Bitfinex analysts expect Bitcoin at $200k by mid-2025. How do they explain it?

The bullrun in crypto continues: despite the current correction of the coin industry, Bitcoin continues to balance at the mark in the $100,000 zone. Representatives of the cryptocurrency exchange Bitfinex are confident that this trend will continue. According to their version, next year BTC will reach the mark of 200 thousand, as the demand of large institutional investors will make itself felt. In addition, industry drawdowns should be much shorter as the bullrun develops.

Demand for Bitcoin from large investors is being seen right now. For example, yesterday MARA Holdings, which is the largest public miner of the world’s first cryptocurrency, reported investing a large sum in BTC. That is, the giant mines bitcoins using ASICs, but also wants to increase the stock of its own coins through direct investment.

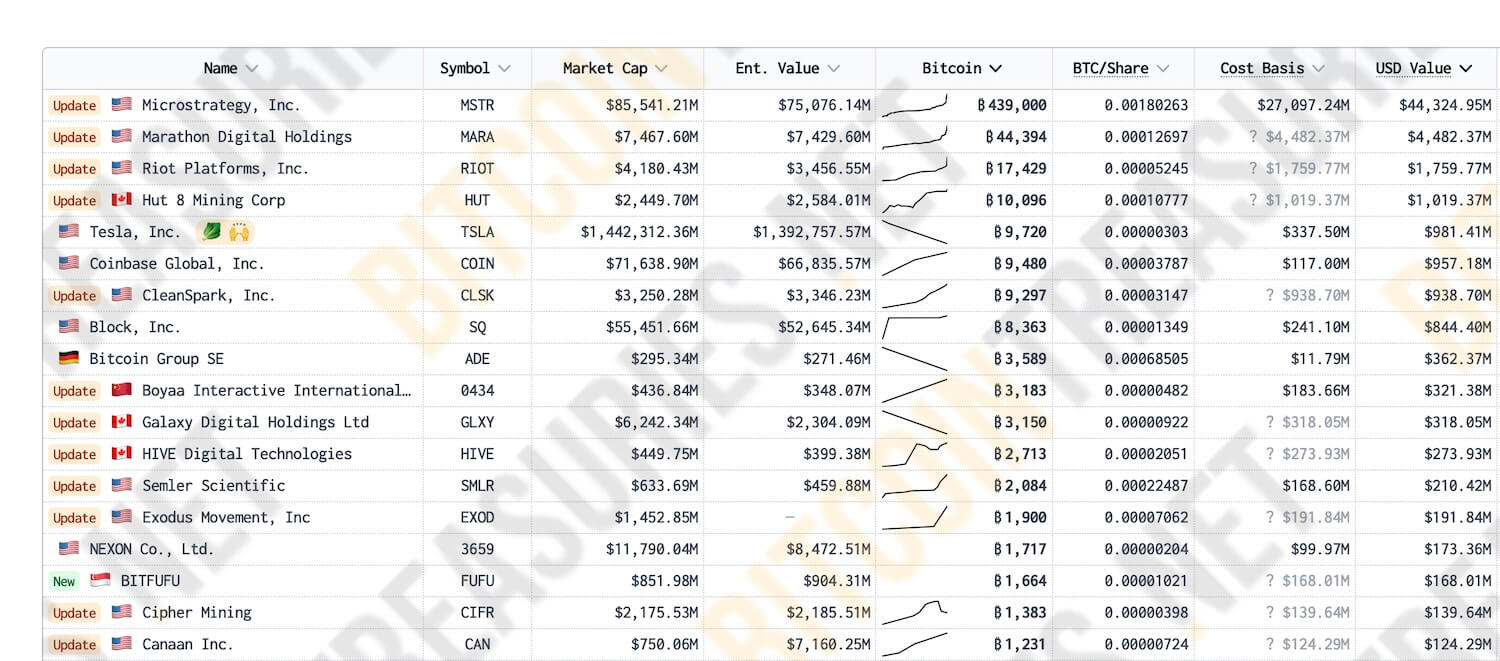

The company acquired 15,574 BTC worth $1.53 billion. Thus, MARA’s total accumulation reached 44,394 bitcoins – today they are valued at 4.48 billion.

