What conclusions can be drawn about the current stage of crypto growth: experts’ versions

Spot Bitcoin-ETFs are almost a year old in the market, with their combined trading volume approaching the $600 billion mark at the end of the week. The launch of these exchange-traded funds in January 2024 marked the unofficial start of the current bullrun in the cryptocurrency industry, i.e. the phase of its active growth. Now the Bitcoin exchange rate has crossed the record line of 100 thousand dollars, in connection with which niche experts make the first global conclusions from the bullish trend.

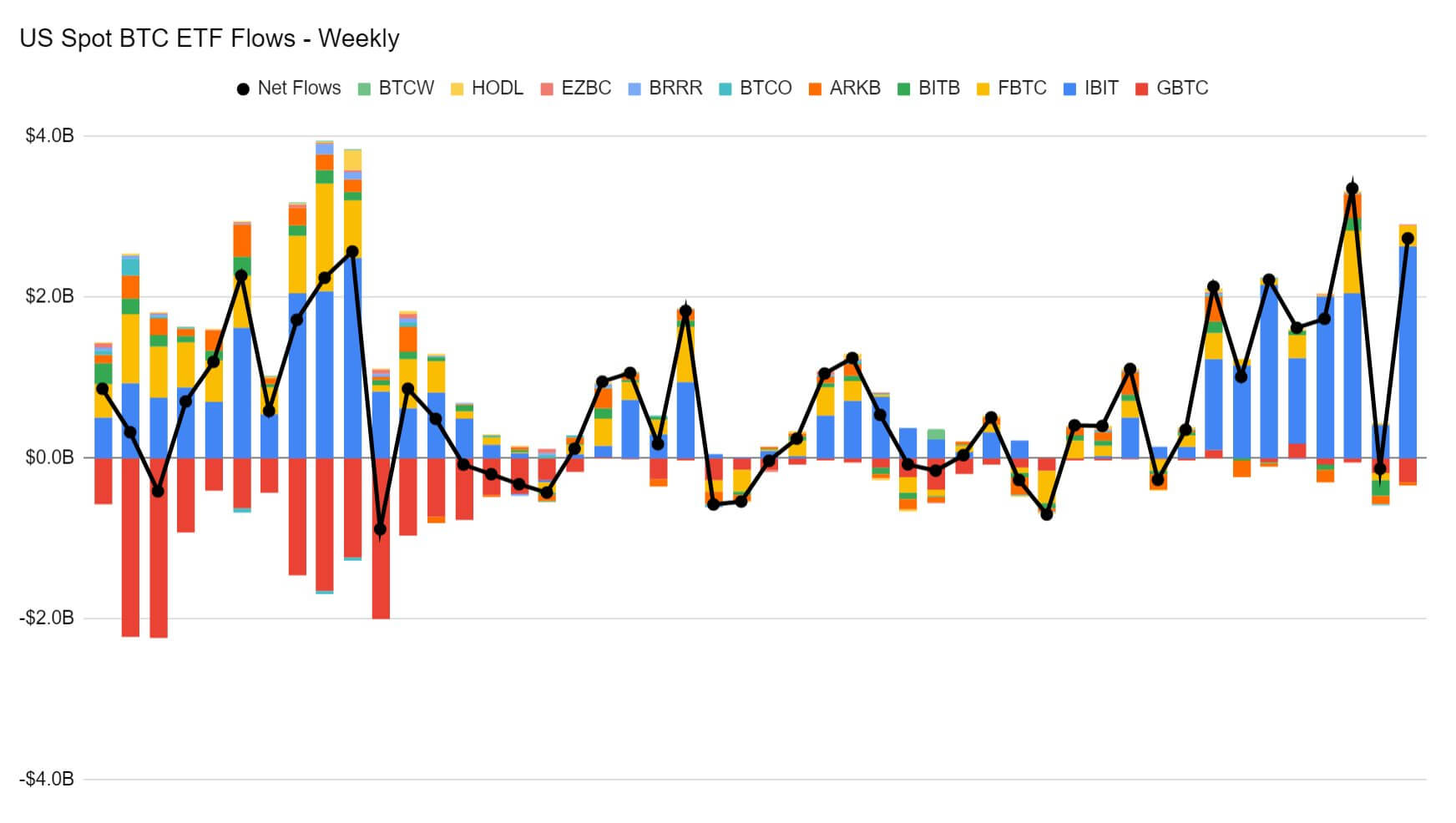

Spot exchange-traded funds on cryptocurrencies in the United States show excellent results. At the end of the last week, Bitcoin-based ETFs recorded a net capital inflow of 2.72 billion, causing the total since their launch to reach 33.3 billion.

