A rising star of American football will be paid in Bitcoin. What terms are we talking about?

Popular American football player Matai Tagoai has joined the ranks of sports stars who have started receiving their salary in bitcoins. Tagoai, who holds the linebacker position, will receive a portion of his income through the Strike app after NIL signed an agreement with the University of Southern California (USC). Accordingly, digital assets are becoming an increasingly popular tool for capital accumulation and settlement.

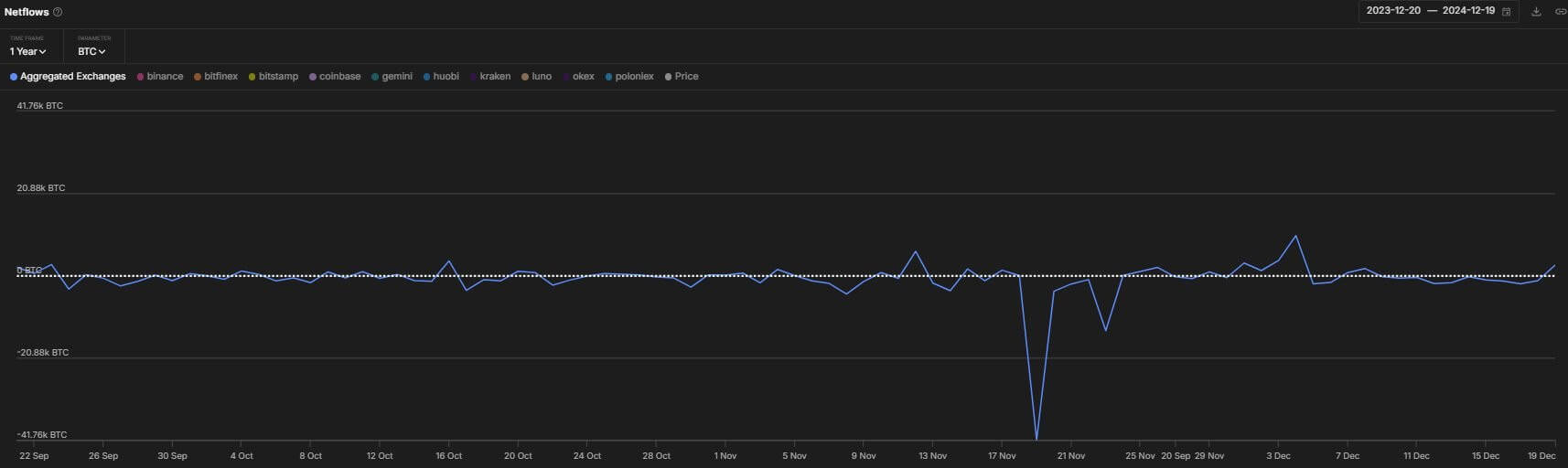

Note that bitcoins on centralised cryptocurrency exchanges are gradually becoming more and more rare. As analysts note, in 2024, $9.4 billion worth of BTC were withdrawn from such platforms. They were sent to wallets outside the trading platforms.

According to experts, the reason for this is the success of spot Bitcoin-ETFs from giants like BlackRock and Fidelity. Still, they are based on real BTC, which are bought by the issuers of such instruments.

Bitcoin movement on centralised cryptocurrency exchanges

Therefore, investor demand for shares of such exchange-traded funds lead to the purchase and further withdrawal of coins.

How Bitcoin is earned

The exact details of the rising star’s contract are not yet known, but some other players of similar stature receive compensation of up to $4.7 million. NIL agreements give organisations the right to use an athlete’s image as they see fit – for example, in video games, official products or as part of sponsorship contracts.

Here’s a quote from Tagoai on the matter, as cited by Decrypt.

For me, this is a watershed moment. By receiving a portion of NIL’s revenue in bitcoins, I’m setting myself up for long-term financial growth.

That is indeed the case. Still, if you study what happened with the first cryptocurrency earlier, any bitcoin holder would come out ahead on their own investment if they held the coins for at least four years.

