The most successful investments of 2024 in the cryptocurrency market. Where should you have invested your money?

Bitcoin has hit an all-time high this year at $108,000, with the launch of spot ETFs in the US and Donald Trump’s presidential election victory being the main catalyst. As a result, as of now, BTC is up 127 per cent since January 1. However, others in the cryptocurrency market have produced equally impressive results – and they’re something to keep in mind.

Decrypt journalists analysed the coin industry and its representatives to make a small rating of the most profitable crypto investments of 2024. For the selection of assets should have had an initial capitalisation of at least $ 500 million on January 1 - the indicator should not fall below this mark until this month.

So, what coins can be called the best of their kind?

Contents

- 1 Pepe – the meme record holder of the year

- 2 Sui – the king of altcoins

- 3 MicroStrategy shares – the best alternative investment

- 4 Dogecoin – the oldest meme token

- 5 XRP – an asset back in the game

- 6 BlackRock’s IBIT exchange-traded fund

Pepe – meme record holder of the year

One of the new meme tokens that has taken top positions is Pepe. It was launched last year based on the internet culture character Pepe the Frog.

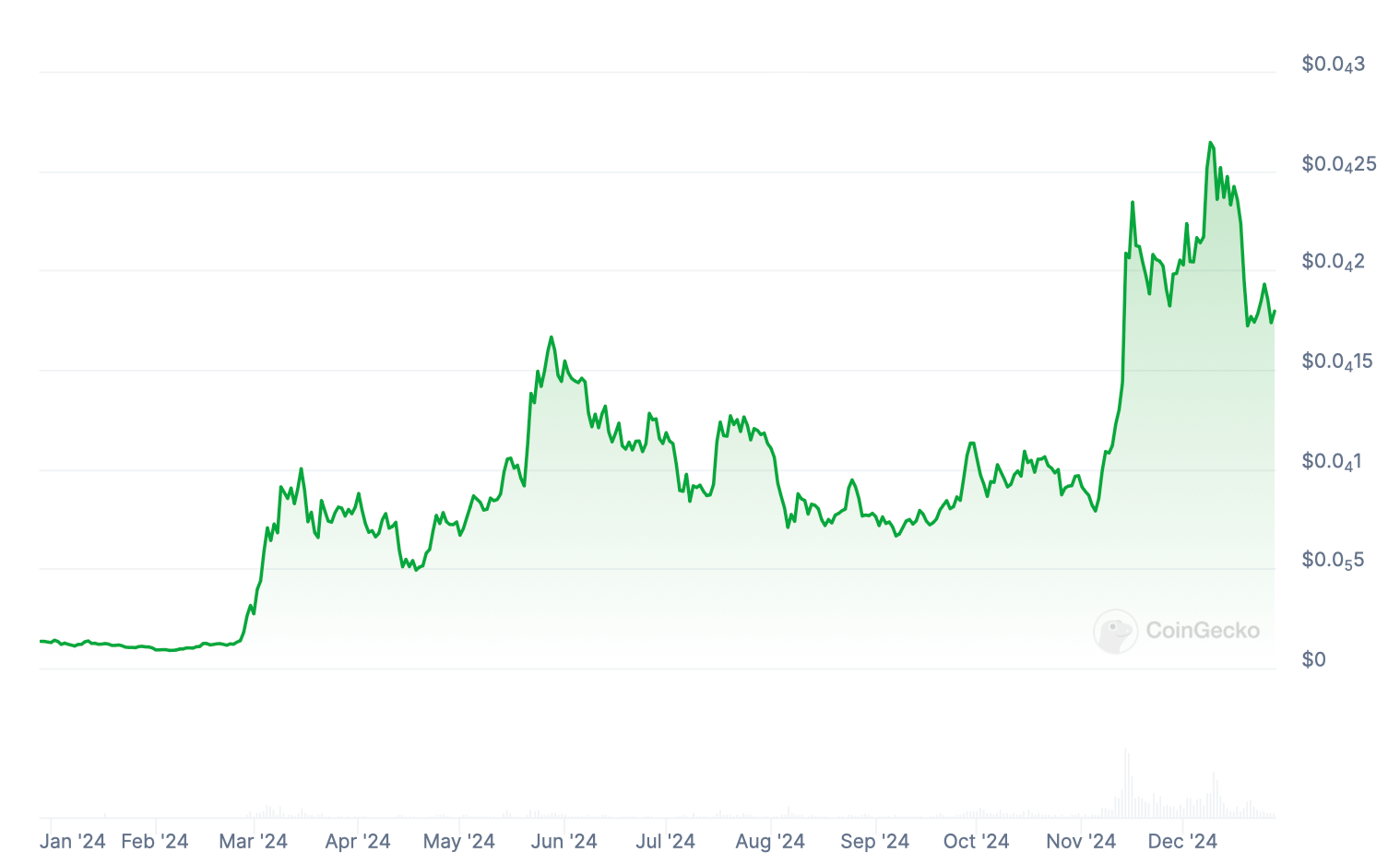

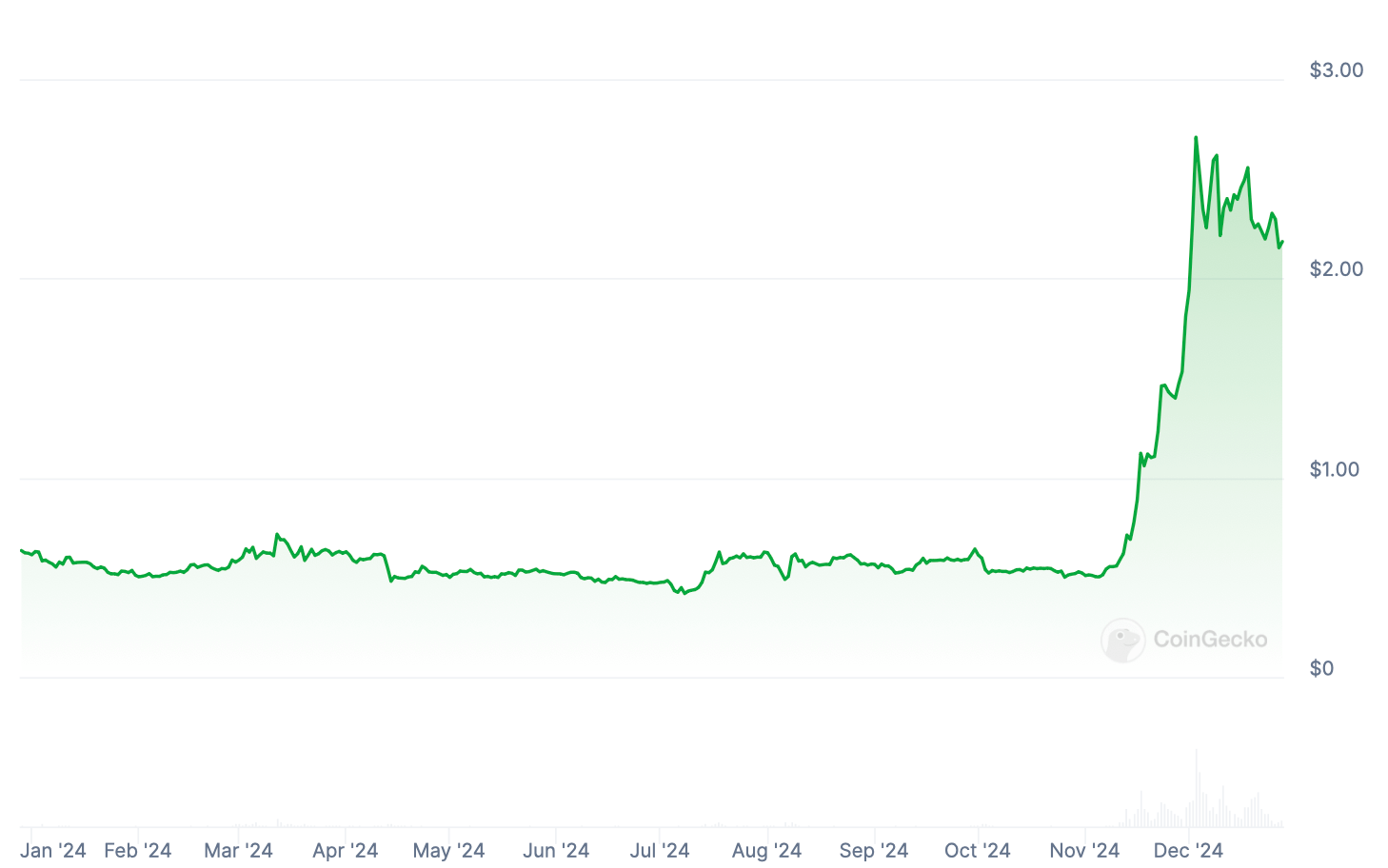

Pepe cryptoasset value change over the year

Pepe reached a new all-time high in December. The token based on the internet character started the year with a market capitalisation of $590.8 million, and by December 17 it reached the $9.4 billion line. That brings the total growth to 1,492 per cent.

Pepe caught the eye with its absurd meme-token-style value and how it made a small group of traders extremely wealthy. Unlike many other assets in its niche, Pepe has proven to be a “long-lived” asset and now ranks 28th in the cryptocurrency capitalisation rankings.

Sui – the king of altcoins

Sui appeared on the market relatively recently: the blockchain was launched in May 2023 by former Meta (formerly Facebook) engineers. Today, the project has an active community utilising its fast network.