Capital inflows and outflows from spot Bitcoin ETFs in the U.S. by week

The instruments on Efirium can also boast of not bad results. For example, during the week they attracted $837 million, which brought the total inflow of funds to the mark of 1.5 billion.

All this confirms the interest of financial market players in crypto and their increasing recognition.

What is happening in the cryptocurrency market

Many opinion leaders were speakers at the Emergence event, organised in partnership with The Block. Among them was 21Shares co-founder and CEO Hani Rashwan, who shared the following opinion on what’s happening.

We are seeing a tipping point in the global order for the first time in a long time. We are seeing a threat to the reserve currency status that the U.S. dollar has.

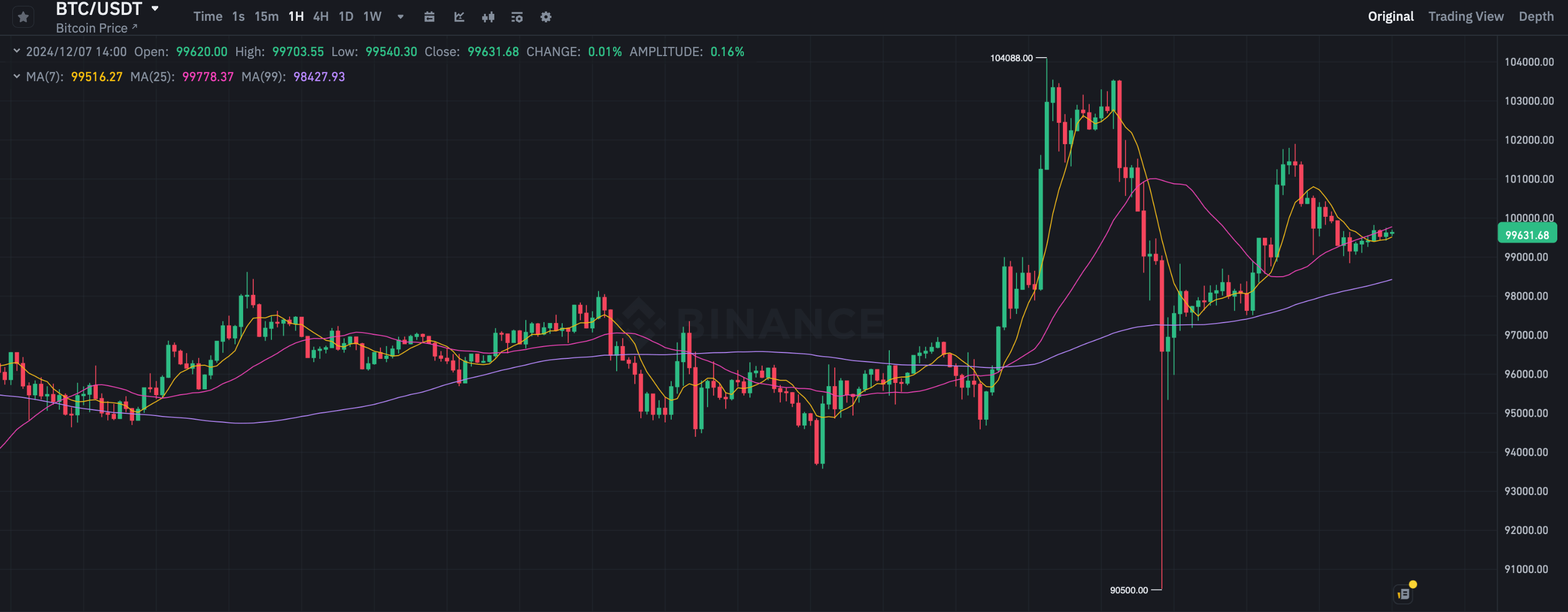

Hourly chart of the Bitcoin BTC exchange rate

21Shares has 53 exchange-traded products in the European market, with the large institutional player also being the issuer of the Bitcoin-based ARKB exchange-traded fund. The popularity of this and other funds helped Bitcoin break the $70,000 mark in March, and after a summer correction, the price soared even higher thanks to Donald Trump’s re-election as US president.

