Mining is making money again. How to earn bitcoins for the future with a regular video card in 2025?

Yesterday Bitcoin for the first time in history took the level of 100 thousand dollars. According to analysts, because of this, the crypto market is waiting for a new wave of growth, because articles about the record in the top world media attracted people’s attention to digital assets. Therefore, it makes sense to get in touch with them for the future. What do you need for this? An ordinary video card will suffice, because mining is profitable again.

Content

- 1 How to get bitcoins for mining – short instructions

- 2 What has changed in mining in recent years

- 3 Which coins can be mined in 2025

- 4 Why mining makes sense

- 5 Is it worth converting your mining reward into Bitcoin?

- 6 Conclusions. Why should you try crypto mining?

How to get bitcoins for mining – short instructions

Below the text – a story about the changes in cryptocurrency mining in recent years, the prospects for Bitcoin and the prerequisites for this bullrun. If you want to familiarise yourself with this later and jump straight into mining, we share the guide with you right away.

Here’s what you need to do to direct your graphics card to mine cryptocurrencies and convert the resulting coins into bitcoins if necessary.

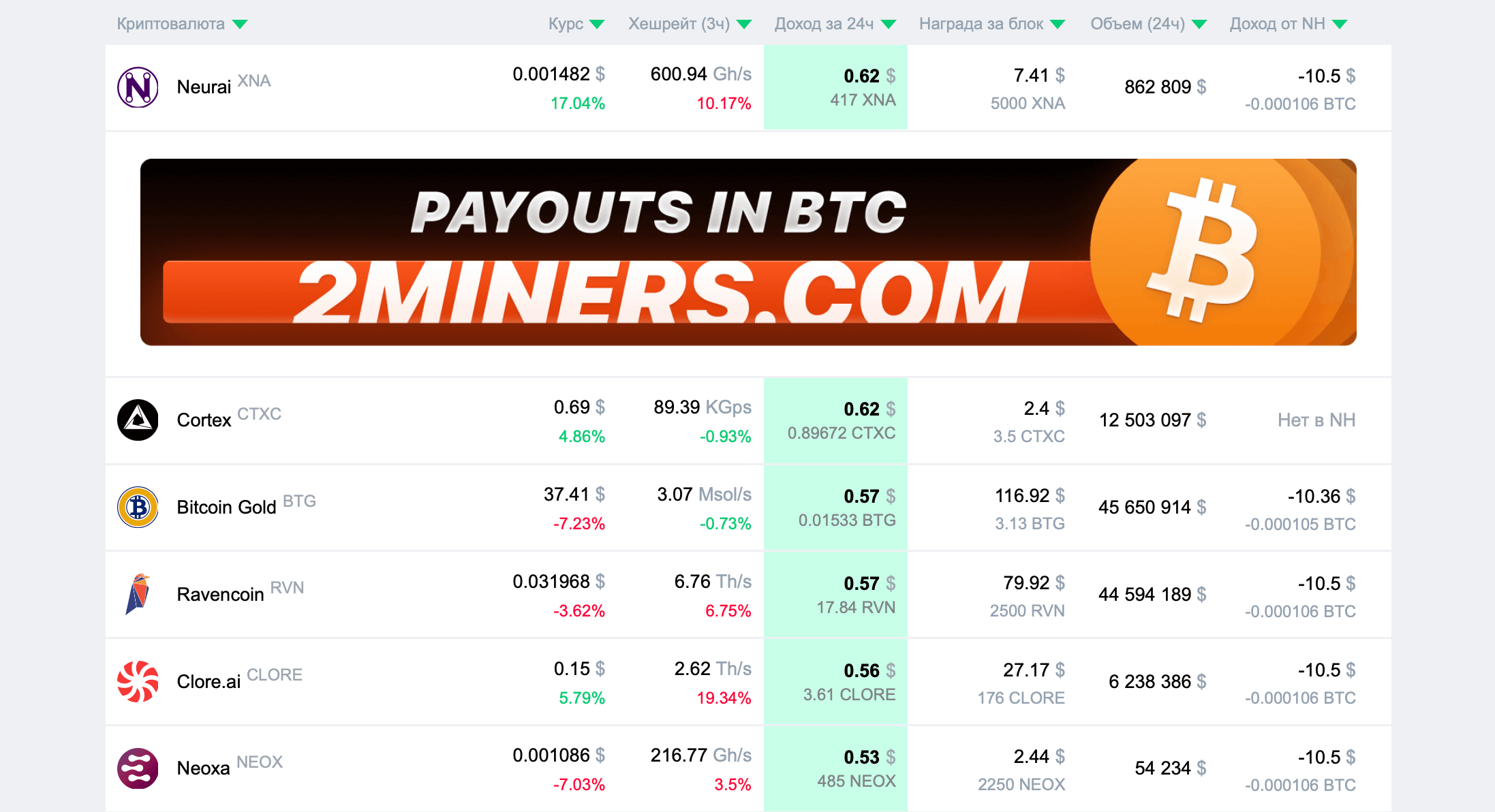

Go to the website of the mining yield calculator and specify your graphics card – for example, Nvidia GeForce RTX 3070. Select it and see the list of the most profitable cryptocurrencies for mining.

The most profitable cryptocurrencies for mining on Nvidia

This is Naurai XNA, mining which brings about 62 cents per day without taking into account electricity costs. What’s next:

- Open the XNA mining help page.

- Create a wallet by following the links provided. If you’re lazy, use the address provided by the crypto exchange.

- Download the miner from the ready-made archive with the password 2miners. Choose T-Rex or GMiner for Nvidia video cards and NBMiner or TeamRedMiner for AMD cards.

- Edit the bat-file, specifying your address. If you want the mining pool to immediately convert the received rewards into BTC and send them to you, specify the address in the Bitcoin network.

- We start the miner, leave the computer in operation and over time we are happy to receive coins to the address. Again, if you specify a Bitcoin address, then BTC will come to the wallet.