Ranking of public companies with the largest bitcoin holdings

The previous time MARA reported another round of investments was last Tuesday, 10 December. At that time, the purchase amounted to 1.1 billion, with 11,774 BTC purchased.

What will be the rate of Bitcoin in 2025?

Bitfinex experts shared their opinion in a fresh market review. According to their version, the growth of Bitcoin next year will be caused by the increasing pressure of sellers on the background of popularisation of the crypto among large institutional-level investors.

Taking this into account, experts also bet on faster and insignificant collapses in value – still willing to buy crypto “at a discount” will be enough.

In general, analysts expect the minimum value of BTC in 145 thousand dollars by the middle of 2025. Potentially, the indicator can jump to the mark of 200 thousand “under suitable conditions”.

Here’s a rejoinder to the situation, as quoted by Cointelegraph.

Our view is that any correction in 2025 will be negligible given the inflows of institutional capital.

As analysts note, they expect volatility to increase in the first quarter of next year due to the political reshuffle in the US – after all, Donald Trump will be inaugurated on 20 January 2025. However, the overall trend suggests growth for Bitcoin and the coin industry as a whole.

Newly elected US President Donald Trump at a Pubkey bar

According to Bitfinex, expect this to happen because of the continued influx of funds through Bitcoin-ETFs in the US. They are spot, that is, the investment instrument is based on ordinary BTC on blockchain wallets. Therefore, market participants’ demand for exchange-traded funds lead to new coin purchases by the issuers of the latter, which is exactly what creates buying pressure.

