Bitcoin correction and record capital outflows from ETFs. What is happening to the cryptocurrency market?

1.4 billion dollars – that was the amount of liquidated positions of traders in the crypto market over the last 24 hours. All to blame for the noticeable correction of Bitcoin and the vast majority of altcoins. According to experts, the collapse was caused by a change in the expectations of market players. Now they are closely watching every action of the team of the newly elected US President Donald Trump, and any disappointment in his strategies will have a negative impact on the industry.

Recall that during the election campaign, Donald Trump promised to support the crypto industry, stating his intention to create a strategic reserve of bitcoins and provide thoughtful regulation of the sphere. These statements contributed to the growth of Bitcoin, the price of which exceeded the level of 100 thousand dollars after Trump's election victory in November.

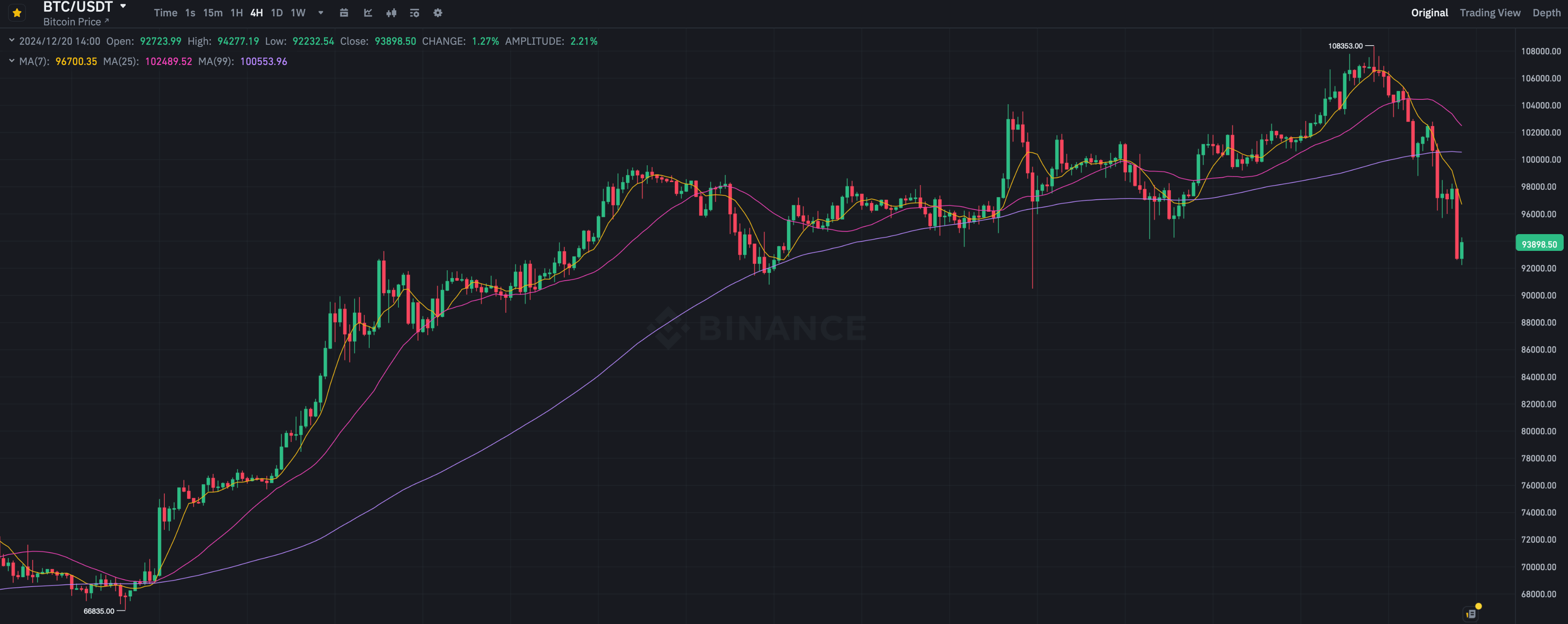

The current high is $108,353 per 1 BTC, which was recorded on Tuesday. Here is the corresponding chart of the coin’s exchange rate.

A four-hour chart of the Bitcoin BTC exchange rate

However, in the middle of the week, the speech of US Federal Reserve Chairman Jerome Powell significantly affected the market. At the time, he was asked if he saw value in the possible creation of a spot Bitcoin-ETF after Trump takes office.