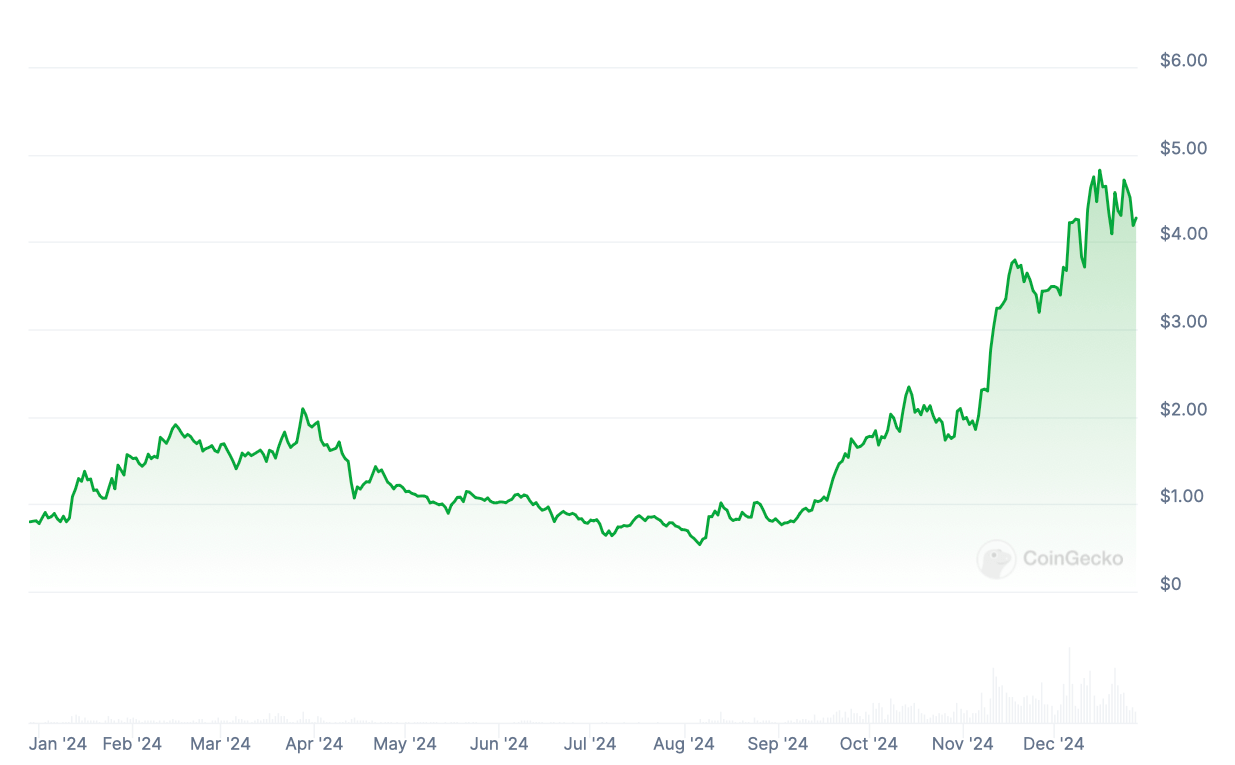

The change in the value of the Sui cryptocurrency over the year

SUI’s native asset has produced impressive growth this year. In January, its market capitalisation stood at $925 million. By December, it reached nearly $12 billion after growing by 1,193 per cent. SUI is now the 18th most capitalised cryptocurrency.

MicroStrategy stock is a better alternative investment

Michael Saylor’s company bet on Bitcoin back in August 2020, starting to add the cryptocurrency to its balance sheet on an ongoing basis. The result of this strategy and its success is clearly demonstrated by MSTR’s share price.

The change in MicroStrategy’s share price over the year

While at the beginning of the year they were trading below $70, by December the value had risen almost fivefold to $386, which equates to a 464 per cent increase. MSTR has outperformed many stocks on the Nasdaq, including Nvidia.

And the company’s association with crypto has been the foundation for this, as MicroStrategy’s activity today is primarily associated with Bitcoin rather than its rank-and-file tasks.

