As early as tomorrow, the US Federal Reserve will cut the benchmark lending rate again. How will this affect the crypto market?

On Wednesday 18 December, the US Federal Reserve (Fed) is set to cut the benchmark interest rate – at least that’s what market participants are counting on now. However, analysts do not predict a significant rise in cryptocurrency prices immediately after the meeting. It is believed that the Fed’s monetary policy could be a catalyst for the subsequent rise in the price of BTC, but in reality the cause-and-effect relationship is different. As experts suggest, the decision of bankers will only serve as a confirmation for the formation of a new round of bullrun, rather than a reason for its instant realisation.

Recall that the base interest rate determines the cost of borrowing funds from the central bank for commercial banks and ordinary users of the latter. Lowering the rate forces investors to withdraw capital from traditional instruments such as treasury bills, which become less profitable.

In such conditions, they are forced to look for new areas for investment, among which are cryptocurrencies. And since digital assets are now on the world’s radar – Bitcoin, for example, has given away 152 per cent growth since the beginning of 2024 – a lower rate could motivate capital holders to get involved with coins, among others.

What will happen to the Bitcoin rate?

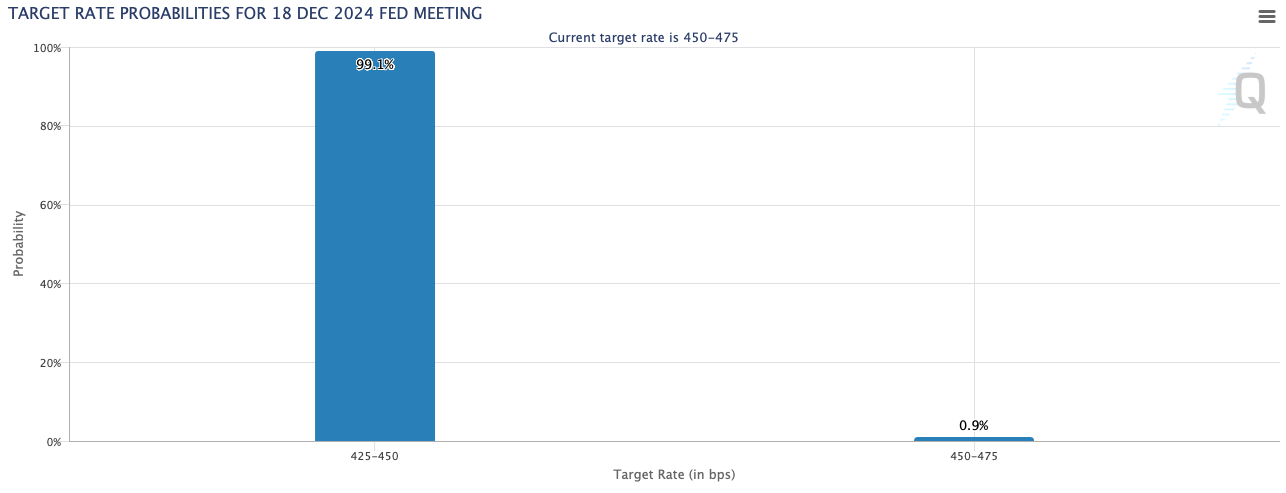

According to CME’s FedWatch portal, banking executives will cut the Fed Funds rate by 25 basis points, i.e. to a range of 4.25-4.50 percent, during the Federal Open Market Committee (FOMC) meeting. As of today, the probability of this happening is 99.1 per cent – meaning it would be the third consecutive rate cut since September.

Probability of a cut in the US benchmark lending rate

The rate was initially cut by 50 basis points or 0.5 per cent in September and 25 basis points in November. The September cut was the first in more than four years and including since the pandemic. And since it wasn’t a minimal downgrade, the market reacted positively to the news, with Bitcoin even jumping to $61,000 at the time.

Luis Bueneventura, head of cryptocurrencies at GCash, said in an interview with Decrypt that investors should not be guided by the Fed’s actions in their forecasts. Here’s the relevant rejoinder.

I don’t think the Fed rate cut will have a significant impact on Bitcoin’s price, as the market has already been anticipating this decision for several weeks.

Accordingly, the expert believes that traders have already taken appropriate actions as preparation for the event. And since the rate cut will not be a surprise, the market's reaction to what is happening will also be predictable.