Now US big investors are paying more and more attention to the crypto, according to Coinbase regional head Daniel Seifert. Here’s his comment.

We are seeing a huge number of serious players from the US. We are talking about institutional players who are supporting the development of crypto and creating their distribution networks here.

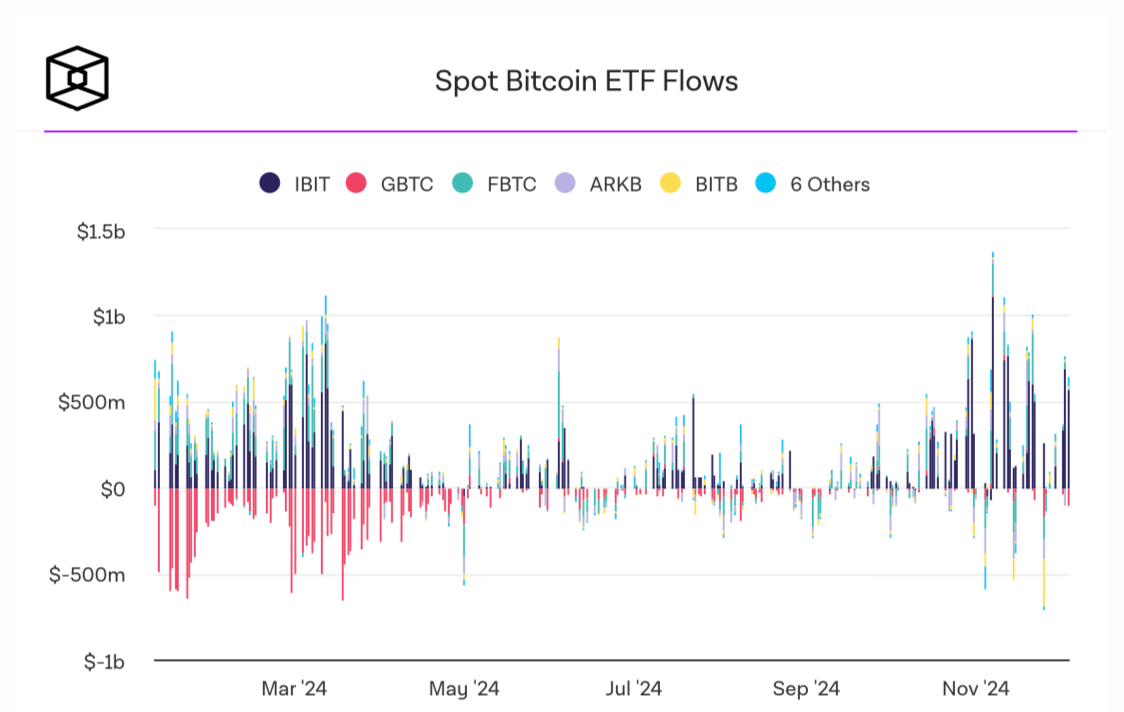

Inflows and outflows from spot Bitcoin-ETFs

The best-known name on this list is BlackRock, the issuer of the largest Bitcoin-ETF called iShares Bitcoin Trust (IBIT) by assets under management. On Monday, it crossed the 500,000 BTC mark or about $48 billion at the time under management.

