Bitcoin set a new record: what awaits the cryptocurrency after another high?

Yesterday’s rise of Bitcoin above $100,000 did not go unnoticed in the circles of cryptocurrency enthusiasts. Moreover, the new BTC record was reported by all major global media, and it also caught the attention of the newly elected US President Donald Trump. In the social network Truth Social, the politician congratulated the holders of digital assets with an important milestone in the development of the market.

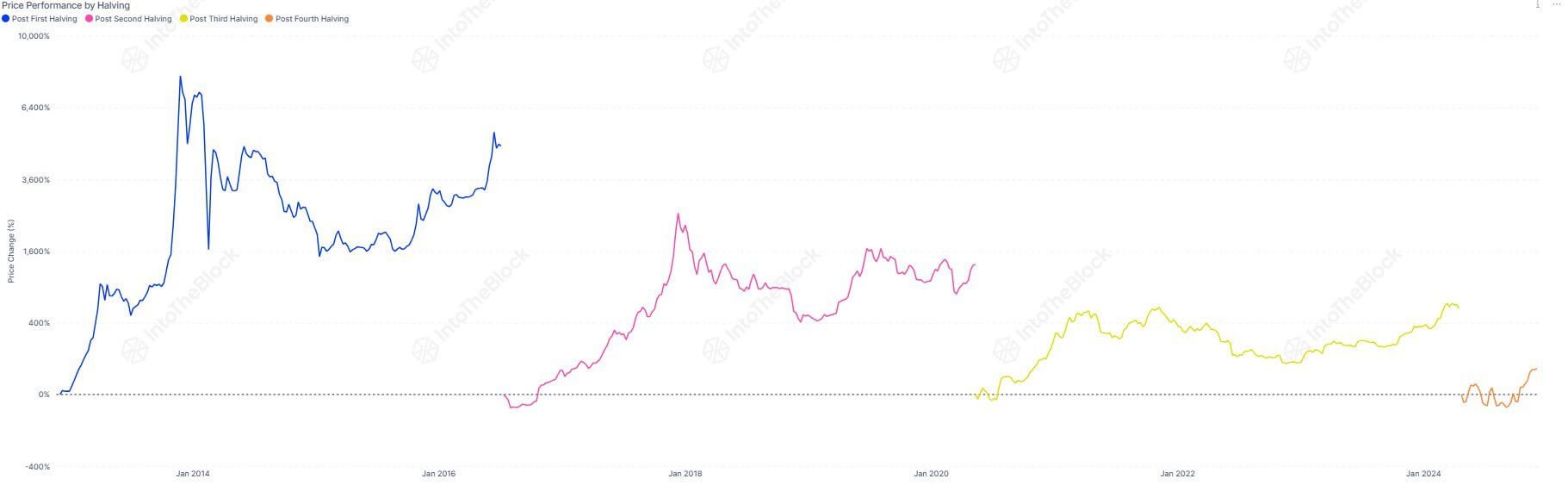

Meanwhile, analysts believe that Bitcoin’s potential for growth remains. This view was voiced by representatives of IntoTheBlock, who compared the scale of growth of BTC after its halving, that is, the reduction of the reward for mining a block by half.

The last time the procedure took place on 20 April 2024. In this case, in the 2013 cycle, the first cryptocurrency grew by 7,900 per cent from the day of the halving to its peak. In 2017 and 2021, the corresponding figures were 2,560 and 594 per cent.

Comparing Bitcoin’s post-halving growth on the cryptocurrency network

It is important to understand that as the market capitalisation of BTC grows, it becomes noticeably more difficult to influence the value of the asset. Therefore, it is not worth counting on the previous scale of jumps in the Bitcoin exchange rate.

However, analysts consider it adequate to count on the growth of the coin in the current cycle by 100-200 per cent of its value on the day of halving. Accordingly, the peak for the cryptocurrency in the current bullrun may be between $130,000 and $190,000.

A new record for Bitcoin

Trump’s post on the Truth Social platform translates as follows. The quote is cited by The Block.