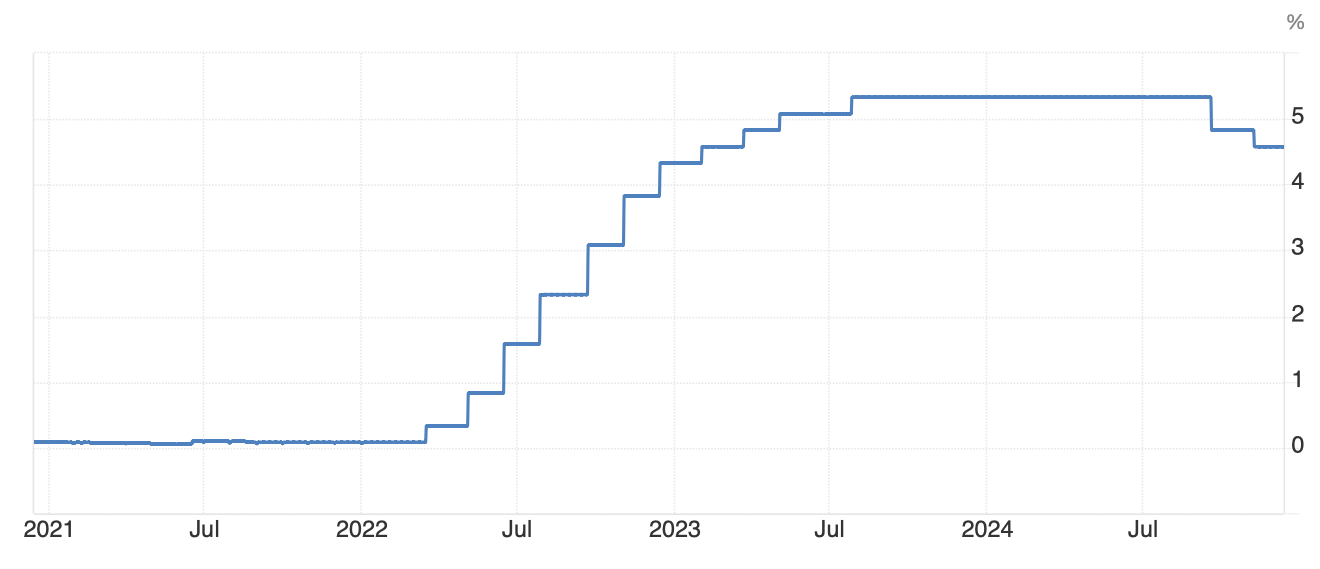

Dynamics of the base lending rate in the U.S.

Bueneventura noted that historical data shows a very interesting trend. In two out of three cases where Bitcoin rises 50 per cent in less than 60 days, this is followed by an additional rise of another 35 per cent in the two months following an interest rate cut. He continues.

Bitcoin has recently risen 50 per cent in the past few weeks, so the chances of this momentum continuing are quite high.

Well, we will separately note that the behaviour of an asset in the past does not guarantee the repetition of a similar situation in the future. Therefore, this version should be treated with caution.

Other experts also emphasise secondary factors influencing the market. These include the appointment of former PayPal COO David Sachs as an advisor to Donald Trump on crypto and artificial intelligence, as well as a surge of institutional interest in crypto, which confirms the net inflow of capital into spot ETFs based on digital assets.

Here’s how Neil Wen, head of global business development at Kronos Research, commented.

These factors have historically fuelled Bitcoin’s growth, as investors look for alternatives to traditional assets in a low-rate environment.

