The Securities Commission will get new heads in January. What exactly will change for the cryptocurrency industry?

On 20 January 2025, newly elected US President Donald Trump will be inaugurated. Also on this day, the current SEC chairman Gary Gensler will resign, who will most likely be replaced by the already familiar Paul Atkins. The latter is considered a good candidate for the cryptocurrency industry, which means the SEC’s approach to coins will change for the better. But what exactly should we expect from the new leadership of the key financial regulator?

Alas, the SEC chairman appointed by Joe Biden is remembered by crypto enthusiasts as being exceptionally bad. Still, Gary Gensler’s approach was to accuse crypto projects of belonging to the category of unregistered securities, which eventually became a reason for lawsuits. This strategy was even called regulation through coercion.

Thus, representatives of Binance, Kraken, Coinbase and many other well-known companies found themselves in court, while some platforms like the decentralised exchange Uniswap received the so-called Wells Notice, hinting at the imminent trial.

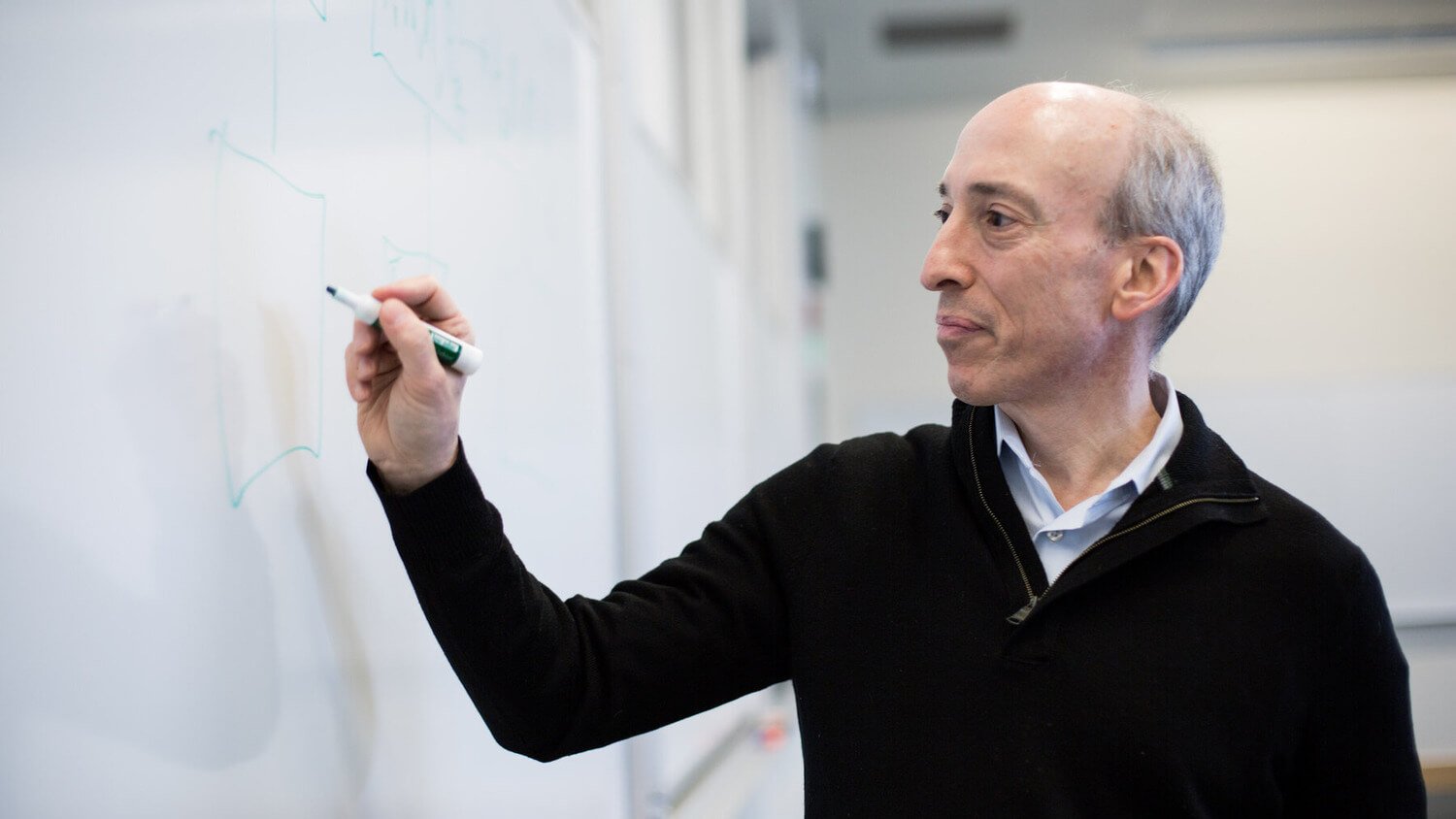

Current SEC Chairman Gary Gensler

The Commission required cryptocurrency companies to obtain special registration with the regulator, but did not disclose details of the process. Yes, under Gary Gensler, the SEC did approve spot ETFs for Bitcoin and Efirium, but that decision was clearly political.

