The cryptocurrency market will see a “surge in demand” in 2025. How will this affect the price of Bitcoin?

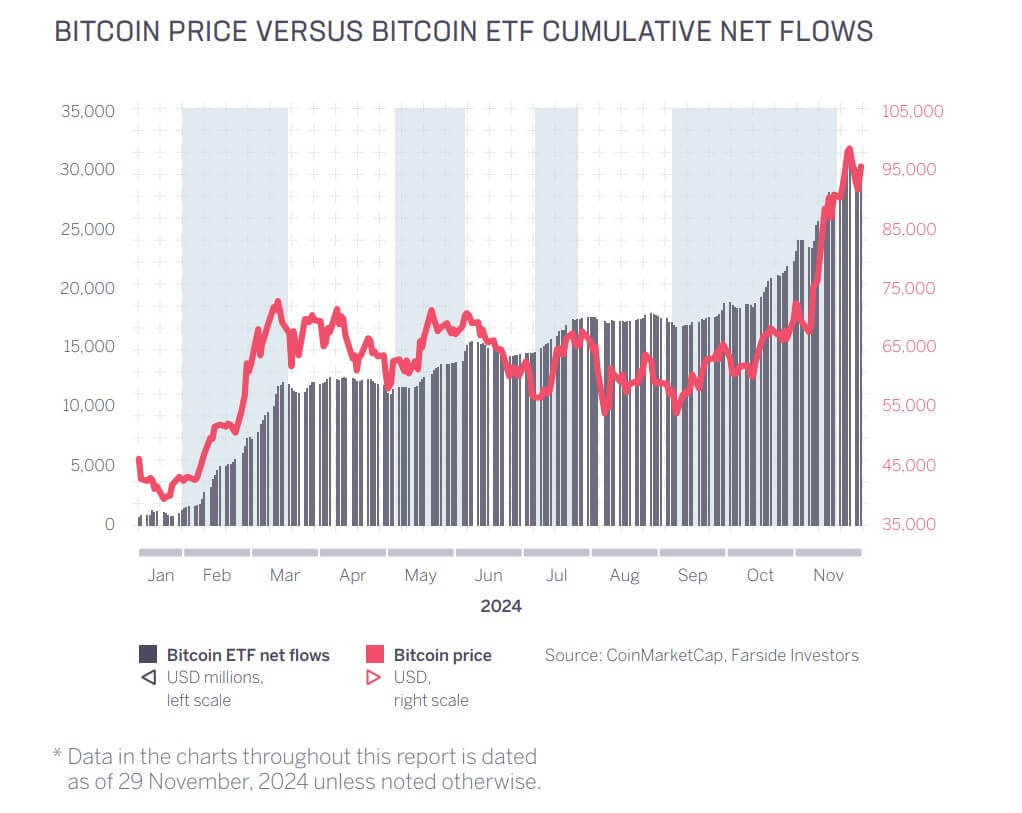

Sygnum Bank experts have published a new study of the crypto market with very optimistic conclusions: according to their version, in 2025 the digital asset industry is expected to experience a so-called “demand explosion”. It will be caused by large-scale capital inflows from institutional investors. Still now the big players want to invest capital in spot Bitcoin-ETFs, and at the moment each new billion of funds in these instruments leads to an increase in the value of the main cryptocurrency by 3-6 per cent. These are not the only reasons to be positive.

The forecast for the state of the cryptocurrency market in 2025 was also shared the day before by representatives of the Bitwise investment fund. They believe that during this period of time, the number of countries that own bitcoins will double.

Analysts also predicted a softening of the attitude to crypto by the U.S. Department of Labour, because of which the sphere of digital assets will receive billions of dollars of investments through pension plans. Also, the capitalisation of stablecoins will jump to $400 billion, i.e. it will grow twofold from the current figure.

Cryptocurrency investors during the bullrun

Read more about these and other points in a separate article.

What will happen to the price of Bitcoin?

Representatives of the Sygnum platform expect that the positive effect for the price of BTC from the inflow of capital into ETFs will only intensify in 2025. This was stated by Martin Burgerr, a spokesperson for the platform’s management team – here’s the relevant rejoinder.

