What new crypto ETFs will emerge in 2025: detailed forecast by Bloomberg analysts

Next year should be rich in new opportunities for those big investors who have long wanted to get involved with digital assets. Still, Bloomberg analysts Eric Balchunas and James Seyffarth predict that in 2025, U.S. regulators will approve a number of spot exchange-traded funds based on popular altcoins. Accordingly, holders of serious capital will have a chance to invest it in instruments based on top digital assets.

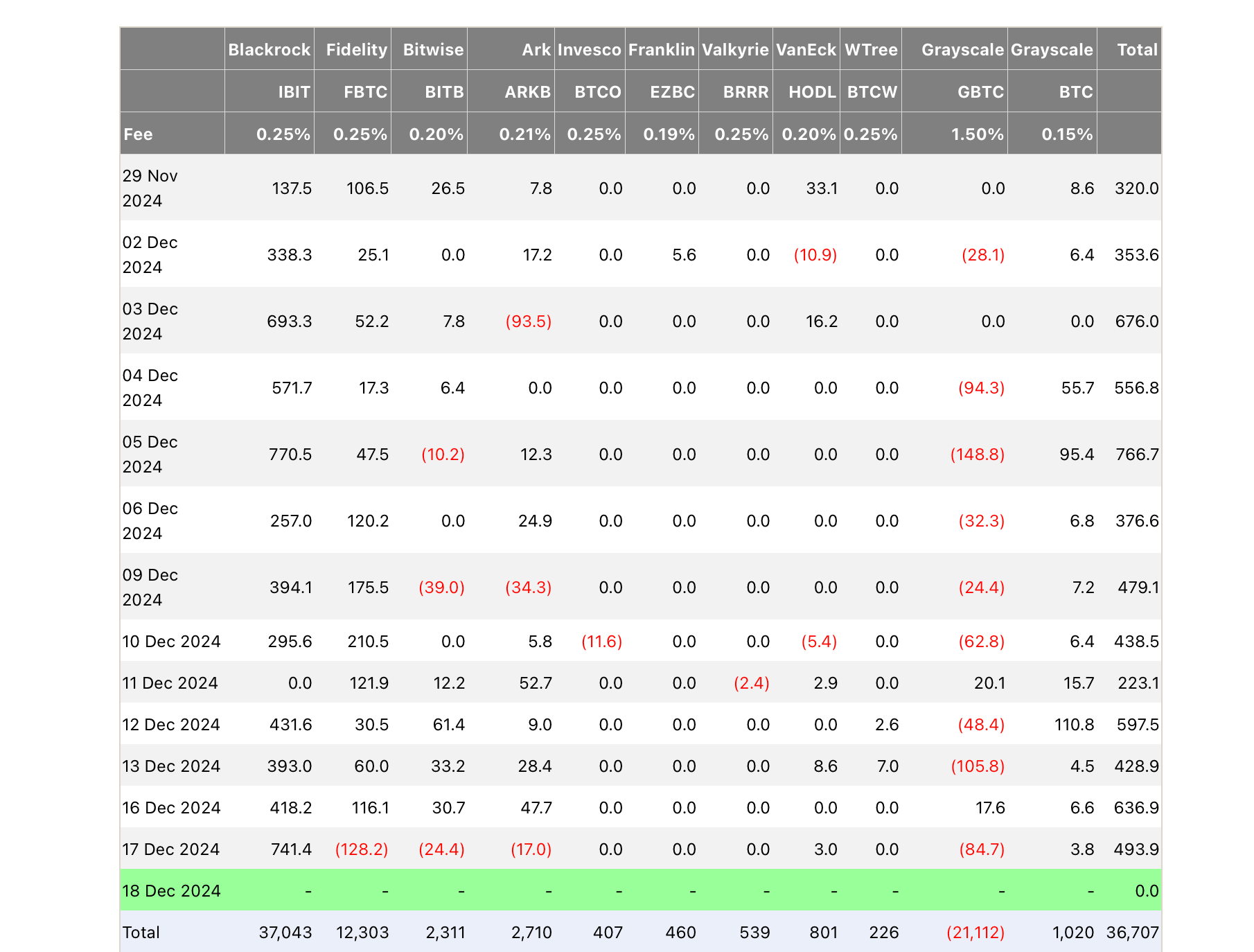

Recall that the listing of Bitcoin-based spot ETFs in early 2024 gave the main cryptocurrency a strong boost for growth. Since then, total net capital inflows into such instruments have totalled an incredible $36.7 billion.

