Bitcoin on the balance sheet: how will companies make money from cryptocurrency in 2025?

The rate of Bitcoin adoption among corporate players is rapidly increasing, as more and more companies want to directly invest in BTC by adding coins to their own wallet balance. According to analysts of the investment firm CoinShares, this trend will lead to an increase in the number of passive earning strategies on Bitcoin. Moreover, it will be possible to implement them already in 2025, which will be the year of active popularisation of digital assets among major market participants.

New tools based on Bitcoin

CoinShares analysts published a forecast of the crypto industry development for 2025, noting such important factors as changes in the political arena in the United States, as well as the rapid growth of the Solana and XRP ecosystems. In addition, one of the main trends for the next year will be the expected growth of Bitcoin yield enhancement solutions, which will allow investors to earn additional profits from owning coins.

Now this trend has been supported by Notcoin developers from the Open Builders team. They have launched the Earn platform, which allows you to receive cryptocurrency accruals depending on the volume of coins on your wallet, and there is no need to send crypto to staking.

And although it is unlikely to make serious money on it, the initiative will certainly be in demand.

According to CoinShares analyst Satish Patel, the new trend reflects a general shift in the perception of Bitcoin by large corporate players. Here’s a rejoinder on the matter, as quoted by Cointelegraph.

The trend reflects a broader recognition of Bitcoin’s potential not only as a tool for storing value, but also as a means of generating profits.

CoinShares has identified three main types of returns for Bitcoin. The first is related to the increase in the amount of BTC relative to the company’s shares on the balance sheet. The second type of yield is farming, where yields are generated by issuing loans secured by bitcoins. Finally, the third strategy uses derivatives to generate returns from BTC stocks.

It is worth noting that the Bitcoin network runs on a Proof-of-Work algorithm, not Proof-of-Stake. Accordingly, it is not possible to steak your BTC at a native level and increase its volume similar to Solana or Efirium. After all, bitcoins are mined by miners with ASICs, not validators.

