Efirium-ETFs and staking: what’s in store for the cryptocurrency market given the SEC’s upcoming reforms

Efirium-based spot ETFs may be able to generate additional income from coin staking for the foreseeable future. Initially prior to the approval of these instruments in July 2024, the staking clause was removed from issuer agreements following pressure from the Securities and Exchange Commission (SEC). According to analysts at brokerage firm Bernstein, the arrival of new President Donald Trump will lead to a radical reform of the SEC. This means that the regulator will definitely change its opinion on the norms of control of such exchange-traded funds.

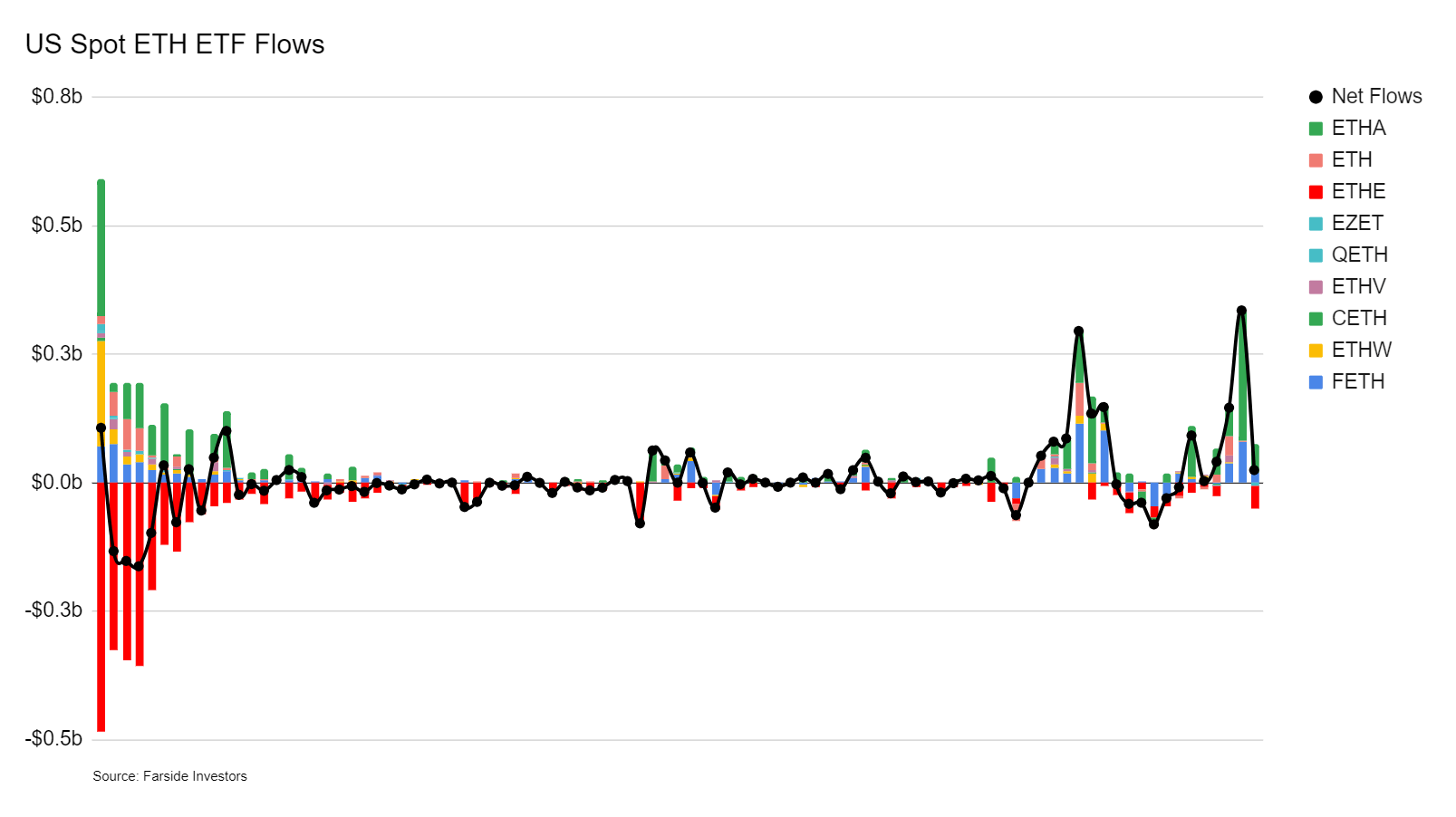

Over the past 24 hours, net inflows into spot Efirium-ETFs totalled $24.4 million. This is an insignificant figure compared to the influx of funds into BTC exchange-traded funds, but in recent weeks such instruments have been attracting more attention from investors.

