Safety margin: to what point does Bitcoin have to fall for MicroStrategy to start having problems?

US-based MicroStrategy, founded in 1989, initially specialised in business intelligence and data processing software. In general, it offers solutions for analysing big data, creating reports, dashboards and forecasting. Today, however, MicroStrategy is not so much known for its technology solutions as for its bold strategy of investing in Bitcoin. How large-scale collapse of the first cryptocurrency can the company survive without any difficulties?

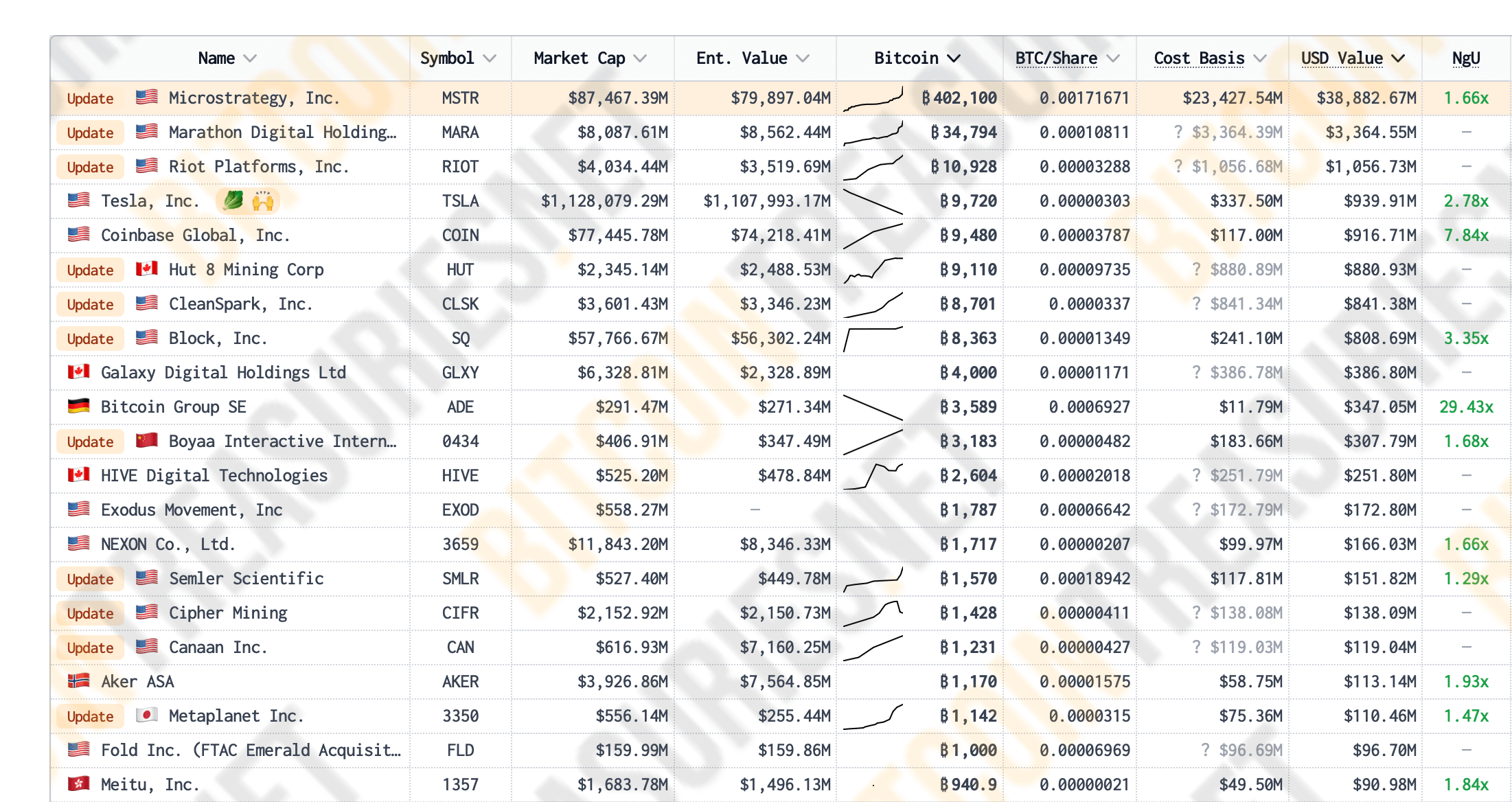

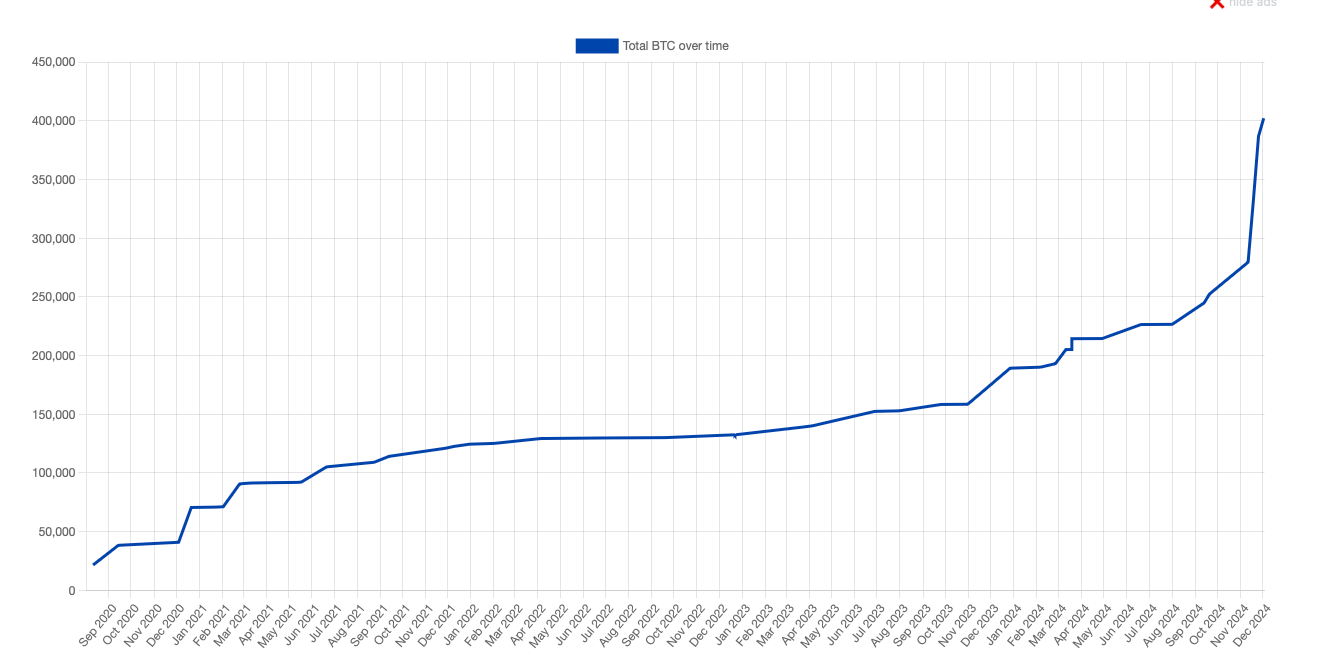

The company gained great fame in the cryptosphere in August 2020, when it started buying up BTC en masse and turned the cryptocurrency into a component of its corporate strategy. This decision was made as a defence against inflation and a way to improve long-term profitability. By today, MicroStrategy has already bought up 402,100 BTC, which at the current exchange rate is $38.8 billion.

Ranking public companies by number of accumulated bitcoins

More importantly, the number of accumulated bitcoins and MicroStrategy is greater than the combined amount of coins of all other public companies combined.