Powell responded by stating that the Fed cannot hold bitcoins. However, if anything, it would be up to Congress to change the law.

Why Bitcoin fell

Swyftx Chief Analyst Pav Khandal said in an interview with reporters that the correction in the market may be short-lived. Here is the relevant rejoinder as quoted by Cointelegraph.

We had such an optimistic scenario in the last one month that the market was completely unprepared for bad news. What we are seeing now is a chaotic sell-off. It’s not the festive rally we were hoping for, but the collapse is unlikely to last too long.

Despite the collapse, Bitfinex analysts still expect Bitcoin to rise to the $140,000 mark by the middle of next year. According to their version, the demand for Bitcoin from large institutional-level investors has become too great, because of which the cryptocurrency will continue to set historical price highs.

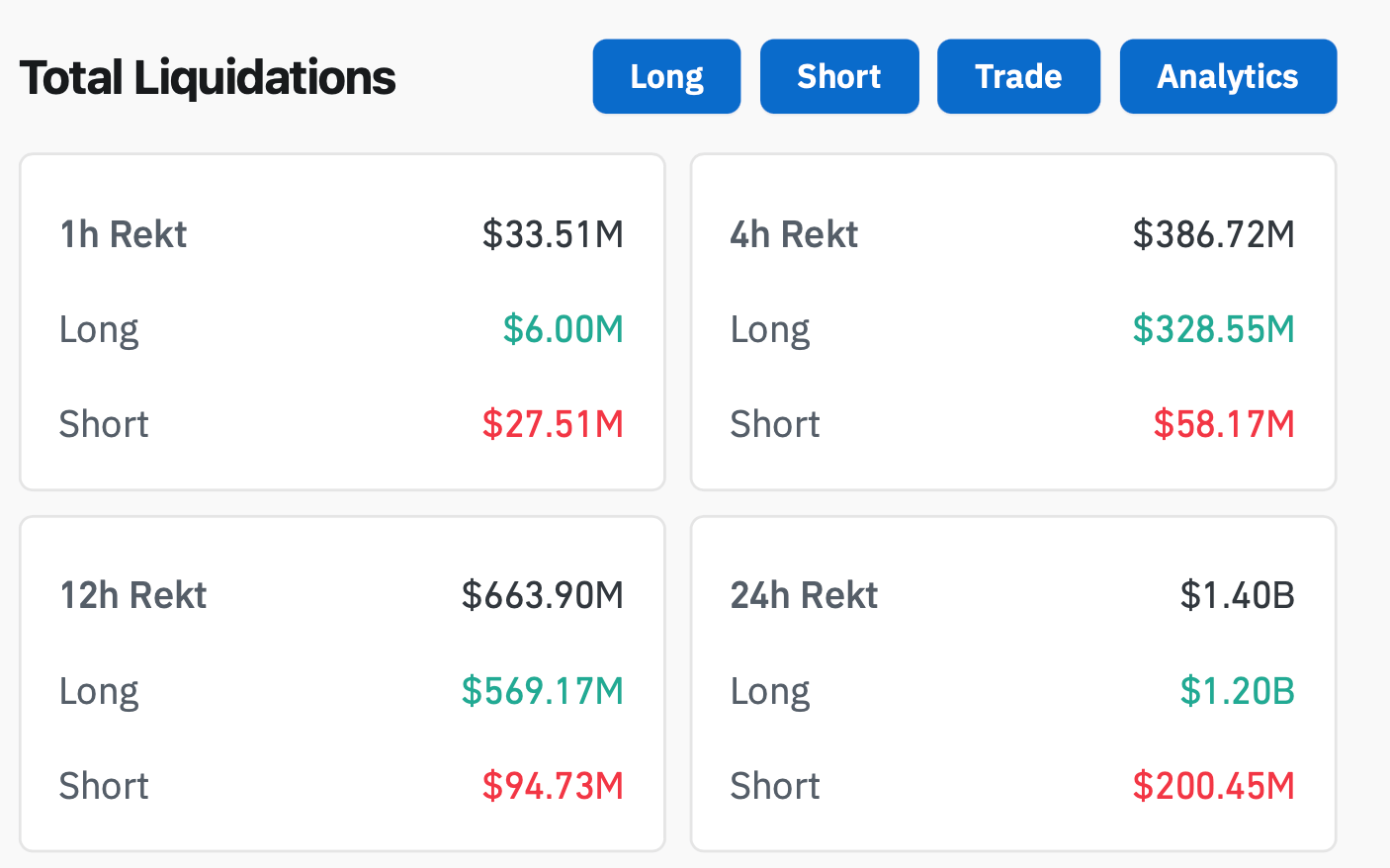

The volume of liquidations of trading positions on cryptocurrency exchanges over the last day

Over the last day, traders’ margin positions in crypto were liquidated to the tune of $1.4 billion, of which $1.2 billion were long positions. Accordingly, their owners were betting on the growth of the market, but due to the reverse movement of exchange rates, exchanges forcibly closed such transactions. Over the same period of time, Bitcoin’s value fell by 8 per cent, dropping below the psychological support level of $100,000 and rolling much lower.

