Gaming company Boyaa Interactive has leaked all the airwaves for the sake of investing millions in Bitcoin. Why?

Hong Kong-based game development firm Boyaa Interactive has reported exchanging its ETH for around $49.5 million in BTC. The firm thus received 515 bitcoins between 19 and 28 November, causing Boyaa Interactive to now have 3,183 BTC with a total value of over 310 million. Most likely, the decision to exchange coins was made against the backdrop of Bitcoin’s rapid rise to the $100,000 level and the growing popularity of the digital asset.

Boyaa Interactive is a company specialising in game development for online and mobile platforms. It is known for its card and board games like Texas poker and mahjong, which are available through websites, mobile apps and social media. The company is focused on creating high-quality gaming content with an emphasis on social user interaction.

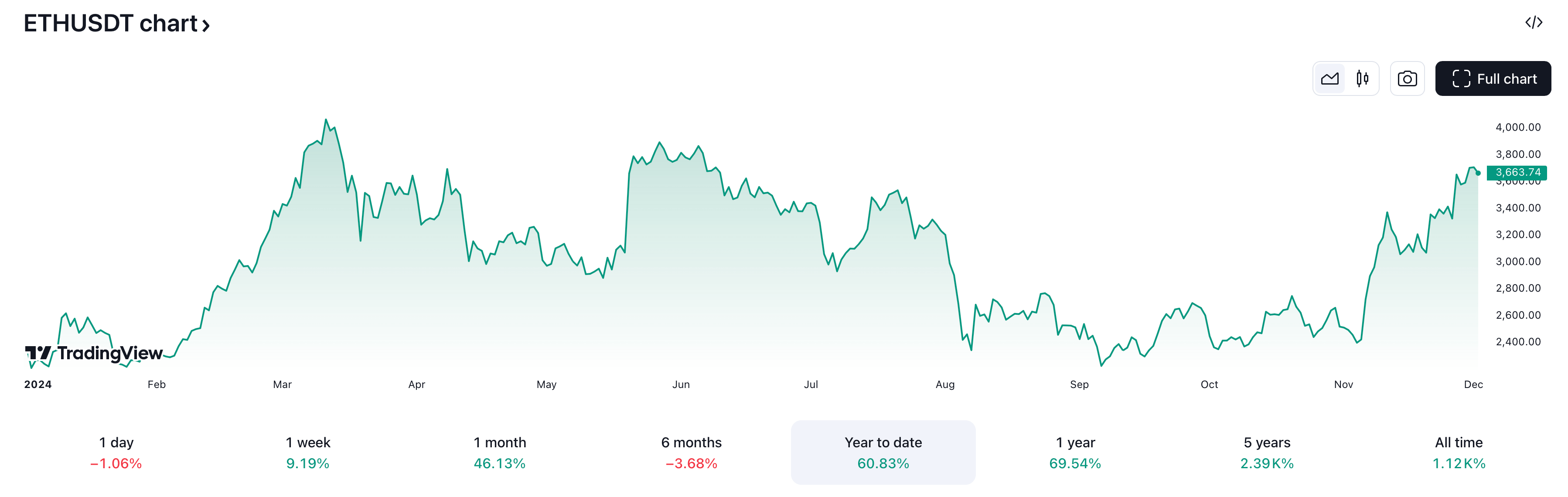

The reasons for moving funds from Etherium to Bitcoin are understandable. Still, ETH on this bullrun shows not the best results, and the cryptocurrency’s rate is not growing so actively.

The creator of Etherium Vitalik Buterin

In particular, since the beginning of 2024, ETH has risen in price by 58 per cent, while the result of Bitcoin is 125 per cent. What is important here is that the first cryptocurrency is considered a more conservative investment that is more reliable, but it does not bring enough profit.

Despite this, ether is noticeably lagging behind the market leader and has been criticised by investors due to this.

Which cryptocurrencies are being bought right now

According to Decrypt’s sources, Boyaa Interactive bought its ether early, spending $39.45 million on the deal.

ETH entered the firm’s wallets at an average value of $2,777, well today the cryptocurrency is trading in the 3.6k zone.

Change in the value of Etherium ETH in 2024

At the same time, the Bitcoin exchange rate has been above the 90 thousand mark for almost two weeks. Another explosive wave of growth in the cost of the main cryptocurrency was due to the victory of Republican Donald Trump in the US presidential election.

One of the key points of his election campaign was to develop loyal regulatory standards for regulating the industry, and he also promised to fire the current chairman of the Securities Commission, Gary Gensler.