Capital flows in spot Efirium-ETFs in the US

What will happen to cryptocurrency ETFs in 2025

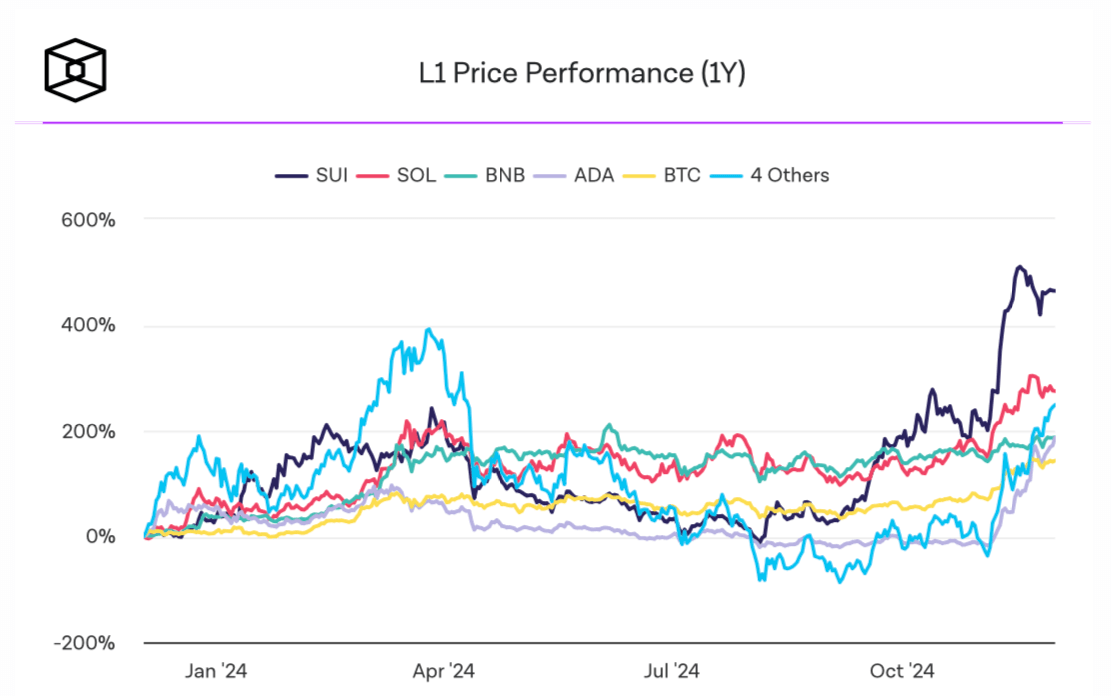

Cryptocurrency market capitalisation took the $3.5 trillion mark the day before, up about 45 percent since Donald Trump won the U.S. presidential election. Among the top coins in terms of returns was Ephirium ETH, which rather unexpectedly rose in value by 46 per cent.

Yields of the largest cryptocurrencies over the past year

However, the altcoin is still lagging behind in the growth rate since the beginning of 2024. Specifically, it has risen in price by around 57 per cent since the first of January, while Bitcoin has risen by 125 per cent and the price of Solana has increased by 122 per cent.

Analysts at the Bernstein platform believe that Efirium is having trouble positioning itself as a means of capital preservation compared to Bitcoin. Plus, it faces competition from faster Tier 1 blockchains like Solana, Sui and Aptos.

