian dollar. Here is the corresponding graph, which is given by Kaiko.

Popular fiat currencies used in cryptocurrency trading

In general, 2025 promises to be a very good year for the coin sphere. First of all, we will see a change in the leadership of the Securities Commission, which has become one of the main enemies of the crypto niche in recent years. In addition, talk of creating national Bitcoin reserves is also in a position to lead to results.

Look for more interesting stuff in our crypto chat. Be sure to wait for you there so that you don’t miss the course of the current bullrun in the world of coins and blockchain.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO KEEP UP TO DATE.