If anything, we have detailed the procedure for getting bitcoins from mining in a separate article. Be sure to familiarise yourself with it if you have never mined coins before.

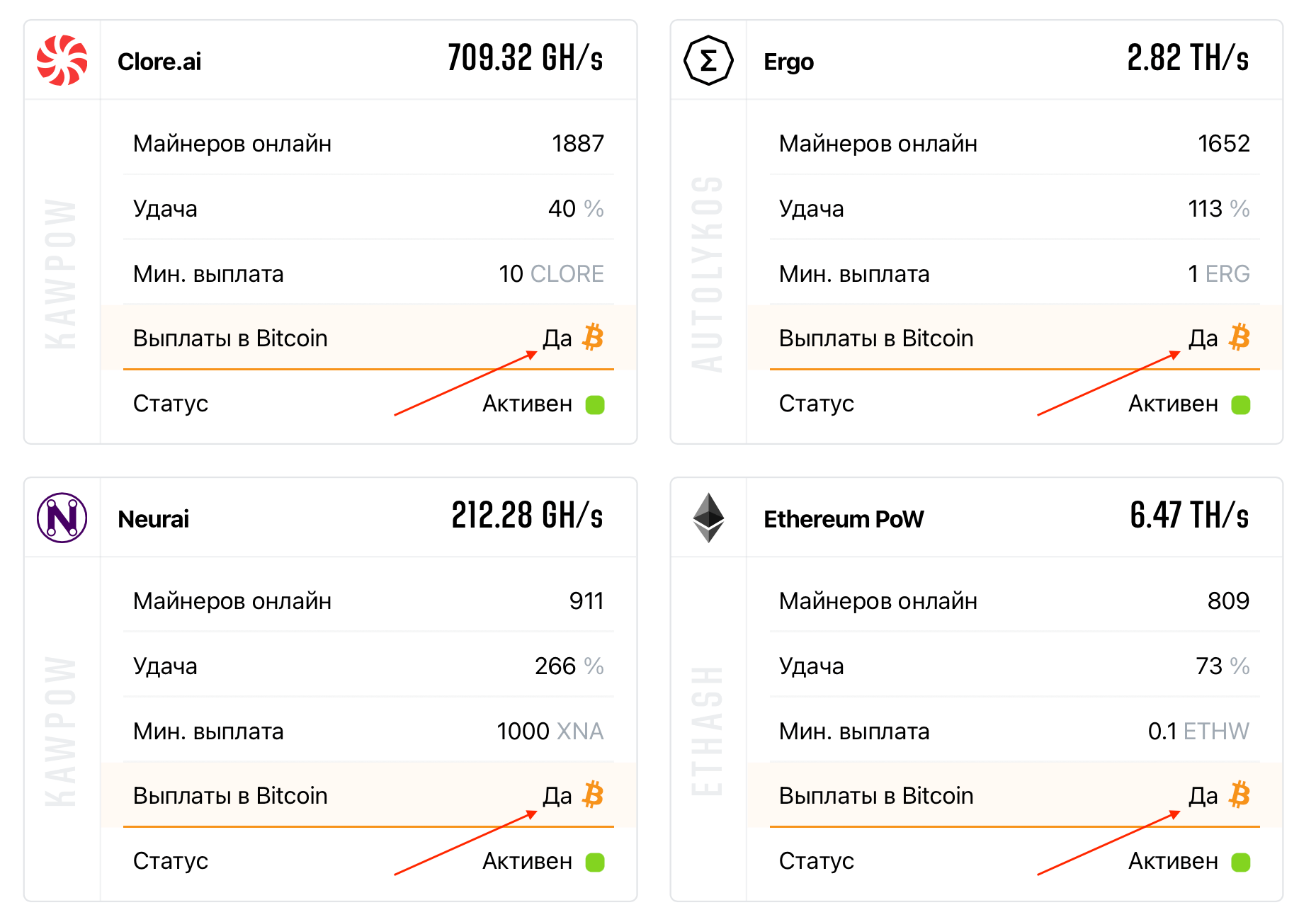

It is possible to receive payments in BTC for most coins on the 2Miners mining pool. You can recognise them by the corresponding mark on the main page.

