Bitcoin took the level of $100,000 for the first time. What is in store for the cryptocurrency market next?

A historic event took place this morning: the Bitcoin exchange rate finally broke the $100k mark. However, the long-term growth of the main cryptocurrency is being held back by BTC sales by large holders of the coin, who held the coin at the level of 98-99 thousand last night. Analysts at the Bitfinex exchange believe that short-term holders need to absorb this volume of sellable assets through active purchases in order to accelerate the growth of digital assets.

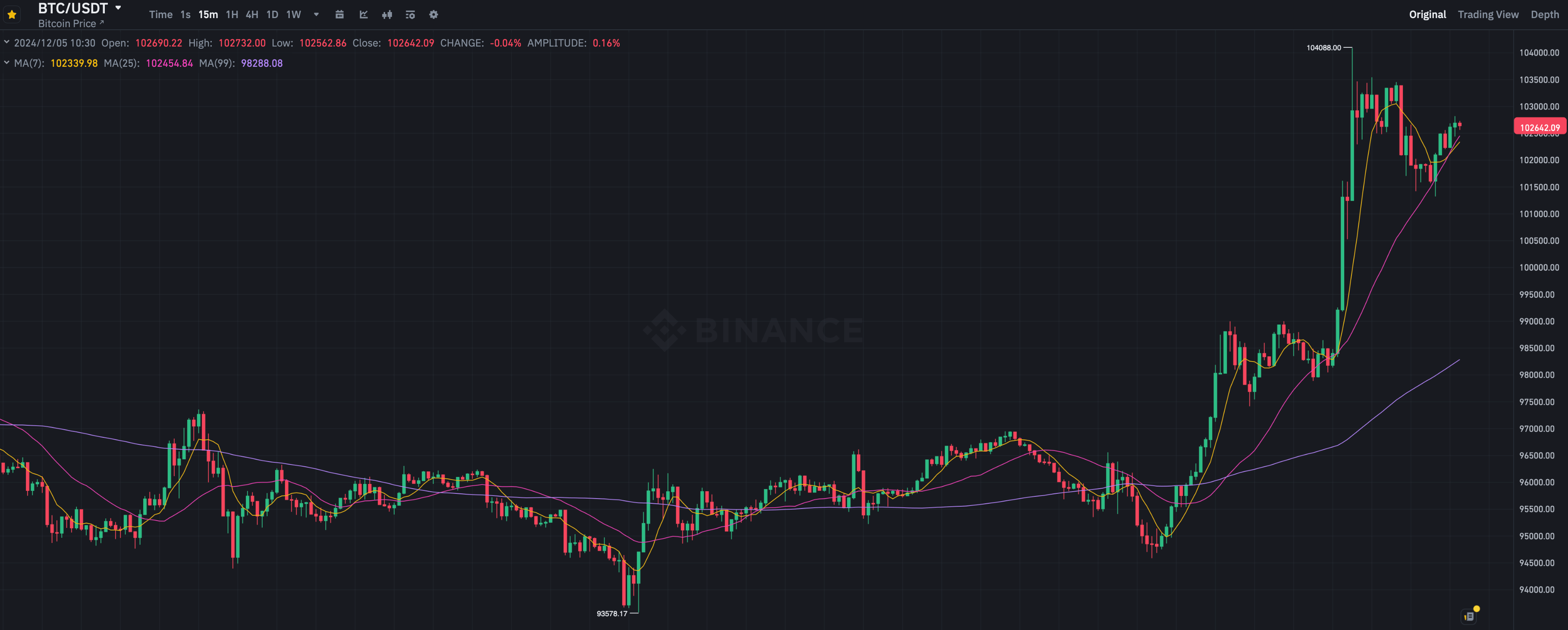

Bitcoin’s breakout of the $100,000 line took place this morning. For a short time, the first cryptocurrency including took the 104 thousand level, after which it sagged slightly. Here is the corresponding chart.

