Billionaire Ray Dalio is betting on Bitcoin and gold. What does he expect from financial markets in the future?

Billionaire and investor Ray Dalio has expressed concern about a possible “looming monetary debt problem” in the global financial system. With this in mind, he urged market players to look to “hard assets” along the lines of Bitcoin and gold. At the same time, during a recent conference in Abu Dhabi, the founder of one of the largest hedge funds in the world called Bridgewater said he would invest in crypto and precious metals.

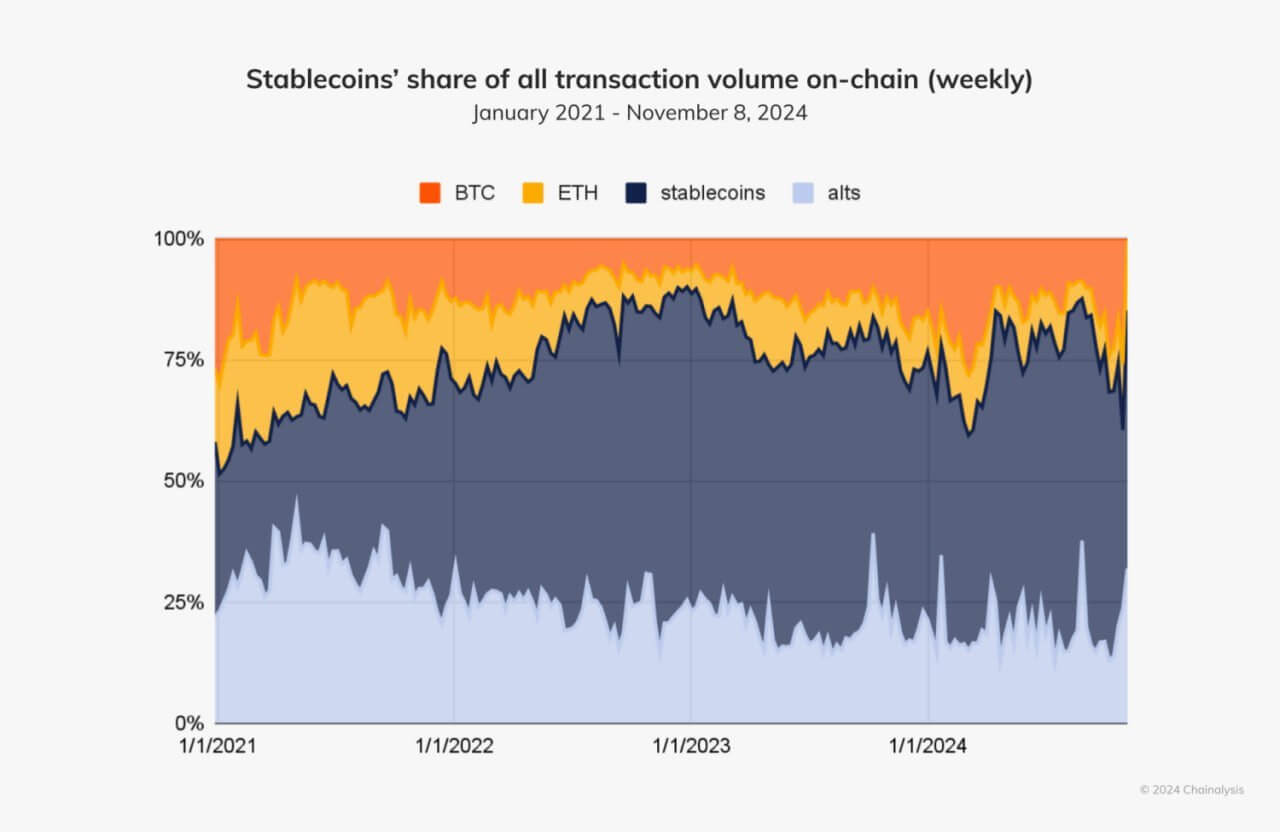

Meanwhile, stablecoins, i.e. tokens linked to the value of real assets and currencies – most often the dollar – are proving to be an increasingly popular way of using digital assets.