Bitcoin payouts support mark on 2Miners mining pool

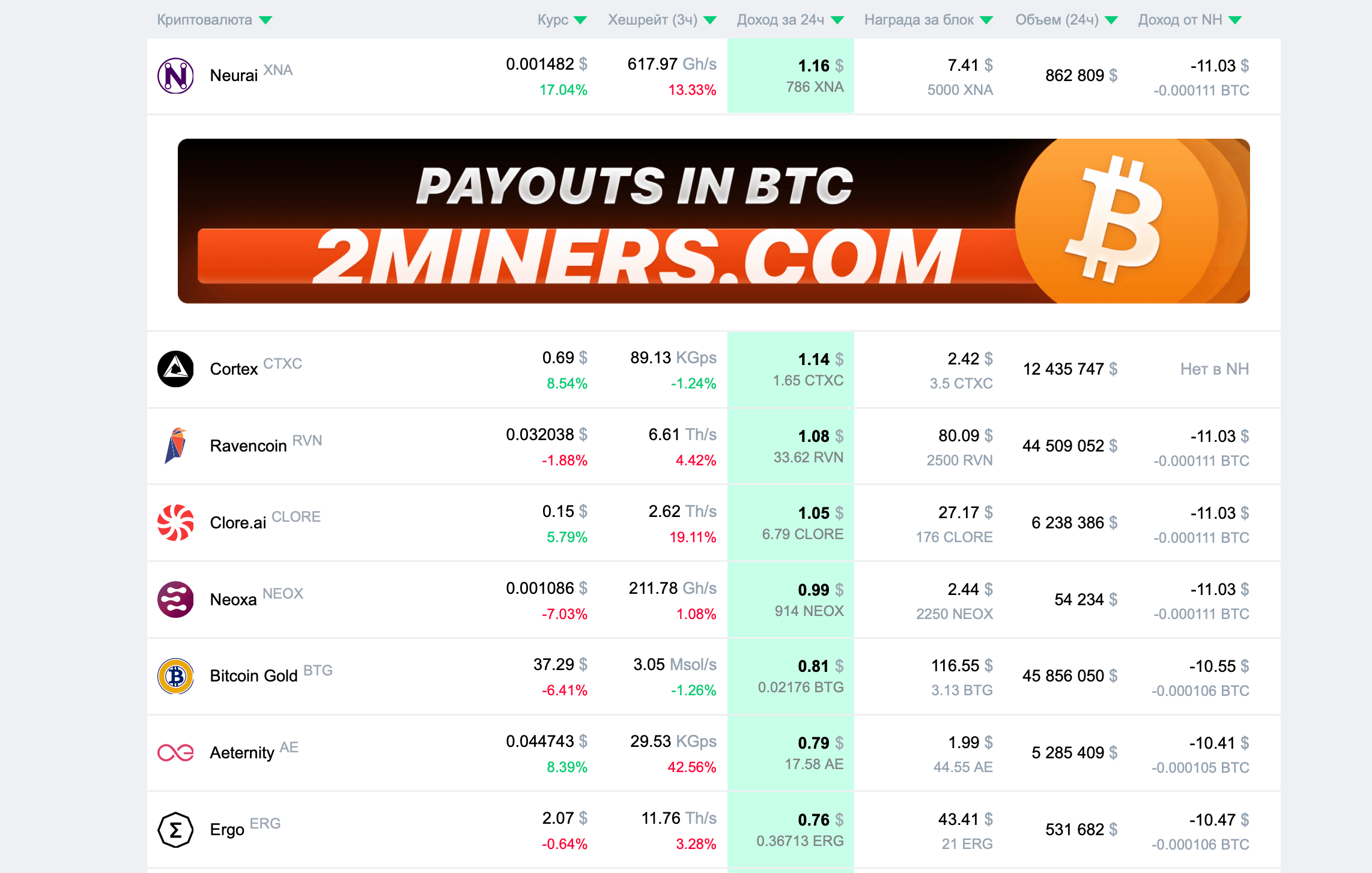

How many dollars in bitcoins will we get by mining? Once again we turn to the calculator and specify a gaming graphics card Nvidia GeForce RTX 3090.

Actual income when mining on one Nvidia GeForce RTX 3090 graphics card.

Now such a graphics card earns crypto for $1.16 per day. From this amount, we extract the cost of electricity, the tariff for which everyone has a different. As a result, you can claim a conditional $ 30 per month and somewhere 350 quid a year.

Is it unnecessary money? Unequivocally no. Can Bitcoin or any other coin grow by tens and hundreds of per cent in a few months? Absolutely.

So let’s not waste time and put the graphics card to work for the sake of relatively quick earnings. Besides, the bullrun won’t go on forever, so you won’t have to leave your computer on for a year.

Cryptocurrency investors

Now let’s get to the story.

What has changed in mining in recent years

Generally, the most popular cryptocurrency in the history of mining is Etherium. Unlike Bitcoin, mining ETH used to not require bulky and loud ASICs. You could dig ethers with ordinary video cards, which is exactly what most miners were doing.

But in September 2022, the Ethereum network finally switched to the Proof-of-Stake or Proof-of-ownership consensus algorithm. This means that validators are now in charge of adding blocks to the blockchain, conducting transactions and monitoring what is happening in the blockchain instead of miners.

Cryptocurrency miner

They block 32 ETH in a special deposit contract, run the validator client and generally do the same thing that miners were responsible for before. In addition, various staking pools are available for users to choose from, thanks to which they can participate in what is happening with much smaller amounts of cryptocurrency.

Thus, in the autumn of the year before last, millions of video cards that had previously been digging ETH were instantly out of work. What did their owners do? Right, switched the devices to mining other cryptocurrencies, which significantly affected the profitability of such activity.

The logic is that the rate of issuing rewards to miners of other altcoins remained the same, while the number of people willing to earn coins increased many times over. This diluted profitability and forced many participants to withdraw from the game – after all, spending resources and time to obtain crypto sometimes became trivially unprofitable.

Despite the changes in Efirium, the sphere of mining developed further. In particular, there were new projects on the algorithm of Proof of Work (PoW), which are traded on exchanges and allow you to easily turn income in coins into food in the fridge, payment for utilities, dinner in a restaurant and other pleasures of life.

Now cryptocurrencies are actively growing and attracting more and more new investors. For example, here is a graph of the market capitalisation of the whole industry, that is, the product of all the coins in circulation at their rate. As we can see, the indicator has already confidently surpassed the highs of 2021 and continues to grow.

