The biopharma giant invested a million dollars in Bitcoin. Why didn’t investors appreciate it?

The adoption of cryptocurrencies by large institutional investors continues. Another publicly traded company in the person of Quantum BioPharma (QNTM) has joined the list of players who have invested in crypto directly. Representatives of the giant reported a million-dollar acquisition of Bitcoin and other cryptocurrencies. However, it seems that not everyone turned out to be happy about the news.

Bitcoin purchases by large companies for serious amounts continue. For example, at the end of last week, the acquisition of 15,574 BTC was announced by the management of MARA Holdings. Thanks to this, the total accumulation of cryptocurrency by the mining giant reached 44,394 coins.

The company Hut 8 conducted a round of investment of 100 million dollars, for which 990 coins were received. Thus, the strategic Bitcoin giant’s Bitcoin reserve exceeded the mark of 10 thousand BTC.

Cryptocurrency miner at the collapse of the market

Who invests money in cryptocurrencies

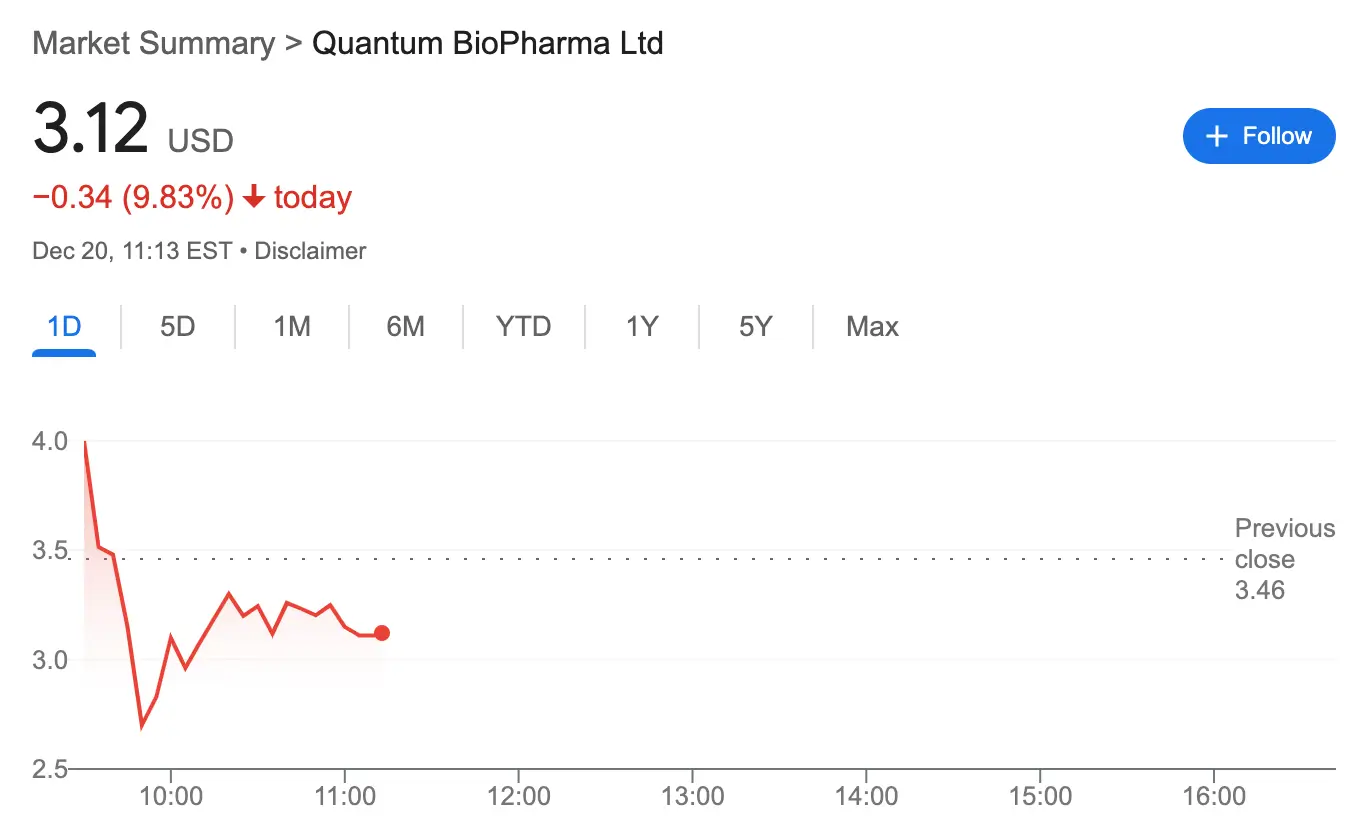

Holders of Quantum BioPharma shares did not particularly like the fresh initiative, as the news of the crypto purchase caused a massive sell-off of the company’s securities. Since the announcement, QNTUM’s share price has dropped by almost 10 per cent, which is a serious event on the stock market.

Change in the value of Quantum BioPharma shares

Obviously, shareholders considered such an initiative risky, as Bitcoin and other coins still face serious volatility. In addition, some market participants must have assumed that the connection with crypto trivially does not go to the pharmaceutical company.

Quantum BioPharma is also traded on the Canadian and Frankfurt stock exchanges. The company offers biotech solutions for the treatment of various diseases, including neurodegenerative disorders, metabolic syndromes, and alcohol abuse disorders.

Another official announcement was made in connection with the cryptocurrency investment, as cited by Cointelegraph.

The company is now ready to accept cryptocurrency funding as well as other types of cryptocurrency transactions.

In general, more and more non-crypto companies are turning to coins to diversify their assets and protect themselves from inflation. The willingness of some states to invest in Bitcoin also deserves a special mention. As we found out the day before, representatives of the legislative branch of government from Texas, Pennsylvania and Ohio are counting on such a prospect. And in most cases, the initiative is explained by the general rise in prices in the country and the gradual depreciation of the dollar.