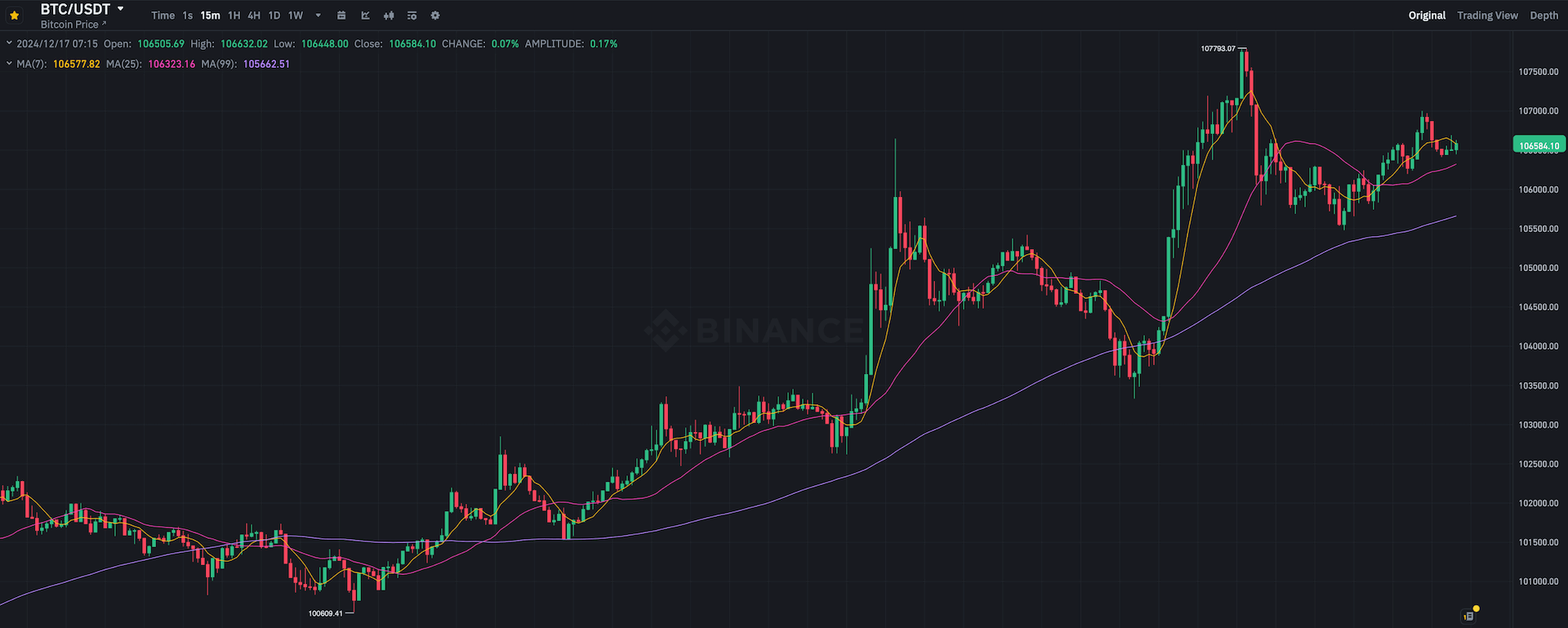

A 15-minute chart of the Bitcoin BTC rate on the Binance exchange

Presto Labs analyst Min Jun voiced the following opinion.

While the rate cut is definitely favourable for Bitcoin’s price, the market may have already factored in this news. As a result, the event itself may have minimal direct impact on the value of BTC.

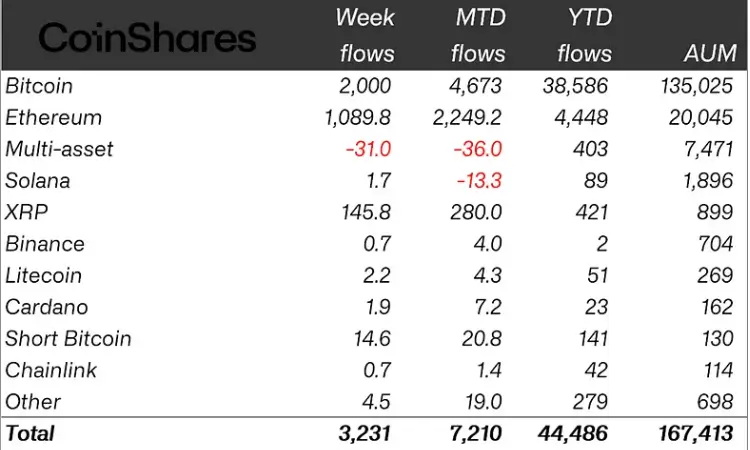

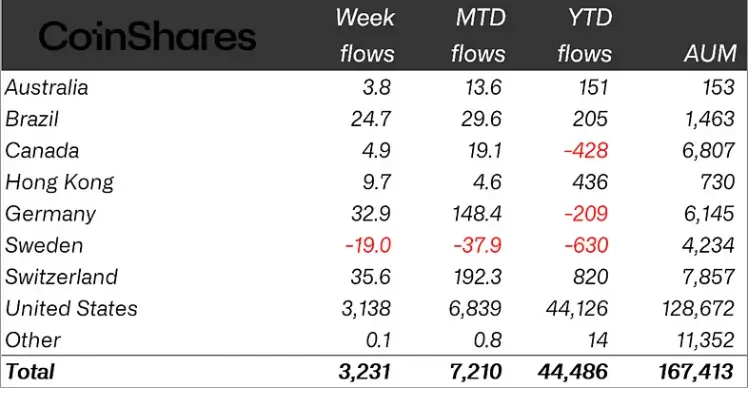

For now, investors continue to actively buy crypto: everyone is encouraged by the new all-time high on Bitcoin’s chart, as well as a prolonged series of record inflows into crypto-based investment instruments. According to a fresh report from CoinShares, digital asset-based investment products for large investors attracted another $3.2 billion in the previous trading week from 9 to 13 December.

Investment inflows by crypto ecosystems

The figures came after record inflows of $3.85 billion last week, pushing the total investment for 2024 to $44.5 billion. The achievement of this mark is due to a series of continuous weekly inflows that began in early October. In the last ten weeks alone, total investments have totalled $20.3 billion, representing 45 per cent of all investments for 2024.

Bitcoin-based funds attracted $2 billion last week, raising the total funds under management since the US presidential election to $11.5 billion. Short position instruments also saw an increase in activity, with $14.6 million in inflows compared to the previous week.

Investment inflows by region

BlackRock’s IBIT exchange-traded fund led the way in terms of inflows into Bitcoin, while the ETF under ticker GBTC from Grayscale recorded outflows of $145 million, according to Cointelegraph.

Spot exchange-traded funds based on Efirium are also performing well. Inflows into such exchange traded funds totalled $1 billion for the week. Overall, ETH ETFs continue to gain momentum, recording capital inflows for the seventh week in a row with a total of 3.7 billion over the period.

A single base interest rate cut may indeed not be enough for a massive pump in the coin market. However, the event will definitely benefit the industry in the long run. Still, it will be another reason for investors to get to know the coin industry.

Look for more interesting stuff in our crypto chat. We look forward to seeing you there to keep up to date with what’s happening in this bullrun.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.