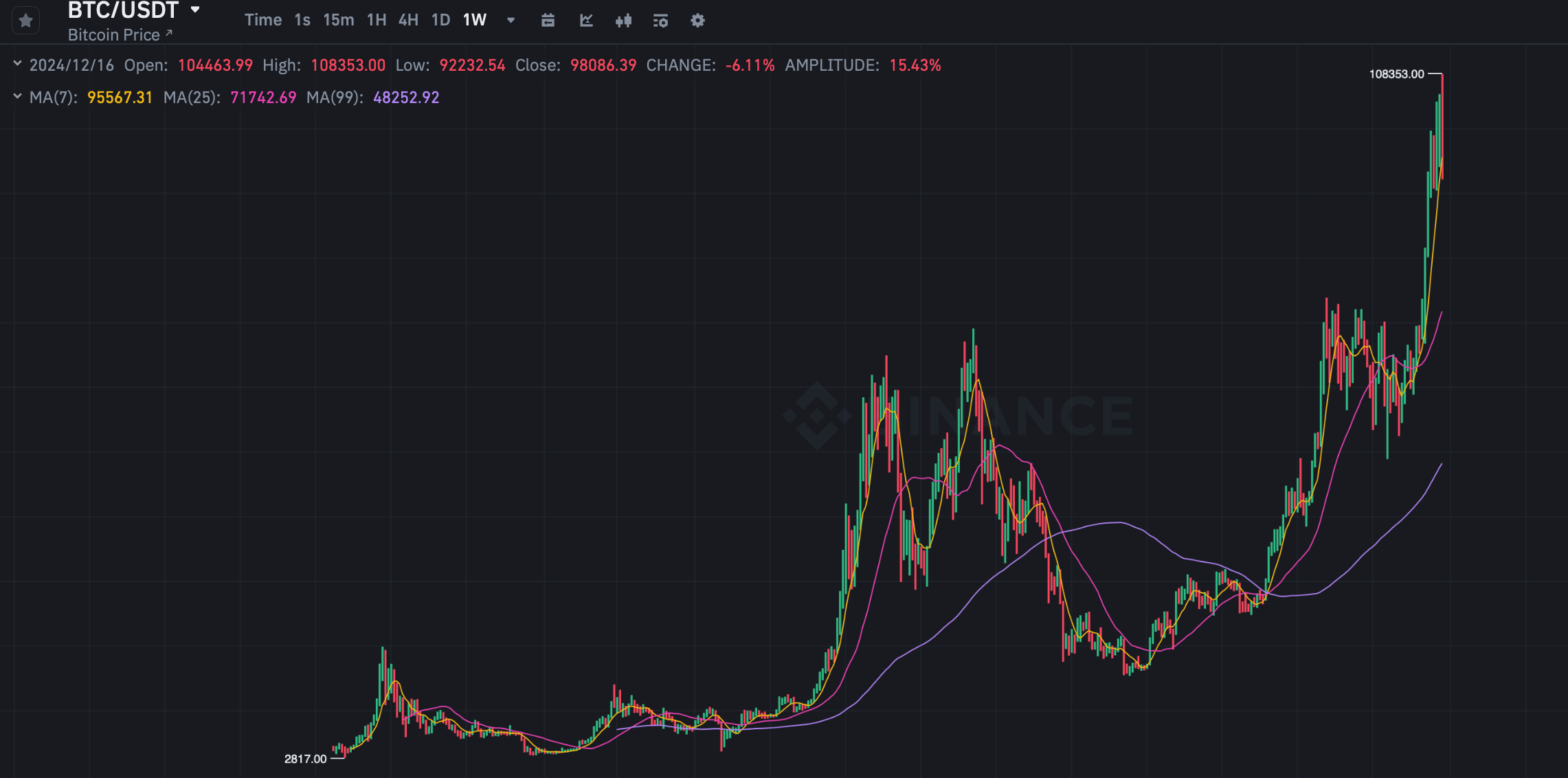

For example, during the current phase of growth, BTC's high was recorded this week at $108,353. At the same time, the minimum of the first cryptocurrency during the bear trend phase at the end of 2022 was $15,476. Accordingly, the coin grew seven times from its absolute bottom to its local peak in two years, which is an incredible result in the world of investment.

A weekly chart of the Bitcoin exchange rate on the Binance exchange

The linebacker also added that he wants to “set an example for other young athletes.”

In general, Tagoai is far from the only Bitcoin supporter in professional football. As we’ve already noted, Odell Beckham Jr. decided to receive his entire $750,000 salary in bitcoins back in 2021. According to sources, he has signed a contract with the Los Angeles Rams team.

Athlete Matai Tagoai.

Incidentally, Beckham mocked his critics on Twitter when the price of Bitcoin surpassed the $100,000 mark after the recent US presidential election. We wrote about it in a separate article.

Some NFL players who decided to receive their multi-million dollar salaries in BTC have already surely increased their fortunes significantly. Former Super Bowl champion Russell Okung became the first known NFL player to receive his salary in crypto when he signed with the Carolina Panthers in 2020. He asked to be paid half of his salary in BTC, which was the equivalent of $6.6 million.

If Okung hasn’t sold his bitcoins by today, they could be worth more than $20 million, given the change in the price of the major cryptocurrency since then. The athlete is also pushing for all NFL players to be paid in BTC.

In November, he announced that he wants to get players in his new Bitball football league to sign contracts with just such a condition. Obviously, such an initiative would make digital assets a much more popular investment vehicle among athletes and spectators alike.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Bitcoin is trading about 10 per cent lower over the weekend from its record high of around $108,000 reached on Tuesday 17 December – that is almost a month and a half after Donald Trump won the US presidential election. Since then, the cryptocurrency has fallen 10 per cent below the new record several times.