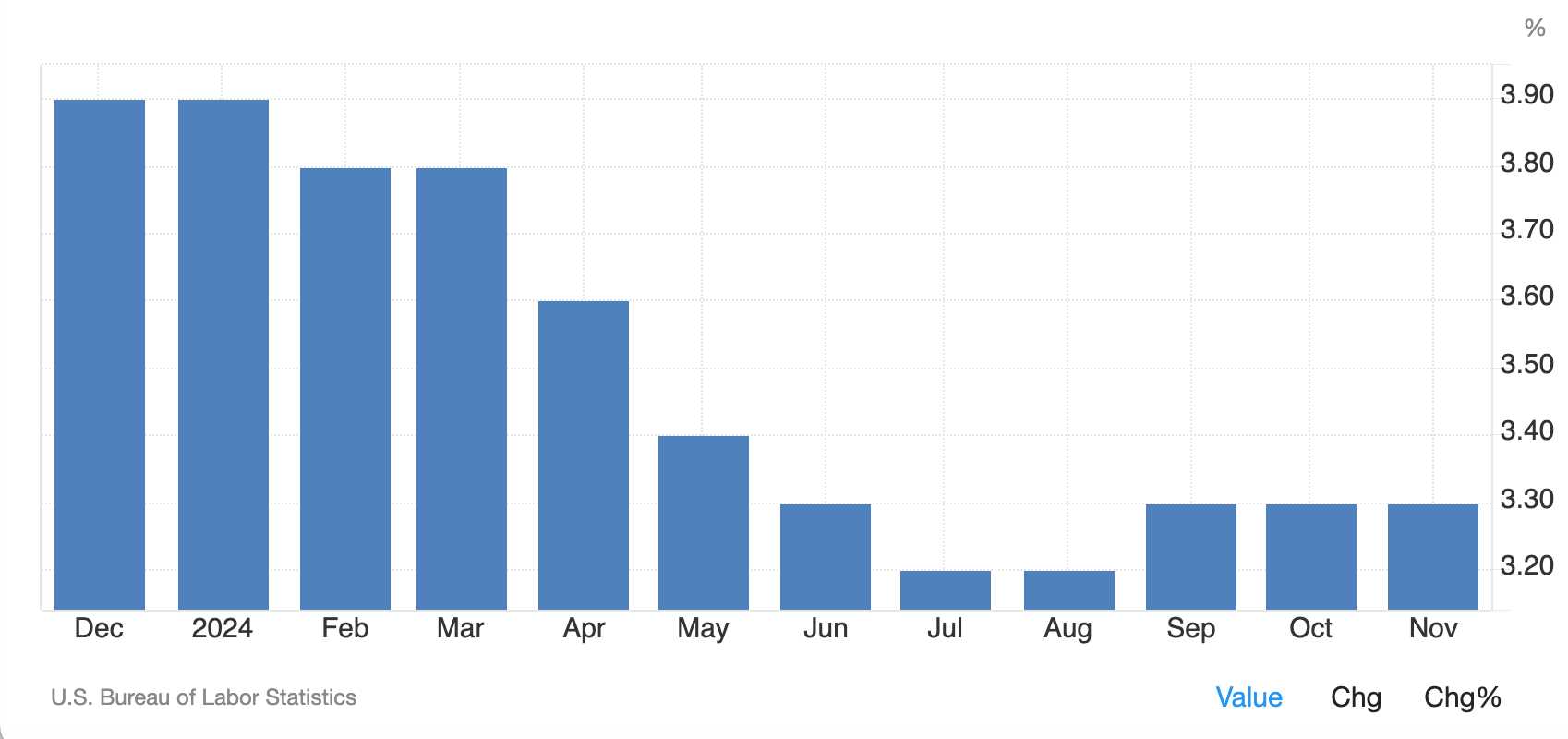

In the United States, inflation rose by 2.7 per cent year-on-year in November 2024, compared to 2.6 per cent in October. For the month, the consumer price index (CPI) rose 0.3 per cent in November, the largest increase in seven months. However, on the scale of recent years, the situation is still much better.

Changes in the CPI index

In November, health and herbal products e-commerce company Jiva Technologies approved a plan to invest up to $1 million in Bitcoin. At the time, the giant’s representatives called it a potentially inflation-resistant means of preserving value.

On 20 November, biopharmaceutical company Hoth Therapeutics spent a million dollars on Bitcoin. However, the record holder on this path is still MicroStrategy. The giant has been actively buying Bitcoins since August 2020 and is the largest corporate holder of the major cryptocurrency as of December 2024.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

The company has now accumulated 444,262 bitcoins with 27.7 billion invested. The latest purchase was announced today by the giant’s founder Michael Saylor: MicroStrategy acquired 5,262 BTC worth $561 million. This brings the average purchase price of each bitcoin to $62,257.

MicroStrategy founder Michael Sailor

Meanwhile, other large corporations like Microsoft and Amazon regularly face pressure from some shareholders to add Bitcoin to their investment portfolio as a possible hedge against inflation. However, Microsoft shareholders voted against the initiative at the company’s annual meeting on 10 December. The board of directors called the proposal “inappropriate” and said the company is “already scrutinising the topic”.

Video hosting site Rumble also previously announced plans to add BTC to its portfolio. The board of directors approved the allocation of up to $20 million from the company’s excess cash reserves to purchase BTC.

With that said, Rumble has received $775 million in investment from the issuer of the market’s largest stablecoin, Tether. The move was commented on Twitter by Tether CEO Paolo Ardoino.

Tether believes deeply in the fundamental values of free speech and financial freedom. Our strategic investment in Rumble strongly emphasises Tether’s focus on supporting technologies and companies that empower people, ensuring the independence and sustainability of our society.

Tether CEO Paolo Ardoino

Ardonio added that he is optimistic about the recent decision by Rumble CEO Chris Pawlowski and his team. As a result, Tether and Rumble plan to collaborate on advertising, cloud technology and crypto-payments.

Pawlowski also commented on the deal.

YouTube, beware. I’m coming for your monopoly market share worldwide.