According to Chainalysis analysts, this category of digital assets now accounts for about 75 per cent of all blockchain transactions. In other words, 3 out of 4 transfers in crypto are conducted exactly in staples.

The share of stablecoins in the total number of transactions

It is not difficult to understand this trend. Firstly, steibles allow everyone to protect their own capital in various national currencies from depreciation. Secondly, they allow to create a reserve of blockchain-based assets, which most likely will not be reached by the government of a particular country.

What to invest in in 2025?

According to Cointelegraph sources, the billionaire pointed to “unprecedented levels” of debt in all major countries, including the United States and China. He emphasised that this situation in the global economy is highly unsustainable, which means it deserves increased attention from market participants.

Here is a relevant quote on the subject.

There is no way these countries will be able to avoid a debt crisis in the coming years, which will lead to a significant decline in the value of money. I believe that a monetary debt problem is indeed looming.

In addition to what he said, the billionaire called for assessing the situation on a larger scale. Here’s his comment.

Don’t get caught up in the day-to-day headlines, but instead think about the big drivers. I want to avoid debt assets along the lines of bonds and have hard money like gold and Bitcoin.

Billionaire Ray Dalio

What’s most interesting is that Dalio wasn’t such an ardent fan of digital assets before. He believed that cryptocurrencies would not be able to succeed on the scale that many coin users expect. However, in recent years, Dalio still became one of Wall Street’s most prominent supporters of BTC.

In 2022, Dalio said it’s prudent to allocate up to 2 per cent of an investment portfolio to Bitcoin in addition to gold to protect against inflation. The billionaire has also previously emphasised that he would prefer gold to Bitcoin, noting the importance of diversification in investments.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Goldman Sachs CEO David Solomon is of a similar opinion. He has now said that the financial giant is willing to “consider” working with Bitcoin and Etherium if the US changes its digital asset regulation rules.

During the Reuters Next conference, Solomon was asked when Goldman Sachs plans to launch BTC trading on the spot. The answer was as follows, and the relevant rejoinder is quoted by The Block.

I do believe that these technologies solve important problems and are attracting a lot of attention at the moment. Still, there is a perception that the regulatory framework will evolve differently than it seemed under the previous US presidential administration.

At the same time, the manager indicated that it is still unclear exactly how regulations will change. He continues.

If the regulatory structure of the market changes, we will evaluate that, but at the moment we are not allowed to launch new projects in crypto.

Goldman Sachs CEO David Solomon

Changes to crypto industry regulation could come amid promises from US President-elect Donald Trump. Before the November elections, Trump said that he would create a strategic reserve of BTC and end the so-called “Operation Strike 2.0”.

Recall, the term is a reference to the initiative of the US Department of Justice in 2013. Back then, the goal was to restrict banking services for industries considered high-risk in terms of fraud and money laundering like microloans and arms trafficking. This time, the target was the crypto industry.

And as the current court case between representatives of the crypto industry and the Federal Deposit Insurance Corporation (FDIC) has shown, the U.S. authorities have indeed tried to purposely prevent the development of the coin industry. Specifically, in 2022, FDIC representatives directly recommended that large banks “suspend all activities related to crypto assets.” Read more about this in a separate piece.

Solomon also stressed that he still considers Bitcoin a “speculative asset.” He continues.

These assets – Bitcoin, for example – you know, they’re speculative assets right now. But people are very interested in them, and I understand why.

Generally speaking, Goldman Sachs launched its own crypto desk in 2021 and later participated in a series of tests on the Canton Network, a compliant network created by Digital Asset Holdings and designed to handle large institutional assets. Goldman Sachs has also seen increased interest in crypto products from its hedge funds.

In general, more and more experienced representatives of the world of finance are convinced of the potential of Bitcoin and digital assets. Well, the possible approval of adequate crypto regulation rules in the U.S. will only strengthen this trend. Therefore, retail players should definitely not ignore the coin market.

Look for more interesting information in our crypto chat room. We are waiting for you there to start closely following the situation on the coin and blockchain platforms market today.

SUBSCRIBE TO OUR CHANNEL ON TELEGRAM TO KEEP UP TO DATE.