This deal by the Hong Kong-based firm is part of a larger plan to invest in digital assets. Notably, last year Boyaa Interactive announced investments of up to $100 million in cryptocurrencies including Bitcoin, Etherium and stablecoins.

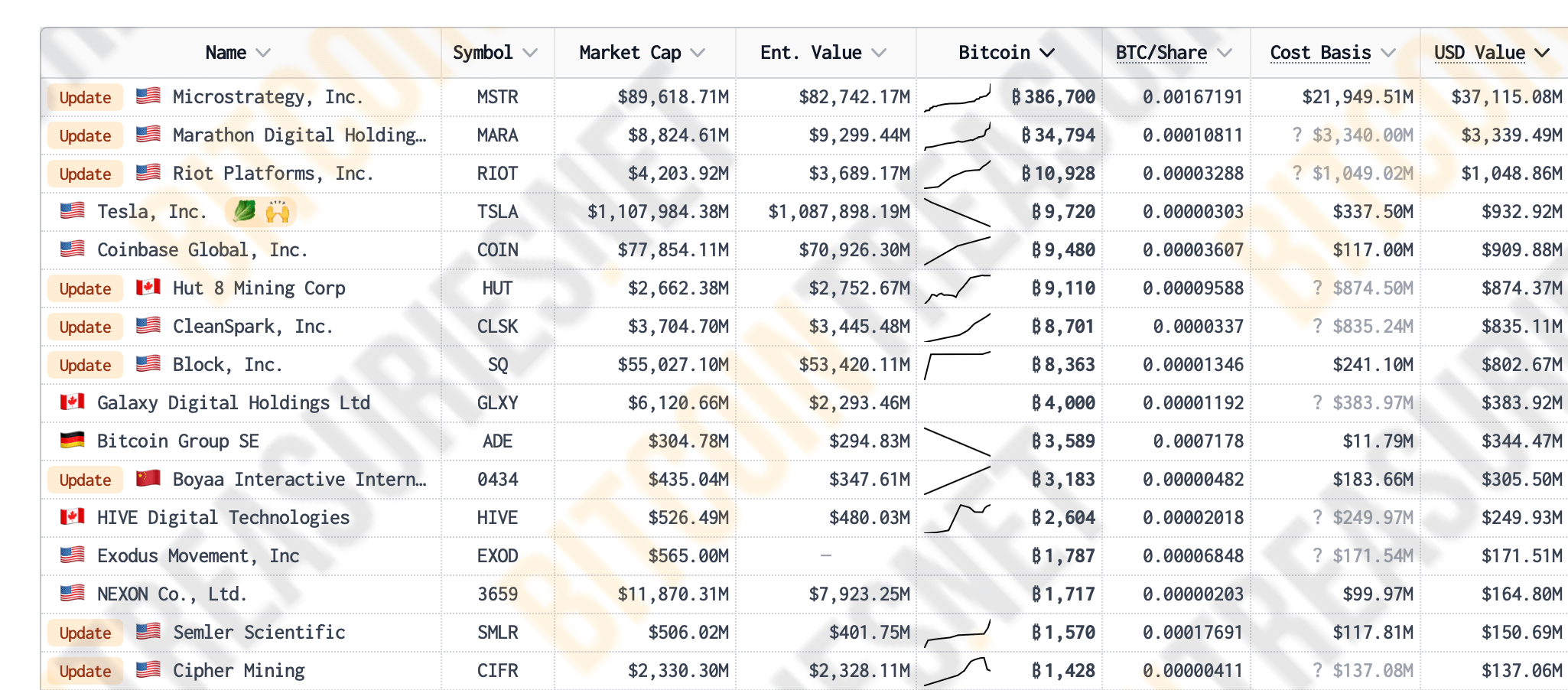

Buying cryptocurrencies by investors

And it’s not the only company adding digital assets to its balance sheet. Previously, Metaplanet, often referred to as Japan’s MicroStrategy, invested about $53 million in BTC. On Thursday, the company announced that it is looking to raise another 62 million for additional bitcoin investments, meaning the buying of the world’s premier cryptocurrency will continue.

Metaplanet has followed in the footsteps of US corporate giant MicroStrategy, which has been actively buying Bitcoin since as early as 2020. Last week on Monday, its representatives announced the purchase of another 55,500 BTC worth $5.4 billion.

That brings MicroStrategy’s balance sheet to 386,700 BTC worth a total of $37.1 billion at today’s exchange rate. The giant is still the largest holder of bitcoins and cryptocurrencies in general among publicly traded companies.