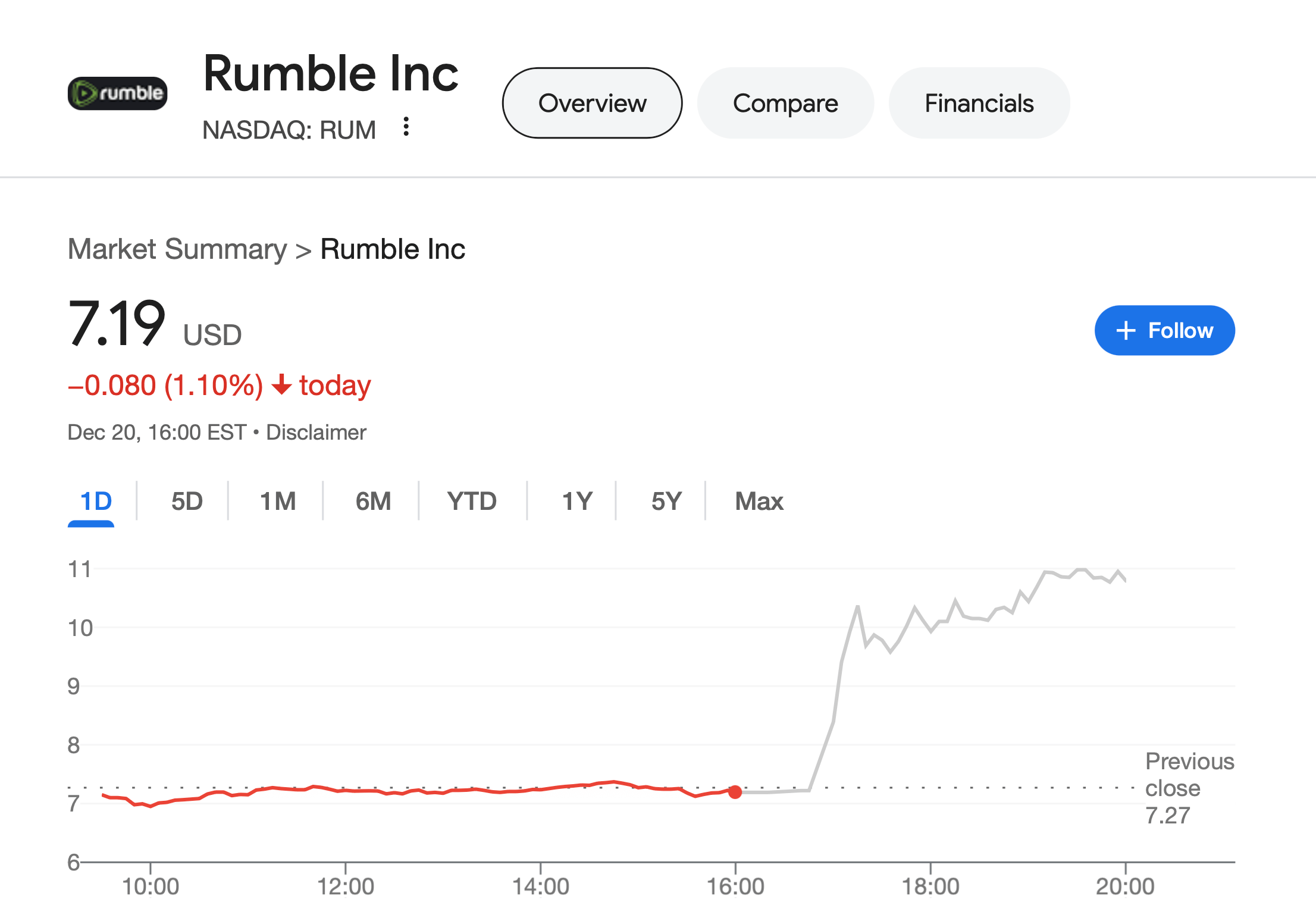

Following the announcement, Rumble’s (RUM) share price rose 51.60 percent in over-the-counter trading to hit $10.90 by the time of publication. As we can see, large investments related to the crypto market may well become a trend aimed at a HYIP among security holders.

Change in Rumble RUM’s share price

Bitcoin is of interest to an increasing number of ordinary companies that are not connected to the blockchain world. Obviously, this is due to rumours about the possible formation of a BTC reserve by the US government. Although such an idea is unlikely to be realised in the coming weeks, this probability makes other market participants make investment decisions.

Look for more interesting things in our crypto chat room. We are waiting for you there right now, so don’t waste your time.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO STAY INFORMED.