How much per cent of an investment portfolio should be allocated to Bitcoin investments: BlackRock analysts’ answer

BlackRock’s Spot Bitcoin ETF has become one of the most successful instruments in the history of the US stock market. In almost a year, the fund has managed to accumulate more than $53.8 billion of funds under management, and earlier the growth rate of the instrument turned out to be the leading among all ETFs in general. And although cryptocurrency has shown excellent results in 2024, BlackRock maintains a rather conservative view in terms of investing in coins.

The need to get in touch with Bitcoin is emphasised by other popular market players. For example, the day before the idea of investing in BTC and gold was supported by the founder of the hedge fund Bridgewater Ray Dalio.

He expects the debt crisis to develop in various countries in the coming years, against the background of which conventional money will be much cheaper. Therefore, in such conditions Bitcoin seems to be a good choice as a tool for capital protection – especially since it has already coped with this task in the past.

How much should you invest in Bitcoin?

BlackRock analysts believe that market players should allocate no more than 2 per cent of their portfolio to the acquisition of BTC. Such a small figure is due to the high risks of investing in crypto and at least the current uncertainty of regulation of the coin sphere in the United States. Although such a recommendation from the world’s largest investment fund is still worth a lot.

Head of BlackRock Larry Fink

BlackRock analysts shared their conclusions about risk management in digital assets in a published report. Here’s the quote Decrypt cites.

In its short history, Bitcoin has experienced both large spikes and severe collapses in value. This volatility, as well as the cryptocurrency’s unique characteristics, raises the question of what role it should play in investors’ portfolios.

The authors added that a “reasonable range for Bitcoin’s share” is 1-2 per cent of a portfolio’s total capitalisation. In addition, the asset is still risky, and in the absence of underlying cash flows, the only driver of its price is acceptance among large investors and regular users around the world.

