MicroStrategy followers: Japanese company Metaplanet to buy 62 million worth of bitcoins

Japanese company Metaplanet has announced a plan for a round of Bitcoin purchases. It plans to raise 9.5 billion Japanese yen, or about $62 million, to increase BTC’s stake in its portfolio. Metaplanet’s management wants to raise the money by issuing shares – a total of 29,000 rights issues of 100 shares each. And the deal will take place through the investment firm EVO Fund, located in the Cayman Islands.

This week it became known about the desire of two entities to allocate money for the acquisition of bitcoins. The first was Rumble, which can be described as a small competitor to video platform YouTube.

It is ready to spend about 20 million dollars for the purchase of coins, and we are talking about the excess funds in the company’s accounts. As Rumble CEO Chris Pawlowski noted, given the change of power in the U.S. and the upcoming changes in the regulation of digital assets, more and more large institutional investors will buy crypto in the coming months.

Rumble video hosting homepage

The mayor of Vancouver also shared the idea of redirecting funds. According to him, a link to Bitcoin would provide better budget diversification and could also protect the money from inflation to a certain extent.

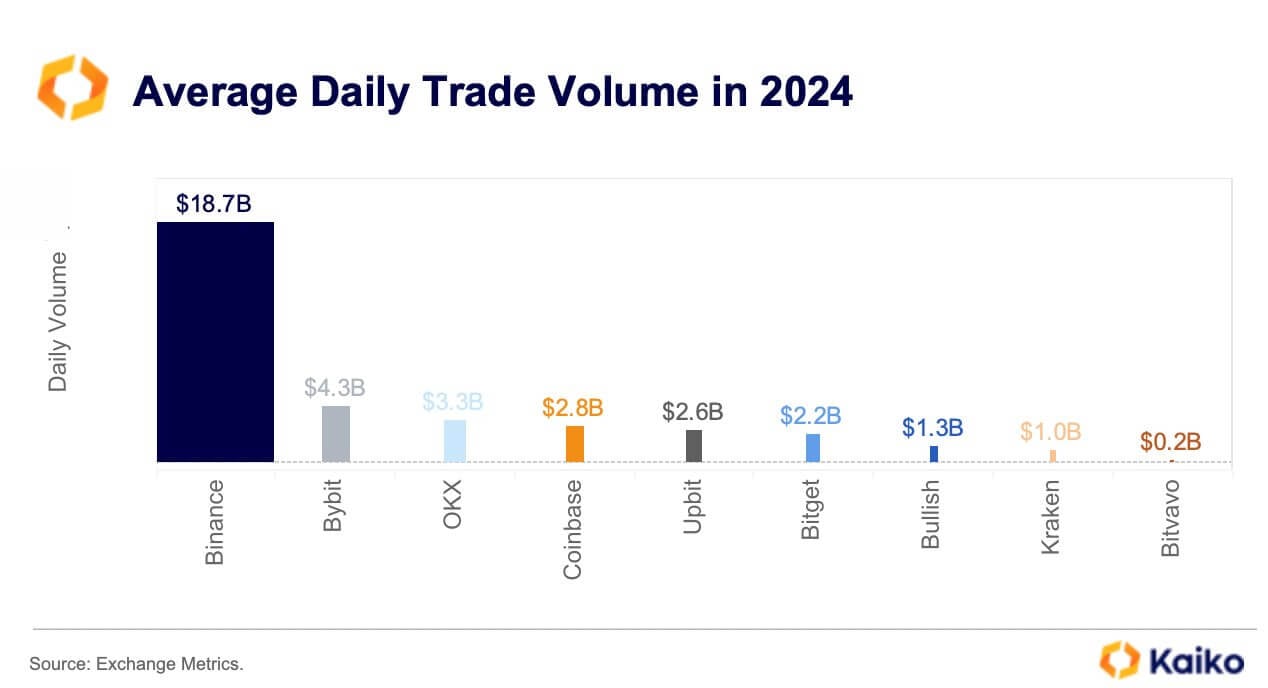

The scale of the coin industry, meanwhile, is getting bigger and bigger. For example, this is what the ranking of centralised cryptocurrency exchanges by average trading volume in 2024 looks like.

Ranking of crypto exchanges by average trading volume in 2024

As you can see, Binance’s figure is $18.7 billion, which is many times ahead of the result of its closest competitors.

Who is buying bitcoins today

According to Decrypt sources, the official announcement of the stock news has the following lines.