Graph of the total capitalisation of the cryptocurrency market

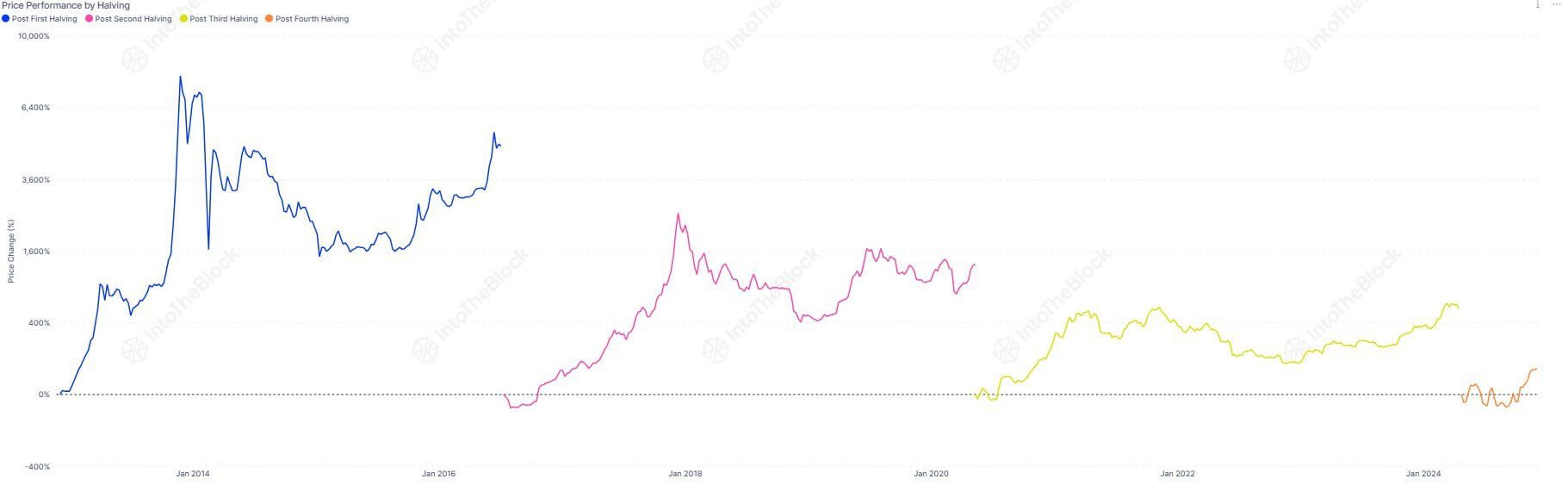

What could be the maximum Bitcoin exchange rate in this growth cycle? IntoTheBlock analysts analysed the cryptocurrency’s past behaviour and came to some curious conclusions. They calculated by what percentage the value of BTC grew to its local maximum after halving in the network, i.e. halving the miners’ reward for mining a block, which occurs every four years.

The situation was as follows:

- In the 2013 cycle, Bitcoin gave away 7,900 per cent growth;

- In the 2017 cycle, the cryptocurrency rose in value by 2,560 per cent

- In the 2021 cycle, BTC jumped 594 per cent.

Comparison of Bitcoin’s post-halving growth on the cryptocurrency network

The trend is towards Bitcoin giving out smaller and smaller returns in each bullrun. This is logical, as the cryptocurrency’s market capitalisation is growing – today it stands at $1.9 trillion. And the higher this indicator, the more difficult it is to influence the value of the asset.

With this in mind, IntoTheBlock analysts believe that the prospect of BTC growing by 100-200 percent of its value on the day of the last halving on April 20, 2024 is normal. And that translates to Bitcoin at $130,000 to $190,000 at the peak of the current bullrun.

The conclusion? There should still be enough time to try to make money in this cycle.

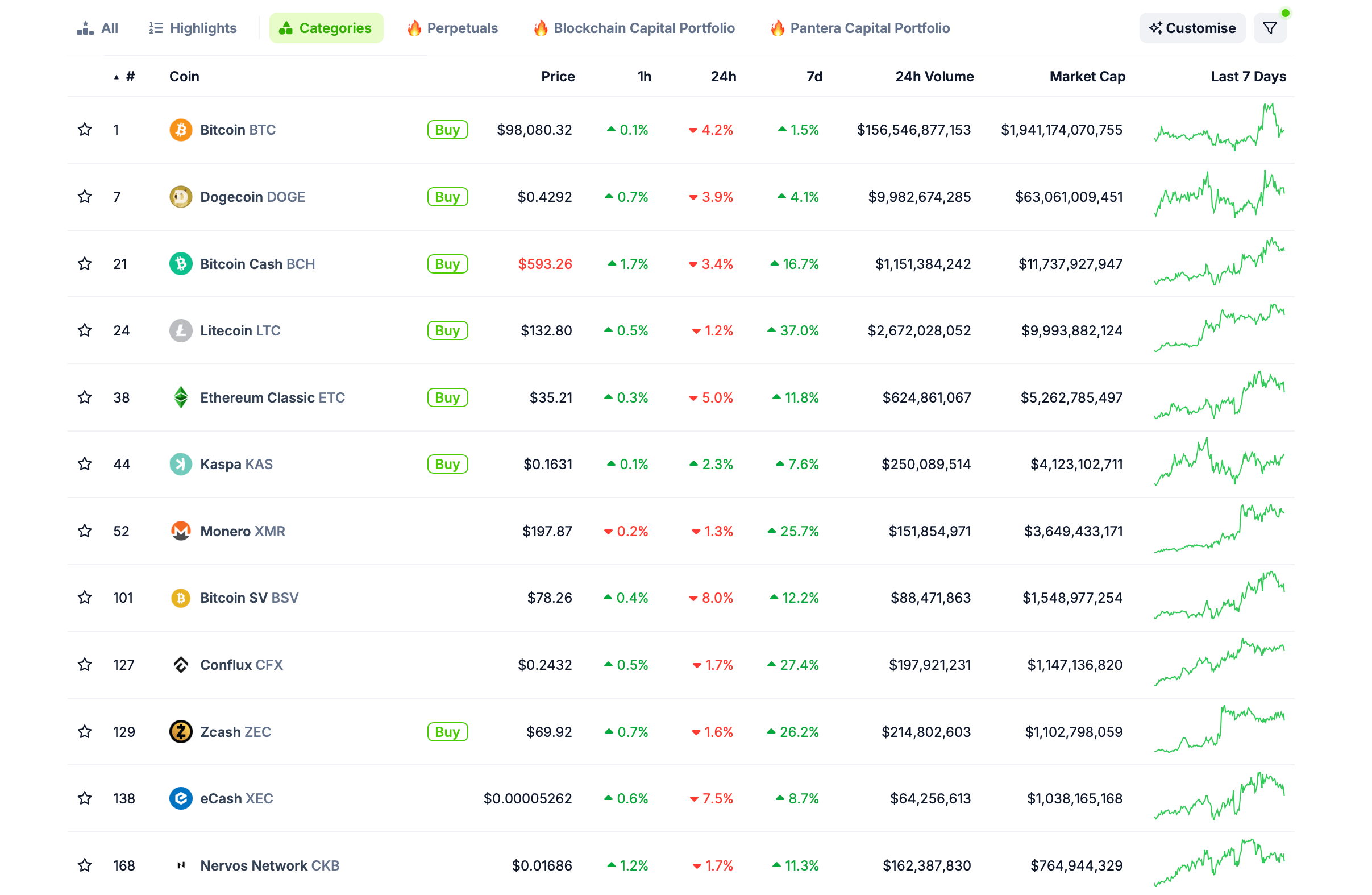

What coins can be mined in 2025

There are enough coins on the market on the PoW consensus algorithm, meaning miners are not sitting idle. Here is a list of the largest cryptocurrencies by market capitalisation that can be mined.

