A Ripple spokesperson has revealed the main way the government is pressurising the cryptocurrency industry. What is it?

Ripple’s CTO David Schwartz has joined the camp of cryptocurrency enthusiasts who are criticising the so-called Operation Poke 2.0. This is a long-term initiative by the US government to undermine the development of the digital asset industry. In general, Schwartz believes that it is a vivid example of government “indirect regulation” of the sphere of coins.

Recall, Uvula 2.0 is the unofficial name of the strategy of US regulators aimed at limiting the access of cryptocurrencies to banking services. The essence of the initiative is to create financial and legal obstacles to impede the operations of representatives of the blockchain industry - primarily their access to payment systems and bank accounts.

It is assumed that measures such as closing bank accounts of crypto firms, denying access to traditional financial services and tightening regulatory requirements may be aimed at controlling the coin industry or pushing it out of the global economic system. Critics of the initiative see the scope as excessive and potentially dangerous for innovation in the financial sector.

US President Joe Biden

Generally speaking, the operation came into the spotlight in the crypto community and even beyond last week. At that time, Marc Andriessen of Andreessen Horowitz took part in Joe Rogan’s podcast, where he just talked about this phenomenon.

Other members of the blockchain industry who had previously experienced similar problems reacted to what was happening. They described in detail their experience of disconnection from the banking sphere, and they had no doubts about the connection of what was happening to coins.

How the development of cryptocurrencies is hindered

In his recent publication, Schwartz argues that the government’s actions in the operation can have the opposite effect. Specifically, companies without the support of banks end up simply going into the shadow economy, completely avoiding taxes or any oversight.

Ripple’s CTO has also said that the second generation of the “Strike” undermines legal procedures, freedom of speech and the right to be protected from unlawful search and seizure. Here is the relevant rejoinder on the matter, as quoted by Cointelegraph.

Our government is addicted to indirect regulation precisely because of these vices. It is cheaper and easier to get someone else to start punishing the unwanted than it is to initiate due process. But government should not punish people without giving them basic rights.

Ripple CTO David Schwartz

According to venture capitalist Mark Andriessen, more than thirty tech companies have been victims of the government initiative. Many founders and CEOs of the affected firms have started openly voicing their displeasure recently.

According to sources, Brian Armstrong, co-founder and CEO of Coinbase, the largest US crypto exchange, has also joined them. He had earlier asked the government for documents regarding such transactions under the Freedom of Information Act (FOIA).

Donald Trump at the Bitcoin 2024 cryptocurrency conference

There is a possibility that the initiative will become history once the administration of new President Donald Trump takes office – his inauguration will take place on 20 January. Trump has positioned himself as a crypto market-friendly politician and favours transparent regulation of the industry.

In addition, his coming to power will lead to a change in the leadership of the Securities Commission. This regulator has caused a lot of problems for the industry in recent years, while simultaneously labelling all cryptocurrencies except Bitcoin as unregistered securities. Such remarks have been used as a basis for filing lawsuits against popular members of the sphere along the lines of Binance, Coinbase and Ripple.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

