MicroStrategy shares will be included in the Nasdaq 100 stock index. What will this bring to the cryptocurrency market?

The annual reshuffle of the Nasdaq 100 stock index will take place very soon. This time it will include shares of MicroStrategy, the largest corporate holder of bitcoins among all market participants. Apparently, MSTR securities will occupy approximately the fortieth line of the index ranking, taking into account the current capitalisation of the giant. No less importantly, inclusion in the index will allow MicroStrategy to take a place in one of the world’s largest ETFs – Invesco QQQ Trust (QQQ) with assets of more than $300 billion. Well that’s sure to have an impact on the digital asset industry.

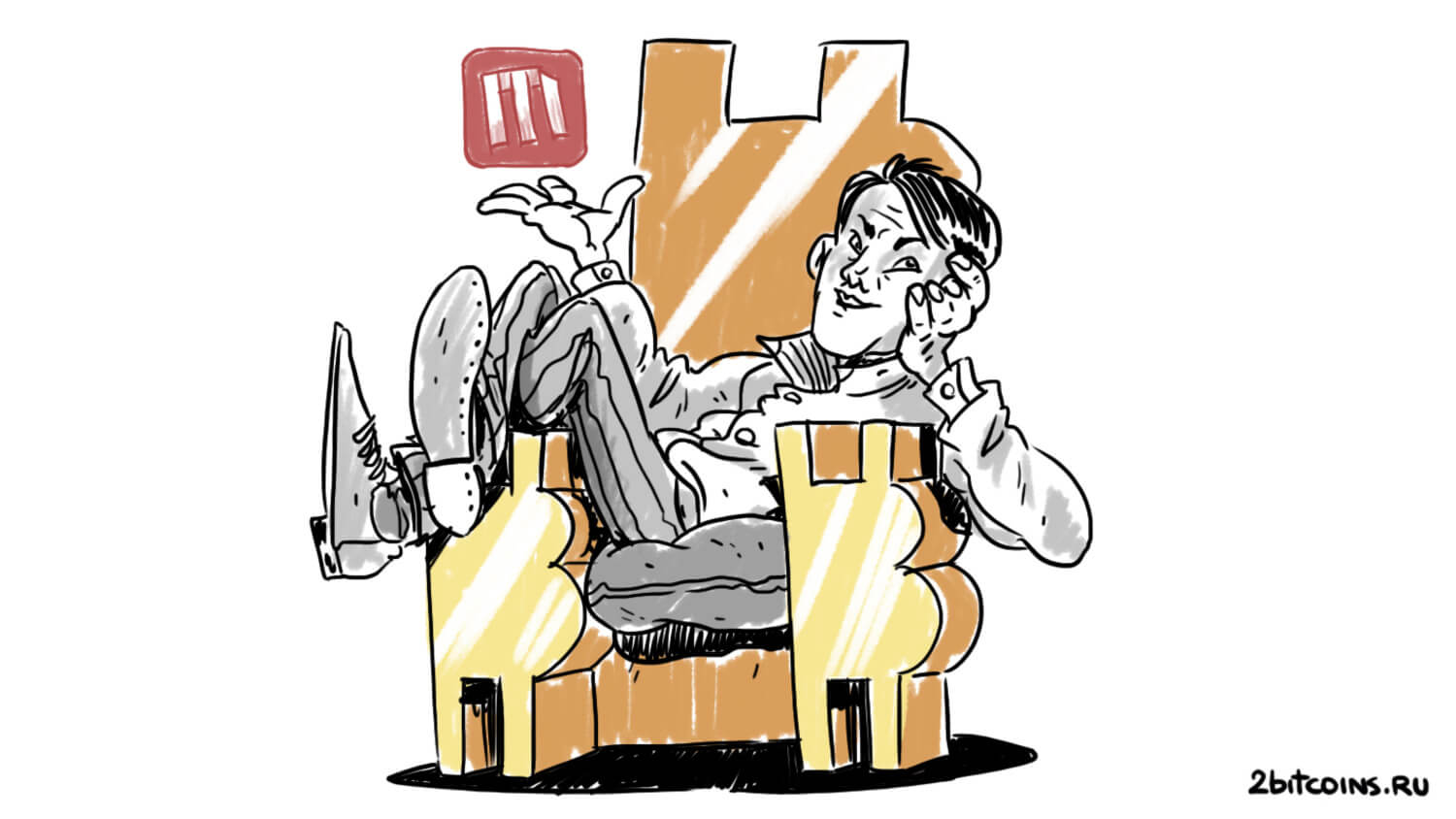

As of today, MicroStrategy owns 423,650 bitcoins with $25.5 billion invested in them. The coins are valued at 43.5 billion, meaning we’re talking about 70 per cent of the unrealised gains on this position.

Ranking of companies by the number of accumulated bitcoins

At the same time, the giant’s founder Michael Saylor on Sunday again hinted at the upcoming next BTC purchase deal. He published a chart that captures the company’s bitcoin purchases.

A graph of bitcoin purchases by MicroStrategy

Sailor asked if there are too few green dots on it, which mark coin purchases. As the events of the previous month show, the day after something like this, MicroStrategy reported another billion dollars invested in Bitcoin.

What will happen to MicroStrategy in 2025

The Nasdaq 100 Index tracks the hundred largest non-financial companies listed on the Nasdaq exchange. It includes well-known brands like Apple, Nvidia, Microsoft, Amazon, Meta, Tesla and Costco.