The largest coins on the Proof-of-Work algorithm

Their total capitalisation is $2.05 trillion, most of which is accounted for by Bitcoin. The total trading volume in the last 24 hours is practically $167 billion.

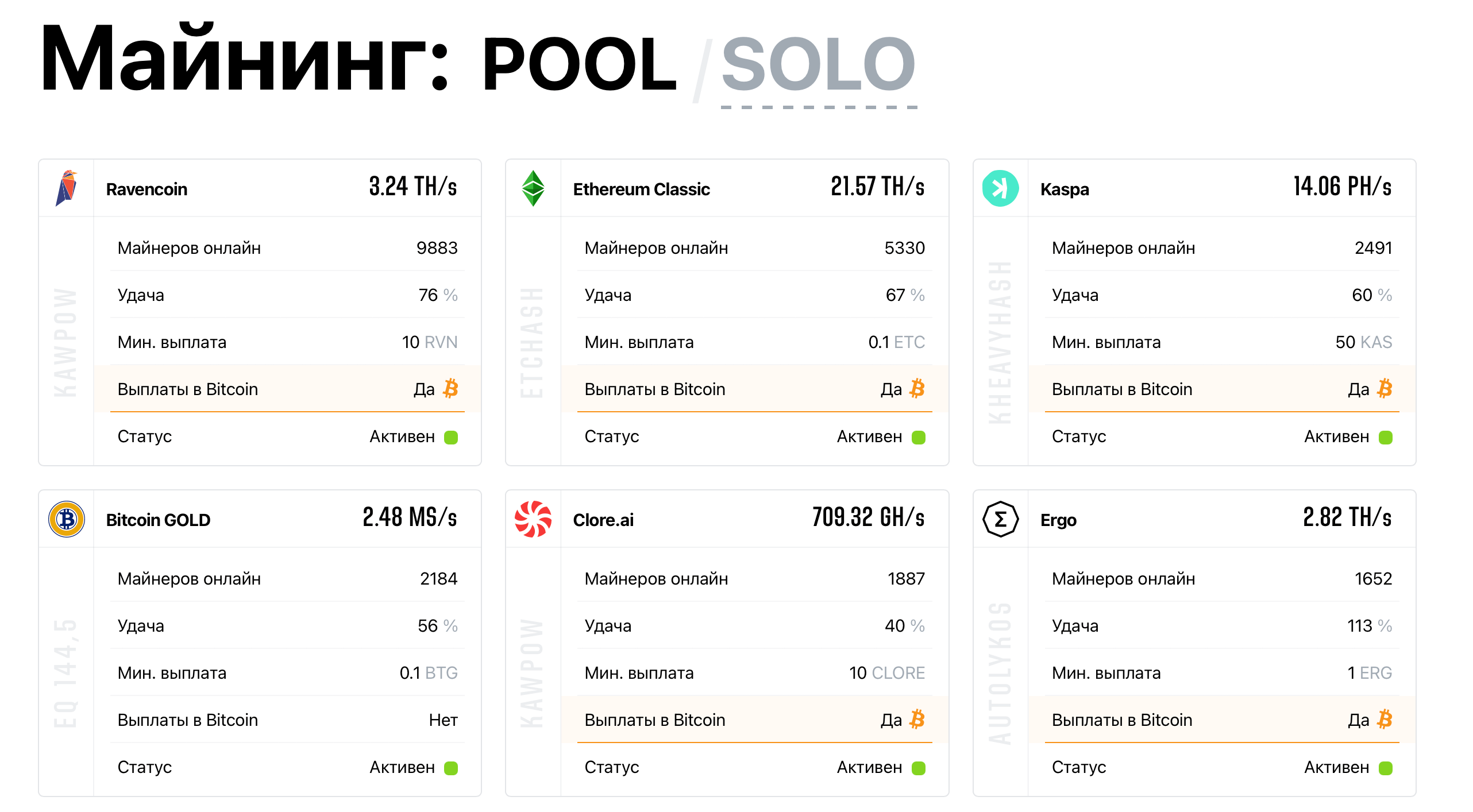

And this is how the most popular coins look like on 2Miners. These are Ravencoin, Ethereum Classic, Kaspa, Clore, Cortex and other coins.

The most popular cryptocurrencies on the 2Miners mining pool

As the number of active miners shows, experienced pool members choose these cryptocurrencies. So follow them and choose the same – especially if the choice is backed up by high returns from the 2CryptoCalc calculator.