Information on capital flows in spot Bitcoin-ETFs in the United States

BlackRock’s iShares Bitcoin Trust instrument accounts for most of the figure – the fund attracted 37 billion. Grayscale’s GBTC hit a record withdrawal of 21.1 billion.

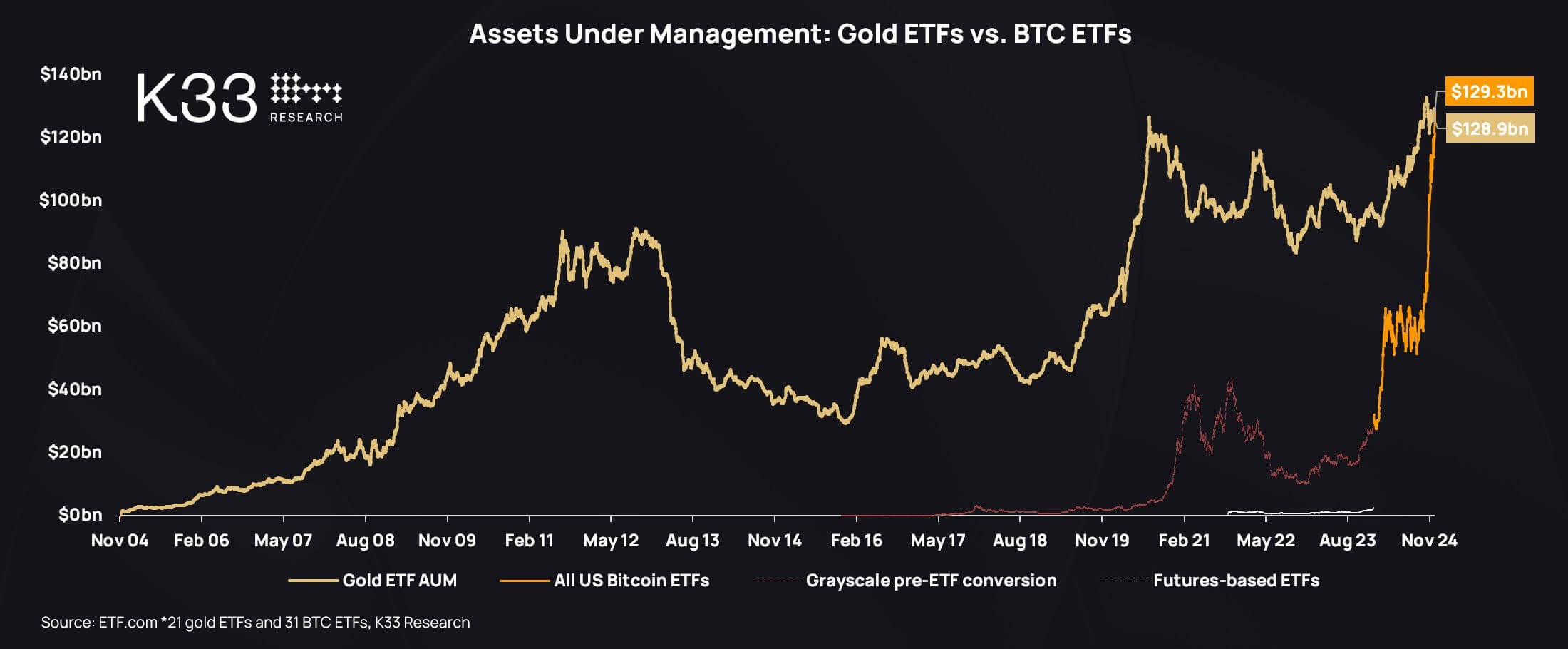

Most importantly, this week the volume of assets under management of Bitcoin-ETF in the U.S. surpassed the corresponding indicator of exchange-traded funds for gold. It was possible to achieve this result faster than in a year since the novelties were introduced.