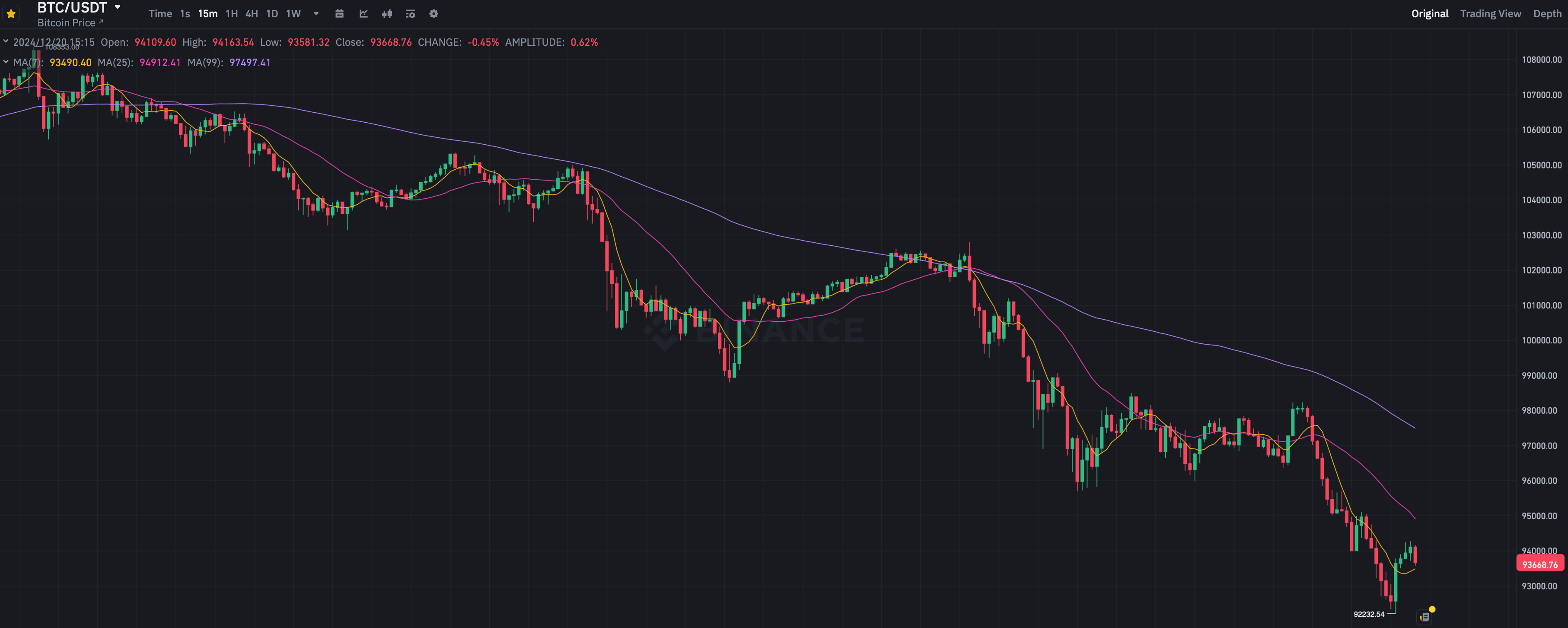

The actual low of the BTC rate on this drawdown is $92,232 from today.

15-minute chart of the Bitcoin BTC exchange rate

It is not the first time this month that Bitcoin is below the above-mentioned line, and each such collapse is accompanied by a massive liquidation of positions. For example, at the beginning of the month, a sudden drop in Bitcoin’s price led to an increase in the volume of liquidated positions to $300 million in a matter of minutes. However, the scale of the current collapse turned out to be much larger.

Analysts of the CoinGlass platform noted that the current liquidation of long positions has so far turned out to be the largest in the current cycle. Moreover, many experts have already reacted to the events on Twitter.