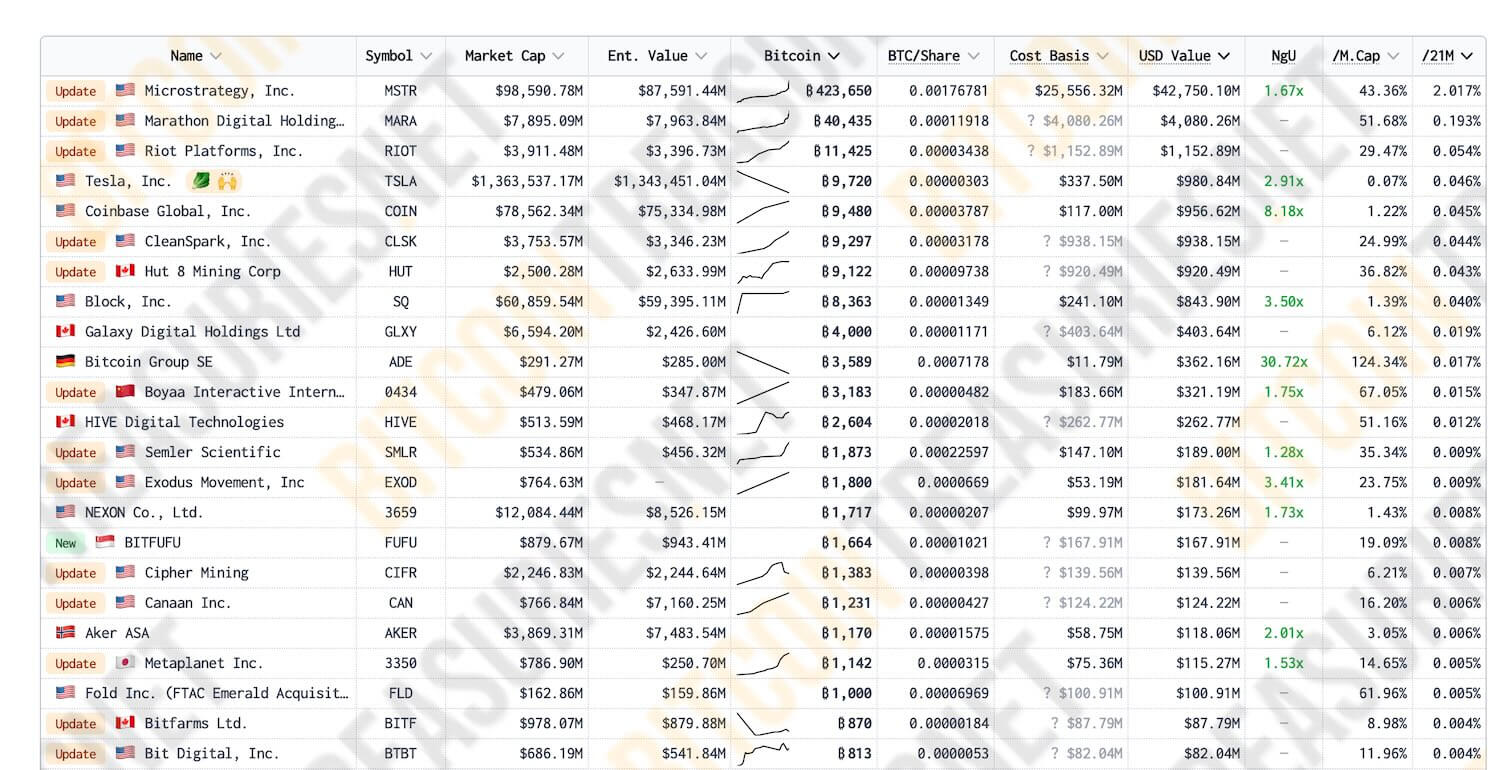

Ranking of public companies by the number of accumulated bitcoins

For example, MicroStrategy, the world’s largest corporate holder of BTC, introduced its own version of the metric to evaluate the effectiveness of its strategy of constantly acquiring bitcoins. The giant allowed investors to evaluate how blockchain-based coin acquisitions contribute to shareholder value.

MicroStrategy’s BTC yield is a key performance metric that represents the percentage change in the ratio between the number of BTC owned and the estimated number of shares outstanding. From Jan. 1 to Nov. 10, MicroStrategy’s BTC yield was 26.4 percent.

According to Patel, one important sign of the increase in BTC stocks on company balance sheets in 2025 is the growing acceptance of crypto payments around the world. Here’s an opinion on that.

During 2024, several large companies began accepting crypto as a means of payment, indicating a potential trend towards Bitcoin adoption in 2025.

Bitcoin’s value change per month

E-commerce giants like Amazon, Shopify, Nike, Expedia and PayPal are already heavily involved in the crypto industry, either through payments or direct or indirect investments. Experts say that such corporate giants may eventually consider listing Bitcoin as one of their assets on their balance sheets in 2025.

Alas, Microsoft will not be among them anytime soon. As it became known after the preliminary results of the vote on Tuesday evening, the company's shareholders opposed direct purchases of BTC by the giant.

Microsoft Corporation founder and billionaire Bill Gates

According to The Block’s sources, another important role in the crypto industry of the future is reserved for stablecoins. According to analysts at Citi Wealth, the development of this category of tokens is hindering the narrative of Bitcoin replacing the dollar. Here is the experts’ commentary on the matter.

Cryptocurrencies like Bitcoin were originally conceived as competitors to currencies issued by central banks. Indeed, some believed, and continue to believe, that BTC could end the hegemony of the US dollar. However, stablecoins, which account for more than four-fifths of crypto trading volume, disprove this theory.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