The volume of funds under management of ETFs for Bitcoin and gold

What to invest in 2025

Bloomberg representative Eric Balchunas shared his prediction on Twitter. Here’s his rejoinder on the matter, as quoted by The Block.

We expect a wave of cryptocurrency-based ETF approvals next year, though it won’t happen simultaneously for different assets. Combined exchange-traded funds for Bitcoin and Etherium will go first, and then a similar thing is likely to happen for Litecoin, HBAR, XRP and Solana.

Following Donald Trump’s victory in the US presidential election in November and news of the imminent resignation of current Securities and Exchange Commission (SEC) chairman Gary Gensler, rumours of approval for new ETFs have received a lot of support.

Still, Gensler is justifiably considered an opponent of digital assets or cryptocurrency-based investment products – and even after the launch of crypto-based exchange-traded funds by major Wall Street players.

Despite this, his vote was still the deciding vote in favour of launching spot Bitcoin-ETFs in January 2024. Perhaps in this way the official wanted to position himself as more liberal with a normal attitude towards digital assets, although in practice the situation is completely opposite.

The reluctance of the current leadership of US regulators to approve spot ETFs based on popular altcoins

Proposals to list ETFs based on Solana and XRP have already been submitted, but the likelihood of their approval in the foreseeable future remains extremely low. According to James Seyffarth, there is a good chance of a Litecoin or HBAR-based ETF being approved faster than other altcoins, as there is a notable demand for them.

Plus, the SEC supposedly does not classify these digital assets as securities. At the same time, the situation on the coin market seems to be the opposite: after all, the favourites of investors among the listed cryptocurrencies are XRP and Solana.

According to sources, in 2025, some issuers plan to submit additional applications for ETFs based on Solana and even Dogecoin. This opinion was supported by ETF Store President Nate Geraci – here’s his rejoinder.

I believe that Solana-based ETFs are very likely to be approved by the end of next year at the latest.

In late June, investment giants VanEck and 21Shares filed applications to launch spot ETFs on SOL. Accordingly, the prospect of such investment products seems significant - especially given the imminent change of the SEC leadership to people who are good with crypto.

Two Prime Digital Assets CEO Alexander Blum agreed with Geraci and said that issuers “wouldn’t spend time and money on this if they weren’t confident of success.” This prediction sounds realistic: still in 2023, many had doubts about the prospects of a Bitcoin-ETF, but they were dispelled in early 2024.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

The appearance of new ETFs will be the result of a more favourable attitude of the administration of US President-elect Donald Trump towards crypto. Moreover, he clearly managed to win the election with the participation of cryptocurrency voters.