In addition, ETH’s reliance on second-tier solutions to scale creates a lot of inconvenience – especially for newcomers – forcing investors to switch to other blockchains. However, despite the low performance, the risk-to-potential return ratio after investing in ETH now looks the most attractive, experts say.

Efirium and other cryptocurrencies

One of the factors supporting this hypothesis is the potential inclusion of staking yields in the terms and conditions of spot ETFs. Here is a comment from analysts on the matter, as quoted by The Block.

We believe that under the new crypto market-friendly SEC, staking in the Efirium-ETF is likely to be approved.

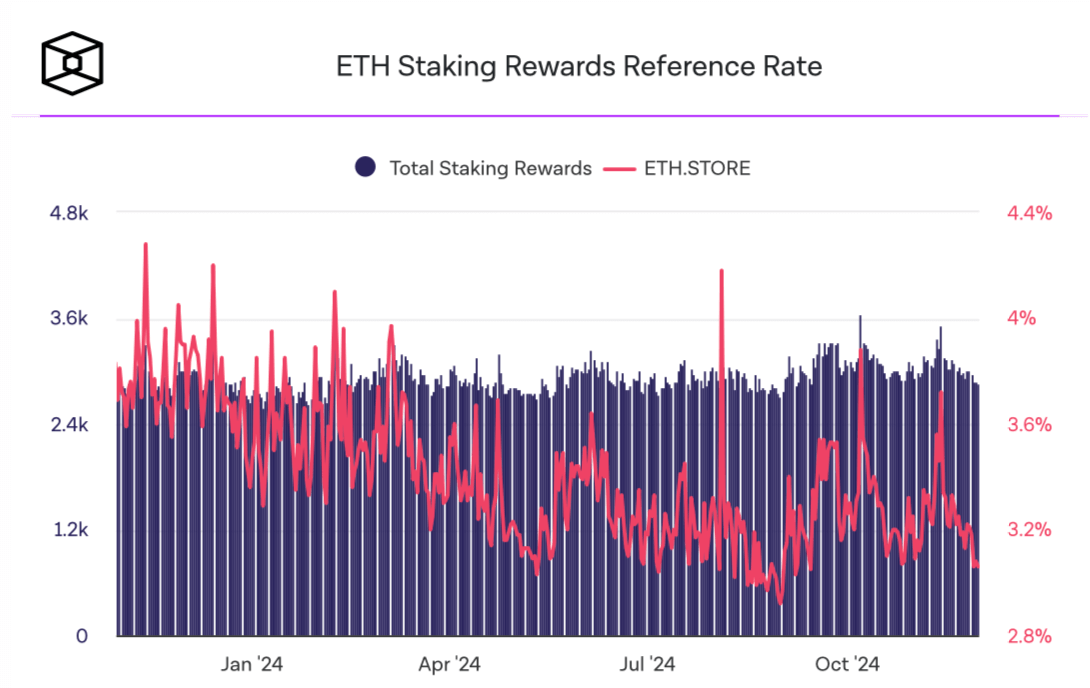

It's important to note that the current yield on ETH staking is 3.16 percent per annum, which is a small value. In addition, if approved, only a small portion of the ethers in the ETF's underlying will be sent to steaking, meaning the yield increase will be even less significant.

However, such a move would mean that the government is open to innovation and changing the perception of steaking. Still, the current SEC leadership sees such activity as a sign of an unregistered security.

The current 3 per cent yield on steaking could well rise to 4-5 per cent as blockchain activity increases. Therefore, this condition for large investors will be attractive one way or another.

Staking yields on the Efirium network

Another catalyst for growth is the recent increase in inflows into ETFs themselves. Despite a relatively weak launch, the funds have raised over $1.1 billion in funds since the US election.