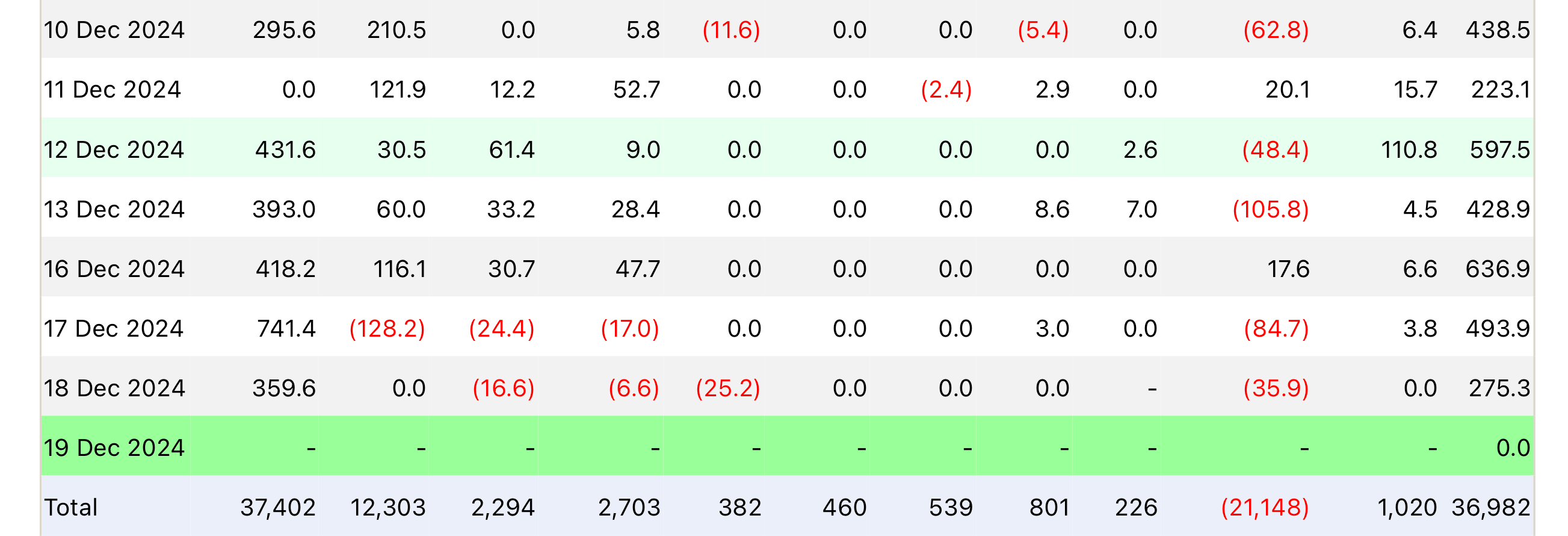

As of today, spot Bitcoin-ETFs have recorded a net capital inflow of $36.9 billion. The amount has been reached since January 2024, which is faster than in a whole year.

Total net capital inflows into spot Bitcoin-ETFs

Experts also noted the size of BTC-based exchange-traded funds. Here’s the cue.

Bitcoin-ETFs are one of the largest holders of coins, as they hold 1.13 million BTC.

Nick Carter of investment firm Castle Island Ventures is also betting on growth. During an airing on Bloomberg Television, he shared a bold prediction on the rate of the first cryptocurrency.

In the long term, I expect Bitcoin’s capitalisation to grow to the scale of gold. Thus the cryptocurrency should be valued at about $900,000.

Cryptocurrency investors

The peak of Bitcoin in the current stage of growth can be fixed near the $ 300 thousand line, according to analysts at Bitfinex. Here’s the line.

In a less likely scenario where the extended 2017 cycle repeats with similar diminishing returns, BTC would be able to peak at $290 thousand by early 2026.

As per tradition, we remind you that most price predictions predominantly come true. Therefore, it is worth treating such replicas only as a possible prospect.