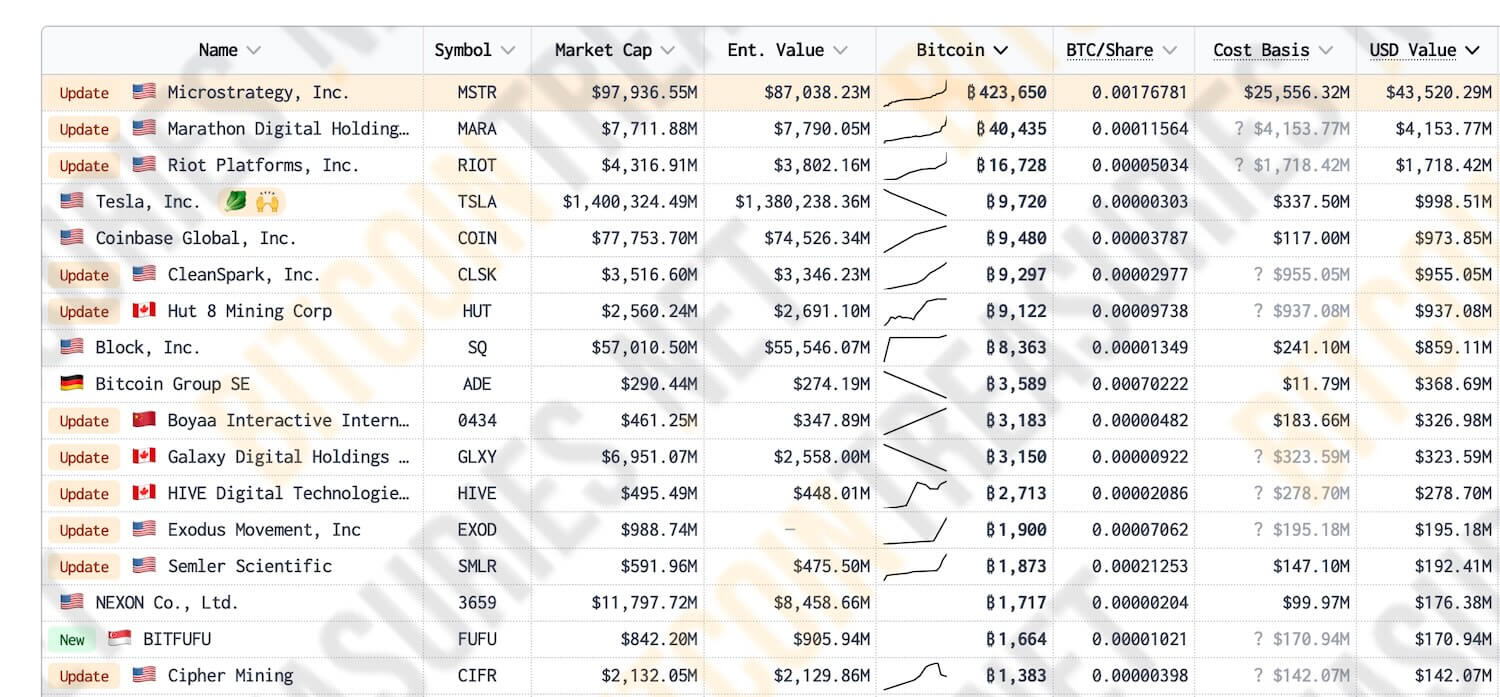

In preparation for the annual rebalancing of the index, the financial performance of the companies was recorded on November 29 – at that time the capitalisation of MicroStrategy was about $92 billion. According to Bloomberg Intelligence analyst Eric Balchunas, that figure would have placed the company under management in the fortieth position with an implied weight in the index of 0.47 percent.

The value of the Nasdaq 100 index

By comparison, Apple had the largest weighting in the index before the current rebalancing at just under 9 percent, while Qualcomm held the twentieth position with a weight of just over 1 percent.

The addition of MicroStrategy will significantly increase Bitcoin’s exposure to Wall Street, as MicroStrategy owns more than $43 billion worth of BTC. It will also give MSTR access to billions of dollars in passive investment capital. According to CoinDesk senior analyst James van Straten, this is an important step in the development of the industry as a whole. Here’s a rejoinder on the matter.

MicroStrategy’s inclusion in the Nasdaq 100 is perhaps the second most important event of 2024, after the launch of the US spot Bitcoin-ETF.

As a reminder, the launch of BTC-based spot exchange-traded funds in the US took place in the first half of January 2024. Since then, the corresponding product under the ticker IBIT from BlackRock has become the fastest growing ETF in the history of the market.

In addition, as of today, such instruments have recorded a total net capital inflow of $35.5 billion. This is despite a $21 billion outflow from the company's Grayscale product, which previously existed in the form of a trust.

According to experts, the event will definitely lead to the inclusion of MSTR in the world’s largest ETFs along the lines of QQQ. This means that MicroStrategy shares will be purchased much more, because they will be passively acquired in the format of exchange-traded funds and other popular investment instruments. So now we can count on the growth of securities value in the nearest future.