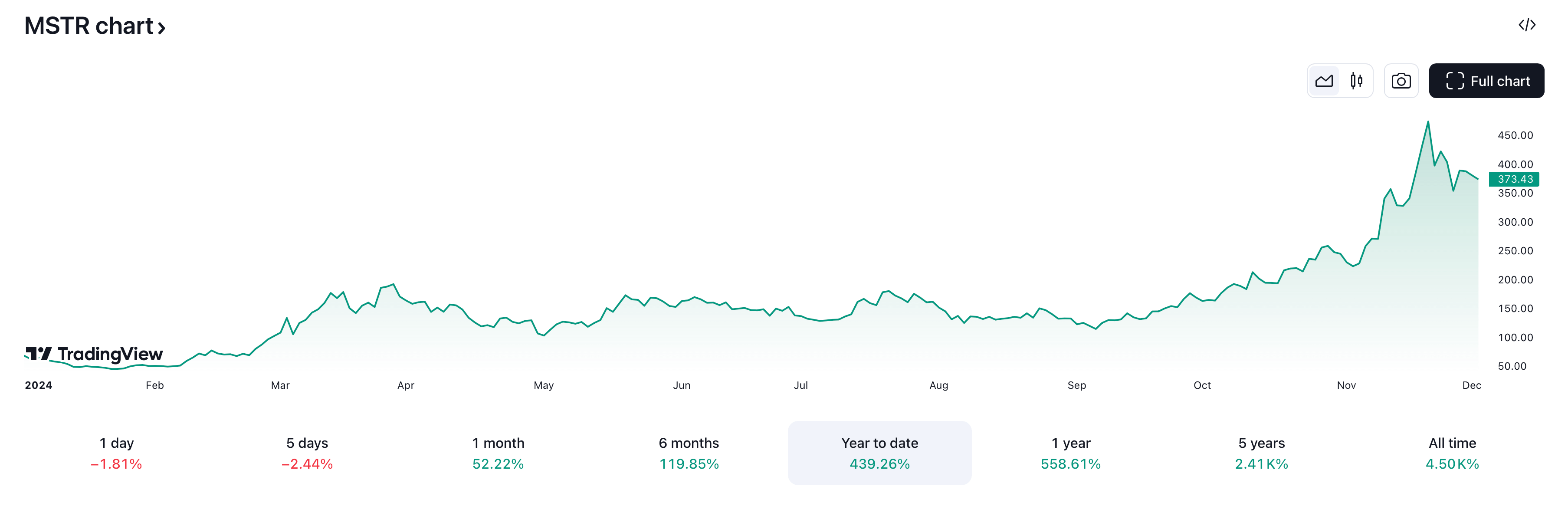

MicroStrategy founder and current executive chairman Michael Saylor’s initiative has paid off – MSTR’s share price has posted one of the most impressive bullruns in the history of the US stock market. For example, the price has risen 439 per cent since the beginning of the year, which includes outperformance of many cryptocurrencies.

MicroStrategy stock price changes for MicroStrategy companies in 2024

However, along with this, it seems that MicroStrategy is now largely dependent on Bitcoin, as it holds tens of billions of dollars worth of coins.

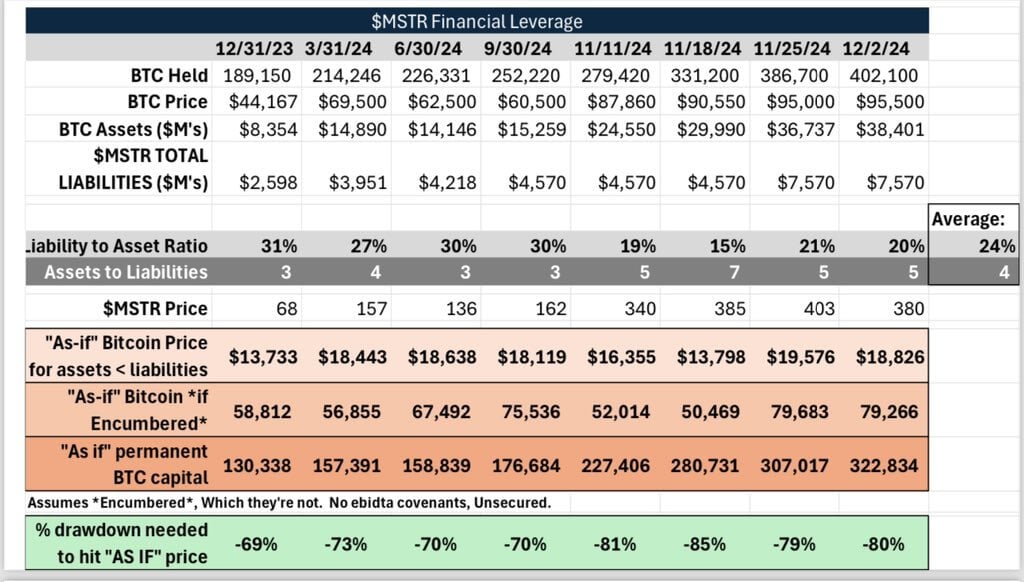

How stable can it be considered financially, and what scale of correction can MicroStrategy survive? Financial advisor Jeff Walton attempted to answer this question in a study.

What will happen to MicroStrategy if Bitcoin collapses?

According to Cointelegraph’s sources, Bitcoin’s exchange rate rose nearly 40 per cent in November alone. The catalyst for the growth was Republican Donald Trump’s election victory – he promised to introduce new and more loyal rules to regulate the digital asset industry.

But such high volatility may well lead to a major Bitcoin correction, which have happened repeatedly over the past few years.