Next, we are tentatively awaiting an adequate line-up of regulatory commissioners. Therefore, the changes here will prove to be more drastic.

Contents

- 1 Who will lead the SEC in 2025

- 2 Support for ETF-based staking

- 3 New rules to regulate cryptocurrencies

- 4 Current SEC lawsuits

Who will lead the SEC in 2025

As we have already noted, Trump has chosen Paul Atkins, who is known for his positive attitude towards the coin market, to be the Chairman of the Commission. Technically, this nomination also has to be approved by the Senate, but this is usually not a problem.

According to Proof of Stake Alliance platform manager Alison Mangiero, “Atkins truly understands the field of cryptocurrencies.” With that in mind, the revamped SEC will have “very different priorities than the SEC under Gensler.”

It's important to note that not only Gensler, but also Democratic Commissioner Jaime Lizarraga will resign in January. Accordingly, the regulator will be led by at least three Republicans - Paul Atkins, Mark Uyeda and Hester Pearce. And because they belong to a single party, agreeing changes for the coin sphere will surely be easier.

The next chairman of the Securities Commission is Paul Atkins

Here’s a comment on this from Theresa Goody Guillen, a partner at law firm BakerHostetler, as quoted by The Block.

There are already three representatives of the same political party on the Commission. Which means after the Senate confirms Paul Atkins’ nomination, Democrats are likely counting on him to nominate someone from the other party fairly quickly. However, that decision will have to be correlated with a host of other presidential appointments that are now being prioritised.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

As a reminder, SEC commissioners can’t be more than three people from the same party. Therefore, the remaining fourth member of the Commission’s leadership will belong to a different political force.

SEC Commissioner Hester Pierce

That doesn’t mean it’s specifically about Democrats, however. It could be a representative of the Libertarian Party, an independent candidate, or a member of any other party.

Below, we list three key changes for crypto that you can count on after the change in Commission leaders.

Support for staking at the core of ETFs

In January 2024, the Securities Commission approved the launch of spot Bitcoin ETFs. Then in July, ETH exchange-traded funds began trading.

However, in the case of the latter, the SEC objected to sending some of the coins in the ETF basis to native coin-stacking on the network, which would have increased the yield of the investment instrument. In general, it is a question of allocating only a small fraction of coins for this purpose, which means that the impact on the yield of the ETF would be insignificant. However, the Commission did not approve this either.

Approval of spot ETFs for cryptocurrencies in the U.S.

According to Alison Mangiero, a revamped regulator could change that. Here’s the cue.

There are many obvious opportunities that this SEC could realise in its first few months in office, thus sending a good signal. To that end, we are pushing the idea of steaking being part of such products.

New rules to regulate cryptocurrencies

During the election campaign, Donald Trump repeatedly spoke about the desire to ensure adequate regulation for the coin sphere. The SEC is already considering projects that could affect the crypto industry.

One of them is the so-called “Regulation ATS”, that is, the regulation of alternative trading systems. Under it, the Commission could require decentralised exchanges to register with the agency.

If the current SEC does not approve this rule before Trump’s inauguration, then the new set of regulators will comprehensively decide whether to mess with it. DeFi Education Fund CEO Miller Whitehouse-Levin shared this opinion.

I don’t think they will approve it in the same way that the current Commission would have approved it – or maybe they will drop the initiative altogether. It all depends on priorities.

SEC building

Ron Hammond of the Blockchain Association even admits that the SEC could start drafting new rules under its purview while Congress is busy approving general operating rules. However, there is no clarity here yet.

Current SEC lawsuits

An important issue in terms of the SEC’s leadership change is the fate of current and new litigation with the blockchain industry.

Goody Guillen believes that there will be significantly fewer such cases involving cryptocurrency companies.

There are expected to be fewer non-fraud cases where there are no investor losses. In addition, I think we will see fewer new and unusual cases, including those that seek to establish precedent.

The expert adds that the Commission may drop cases that do not involve unregistered securities. In such a case, the cases could be redirected to the Ministry of Justice and other similar bodies.

Newly elected US President Donald Trump

As Whitehouse-Levin added, he and his colleagues will wait for changes in the industry and analyse them thoroughly. At the same time, their expectations from the new composition of the SEC remain the same.

Obviously, analysts' expectations from the SEC reshuffle are proving to be moderately positive. However, the merit in this is not only Paul Atkins. First of all, the SEC's reputation and its overall adequacy was destroyed by Gary Gensler. So any normal changes would clearly benefit the market.

Look for more interesting stuff in our cryptocurrency chat room. Come in!

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO STAY INFORMED.