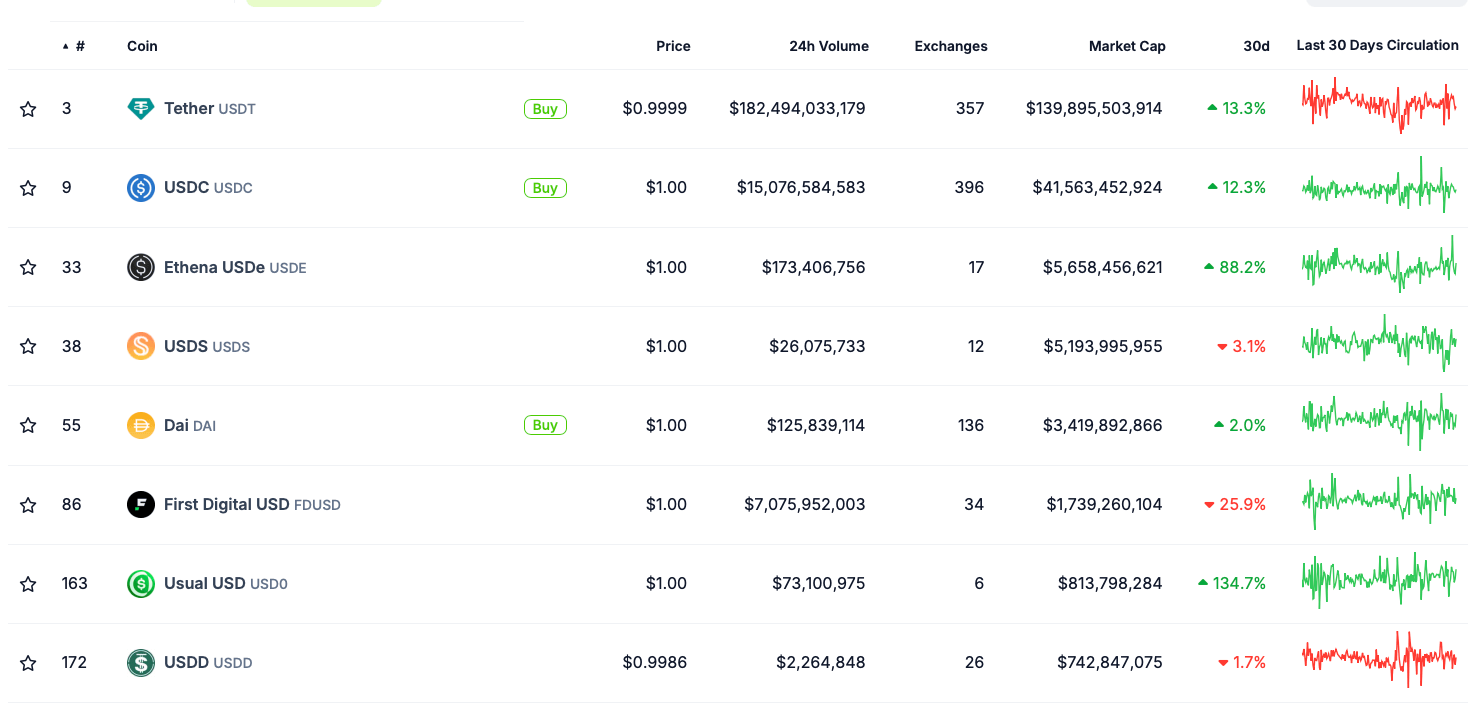

Ranking of stablecoins by capitalisation

Citi points to the fact that the vast majority of stablecoins are pegged to the dollar, with issuers holding both dollars and US Treasuries in reserve. Analysts also suggest that if the US government takes steps to further legitimise steblecoins, it will only increase the dominance of the dollar.

Greater regulatory clarity also has the potential to further increase the attractiveness of stablecoins. If this happens, demand for U.S. Treasuries from issuers of such tokens could increase substantially. In this way, such coins will not usurp the dollar, but will make it more accessible to the world.

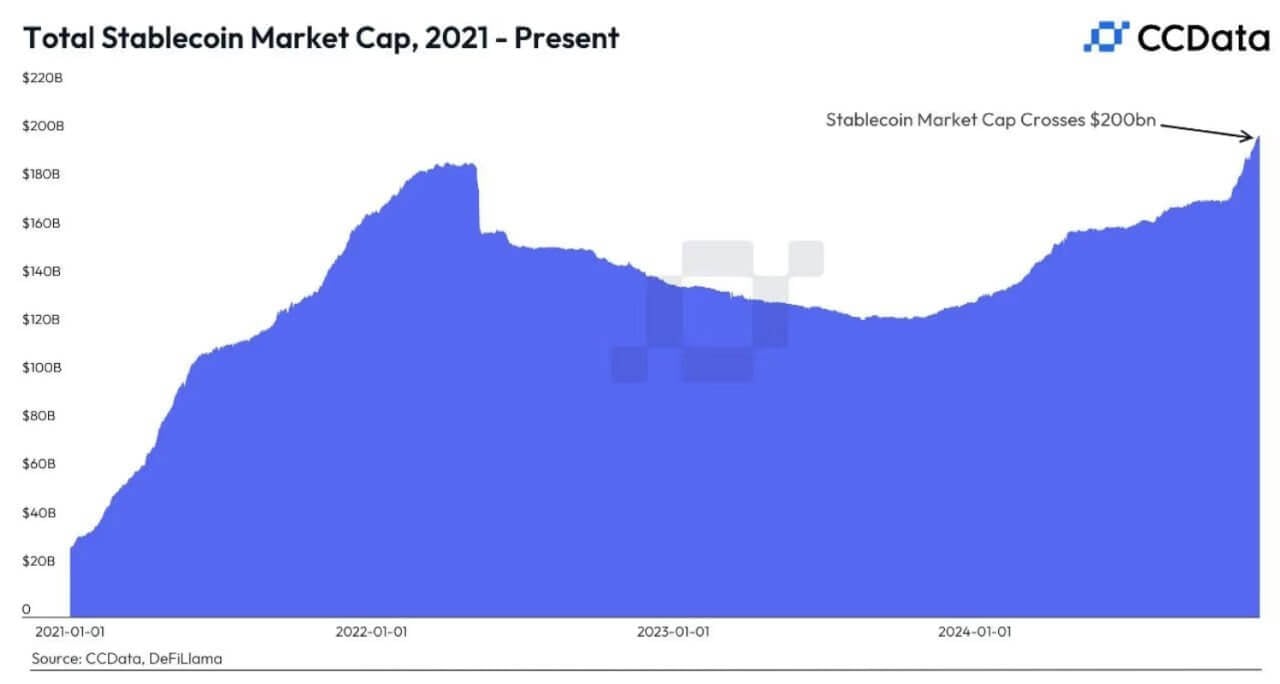

At the moment, USDT from Tether is the leading steiblcoin by a number of indicators. Well, the total capitalisation of steibles has exceeded 200 billion for the first time in its history, which confirms the serious demand for such assets.

Changes in the capitalisation of all stablecoins

So far, everything is going towards the fact that cryptocurrencies will turn into an increasingly popular investment tool. This will be facilitated not only by Trump's victory and the possible creation of adequate coin regulation rules in the US, but also by the continuation of the current bullrun. As we know, it is the growth of rates that attracts new users to the world of crypto best of all.

Look for more interesting things in our crypto chat. There we’ll talk about other important topics that are happening in the digital asset industry.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO KEEP UP TO DATE.