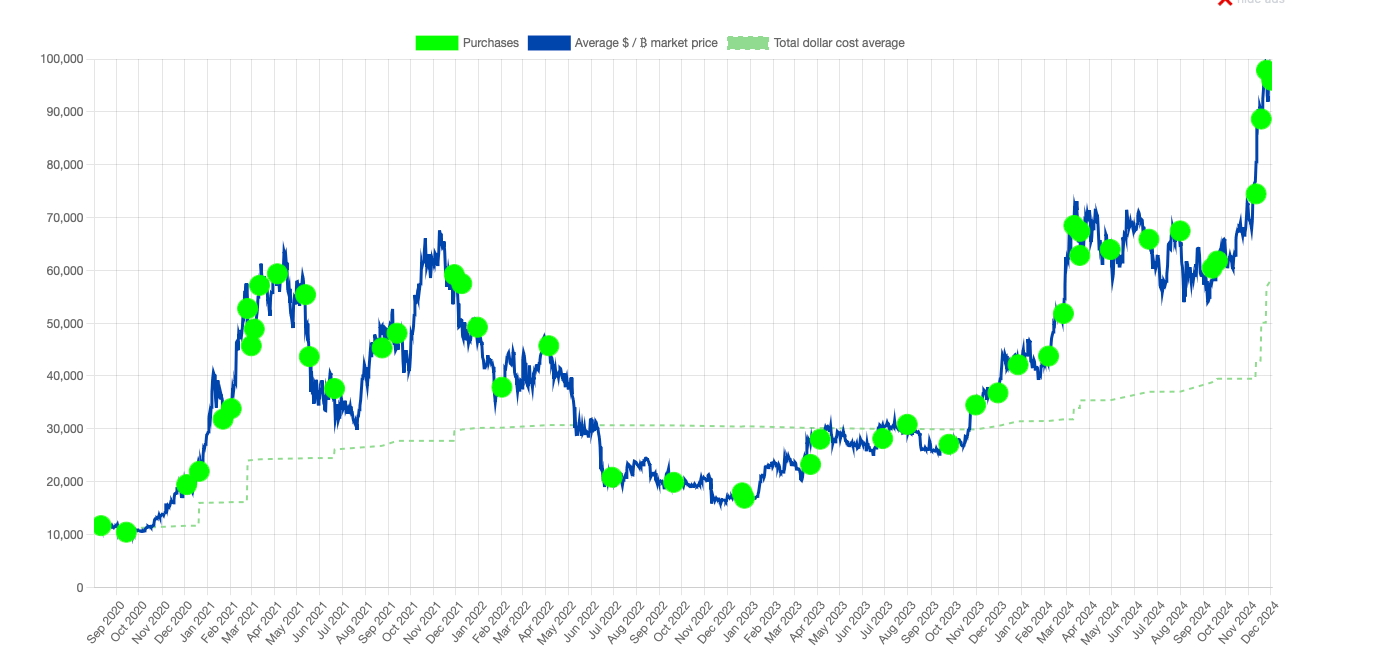

Rounds of BTC purchases by MicroStrategy on Bitcoin chart

However, Walton is confident that MicroStrategy could survive even the toughest crisis. Here is his rejoinder on the matter.

Bitcoin’s price would have to fall to the $18,826 line for MicroStrategy’s assets to start being worth less than the company’s liabilities. That’s a correction of the major cryptocurrency of 80 per cent of today’s price.

It is important to note that during the 2022-2023 bear trend, Bitcoin's low was the $15,476 line, whereas during the 2018-2019 collapse, BTC sagged to $3,156. With this in mind, we can assume that counting on the first cryptocurrency to collapse to $18,000 ever again is no longer an option, as BTC doesn't usually fall to previous lows, and over the years its value has become increasingly higher as demand for the cryptocurrency grows.

BTC bitcoin gains on MicroStrategy’s balance sheet

Bitcoin has previously experienced 80 per cent corrections. For example, between November 2021 and November 2022, the BTC exchange rate fell from $69 to $15.6 thousand during a prolonged “cryptozyme.”

Amid that decline, many major crypto firms went bankrupt, although even during this period MicroStrategy continued to persistently add coins to its balance sheet.

MicroStrategy executive chairman Michael Saylor

Yet for Walton himself, the argument against large corporate holders buying Bitcoin contains no logic. He continues.

As Bitcoin’s price rises, the leverage effect falls off rapidly. For those talking about a financial pyramid scheme or collapse, I suggest looking at MicroStrategy’s balance sheet. It is likely still underutilised.