The majority of the funds raised this time around will be strategically used to buy additional bitcoin volume. We have made it clear that we intend to use debt and periodic equity issuance to systematically increase our cryptocurrency holdings while mitigating the risk of yen depreciation.

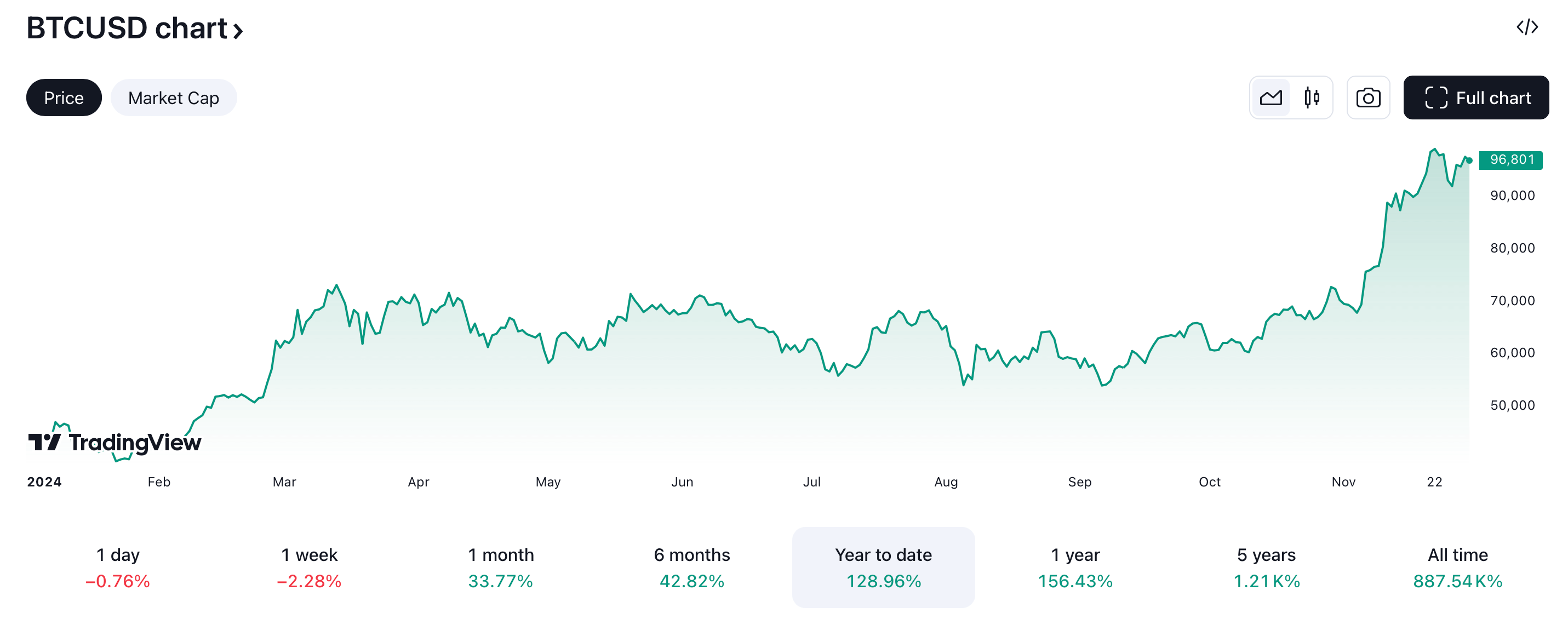

Changes in Bitcoin’s value in 2024

Metaplanet representatives also emphasised that Bitcoin’s “prominence continues to grow” as the main cryptocurrency moves towards the $100,000 mark.

Meanwhile, the Japanese yen “continues to depreciate” on a large scale, causing ongoing concern among local investors.

Given these circumstances, we recognise the urgent need to increase our BTC holdings and have therefore decided to embark on a fundraising initiative.

The stock acquisition is still subject to approval by local regulators in accordance with the Japanese Financial Instruments and Exchange Act. If approved, the transaction will take place from 16 December 2024 to 16 June 2025. At the cryptocurrency’s current price of about $98,000, the company will buy more than 638 BTC as a result of the transaction.

Metaplanet said that the company’s management decided to postpone its “plans to develop a meta-universe business.” This trend has long been on hiatus, while Bitcoin’s growth looks extremely promising amid the bullishness of the digital asset bullrun. Therefore, the idea of accumulating the main cryptocurrency seems much better in terms of finances and possible rewards.