Ranking of public companies by number of bitcoins accumulated

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

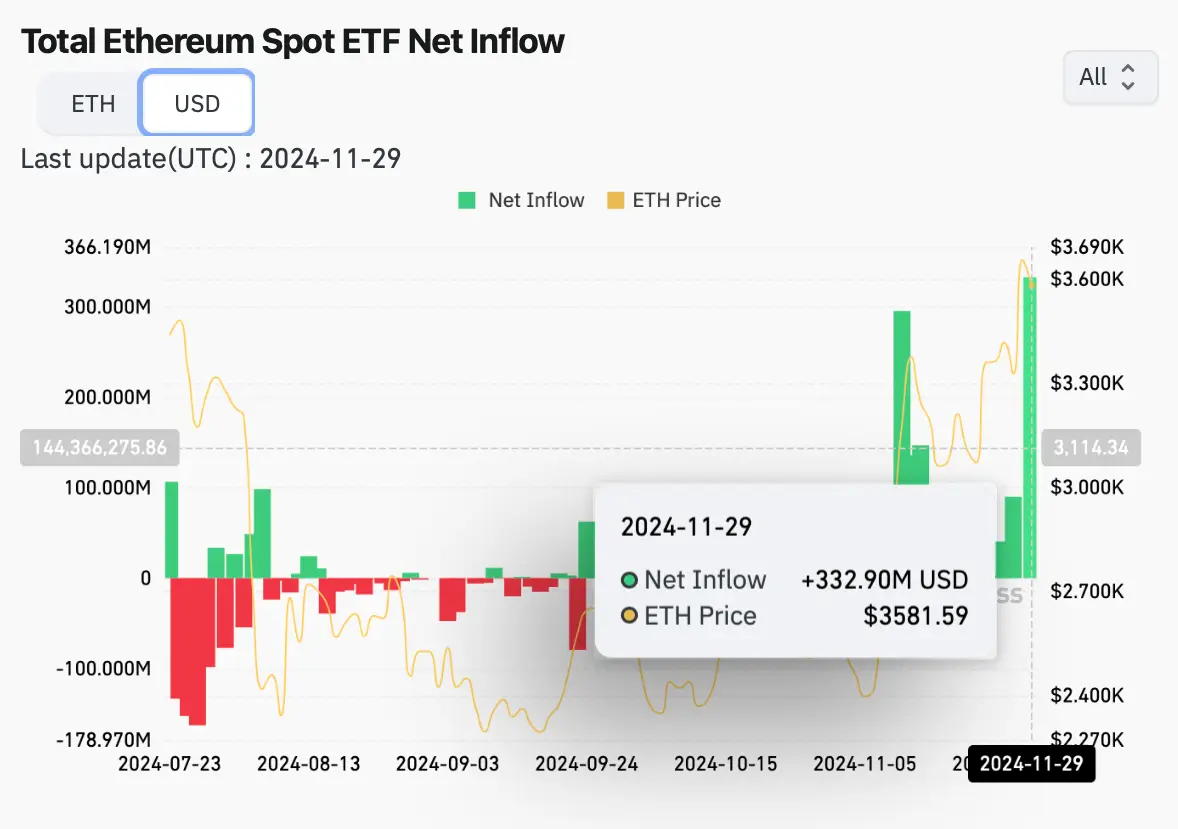

Good investment opportunities may also be lurking in altcoins – at least as indicated by the rotation of funds into spot Efirium-ETFs. They hit a new daily record for inflows of $332.9 million at the end of Friday.

An exchange-traded fund from the world’s largest asset manager BlackRock accounted for $250.4 million of the total inflows on 29 November. ETF Store president Nate Geraci said the iShares Ethereum Trust (ETHA) from BlackRock has seen more than $2 billion in inflows since the product launched on 23 July.

Inflows and outflows of funds from spot Efirium-ETFs in the US

A crypto trader under the nickname Pentoshi also commented on Twitter about the new trend. Here’s his quote on what’s happening, as quoted by Cointelegraph.

We now have the first signs that something interesting is happening in the Efirium ecosystem. Fund inflows are finally starting to pick up and the shares being sold are being absorbed by the bulls. It only takes time for the trend to develop.