Congratulations, bitcoin owners! 100 thousand dollars! You’re welcome! Together we will make America great again.

Trump didn't write "you're welcome" in his tweet for nothing. Still, his victory in the US presidential election led to a sharp rise in the cryptocurrency market - mainly due to investors' hopes for the emergence of normal regulation.

Newly elected US President Donald Trump

To make matters worse, the day before, Trump had nominated cryptocurrency proponent Paul Atkins as chairman of the Securities and Exchange Commission (SEC). This move was the latest and decisive push for Bitcoin’s price towards the $100,000 mark.

This was stated by analysts at brokerage firm Bernstein in their latest publication. Here is their commentary on what is happening.

We believe that this appointment and the larger direction in market regulation under Trump is extremely positive for the entire crypto industry. We remain convinced that $100,000 is not the final milestone. Bitcoin is expected to hit a cycle high at the $200k line in late 2025.

Ryan Lee, head of research at Bitget Research platform Bitget Research, also commented on what’s happening in an interview with reporters.

Bitcoin reaching the $100,000 mark is a turning point, emphasising its growing acceptance and perceived value. Analysts are now turning their attention to the next potential resistance levels, looking at targets of $150,000 and even $200,000. The market reaction suggests that Bitcoin still has room to grow.

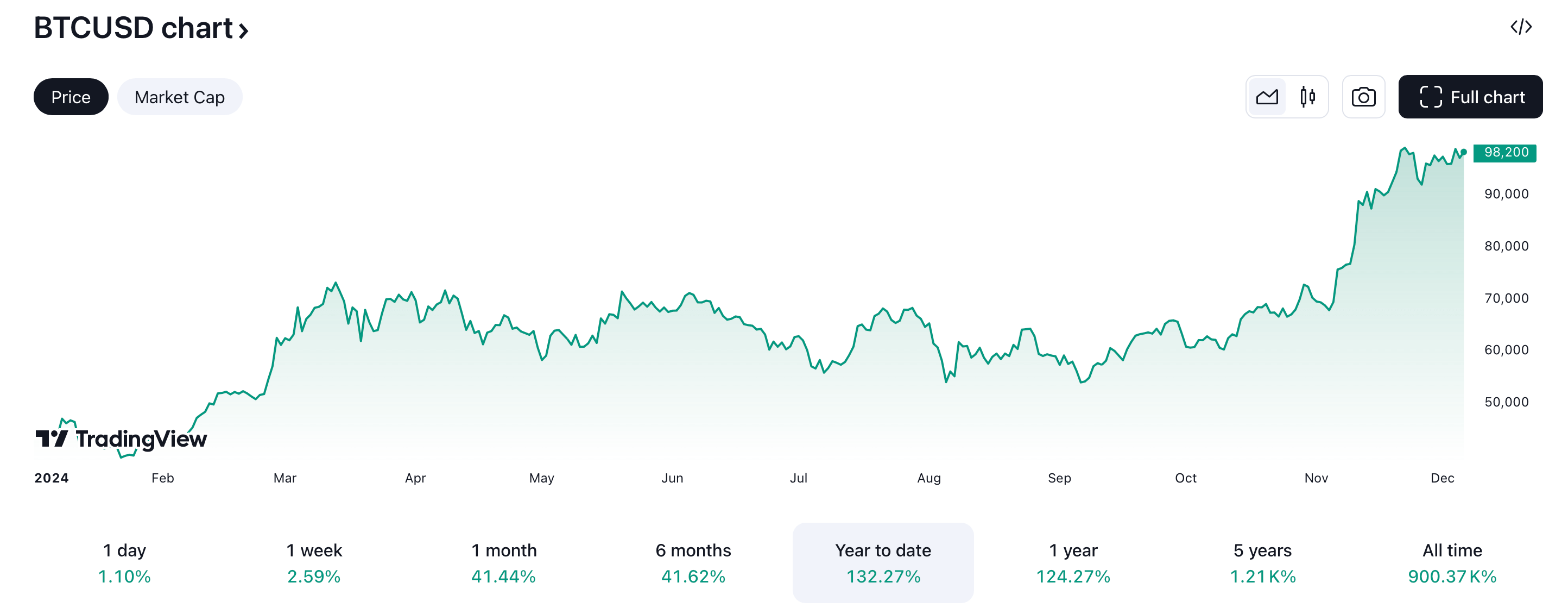

Bitcoin exchange rate value changes in 2024