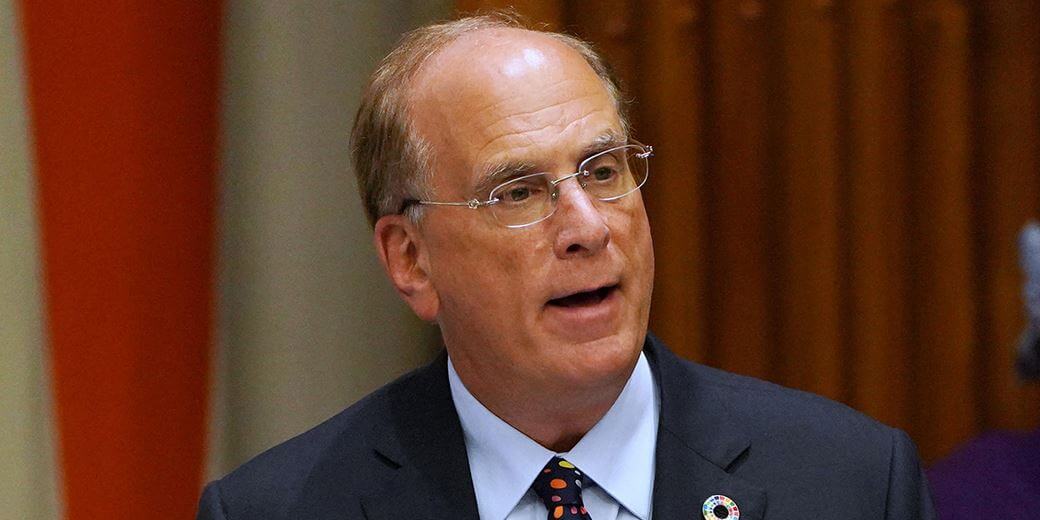

Recall that BlackRock CEO Larry Fink admitted back in July that he was “wrong” about cryptocurrencies, and has radically changed his position over the past five years.

BlackRock’s progress was commented on by K33’s head of research Vetle Lunde. Here’s the quote.

BlackRock’s ETF exceeding the 500k BTC level is another huge milestone after an amazing launch year. IBIT has become the third-best U.S. ETF in inflows since the start of the year, ahead of even Invesco’s QQQQ.

Bloomberg analyst Eric Balchunas separately noted that over the previous five days of trading this week, the spot ETF under BlackRock's IBIT ticker attracted $2.5 billion in net inflows. As the expert noted, this is the largest result among all exchange-traded funds in general.

BlackRock investment fund manager Larry Fink

The growing popularity of stablecoins also contributed to the overall increase in demand for cryptocurrencies. This opinion was voiced by John Swolos, head of research at SkyBridge Capital.

Ironically, the most important assets outside of the Bitcoin ecosystem are the US dollar-linked stablecoins. While demand for Bitcoin can be attributed to concerns about any currency, the US is actually benefiting thanks to the globalisation of stablecoins.

The capitalisation of USDT, the largest US dollar-based stablecoin, has risen sharply over the past three weeks. According to Tether CEO Paolo Ardoino, this is due to massive capital injections into Bitcoin-ETFs. Accordingly, staples continue to be a key bridge between the world of fiat and digital assets.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Meanwhile, California-based Semler Scientific acquired an additional 303 BTC worth $29.3 million. The company has thus increased its total cryptocurrency reserves to 1,873 BTC.

Cryptocurrency purchases by investors

On Thursday, company officials said that the crypto purchase round was made between 25 November and 4 December at an average price of $96,779 per BTC including fees and expenses. A total of 1,873 BTC were purchased for $147.1 million at an average price of $78,553. Accordingly, the team is now in a nice plus position.

Semler Scientific officials said that their strategy has generated a 78.7 percent return since July 1. Meanwhile, BTC yield is used as a key performance indicator to evaluate a crypto market strategy.

Definitely, the launch of spot Bitcoin-ETFs in the US turned out to be one of the most important events of this year for the cryptocurrency market. Thanks to these instruments, the interest of large institutional investors in coins has increased significantly, which has affected their perception in the world. So for now, we can imagine what will happen in crypto after the change of SEC leadership and approval of an adequate regulatory framework for digital assets in the US.

For more interesting stuff, check out our crypto chat room. Be sure to go there to discuss everything interesting from the world of blockchain and decentralised platforms.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO KEEP UP TO DATE.