15-minute chart of the Bitcoin BTC exchange rate on the Binance exchange

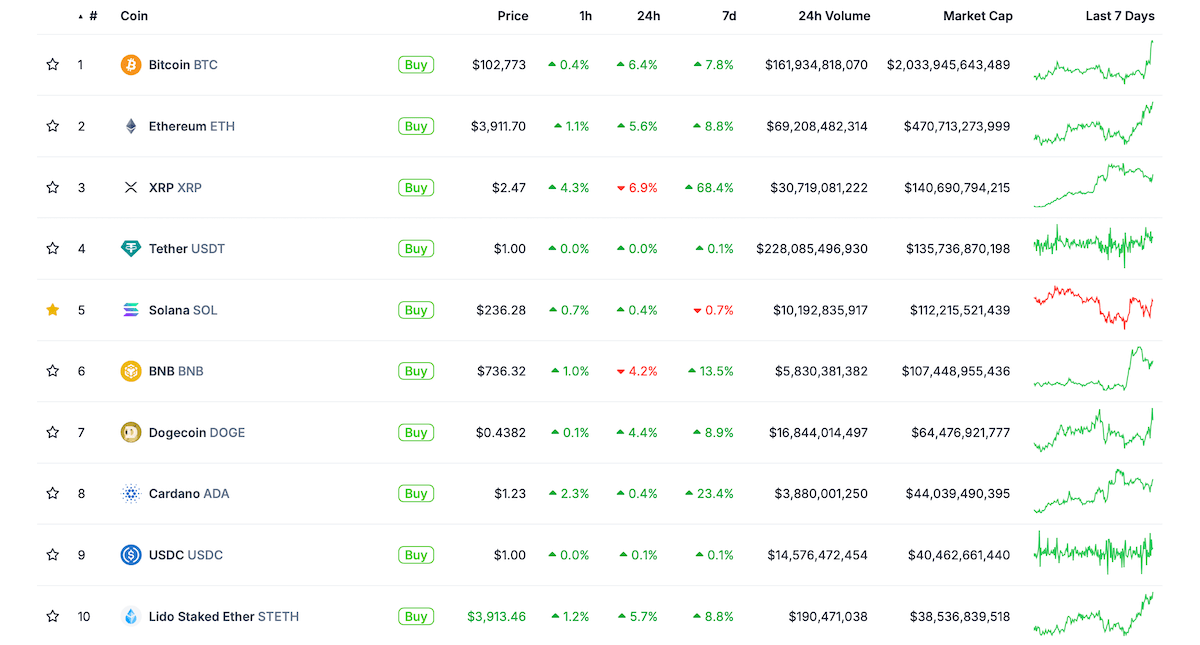

And this is how the current top of the largest cryptocurrencies by market capitalisation looks like. As you can see, the best result of growth in the scale of the week gave the coin XRP, which rose in price by 68 per cent in seven days.

The largest cryptocurrencies by market capitalisation

Also on the background of BTC growth, the volume of coins at the disposal of MicroStrategy exceeded the level of 40 billion dollars for the first time. The actual figure at the moment is 41.3 billion.

Ranking of public companies by the number of accumulated BTC bitcoins

What is happening with the Bitcoin exchange rate?

According to experts, the volume of the asset in the hands of short-term holders is approaching a cycle high of 3.28 million BTC. This is a level that is historically associated with the beginning of the formation of the peak of the bullish trend.

Here’s a comment from Bitfinex representatives as quoted by The Block.

This indicates growing interest from regular investors, but also emphasises the need for increased demand to absorb profit taking from long-term Bitcoin holders.

Cryptocurrency investors during the bullrun

Increased profit taking by long-term holders is putting pressure on Bitcoin’s upward momentum, potentially preventing further gains for the leading digital asset. Still, as the events of the last few days show, the number of those willing to get rid of BTC worth more than $95,000 has been more than sufficient.

The supply on the market from long-term holders has remained steady over the past two weeks. The lack of demand to absorb this supply may lead to a further fall in the Bitcoin exchange rate.