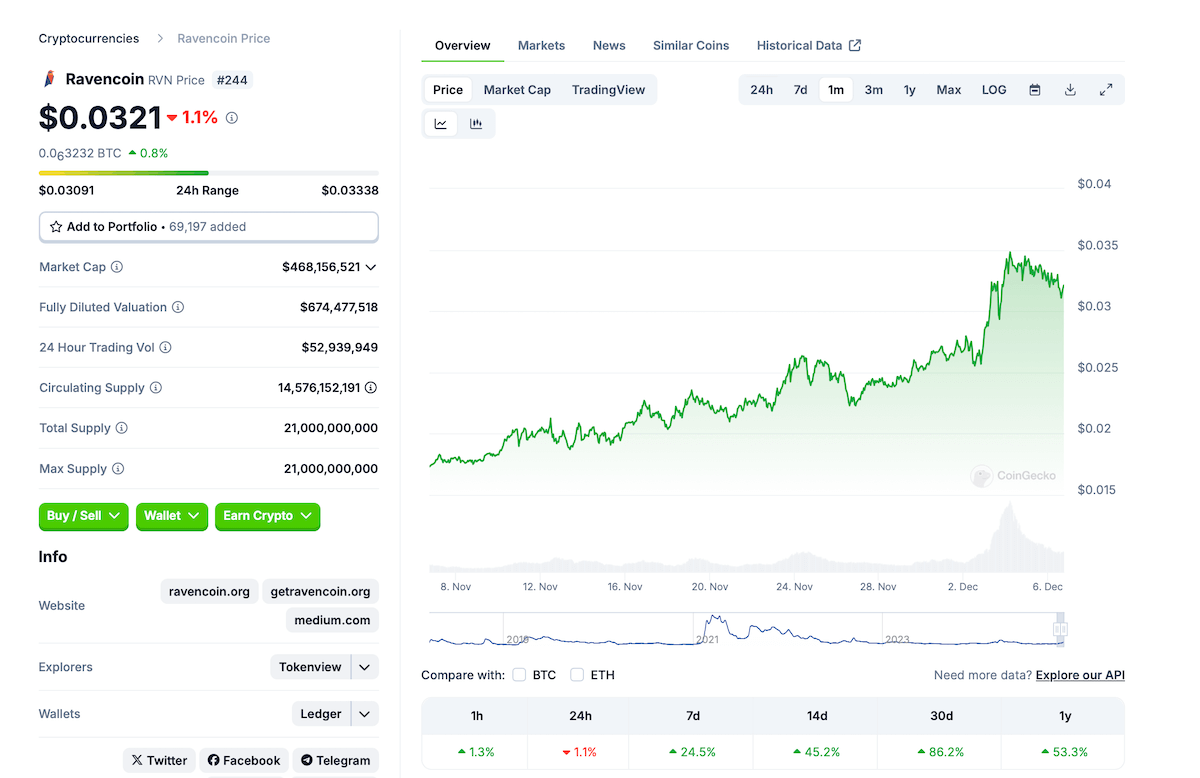

The aforementioned Ravencoin jumped 86 per cent in a month. ETC’s result in thirty days was 96 per cent, Clore jumped 127 per cent in a fortnight, and Cortex posted 233 per cent growth in a month.