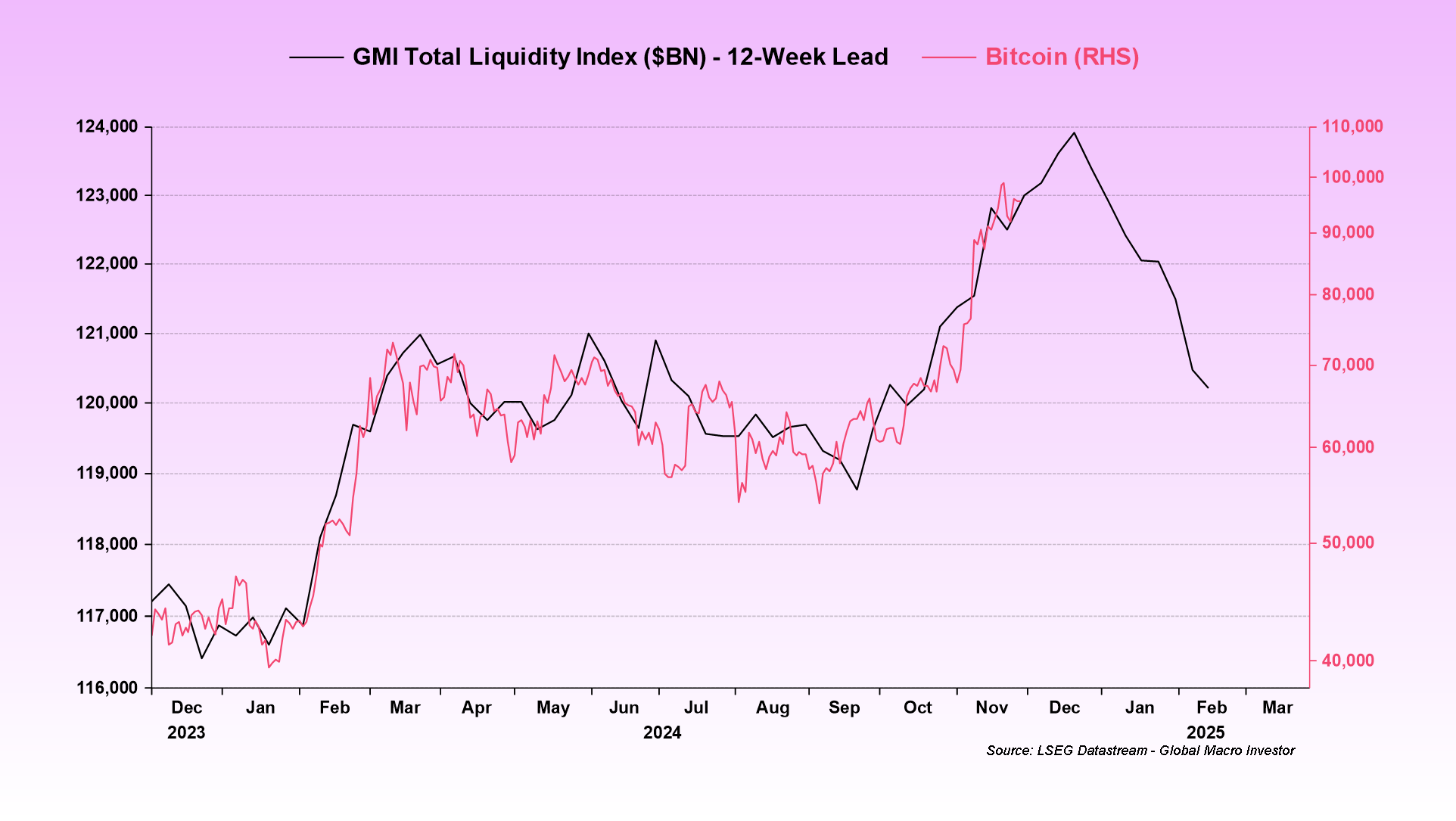

Meanwhile, Bitcoin has entered the parabolic phase of a bullish trend. According to analysts, the main cryptocurrency is able to reach a local peak above the level of 110 thousand dollars by the end of January 2025. This conclusion is based on correlation with the Global Macro Investor Total Liquidity Index, which is an aggregate overview of the balance sheets of all major central banks.

However, the projected level is just another step in a more global uptrend. This is the view shared by Raul Paul, founder and CEO of Global Macro Investor.

Recently, there have been many mock-ups of this chart with incorrect wording. Here is an updated original created by us at Global Macro Investor.

Liquidity Index

According to Bitget Wallet COO Alvin Kahn, the growth in M2 money supply is also a historical catalyst for Bitcoin’s bullrun. Here’s his comment.

Increased liquidity from the Fed typically improves market conditions for risky assets like Bitcoin. Historically, such liquidity injections have led to increased investor interest and capital flows into cryptocurrencies.

Other analysts expect global liquidity to peak in late January 2026. By then, Bitcoin will be able to absorb up to 10 per cent of the newly printed money supply.

In turn, this could attract an additional $2 trillion in new investment into the crypto industry over the course of 2025, based on a projected $20 trillion increase in liquidity.

The current administration of US President Joe Biden seems to have paid a lot of attention to the fight against crypto. And while this has stalled the development of the industry in this country, Donald Trump can fix things. Which means we're left here to wait for his inauguration and further changes in government.

Look for more interesting stuff in our cryptocurrency chat room. There we discuss other important news affecting the current bullrun.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO KEEP UP TO DATE.