How much have Bitcoin miners earned since the launch of the main cryptocurrency’s network: analysts’ answer

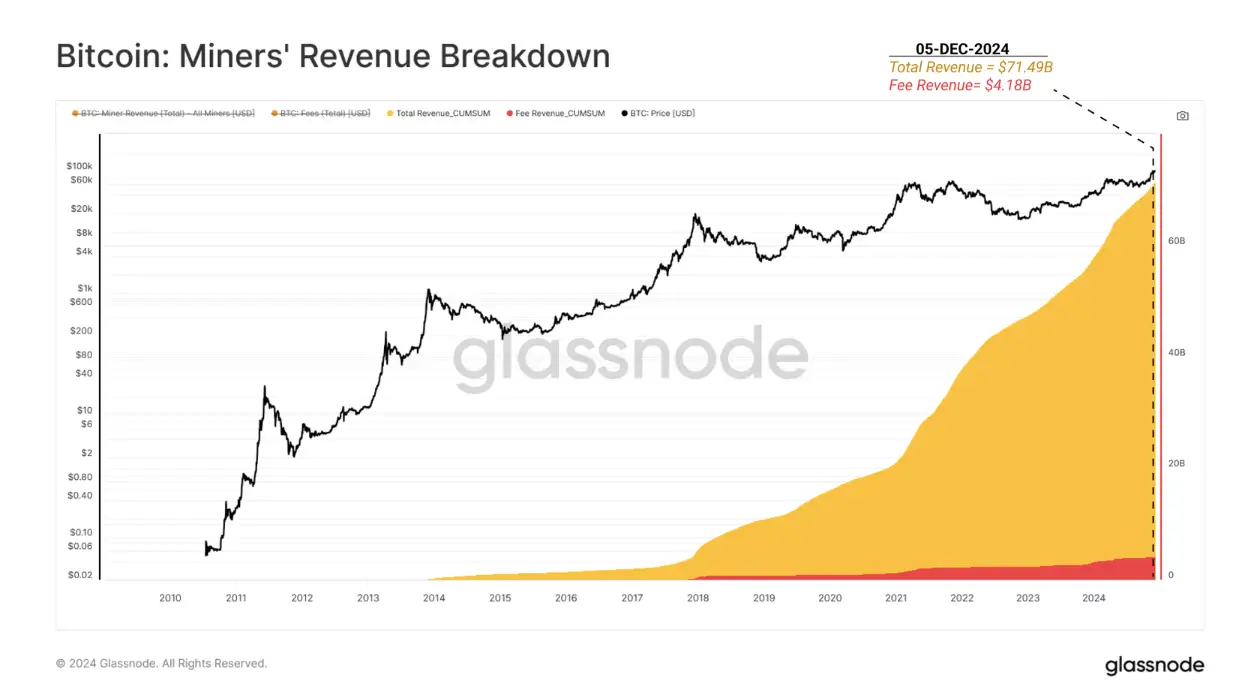

The real earnings of Bitcoin miners are not that huge on the scale of the whole crypto industry. Still, since the launch of the BTC network, they have earned a little more than $71.49 billion – this is the conclusion reached by Glassnode analysts in their latest study. And although tens of billions of dollars are earned by processing transactions, the income of miners is only a small part of the total capitalisation of the first cryptocurrency.

Note that it is also possible to earn BTC on a regular basis with the help of video cards. As we found out the day before, now an ordinary gaming GPU can be used to mine alts, which will be automatically converted into bitcoins thanks to the unique function of the 2Miners pool.

Altcoin mining with automatic conversion to BTC

And since the bullrun in the industry is sure to continue onwards, people will have the opportunity to make good money and set aside coins for better times for the market.

How much can you earn from Bitcoin mining?

According to Cointelegraph’s sources, experts have commented on the statistics of earning by mining as follows.

As of 5 December, miners collectively earned $71.49 billion – this is including the value of the reward per block at the time of mining. This income consists of $67.31 billion in block mining rewards and $4.18 billion in transaction fees.

Bitcoin miners’ revenue according to Glassnode analysts’ data

That said, Bitcoin’s capitalisation has reached such heights that these numbers are now not impressive at all. Still, as of this weekend, the BTC figure exceeds the $2 trillion mark.

Experts continue.

The total return is just 3.57 percent of Bitcoin’s peak capitalisation of $2 trillion. This reflects the huge return on investment in securing the network.

It is important to note that many miners sell their mined cryptocurrencies quite quickly, as this is how they pay for operational expenses like electricity bills and rent. That is, quite a few coins were sold in the early days of digital assets, when Bitcoin was valued at relatively modest amounts. This has also affected Glassnode's current calculations.

Accordingly, the cost of computing resources for miners is relatively small compared to the overall value of the ecosystem. Well, their work in securing the blockchain and confirming transactions brings significant benefits to the whole system, ensuring reliability and decentralisation.