The consensus among their opinions is clear: the use of leverage – i.e. borrowed capital from centralised cryptocurrency exchanges – can be extremely dangerous for traders’ deposits. All because of too high market volatility, which leads to the closing of such positions.

Cryptocurrency market crash

Handal expects that the crypto market will begin to take into account its expectations regarding the Trump administration. Still, Donald Trump’s inauguration as the 47th president of the United States is scheduled for 20 January 2025. Crypto market participants are eagerly awaiting his plans to create a strategic bitcoin reserve in the US.

At the same time, the former head of crypto exchange BitMEX Arthur Hayes admits that such a reserve will eventually not be created at all. In addition, he expects a market crash during Trump’s inauguration, as crypto investors allegedly realise the impossibility of quick regulatory changes.

😈 MORE INTERESTING STUFF FROM US AT YANDEX.ZEN!

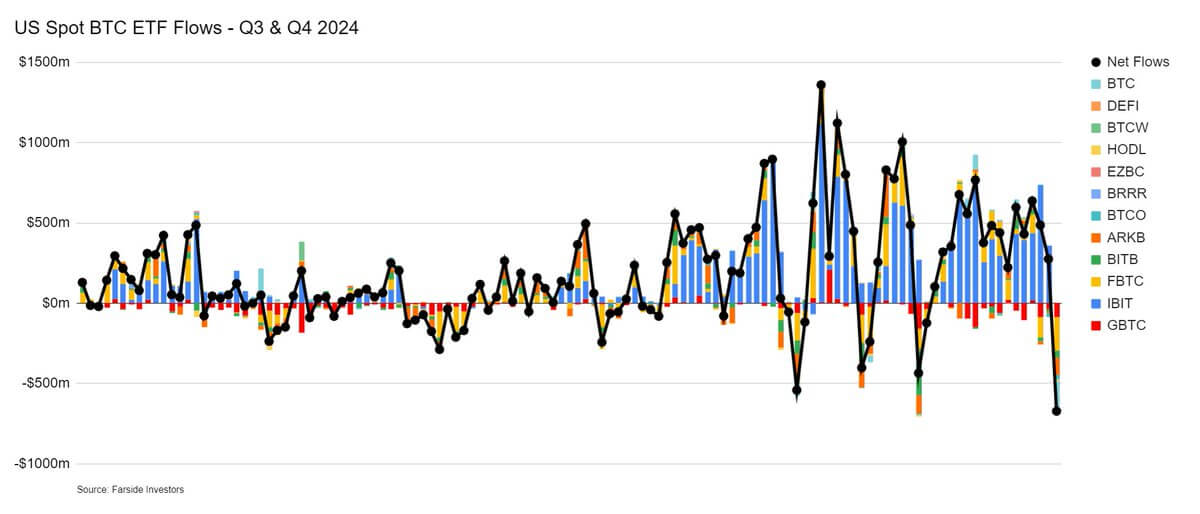

Also on Thursday, spot Bitcoin-ETFs in the US recorded the largest net outflow of funds in a day in the history of trading. A total of $671.9 million was withdrawn from the instruments after a 15-day streak of capital inflows, The Block reported.

Capital inflows and outflows from spot Bitcoin-ETFs in the US

The leader in outflows is Fidelity’s FBTC fund, which lost $208.5 million. Grayscale’s Bitcoin Mini Trust fund recorded an outflow of $188.6 million, while ARKB from Ark and 21Shares lost $108.4 million.

The GBTC fund from Grayscale saw $87.9 million in withdrawals. BITB from Bitwise recorded an outflow of $43.6 million.

The largest spot Bitcoin-ETF IBIT from BlackRock remained “neutral” yesterday, meaning it did not record any capital flows. The only fund of all existing funds that showed positive results was BTCW from WisdomTree with an inflow of only $2 million per day. At the same time, the trading volume of all BTC-based exchange-traded funds reached $6.3 billion on Thursday, up from $5.9 billion the day before.

Experts believe that the reason for the current collapse of the coin market was the unpreparedness of investors to negative news. The latter primarily included Jerome Powell's statement about the inability of the U.S. Federal Reserve System to hold bitcoins at the moment. However, it is important to realise that Congress will be able to change this if anything happens.

For more interesting stuff, check out our cryptocurrency chat room. Be sure to check it out so you don’t miss the development of the current bullrun in the digital asset sphere.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.