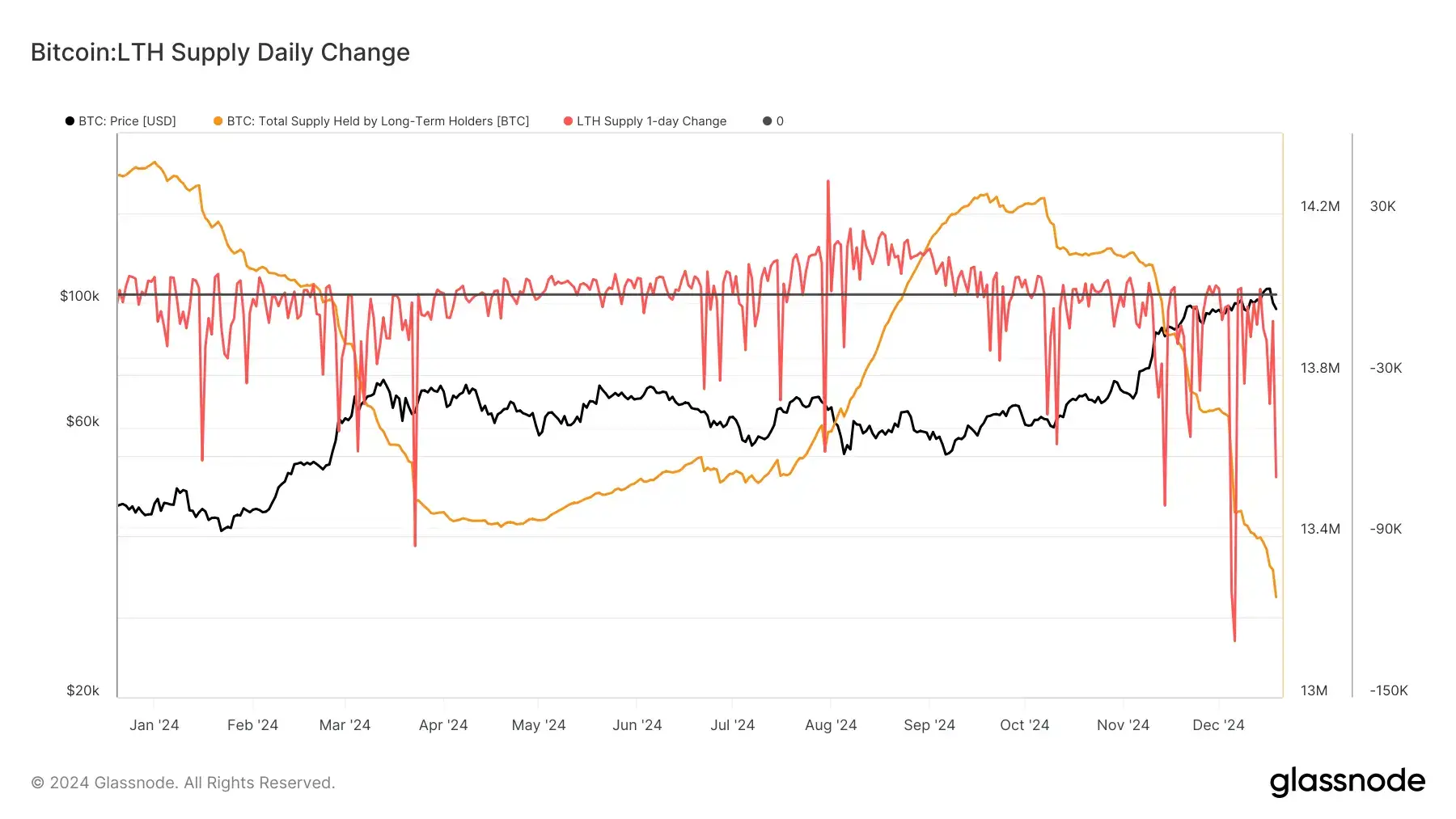

According to analytics platform Glassnode, BTC is mostly now being sold by long-term holders, meaning investors who have owned their coins for at least 155 days. They usually get rid of the crypto amid rising prices after accumulating coins during periods of its decline, Coindesk reported.

Long-term holders started actively selling significant amounts of BTC about a week ago. Since then, the pace of sales has picked up – their total holdings have dropped from 14.2 million in mid-September to about 13.2 million bitcoins. On Thursday, they sold nearly 70,000 coins, and that’s the fourth-highest daily sales volume for 2024.

Here’s the corresponding graph of the change in the figure.

Change in the volume of bitcoins in the wallets of long-term cryptocurrency investors

On the other hand, for every seller, there is always a buyer. In this case, these are short-term holders who have accumulated about 1.3 million BTC during the same period.

Bitcoin rate corrections on the general chart of the cryptocurrency

Over the past few days, the situation has changed a bit – long-term investors are eager to sell more than short-term traders are willing to buy. This imbalance has contributed to the price dropping to around $94,500. However, following this movement, the market has shown a definite recovery, which was especially noticeable on Saturday.

Bitcoin is becoming an increasingly popular investment tool at many different levels. Both state governments and major companies along with ordinary retail investors want to own the coin. Obviously, the trend will intensify in the future.

For more interesting stuff, check out our crypto chat. Be sure to check it out so you don’t miss the bullrun development in the digital asset industry.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.