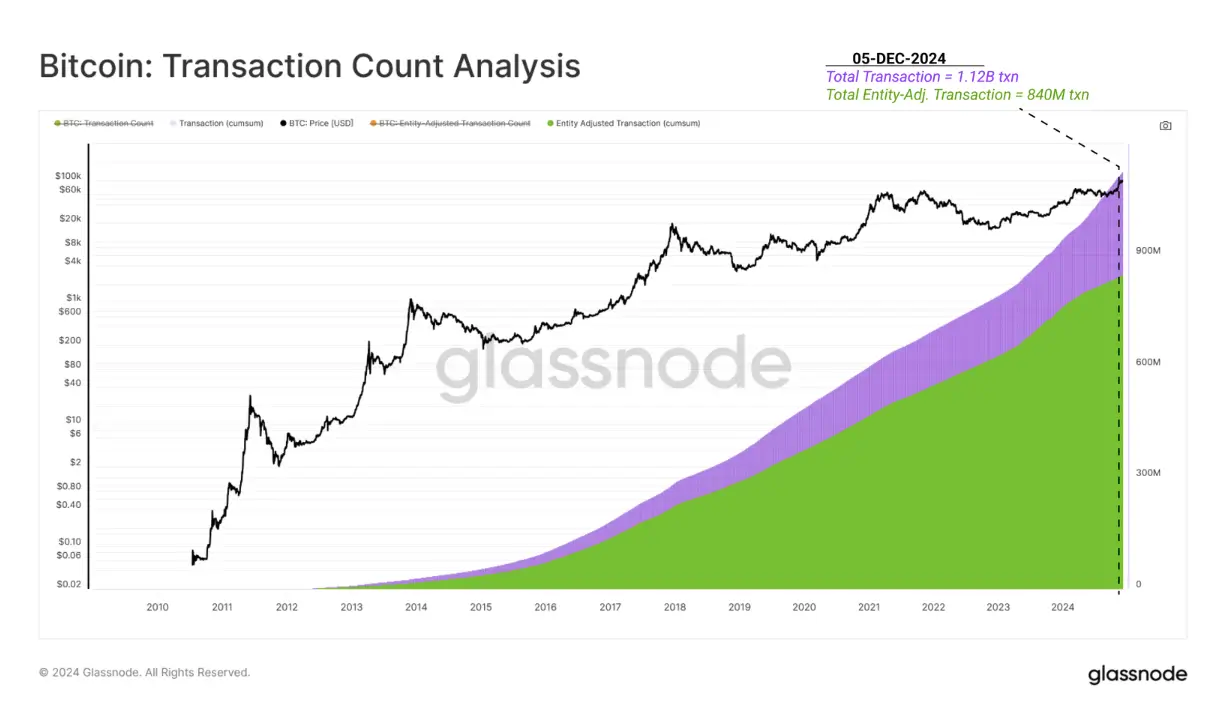

Today, the total number of transactions on the Bitcoin network – excluding internal transfers by exchanges or institutional instruments – is around 840 million units. Experts continue.

Including the dollar value of these transactions, the Bitcoin network has processed a volume of $131.25 trillion at the time of confirmation. After adjusting for entities, the filtered volume of transfers is $11.63 trillion, just 8.86 per cent of the total.

The number of transactions on the Bitcoin network

Bitcoin’s network hashrate currently exceeds the 800 exahashes per second mark, which is extremely high and at the same time confirms a serious level of mining activity. On Friday, it set an all-time record at 940 hash per second.

Bitcoin network hash rate graph

The main mining capacity is concentrated in the United States, where about 37 percent of the total network hashrate is created thanks to large data centres using mostly renewable energy. The rest of the miners are spread across countries like Kazakhstan, Canada and the Russian Federation, which also hold significant shares of the global digital asset mining infrastructure.

US companies continue to play a key role in the mining industry. In addition, players such as Marathon Digital and Riot Platforms are actively building capacity by investing in energy-efficient equipment and infrastructure. For example, Marathon Digital manages the largest BTC stockpile among publicly traded mining companies, while Bit Digital is focusing on using 99 per cent renewable energy.

Yesterday, Riot Platforms announced the purchase of an additional 5,117 bitcoins for $510 million. This brings the company's total to 16,728 BTC.

Records are being set in other ways, too: an early Bitcoin investor from Austin, Texas, has become the first person charged with a felony for failing to pay taxes on nearly $4 million in cryptocurrency proceeds. According to the US Department of Justice, one Frank Richard Algren III “misreported realised capital gains” from the sale of $3.7 million worth of bitcoins between 2017 and 2019.

Cryptocurrency investors during the bullrun

Here’s a rejoinder to this from reporters.

All taxpayers are required to report the proceeds from the sale of cryptocurrencies like Bitcoin, as well as gains or losses from such transactions, on their tax returns.

Algren has been investing in BTC since 2011 and purchased 1,366 BTC on cryptocurrency exchange Coinbase in 2015 when the coin was worth less than $500. In October 2017, he sold about 640 BTC at an average price of $5,807 and invested the proceeds of $3.7 million in real estate. Authorities eventually discovered discrepancies on his 2017 tax return.

In addition, Algren failed to report more than $650,000 from BTC sales in 2018 and 2019. He attempted to hide the movement of his funds through multiple transfers between wallets, the use of cryptomixers and cash transactions.

Acting Deputy Assistant Attorney General Stuart Goldberg of the Justice Department’s Tax Division noted that Algren’s decision to hide profits and movements of funds “secured him a two-year prison sentence.”

Experts believe that the crypto industry's bullrun could continue until at least mid-2025. Therefore, it makes sense to get in touch with coins now and start mining alts with their further conversion into BTC. You can find digital assets with support for this function here.

.

Want to be aware of other interesting news? Visit our crypto chat to not miss the most interesting things on the coin market.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO STAY INFORMED.