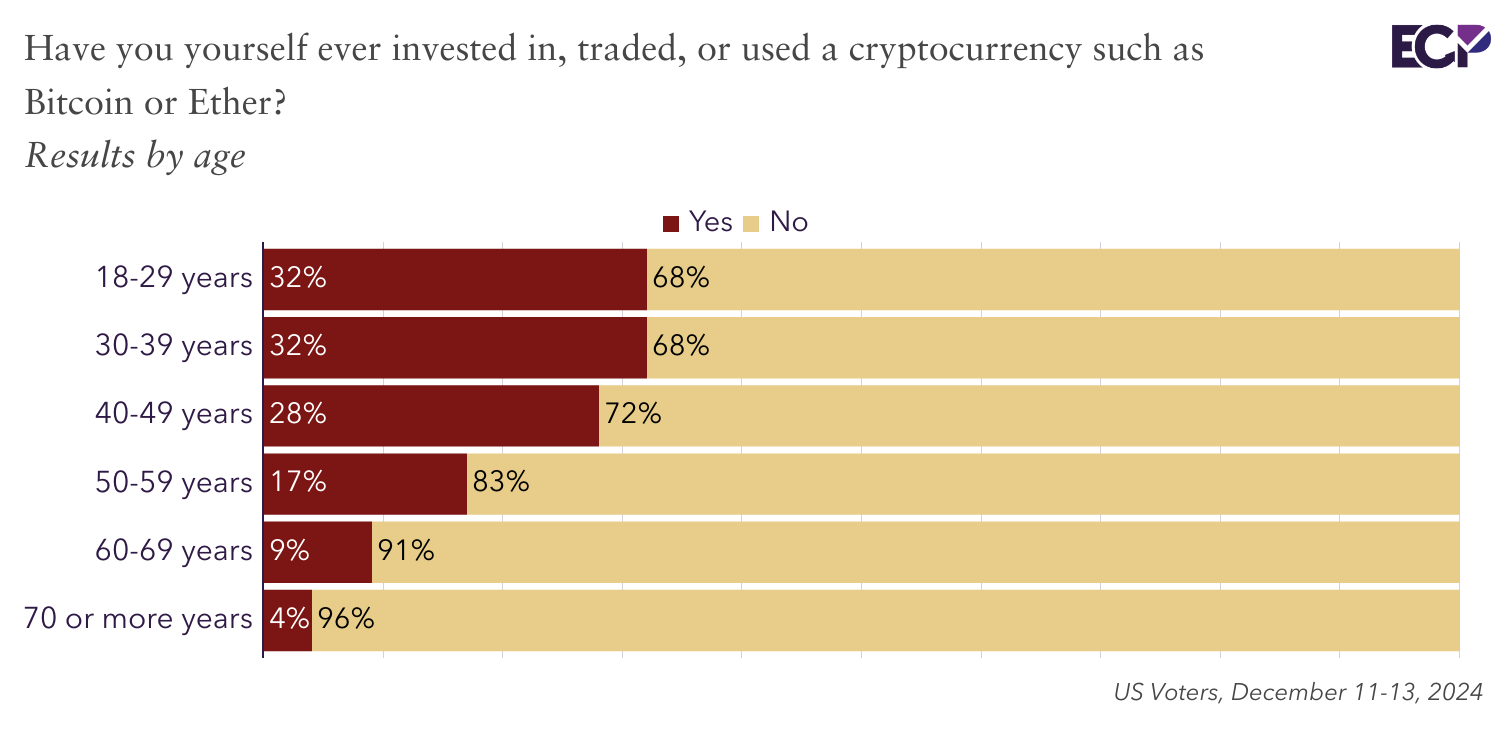

As Cointelegraph notes, nearly one in five US voters (19 per cent) say they have ever invested in, traded or used digital assets, according to a new Emerson College poll.

The survey data on engagement with cryptocurrencies in the US

The data was released on 17 December and is based on a survey of 1,000 registered voters from 11 to 13 December. The survey showed that nearly 40 per cent of respondents who used cryptocurrencies also made purchases with it.

Spencer Kimball, executive director of Emerson College’s polling department, commented on the survey results.

Cryptocurrency users are younger and include more minorities, highlighting them as a growing and diverse group of voters. 57 per cent of cryptocurrency users have a positive view of Donald Trump.

Trump’s campaign showed his support for the crypto industry. Since then, he has picked a host of market supporters for key government positions, including Paul Atkins for SEC chairman. The survey showed that respondents under 40 had the highest proportion of respondents using cryptocurrency – almost a third of people.

Buying cryptocurrency by investors

Men use cryptocurrency twice as often as women, with 26 per cent of men and 13 per cent of women reporting transactions in digital assets. About a third of cryptocurrency users were Asian, Hispanic or black, while only 14 per cent were white. Approximately 40 per cent of voters surveyed support banning the social network TikTok, but the figure is much lower among respondents under the age of 29.

For more interesting stuff, check out our cryptocurrency chat. We look forward to seeing you there today.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM. MORE INTERESTING NEWS HERE.