MicroStrategy’s financial leverage data

In other words, even now, the company could buy a lot more bitcoins without compromising its financial stability. With the long-term growth of crypto market capitalisation, MicroStrategy’s position will continue to strengthen, and the company’s shares will become an unofficial index of the state of digital assets.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

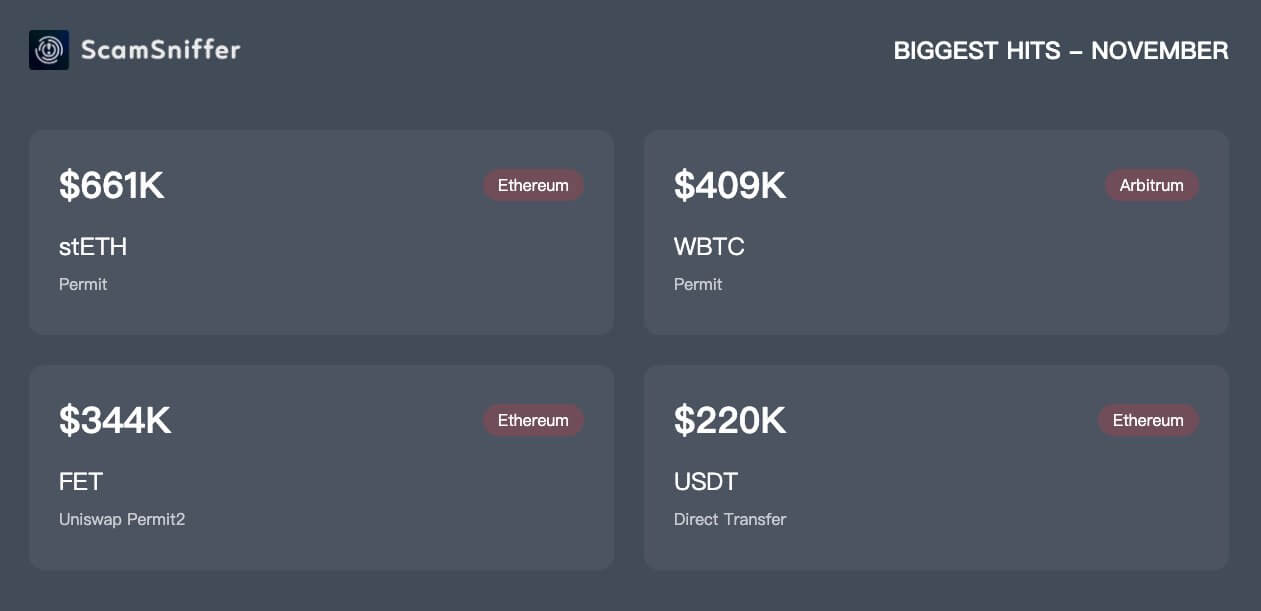

On a smaller scale, the industry will soon face an epidemic of phishing attacks – experts remind us that scammers are particularly active over the festive New Year’s weekend. According to Scam Sniffer, more than 9,200 crypto investors lost $9.3 million to phishing attacks in November alone.

$9.38 million was stolen. 9,208 victims. In November, one victim lost $661,000 within minutes – and that’s just the tip of the iceberg.

Cryptocurrency loss statistics for November

Malicious signatures remain the “deadliest weapon” of fraudsters. Still, signing a malicious transaction on a blockchain without realising it can give an attacker control over a wallet’s digital assets, resulting in a complete loss of funds.

November’s phishing losses of $9.3 million were 53 per cent less than October, when phishing attacks brought in more than $20.2 million for attackers.

However, according to Cyvers co-founder and CEO Deddy Lavid, phishing attacks could increase in December. Here’s his comment.

To safeguard their assets, investors should verify messages, enable two-factor authentication, and avoid public WiFi hotspots for sensitive activities.

The volume of crypto losses from fraudsters in previous months

Additionally, users should be increasingly aware of the growing risk of signing malicious crypto transactions. Ideally, transactions should use hardware wallets that show details of an increasing number of transactions using Ledger’s so-called transparent signature.

Despite the growing risks due to the holiday season, there has been a noticeable decrease in fraud incidents compared to 2023. Specifically, hackers stole $1.48 billion through November 28, a 15 percent decrease from the same period in 2023. In November, the biggest incident was the $25.5 million Thala hack, but the protocol team still recovered all assets lost due to the vulnerability.

Apparently, MicroStrategy's financial position allows it to hold its bitcoins without significant risks. This means that the giant has all the conditions to acquire more and more coins. Earlier, the company confirmed such plans, talking about its desire to raise $42 billion to buy BTC.

Look for even more interesting things in our crypto chat room. Check it out so you don’t miss the most interesting things in the world of digital assets.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO STAY UP TO DATE.