Ravencoin RVN rate growth in thirty days

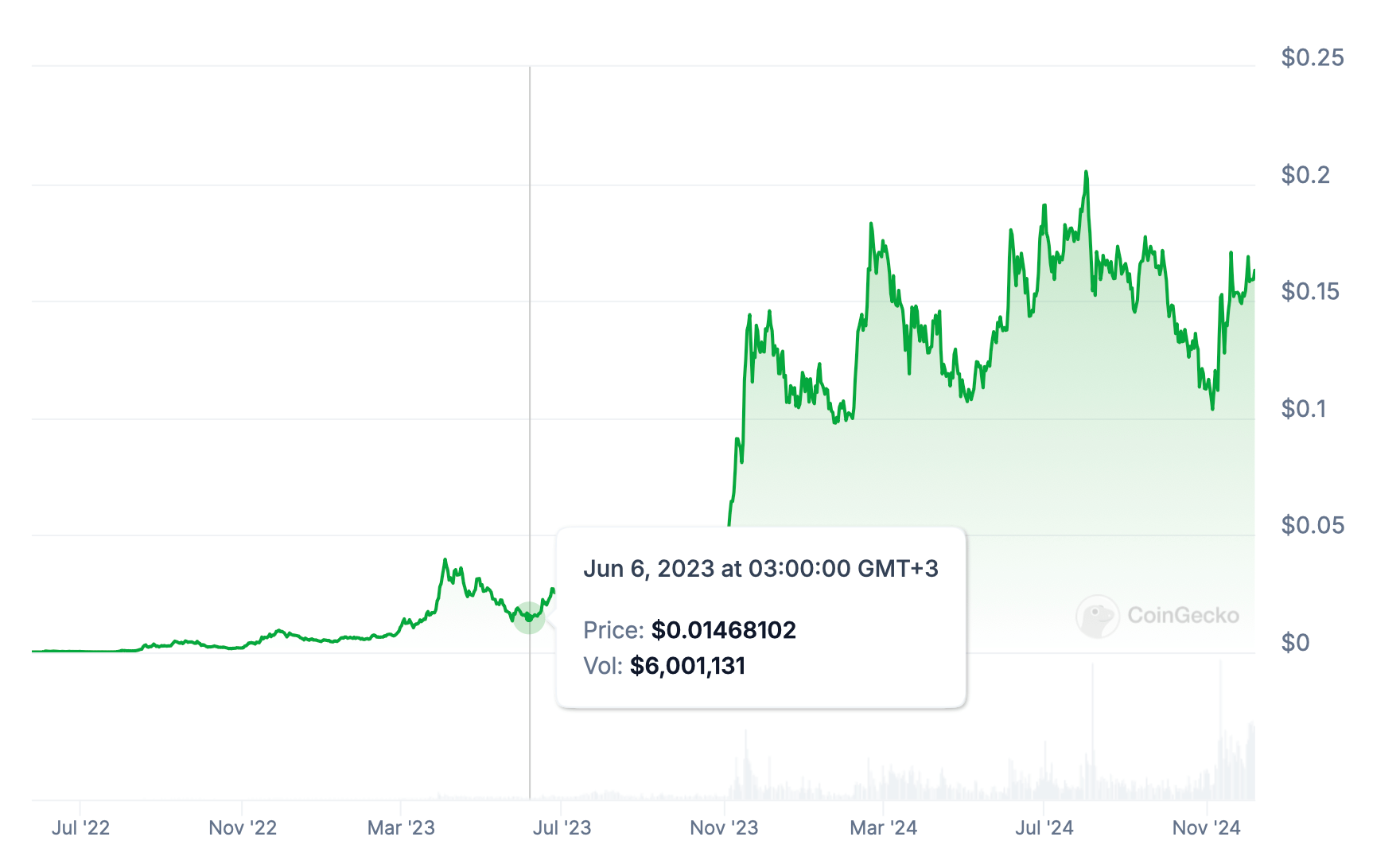

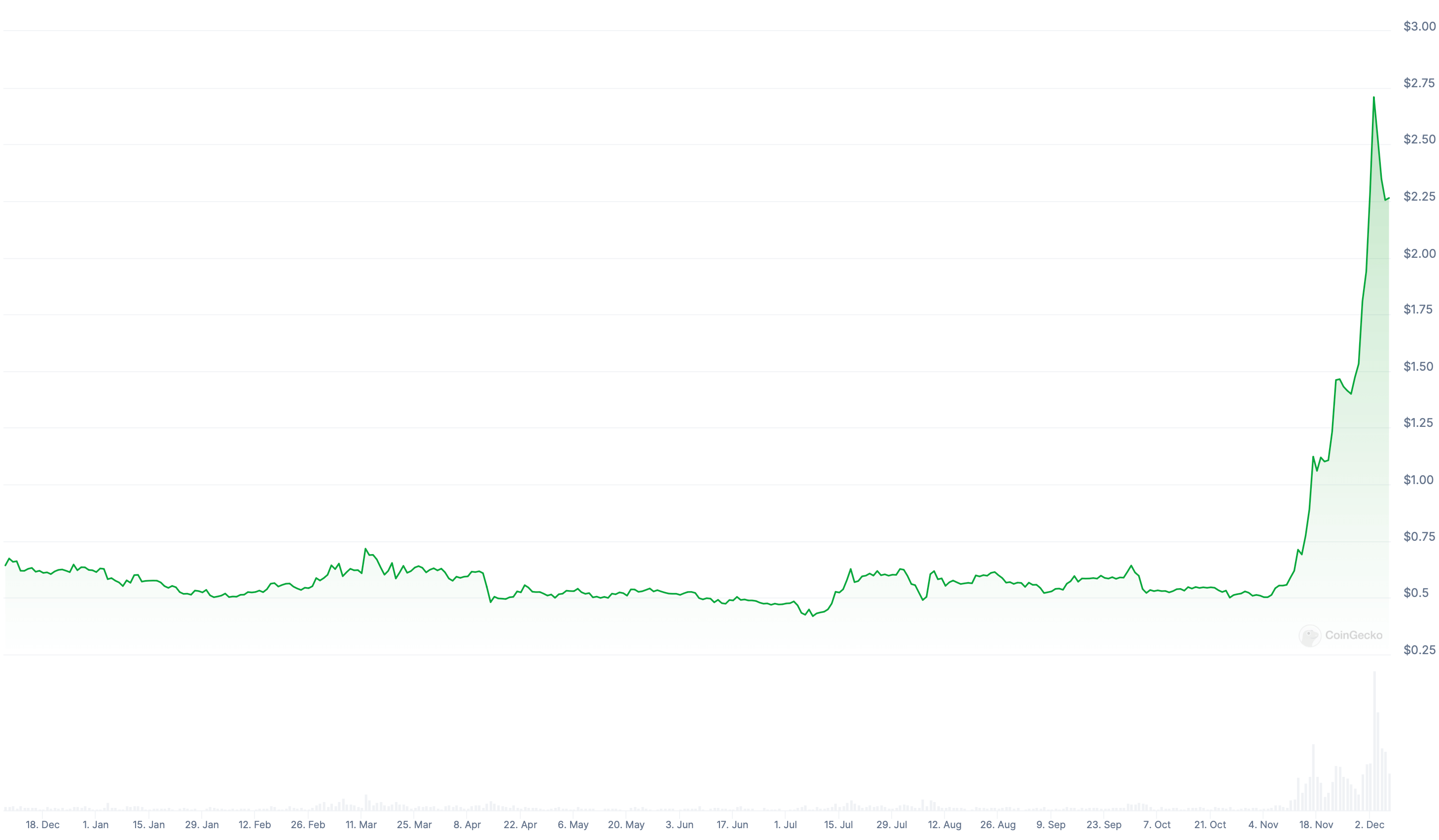

Kaspa KAS deserves a special mention. Here is the graph for the entire time of this coin, which is mined on ASIC miners.

Kaspa KAS cryptocurrency rate a year and a half ago

Exactly a year and a half ago – on 6 June 2023 – 1 KAS was valued at only 1.4 cents. Today, the coin is valued at $0.16, that is, we are talking about a jump of eleven times. And this is far from the maximum crypto in its history.

So experienced players may well hold on to namainenye altcoins and sell them later. The sharp growth of coins in the industry is not uncommon.

Why mining makes sense

Some people may think that it’s too late to get involved with coins, and their first purchase will definitely lead to a market crash or even a bearish trend in crypto.

Cryptocurrency market growth for investors

However, this is not quite true, because there are more than enough reasons to expect a further continuation of the bullrun.

Here they are.

- The US presidential election was won by Donald Trump. During the election campaign, he supported the crypto industry and promised to approve adequate regulation for the sphere of digital assets in the country. Such a thing has never happened in America before, therefore investors are waiting for further popularisation of crypto globally.

- The Securities Commission will have a change of leadership. The new SEC chairman will be Paul Atkins, who is characterised by a good attitude towards coins. It is logical to assume that the regulator will stop pointless litigation with many blockchain companies, which it has been doing for the last few years.

- During the night it became known that Trump decided on a candidate for the position responsible for policy in the field of artificial intelligence and cryptocurrencies. He will be the former chief operating officer of PayPal David Sachs, who just will be engaged in the development of rules for the regulation of coins in the country.