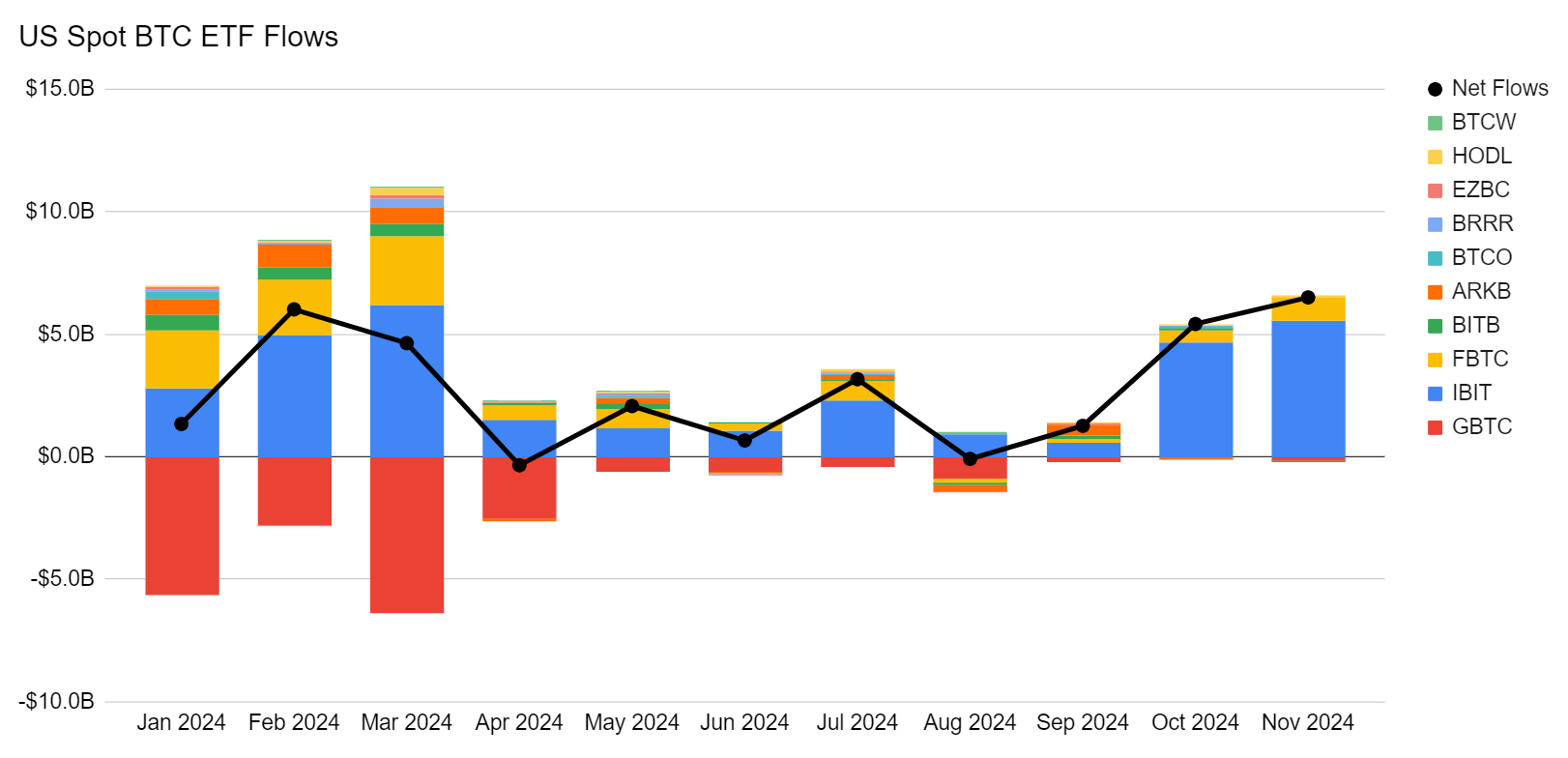

Another interesting detail is that the inflows into the Etherium-ETF on the aforementioned day were higher than the Bitcoin-based spot exchange traded funds. According to some experts, this trend may be the first signal to the beginning of the “altcoin season” – a period of rapid growth of most coins in the rating of cryptocurrencies. The most vivid such phenomenon was observed in January 2018, that is, a few weeks later before the first ever growth of BTC to 20 thousand dollars.

However, by the end of November, exchange-traded funds based on Bitcoin still recorded a net capital inflow of $6.5 billion. At the same time, the total net inflow of Efirium-ETFs since their launch in late July is 576.8 million – the equivalent of 8 per cent of the funds’ November BTC result.

US spot Bitcoin-ETF performance by month

Boyaa Interactive's management decision reflects current trends in the cryptocurrency market. At the current stage of growth, Bitcoin is gaining popularity among large companies and even governments of certain cities, which affects the coin's price performance. And the desire to get rid of ethers for the sake of "digital gold" can be easily understood.

Want to keep up with other interesting news? Join our crypto chat of future millionaires. There, let’s talk about the hot topics that are driving the industry’s bullrun.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.