Dogecoin is the oldest meme token

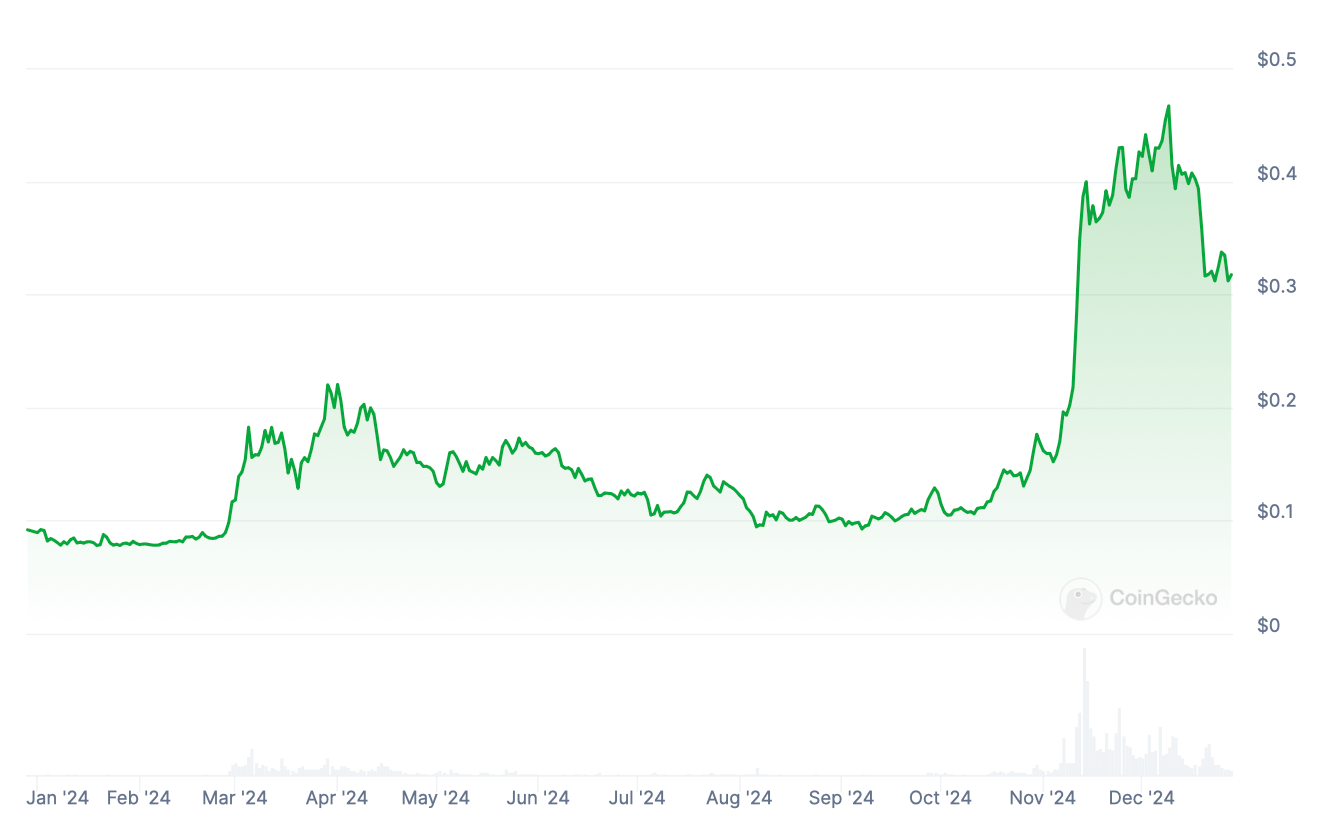

Dogecoin was created as a joke on the absurd amount of altcoins being issued, but it now ranks seventh in terms of market capitalisation. Its capitalisation has grown 342 percent this year and now stands at $45.9 billion. This growth has traditionally been fuelled by Bitcoin’s success.

The change in the value of the Dogecoin cryptocurrency over the year

In addition, billionaire Ilon Musk has joined in on what’s going on. Still, the Tesla CEO tweeted about Dogecoin frequently between 2020 and 2021. He has also brought the asset back into the spotlight this year amid rumours of a possible use of the coin by social network X under his leadership.

XRP is an asset back in the game

For XRP, this year has been quite successful. XRP’s capitalisation has grown so much that the coin has become the fourth largest in the world, rising from $34 billion to $131.2 billion. This month, the crypto briefly surpassed USDT and took third place, although as of 1 January it was ranked 6th.

The change in the value of the XRP cryptocurrency over the year

The asset has long been in the spotlight due to regulatory litigation, as the SEC previously filed a lawsuit against Ripple back in late 2020, accusing the company of selling unregistered securities. In 2023, Ripple partially won the case – a judge ruled that sales of XRP on cryptocurrency exchanges to retail investors could not be considered unregistered securities transactions.

The decision was a victory for Ripple and the entire crypto industry. However, the judge also ruled that $728 million worth of token sales to institutional investors still fell under securities law regulation.

BlackRock’s IBIT exchange-traded fund

This asset deserves a separate honourable mention. The year 2024 was an incredible year for Bitcoin, and BlackRock, the world’s largest investment company, contributed to it by giving those willing to invest in the cryptocurrency through an ETF.

This was the iShares Bitcoin Trust (IBIT), a traditional investment vehicle that allows investors to buy and sell Bitcoin-based stocks. The stock is traded on the Nasdaq.

BlackRock executive Larry Fink

Since it began trading in January, IBIT has broken multiple records for trading volume and capital inflows. By December, the fund's assets under management surpassed the 50 billion mark, a record. This result was achieved in just 228 days - faster than any other ETF in history.

Most importantly, IBIT has recorded $37.2 billion in net inflows to date. This is the best result in this category of investment instruments.

Statistics show that 2024 has been a great year of opportunity for crypto earnings. And although serious profitability affected not all coins, it was still realistic to get extra money. And 2025 promises to be the final year in the current crypto growth cycle, so you should not ignore it.

Look for more interesting things in our crypto chat. Do not linger outside of it.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO STAY INFORMED.