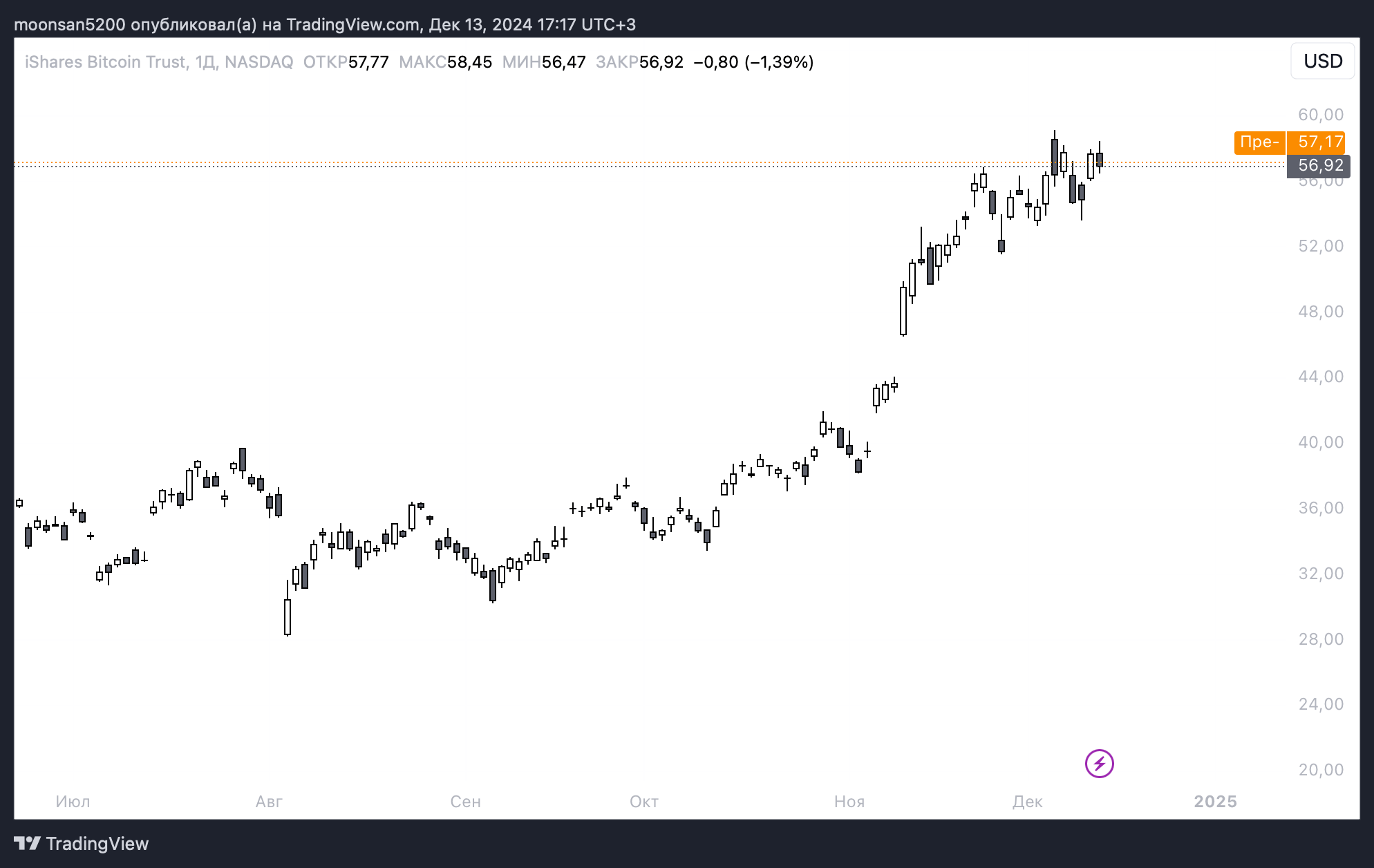

Changes in IBIT’s share price

Experts have also noted that in the future, Bitcoin’s greater proliferation could lead to a reduction in the risks associated with investing in it. However, in such a case, the growth rate of BTC may also slow down, which would be quite logical.

The BlackRock report is aimed at users who want to include Bitcoin in their multi-asset portfolios. The Wall Street giant, meanwhile, is not necessarily advising all investors to buy the cryptocurrency.

Last year, BlackRock was one of the driving forces behind the approval process for Bitcoin-based spot ETFs. Thanks to her efforts, the Securities and Exchange Commission (SEC) allowed the listing of cryptocurrency exchange traded funds.

In doing so, of all the cryptocurrency ETFs, BlackRock’s fund was the most successful, attracting the most investment and generating the most trading volume. BlackRock has previously stated that Bitcoin is an asset class in its own right, and investors buy it to hedge against potential debt crises.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