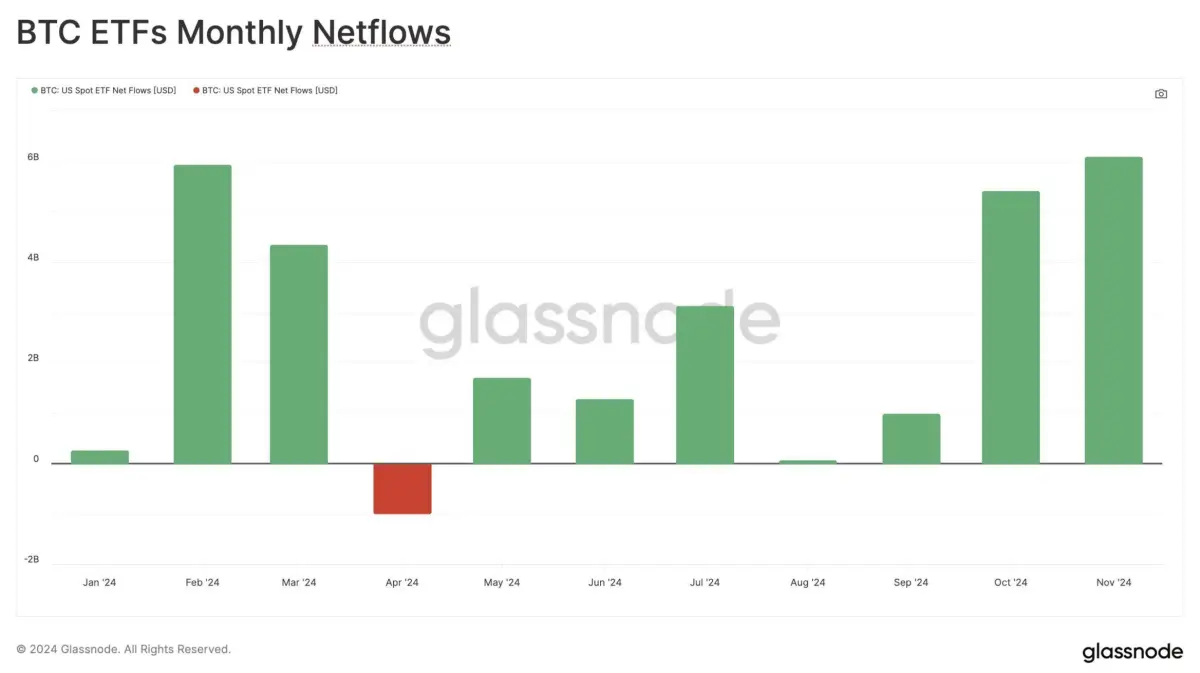

Inflows and outflows into Bitcoin-ETFs by month

Bitcoin’s debut rise above $100,000 was commented on by Brian Armstrong, head of cryptocurrency exchange Coinbase. He decided to celebrate the cryptocurrency’s ability to grow and at the same time protect its investors from capital depreciation. Here’s the quote.

If you had invested $100 in Bitcoin during the launch of the Coinbase crypto exchange in June 2012, that amount would have turned into $1.5 million today. And if you had kept your $100 in dollars, you could now buy only $73 worth of goods with it.

Bitcoin has been the most profitable asset of the last twelve years, and this is just the beginning. Every government – especially those who want to protect themselves from inflation – should think about creating a strategic BTC reserve.

The fact that it was fairly easy for Bitcoin to reach the $100,000 mark this morning is supported by the statistics of inflows into spot exchange traded funds based on the main cryptocurrency. For example, at the end of December 4, ETFs based on the first cryptocurrency in the U.S. attracted $556.8 million, which is not bad.

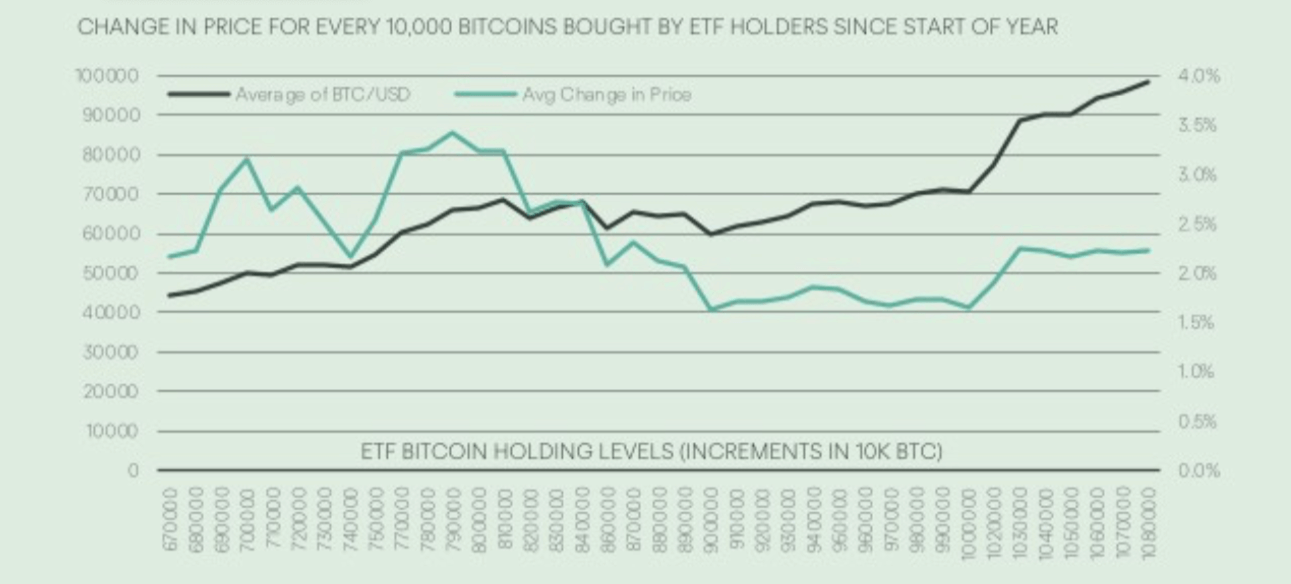

Here’s how Copper’s head of research Fadi Abualfa commented on this even before the fresh wave of growth.