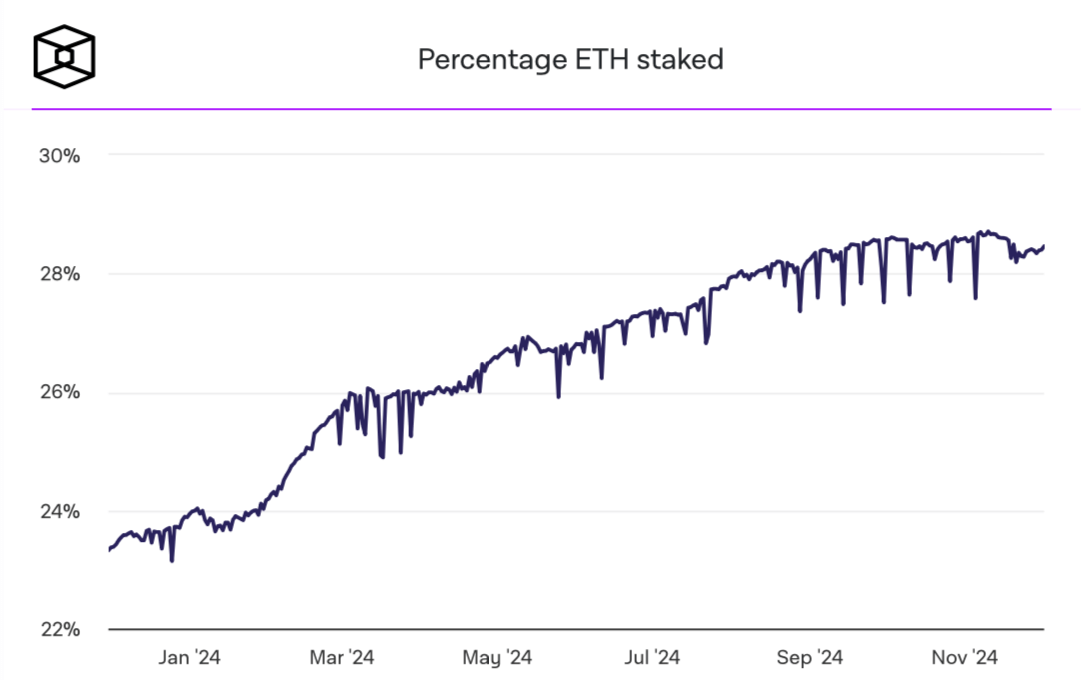

ETH’s share of the staking

Finally, Efirium’s transition to the Proof-of-Stake consensus algorithm in September 2022 and its coin-burning mechanism have stabilised the maximum currently available supply of the asset at around 120 million ETH.

Meanwhile, 28 per cent of Ether is locked in staking and another 10 per cent is in lending protocols or blockchain bridges. These factors point to a solid investor demand base and favourable dynamics for the asset as a whole.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