- In the US and other countries, there is talk of creating national Bitcoin reserves. For example, Senator Cynthia Lummis’ bill calls for the purchase of one million coins to be held for at least twenty years.

- MicroStrategy, along with Michael Saylor, continues to invest huge sums in Bitcoin. For example, on Monday, the giant announced the acquisition of 15,400 BTC worth $1.5 billion. And the company wants to raise an additional 42 billion to buy coins in the coming years.

The current positivity in crypto sometimes leads to absurd coin growth. The main illustration of such in recent weeks has been Ripple’s XRP cryptocurrency.

The coin has jumped 323 per cent this month, meaning it has gone up in value several times over. And this is what the XRP chart looks like over the past year.

Graph of the value of the cryptocurrency XRP for a year

So hoarding bitcoins and other cryptocurrencies in the current environment seems like a good idea.

Whether it is worth transferring the reward for mining into Bitcoin

Some crypto investors are reluctant to get involved with altcoins, that is, any other coins other than Bitcoin. And while altcoins are more often than not happy with higher returns, this approach is understandable.

Firstly, altcoins have higher volatility, i.e. the volatility of exchange rates. This means that they change in price much more actively – including falling. Beginner investors are hardly ready for something like this, so you can really start your crypto journey with Bitcoin.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Secondly, long-term investments in alts are more dangerous than bitcoin investments. Still, some such projects do not survive the stage of general market collapse or the so-called bear trend. They lose the interest of investors, trading volumes with them fall to hundreds of thousands of dollars, after which the coin can most likely be put a cross.

The unique feature of 2Miners mining pool - namely Bitcoin payouts - will help to get out of the situation. As we have already mentioned, in this case the reward in other coins will be automatically converted to BTC and sent to the specified address.

Cryptocurrency investors during the bullrun

However, if you have experience investing in different coins and the ability to sell crypto when it reaches pre-marked price levels, you can also mine alts.

Conclusions. Why is it worth trying crypto mining?

Bullrun is the best period for cryptocurrency mining. Still, coins are actively growing in value, and mining does not bring losses and even allows you to save coins. Again, the latter can be automatically converted into bitcoins.

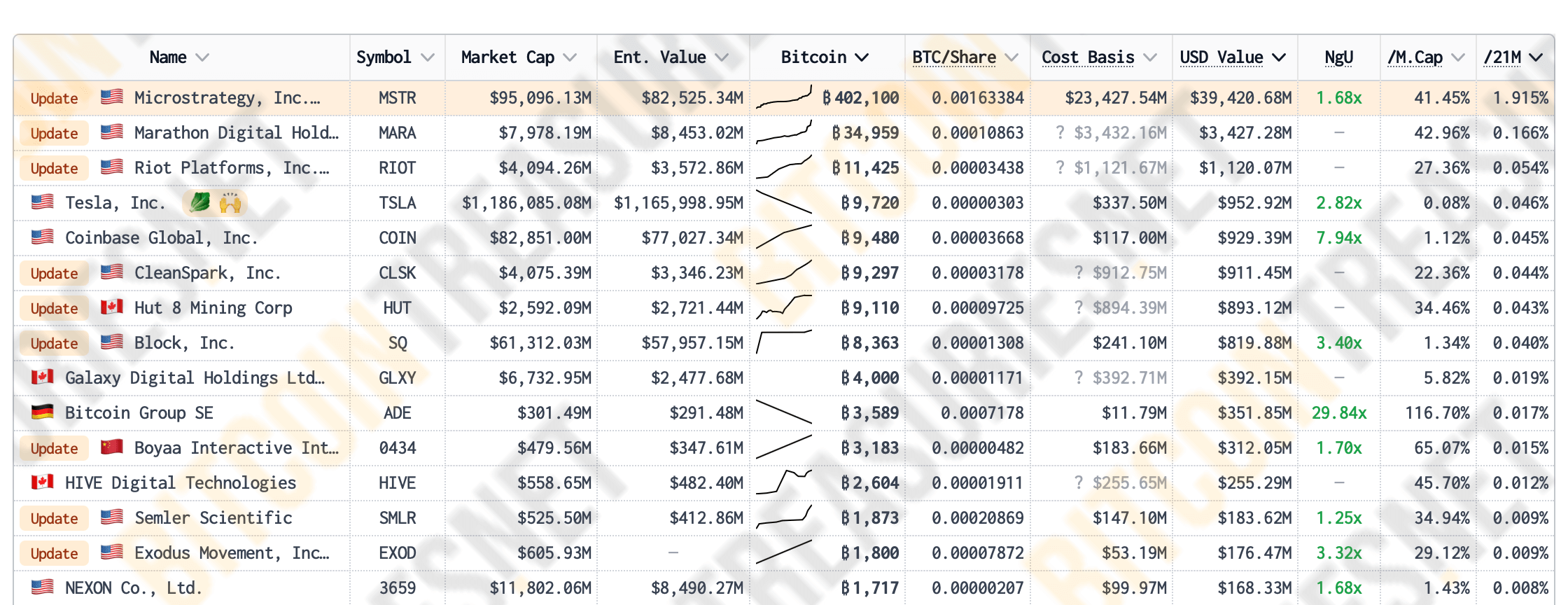

MicroStrategy comes to mind as a success story. It has invested $23.4 billion in its 402,100 BTC as of today, and now the amount is estimated at $39.2 billion. That is an unrealised profit of over $15 billion, which means the risk of a newcomer mining new coins is almost nothing compared to the strategy MicroStrategy has adopted.

Public companies with the largest bitcoin reserves

In addition, this activity is not difficult and will not burn your video card. And from the bonuses we will get a constant inflow of bitcoins, which can be easily and without fear to hold for several years.

Come to our crypto chat. There we will talk about other trivia and other trivia not on the topic of actual bullrun in crypto.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO BE INFORMED.