Every 10,000 BTC added to ETF balances increases the price of the cryptocurrency by 2.2 percent. Given the current 1.08 million BTC under management in exchange-traded funds, an inflow of about $1.9 billion into ETFs would be enough to buy another 20,000 BTC. This could lead to a rate increase of up to $100,000 in as little as a week or two.

Bitcoin price change for every 10 thousand BTC inflow into cryptocurrency ETFs

Last November turned out to be a great month for spot exchange traded funds based on the main cryptocurrency. In the previous month, Bitcoin ETFs saw inflows of $6.1 billion, which was the best result in the last seven months.

And $5.4 billion of that amount went into the IBIT fund from BlackRock, the world’s largest investment firm.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

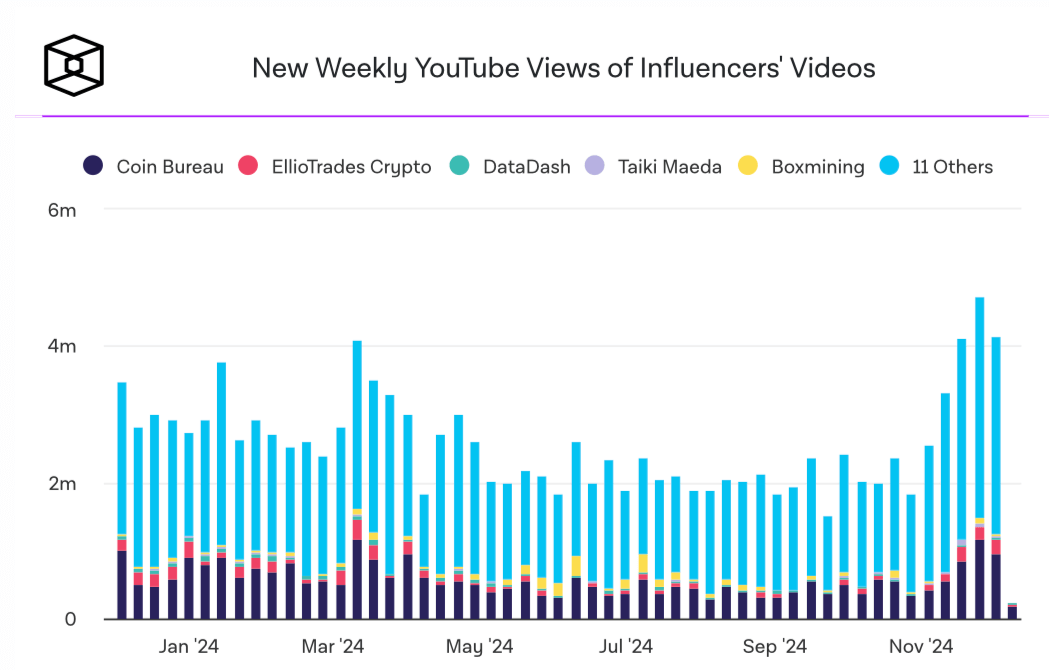

The euphoria in the crypto sphere significantly increases demand not only for the digital assets themselves, but also for related content. This is reflected in the statistics of views of relevant YouTube bloggers. The indicator reached a record level of 4.72 million views, which indicates a new wave of interest of ordinary users in digital assets.

In particular, the Coin Bureau and Crypto Banter channels became the leaders in terms of the indicator growth, as each of them gained more than 1 million weekly views.

However, so far, the number of weekly views of cryptocurrency channels remains below the historical maximum of 9.3 million. In other words, interest in digital assets among ordinary investors is nowhere near its peak, and there should be plenty of room for digital assets to grow.

YouTube channel views statistics on crypto for the week

The rise in consumption of content about cryptocurrencies coincides with other indicators of individual investor engagement. For example, Phantom Wallet and Coinbase were ranked in the top 100 app shops, which confirms their active downloads by regular users.

There are several factors to consider when interpreting these metrics. Firstly, YouTube views alone do not guarantee sustained investor participation in the market and do not predict the direction of BTC price movement. Second, experience from previous market cycles has shown that social metrics can be a lagging indicator of interest.

Many experts share the view that the $100,000 line for Bitcoin will only be the beginning of a global bullrun now. Still, this event will be covered by all major media outlets, which means the interest of ordinary investors in digital assets will increase again. So the best times in the current growth phase are still definitely ahead of us.

Look for more interesting information in our crypto chat room. In it we will discuss other important news related to the world of decentralised platforms and blockchain assets.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO KEEP UP TO DATE.