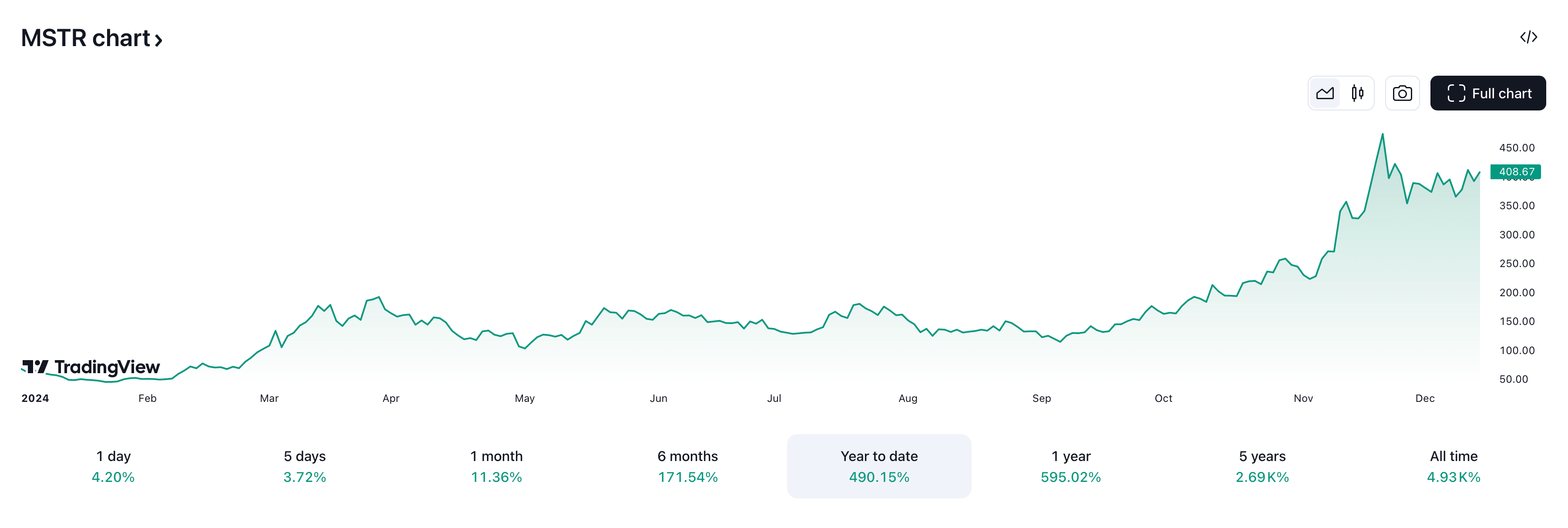

Since the beginning of the year, MicroStrategy shares have risen by 490 per cent

At the same time, analyst James Seyffarth warns that MicroStrategy shares in the index may not last long: in March 2025, the company may be reclassified as a financial firm, as its capitalisation is largely determined by the amount of BTC on its balance sheet.

Previously, MicroStrategy founder and executive chairman Michael Saylor even announced plans to turn the company into a “Bitcoin bank,” which would make it even less tech-savvy in this regard.

😈 MORE INTERESTING STUFF FROM US AT YANDEX.ZEN!

Meanwhile, Japan is considering using Bitcoin as a reserve asset on a national level. A member of the Japanese parliament is pushing the idea of creating a national reserve in bitcoins, as calls to hoard the cryptocurrency are gaining popularity around the world.

According to the Japanese parliament’s website, a formal request to discuss the possible creation of a reserve was submitted on 11 December 2024. As Decrypt’s sources note, the initiative was made by Satoshi Hamada, a member of the National Parliament. It is noteworthy that his name coincides with the first half of the pseudonym of the anonymous Bitcoin creator Satoshi Nakamoto, whose identity still remains unknown despite all the attempts of researchers.

Japanese Member of Parliament Satoshi Hamada

The proposal to start discussing the creation of a new national reserve in Japan follows similar initiatives from lawmakers in the Russian Federation, Brazil, Poland and the United States. The issue gained more supporters after the recent rise in the price of Bitcoin to a record high above the $104,000 level.

Meanwhile, newly elected US President Donald Trump confirmed the day before that he still expects to create a national Bitcoin reserve for America. He noted that his company will do something wonderful with cryptocurrencies.

Newly elected US President Donald Trump is buying burgers with bitcoins

Shortly after the related proposal, Japan’s National Parliament still hasn’t responded to the reserve proposal. A parliamentary spokesperson also did not respond to reporters’ request for comment. Although Satoshi Hamada is a member of a political party with only two seats in the upper house of the Japanese parliament, his initiative may well find support from a number of other lawmakers.

The inclusion of MicroStrategy shares in the Nasdaq 100 index will make these securities much more popular among investors, including through inclusion in various ETFs. Consequently, the giant will be able to more easily raise capital through convertible bonds, which is what it usually does. So the company will definitely be able to realise its so-called "21/21" plan to invest $42 billion in bitcoins.

.

Look for more interesting things in our crypto chat room. In it we discuss other important news related to the world of decentralised assets.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO STAY INFORMED.