With improved clarity in US law and the possibility of Bitcoin being recognised as a reserve asset, 2025 could see a dramatic acceleration in institutional participation in crypto-assets. Our analysis shows how even relatively modest investments from this segment can fundamentally change the ecosystem.

Today, an important event took place for the cryptocurrency sphere: analysts of the largest investment fund BlackRock recommended other companies to increase the size of investments in BTC. According to their version, it is worth allocating 2 per cent of free capital for this purpose.

As representatives of the company noted, the first cryptocurrency can be considered a good tool for diversification of the investment portfolio. However, together with this, its risk profile is generally comparable to what is happening with the shares of major players such as Google, Amazon, Meta and Apple. Therefore, they definitely recommend getting in touch with coins.

Dependence between inflows of funds into Bitcoin-ETFs and the price of the coin

According to Cointelegraph’s sources, this trend will also extend to altcoins. However, such a thing will only be relevant if the United States passes laws that support proper regulation of cryptocurrencies. Experts continue.

Policymakers should create rules tailored to the asset class that allow projects to transfer value to token holders, but without creating compliance burdens they cannot reasonably meet.

Recall that during Joe Biden's presidency, the SEC required cryptocurrency companies to comply with the Securities Act, which was issued in the first half of the last century. And although the biggest players in the industry asked the regulators to create a new framework for managing the coin sphere, it never ended up with anything.

Well, Trump and their appointed officials are expected to approve just such norms of market governance. This was one of the reasons for the industry's surge after the Republican won the election in early November.

Sygnum cited the proposed FIT21 bill and the Stablecoin Act as particularly important for cryptocurrencies.

The US also needs laws regulating self-storage of digital assets, cryptocurrency mining and decentralised finance (DeFi). Until then, Bitcoin’s unusually strong growth factors will hold back the rest of the market.

In all the diversity of cryptocurrencies, platform experts also have certain causes for concern. One of them is the sphere of meme tokens, which are still in demand among investors. Analysts believe that capital injections into such projects have led to a strong interest in memes – and this is allegedly fraught with the formation of a new bubble.

The POPCAT meme on the Solana network, the token based on which is one of the biggest hits of the current bullrun

😈 MORE INTERESTING STUFF CAN BE FOUND AT US AT YANDEX.ZEN!

Overall, Trump is going to make digital assets an important issue in the political arena in the United States. For example, Axios sources from Donald Trump’s transition team said on Tuesday that “the newly elected president will be very focused on the Bitcoin exchange rate as it is a second stock market for him.”

It was also noted that Trump would be “very pleased” if BTC rises to the $150,000 mark immediately after the politician takes office.

Newly elected US President Donald Trump

However, government structures not only of this country are interested in Bitcoin and crypto in general. Now the local authorities of the Canadian city of Vancouver have officially approved a proposal to develop the adoption of BTC.

The relevant document, presented by the city’s mayor Ken Sim last month, proposed to integrate Bitcoin into Vancouver’s financial strategies. For example, the cryptocurrency was proposed to be used to pay taxes and fees, as well as to transfer a portion of the city’s financial reserves into it.

The current proposal explains that turning a portion of financial reserves into Bitcoin will help preserve Vancouver’s purchasing power in the face of the volatility, depreciation and inflationary pressures of traditional currencies. A quote on the matter is cited by The Block.

Diversifying the City of Vancouver’s financial reserves and payment methods to include Bitcoin will not only increase the resilience of our City’s financial portfolio, but will ultimately benefit the City’s taxpayers.

The motion also mandates that the feasibility, risks and potential benefits of a Bitcoin strategy be evaluated and reported to City Council by the end of the first quarter of 2025.

This is far from the first time that local foundations have allocated resources to study the benefits of the crypto market. Recall, earlier the management of the British pension fund Cartwright did the same.

The crypto industry will surely move to the final stage of the bullrun in 2025. Some analysts are already calling it the largest in the history of the market due to the presence of the largest companies in the world. It will be possible to check this version in practice very soon.

.

Look for more interesting things in our crypto chat. There we will talk about other topics that define the current bullrun in the digital asset and blockchain industry.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO KEEP UP TO DATE.