MicroStrategy’s share price from the beginning of 2024

Metaplanet is following in the footsteps of US corporate giant MicroStrategy in its strategy. Up until around 2020, MicroStrategy was primarily in the business of selling software, but under the leadership of its current executive chairman Michael Saylor, the company began actively acquiring BTC for its balance sheet, making dozens of large investment rounds in the meantime.

😈 MORE INTERESTING STUFF CAN BE FOUND AT US AT YANDEX.ZEN!

MicroStrategy now owns 1.84 percent of the actual number of bitcoins in circulation. Sailor Strategy also actively used borrowed funds for investment, and such a strategy did bear fruit.

However, after renewed interest in the company earlier this bullrun, MicroStrategy’s stock still fell 16 per cent. This happened just as Bitcoin approached the $100,000 mark.

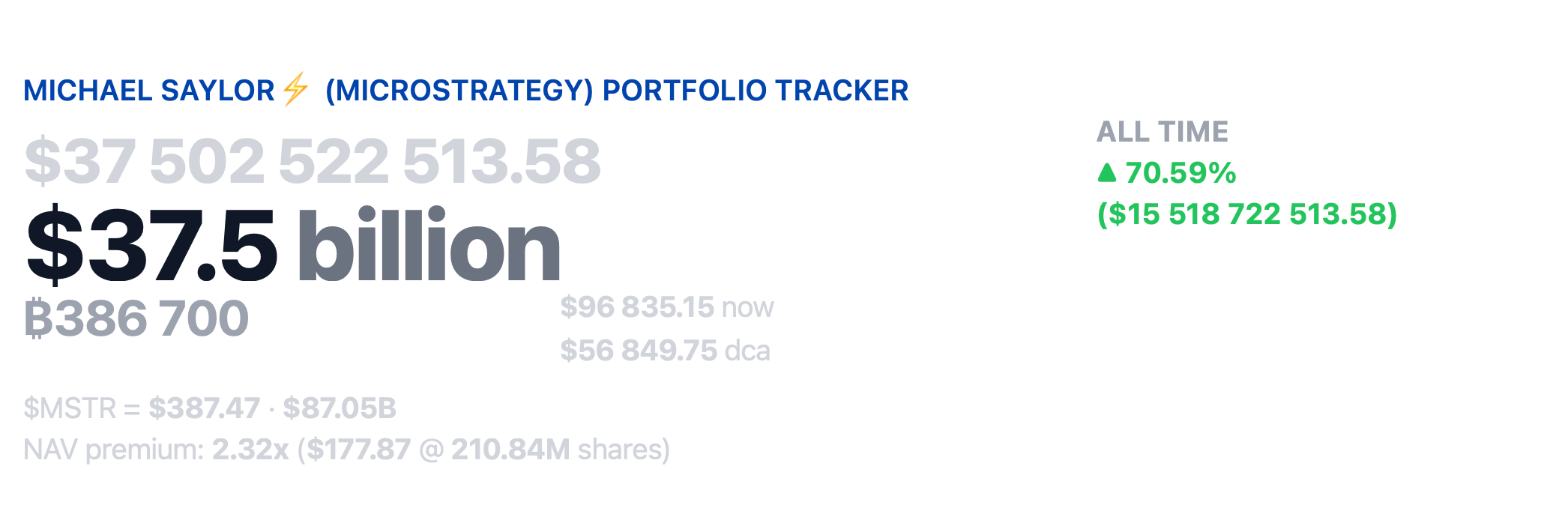

MicroStrategy’s cryptocurrency portfolio

As a reminder, Metaplanet is a Japanese company specialising in the development of solutions in the field of artificial intelligence and virtual and augmented reality (VR/AR).

Its mission is to innovate technologies to create a more integrated digital future.

Metaplanet’s stock price since the beginning of 2024

The company is actively creating meta universes by developing platforms and tools for virtual worlds. These technologies allow users to interact, work and have fun in a 3D space.

In addition, Metaplanet offers solutions for integrating augmented reality (AR) into everyday life, finding applications in popular fields like education and marketing.

In recent weeks, quite a few investors, companies and even city representatives have announced their desire to get in touch with crypto and allocate millions of dollars to buy bitcoins. Obviously, this comes amid expectations of better regulation of crypto in the US as the change of power in the country approaches. So the trend is sure to intensify further.

Want to stay up to date with other interesting news? Join our crypto chat of future millionaires. There we will talk about other important topics that contribute to the development of the coin market.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.