Bitcoin has overcome the level of 100 thousand dollars. What to expect from the cryptocurrency next: analysts’ opinion

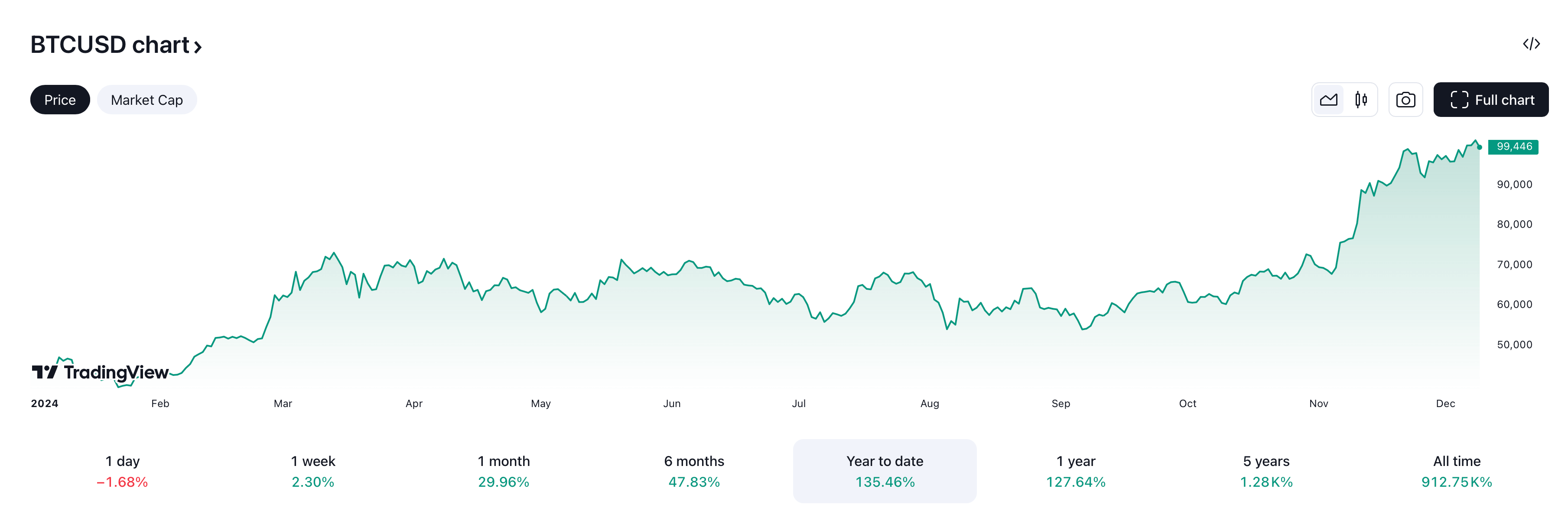

Last week, the Bitcoin exchange rate broke the $100,000 mark for the first time and set another historic high. However, for the first cryptocurrency it is not the limit yet. Still, many analysts are already making forecasts for the next year, in which the value of the asset will be much higher. Accordingly, investors should pay attention to such probabilities and prepare for different scenarios in the market.

Analysts agree that the key reason for the current growth of the coin market was the victory of Donald Trump in the US presidential election. One of his most attractive election promises is the creation of a national crypto reserve in bitcoins. The plan as a minimum involves refusing to sell coins that were previously confiscated by the US authorities from various criminals.

At the same time, the programme maximum means buying a million bitcoins, which will be stored without moving for at least twenty years.

Such an idea was supported the day before by the former head of MicroStrategy Michael Saylor. According to him, BTC is now the most desirable asset for long-term investors, so the U.S. government should get rid of all the gold in its reserves. And the proceeds should be redirected to the purchase of bitcoins.

However, not everyone favours this idea. Earlier, former U.S. Treasury Secretary Lawrence Summers spoke out against it. Because of this, the expert received instant criticism from fans of digital assets, who questioned his competence.

What will happen to the Bitcoin exchange rate in 2025

In a fresh address to clients, Standard Chartered’s head of research Jeff Kendrick said that Bitcoin’s record rally the day before was fuelled mainly by capital flows from institutional investors into cryptocurrency ETFs – primarily BlackRock’s iShares Bitcoin Trust product.