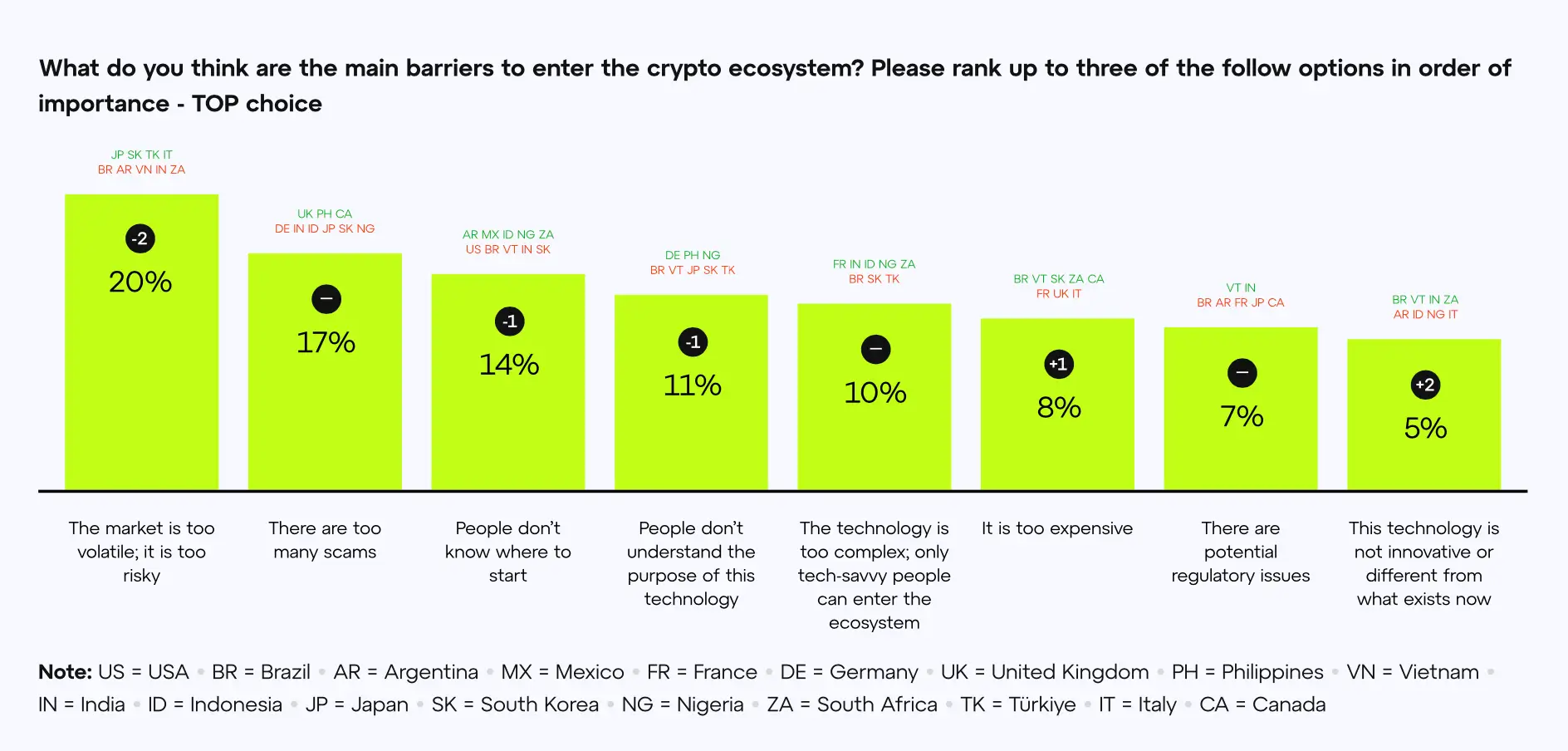

Meanwhile, the fundamental adoption of BTC is getting bigger. According to research from platform Consensys, the number of cryptocurrency holders in 2024 has increased in several countries: by 8 per cent in Mexico, 7 per cent in the Philippines and South Africa, as well as 5 per cent in Germany and 4 per cent in Japan.

Overall, emerging markets are leading the way in cryptocurrency adoption, Cointelegraph reported. For example, at least half of respondents in Nigeria (84 per cent), South Africa (66 per cent), Vietnam (60 per cent), the Philippines (54 per cent) and India (50 per cent) reported having a cryptocurrency wallet in 2024.

Turkey and the U.S. also ranked high, with 44 per cent and 43 per cent of respondents indicating they have a digital asset transaction tool on the blockchain.

Survey data on engagement with crypto

According to the survey, around 40 per cent of survey participants currently own or have previously purchased cryptocurrencies. However, coin ownership is noticeably lower in countries such as Japan, Argentina, Canada, France, Italy and the UK, where less than a third of respondents have ever purchased digital assets.

It's important to note that such surveys may not be fully representative. Either way, savvy coin holders prefer not to talk about their own connection to the coin world, as it could put them at risk.

Alas, there are regular situations in the world where miscreants rob or even kidnap cryptocurrency investors. In doing so, they may be tortured to force them to reveal their cryptocurrency wallet password or simply transfer coins to a specified address. Therefore, ideally, you should not disclose your participation in the blockchain industry - including through a survey form.

Buying cryptocurrency by investors

In terms of intentions to purchase cryptocurrency, the majority of respondents in Asia and Africa want to invest within the next 12 months. But the majority of respondents in Europe, Canada, South Korea and Japan indicate that they are unlikely to invest in Bitcoin.

Respondents in Turkey, the US and Latin America show moderate investment intentions, falling between these two extremes.

2 per cent of capital to buy Bitcoin is not a bad level. Still, cryptocurrencies are still a new phenomenon for Wall Street, as not even a year has passed since the introduction of spot ETFs on BTC. Well, as the sphere of coins becomes more popularised, such benchmarks are sure to grow.

More interesting stuff is in our crypto chat. Be sure to visit us to spend your time in a useful and interesting way.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.