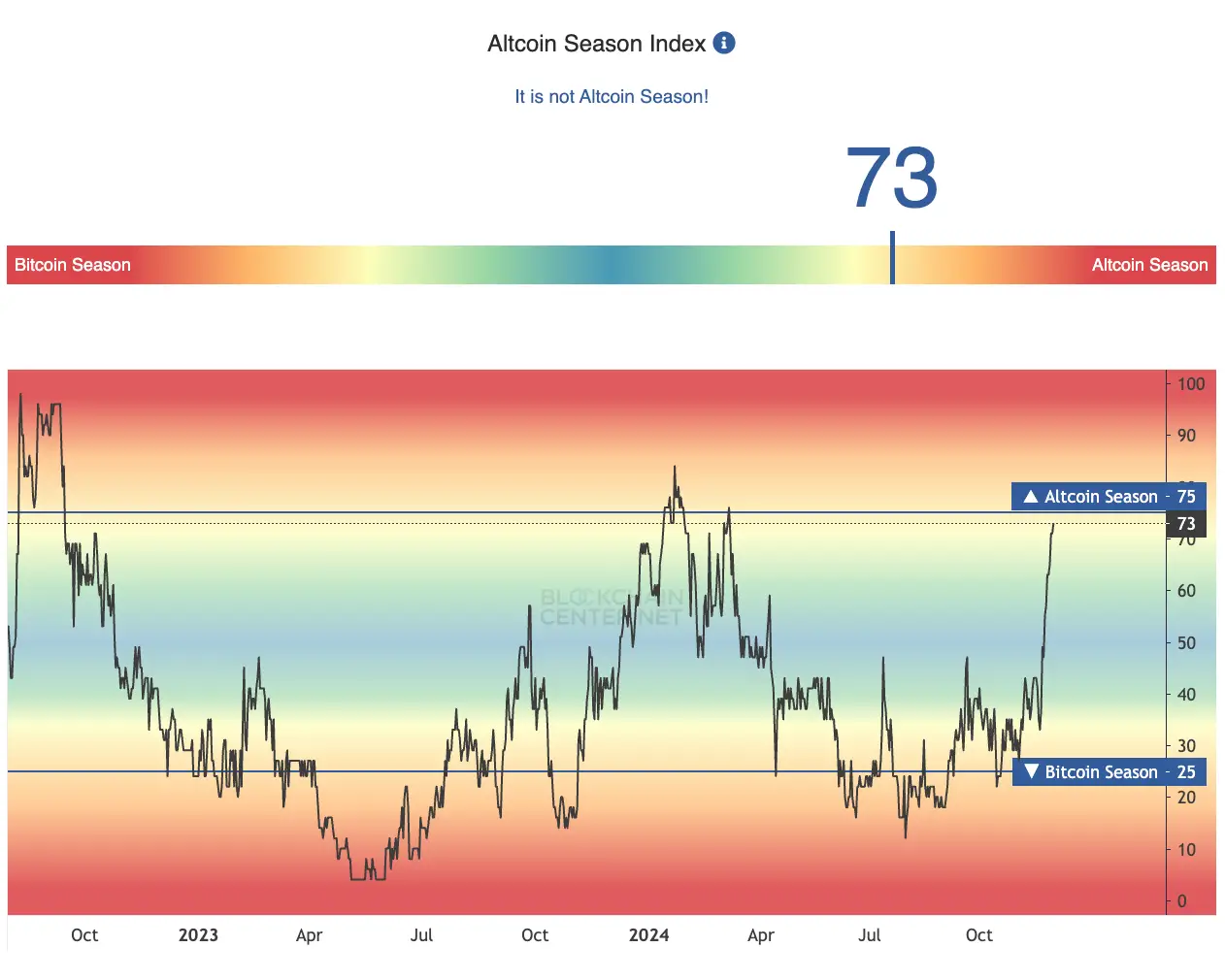

Efirium will be at the centre of a maelstrom of events if the “altcoin season” predicted by many experts becomes a reality in the coming months. Moreover, this period of active growth of coins with the exception of BTC has already experienced a transformation.

According to the head of CryptoQuant, Ki Ën Joo, the rapid growth of altcoins depends less and less on the dynamics within the Bitcoin ecosystem. Whereas in the past, altcoins gave out a lot of percent returns after a sharp jump in the BTC exchange rate and its subsequent stabilisation, the situation has now changed significantly.