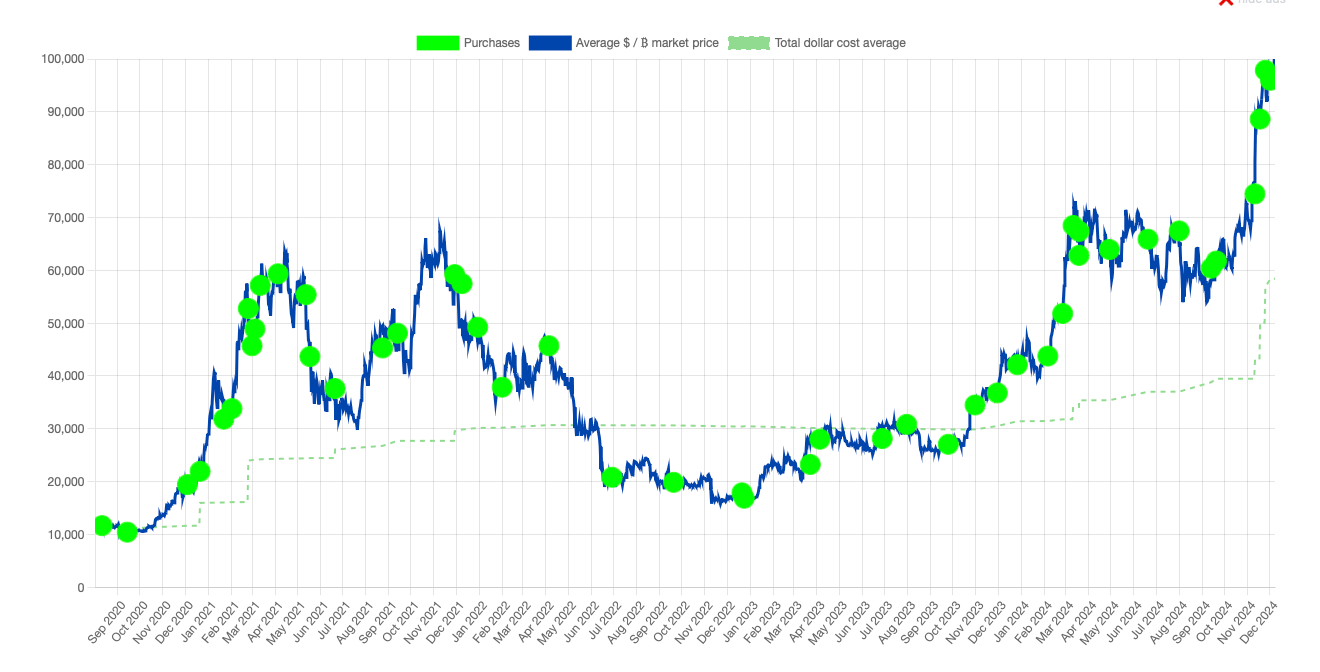

Massive BTC purchases by MicroStrategy had an additional effect. Here is an expert’s rejoinder on the subject.

We expect institutional capital inflows in 2025 to remain at or exceed 2024 levels. Against this backdrop, we believe that our Bitcoin price target of around $200,000 at the end of 2025 is achievable.

Earlier Bernstein analysts announced a similar target. And given the industry's growing attention to BTC, they called the 200,000 target conservative, i.e. quite modest.

Change in the value of Bitcoin in 2024

Earlier, MicroStrategy unveiled a plan to buy $42 billion worth of bitcoins over the next three years using equity and debt capital. And Kendrick believes the company is “operating well ahead of plan.” Since about the beginning of November, MicroStrategy’s balance sheet has grown by 150,000 BTC, or more than $15 billion.

In addition, today the giant announced the acquisition of 21,550 BTC for $2.1 billion. Thus the total amount of cryptocurrency at the disposal of MicroStrategy reached 423,650 bitcoins, in which a total of $25.6 billion was invested.

Along with this, Standard Chartered analyst predicts that in 2025, pension funds will be among the most active buyers of spot Bitcoin-ETF shares. If financial performance is more optimistic than forecast in this regard, Standard Chartered experts are considering a further increase in their Bitcoin price target by the end of 2025.

MicroStrategy’s BTC purchases on the Bitcoin chart

According to Decrypt’s sources, Kendrick singled out Trump’s initiative to create a national crypto reserve. Although he generally considers something like that “unlikely.”

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

While Kendrick focuses on long-term predictions, other experts pay more attention to short-term movements on the chart. For example, cryptocurrency strategist at 21Shares Matt Mena stated that the $100,000 price is a key psychological boundary for Bitcoin investors.

A solid break above this line “has the potential to attract a new wave of investors” who have previously stayed on the sidelines of deals and ignored the coin sphere for whatever reason.

However, active buyers of BTC at the same time can fix the profit when the asset will overcome the barrier of 100 thousand dollars. This is the opinion shared by Brent Kenwell, an investment analyst from eToro.

It would not be something surprising if Bitcoin, which has grown by more than 40 per cent since the election, takes a small pause.

Cryptocurrency market growth

Overall, Bitcoin’s long-term price outlook for 2025 depends largely on the acceptance of institutional investors and the regulatory environment. Given the current dynamics, the continued integration of cryptocurrencies into the financial system has the potential to lead to strong growth in the BTC price. It is expected that further spread of Bitcoin-ETF and strengthening of the role of the first cryptocurrency as a protective asset in the context of instability of traditional markets will push its value to new highs.

Analysts agree that 2025 will be a successful year for Bitcoin and the cryptocurrency market as a whole. The most obvious factors for this are the change in leadership of the Securities Commission after Trump's rise to power and the development of an adequate framework for the regulation of coins. Perhaps the successful implementation of these two items will be enough to noticeably affect the value of digital assets.

Look for more interesting stuff in our crypto chat. There we will discuss other important topics from the world of digital assets.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.