Among the key factors that formed the waves of BTC growth, Bitfinex analysts highlighted Trump’s victory, the mention of the cryptocurrency by Fed chief Jerome Powell and the absence of a strong recession in the US economy. Recall, Powell called BTC the digital analogue of gold. And although he mentioned speculation in his remark, such a comment is still worth a lot.

The analysts’ comment was as follows.

Our short-term target is $112,000. However, we need to take into account that the holiday weekend trading will be with low activity.

Indeed, usually crypto traders and investors do not pay much attention to the market during holidays. Thus, there are fewer transactions, and along with them, the number of reasons for sharp changes in coin prices decreases. Therefore, in previous years, activity in the industry was observed either before or after 31 December.

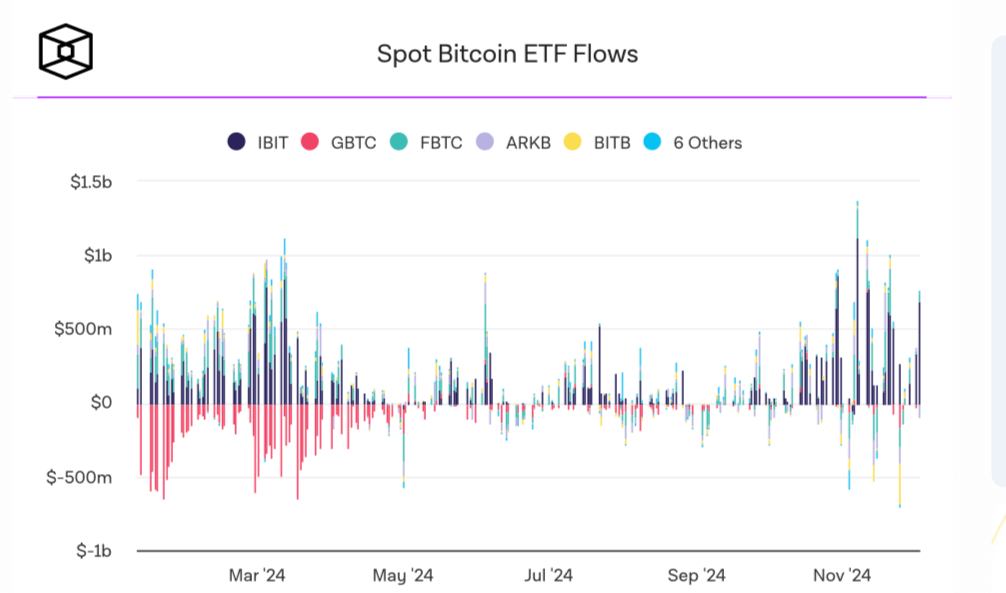

Inflows and outflows from spot Bitcoin-ETFs

Standard Chartered analyst Jeffrey Kendrick emphasised the role of institutional investors’ fund inflows into Bitcoin. U.S. ETFs alone have generated more than $32 billion in net capital inflows, indicating that major players are seriously interested in digital assets.

Kendrick also noted that Michael Saylor’s MicroStrategy has acquired 213,000 BTC in 2024. Against this backdrop, he expects the giant’s investment rounds to equal or exceed the levels reached by tens of billions of dollars in 2025.

😈 MORE INTERESTING CAN BE FOUND IN OUR YANDEX.ZEN!

Similar successes can boast the sphere of stablecoins, which have traditionally been the most important bridge between fiat currencies and crypto. With this in mind, the growth in the capitalisation of such tokens indicates an influx of capital into the coin industry.

Tether CEO Paolo Ardoino, during a recent interview, spoke about the new heights of the company, the issuer of the largest stablecoin USDT. Here’s his cue.