Altcoin Season Index

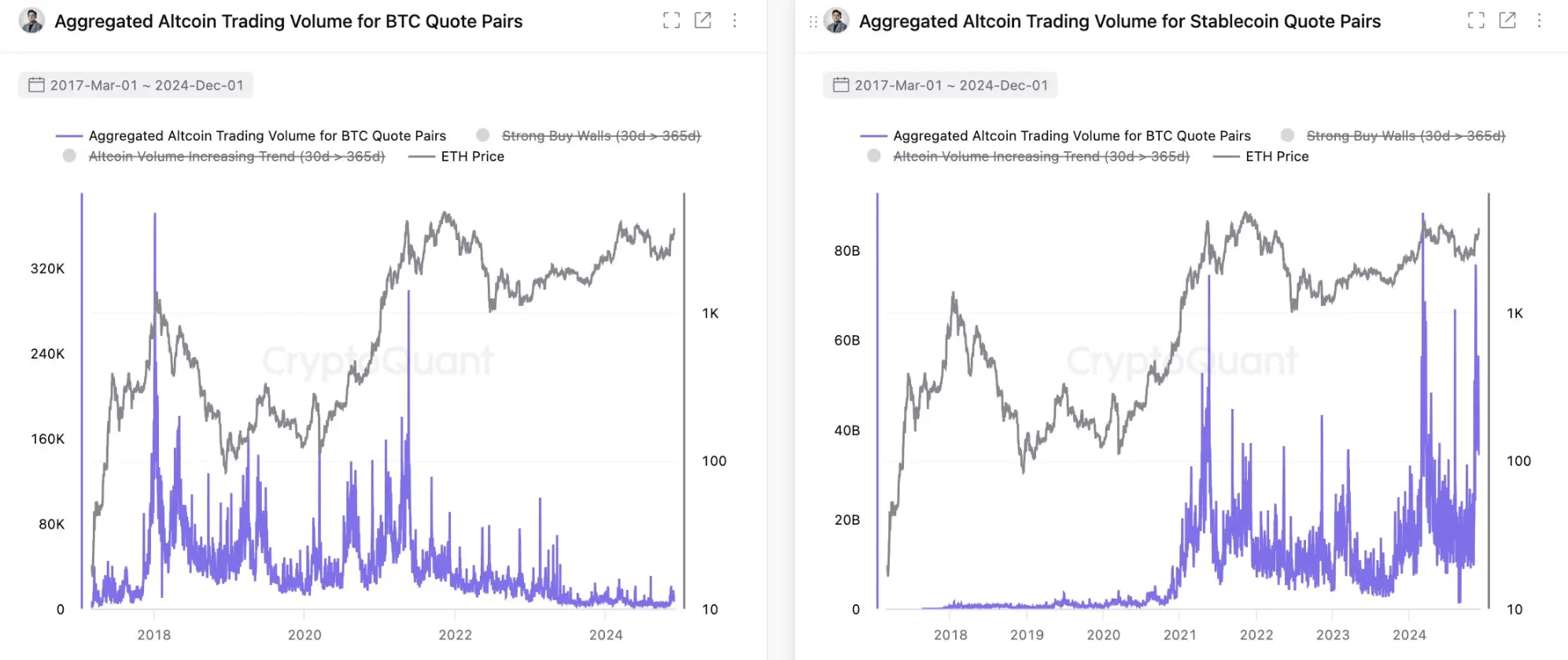

According to experts, the traditional signal of the beginning of the “altcoin season” when capital moves from Bitcoin to alts is supposedly outdated. Instead, the trading volume of the coins themselves has become more significant in terms of predicting the situation, Cointelegraph notes.

For example, the aggregate trading volume of altcoins paired with BTC has remained relatively low over the past few weeks, despite the rise in the price of ETH over the same period.

Moreover, some altcoins in the form of XRP and Solana are near their all-time highs, while the price of BTC is consolidating below the $100,000 mark.

The volume of transactions with altcoins in pairs with BTC and stablecoins

Meanwhile, the chart below right shows a spike in the aggregate trading volume of altcoins in pairs with stablecoins, which increased in tandem with the rise in the price of ETH.

According to Key, this reflects “real market growth, not asset rotation.” He also made it clear how to determine the fact of the beginning of the “altcoin season” – for this to happen, more than 75 per cent of the coins from the top 50 must show higher returns than Bitcoin. Meanwhile, such a thing is observed only in isolated cases, a fresh example of which is XRP.

The experts' point of view is that altcoins and their respective ecosystems are attracting more and more attention from investors. That is, they can produce growth regardless of what happens with Bitcoin. And judging by the charts of some coins, this trend is becoming more and more relevant.

Want to stay up to date with other interesting news? Join our Future Millionaires crypto chat where we actively discuss the progress of the current bullrun in the digital asset industry.

SUBSCRIBE TO OUR CHANNEL ON TELEGRAM TO KEEP UP TO DATE.