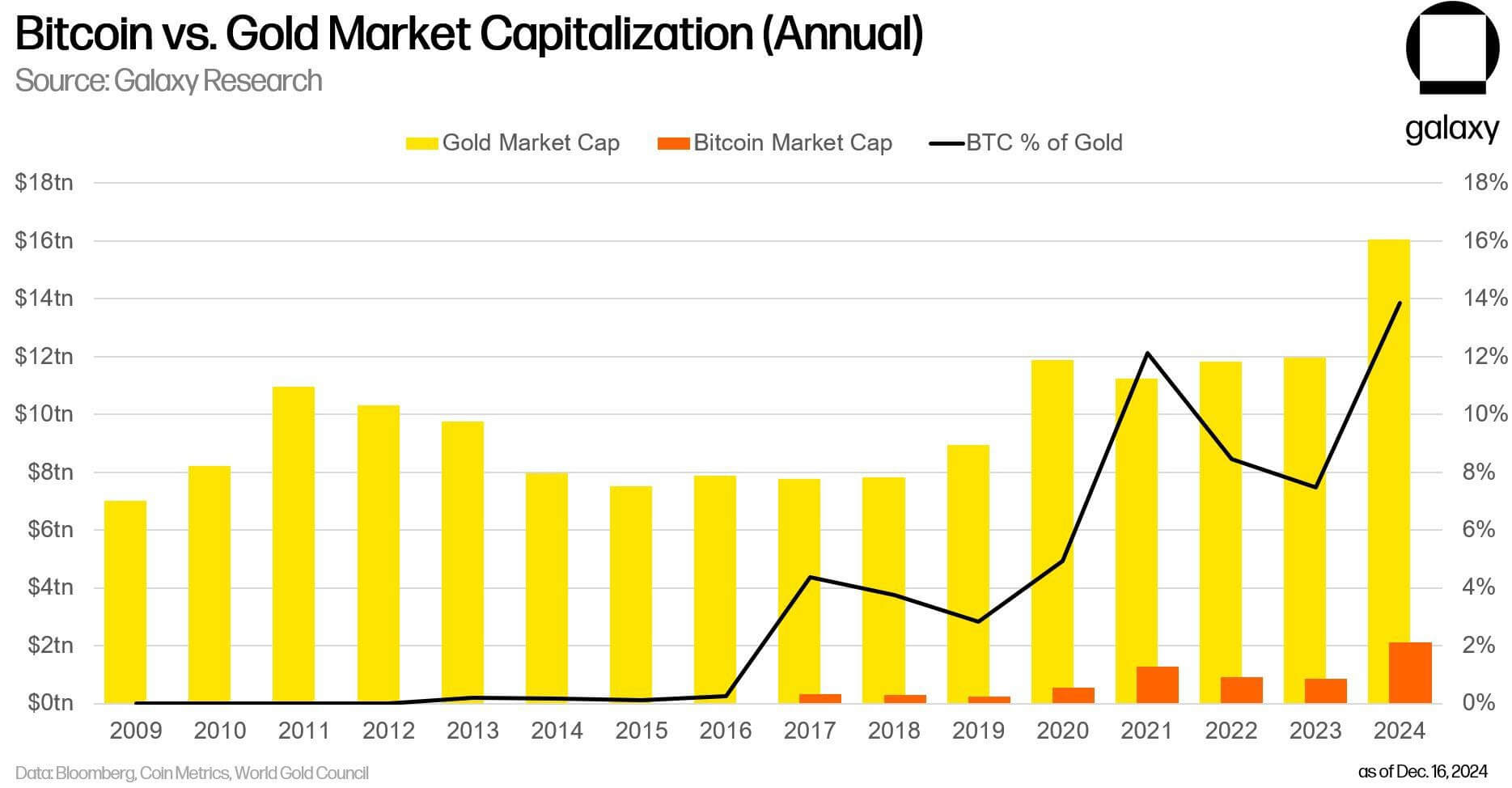

And while analysts are betting on the Bitcoin rate in the future, the cryptocurrency has already set a record against gold. Now the share of the coin’s market capitalisation in the corresponding indicator of the precious metal has reached a record 14 per cent. That is, now the value of all BTC is such a percentage in the total value of gold.

The ratio of Bitcoin’s capitalisation to the market capitalisation of gold

😈 MORE INTERESTING CAN BE FOUND IN OUR YANDEX.ZEN!

This happened against the backdrop of the fact that the amount of capital in the basis of spot Bitcoin-ETFs outperformed the corresponding figure of gold exchange-traded funds. Moreover, this happened in less than a year since the launch of new products, while ETFs for gold have existed for about twenty years.

The trend was noted by Bloomberg analyst Eric Balchunas. Here is his commentary, as quoted by The Block.

Bitcoin ETFs have changed the way institutional investors approach cryptocurrencies, reaching near-equilibrium with gold exchange-traded funds in less than a year after launching in January.

Approval of spot ETFs for cryptocurrencies in the US

The positivity in the digital asset market was also emphasised by BRN analyst Valentin Fournier. He noted the growing popularity of the Bitcoin investment strategy implemented by MicroStrategy with Michael Saylor.

Still, thanks to the company’s activities, more and more global giants are doing similar things. Here’s a quote.

Looking ahead, we foresee increased volatility as markets adjust to high expectations around Donald Trump’s possible return to the presidency. Despite the short-term fluctuations, the long-term outlook looks more than optimistic, with substantial investment in Bitcoin and Efirium remaining the most compelling strategy to get through this cycle with confidence.

We can conclude that 2025 will prove to be an extremely pleasant year for cryptocurrency investors. It seems that the coin sphere has finally reached the stage of large-scale popularisation. And from now on, it will only gain momentum if everything goes according to plan.

Visit our crypto chat. It is desirable to do it in the next second.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.