In the last 20 days alone, USDT’s capitalisation has grown by about $16 billion. This is partly due to the fact that there has been a significant influx of funds into spot ETFs. MicroStrategy spokesman Michael Saylor and many other players started buying Bitcoin at a very rapid pace – especially after the election.

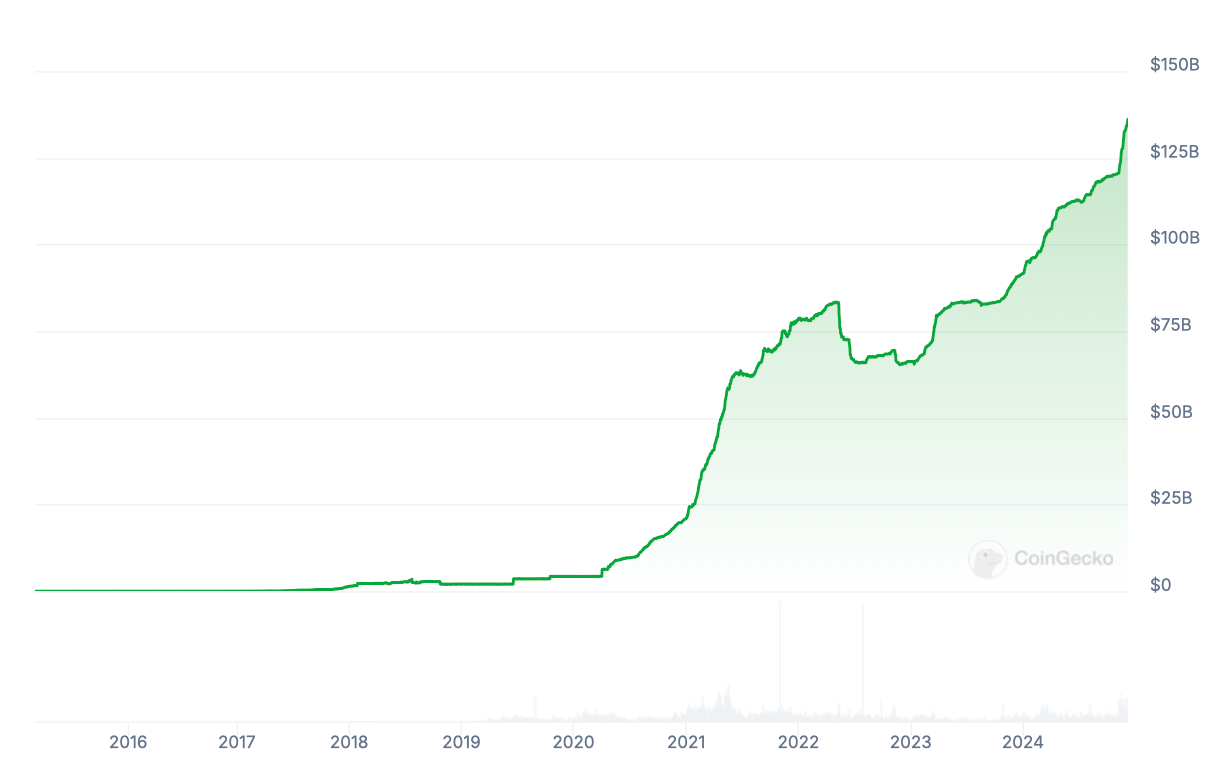

USDT Stablecoin Capitalisation Changes

With a capitalisation of over $136 billion, USDT is the most popular stablecoin in the world with a big lead over all other sphere projects. In addition, the total supply volume of the sphere of coins pegged to the US dollar has recently exceeded the line of $200 billion.

Analysts are inclined to the version that Bitcoin's growth will not end here. When compared to previous bullruns in the industry, there is more than enough reason to expect such a thing.

For more interesting stuff, check out our crypto chat. Be sure to stop by so you don’t miss the growing interest in digital assets around the world.

SUBSCRIBE TO OUR CHANNEL ON TELEGRAM TO KEEP UP TO DATE.