What new cryptocurrency ETFs could emerge in 2025? Detailed expert forecast

The year 2025 could be a period of real breakthrough for many cryptocurrency-based exchange traded funds. As of today, spot ETFs based on only two coins – Bitcoin and Etherium – are available in the US. This in any case limits the opportunities for large investors to invest capital in the ecosystems of various altcoins. But what will change next year? Thoughts on the subject were shared by well-known analysts.

Which cryptocurrency ETFs to buy in 2025?

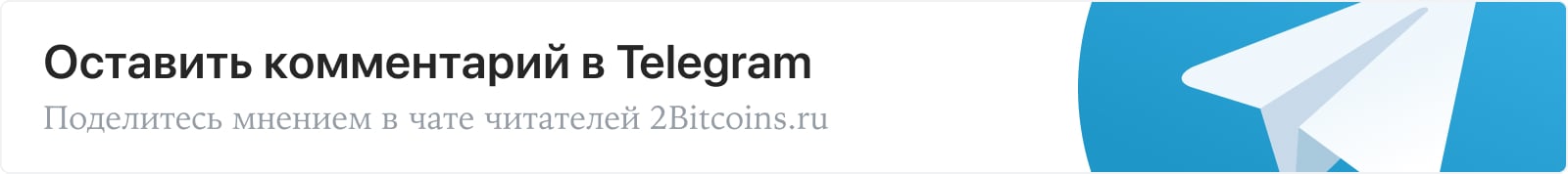

It hasn’t even been a year since the Securities Commission approved spot Bitcoin ETFs, but now more than 5 per cent of total BTC is already managed by such exchange-traded funds.

A total of eleven Bitcoin ETFs in the U.S. have accumulated more coins than the known wallets of the anonymous creator of the main cryptocurrency under the pseudonym Satoshi Nakamoto.

Assets under management in cryptocurrency ETFs

Anchorage Digital CEO and co-founder Nathan McCaulay commented on the effect created by the emergence of exchange traded funds in an interview with The Block. Here’s his rejoinder.

Since January, the history of cryptocurrency ETFs is a sign of the continued maturity of the market. The market is becoming more developed for both institutional and retail players.

Bitcoin ETFs were approved and launched in January 2024, with the approval of spot ETFs based on Etherium following in July. According to ETF Store president Nate Geraci, supporting a broader range of altcoins will be a key issue for 2025. Here’s his cue.

Generally speaking, cryptocurrency regulatory trends have shifted significantly, and there is now much more optimism about the possibility of additional exchange traded funds based on digital assets entering the market.

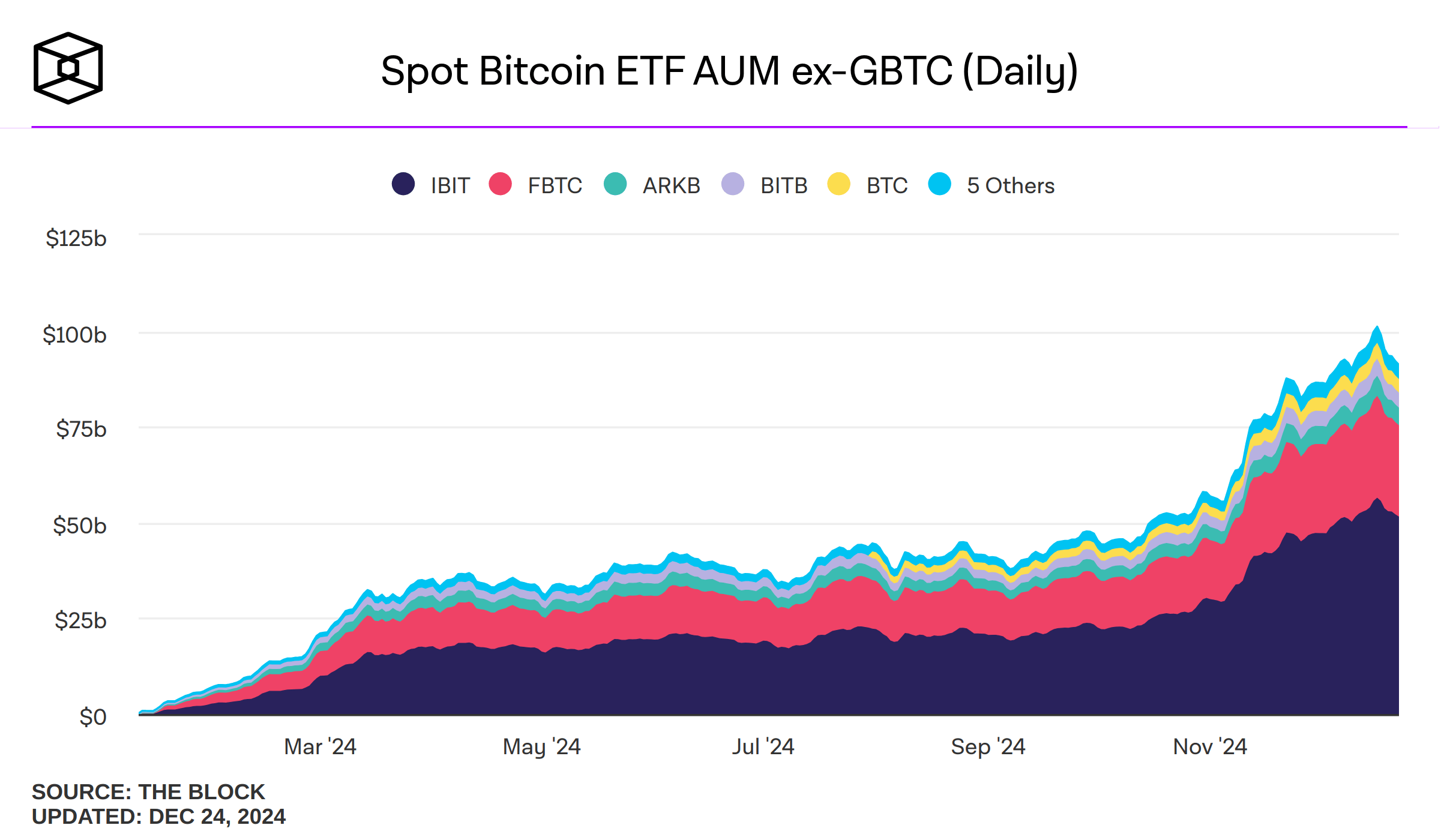

Inflows and outflows from spot Bitcoin-ETFs in the US

In the race to approve altcoin-based spot ETFs, BlackRock, the Wall Street investment giant and the world’s largest investment firm, is unlikely to be directly involved. BlackRock now owns the largest Bitcoin-based exchange-traded fund called iShares Bitcoin Trust (IBIT). However, according to the company’s representatives, even BlackRock’s own clients in their majority do not own IBIT shares at all, which means the firm will focus on developing this sector for the time being.

In opposition to the prospects of listing new ETFs for a long time was the leadership of the U.S. Securities and Exchange Commission (SEC), which continues to fight with the coin industry even now. However, the regulator’s current chairman, Gary Gensler, has announced that he will leave office on 20 January 2025, which is the day of Donald Trump’s inauguration.

At the same time, the newly elected president proposed Paul Atkins, a long-time supporter of cryptocurrencies, to head the SEC. According to McCaulay, this factor will play into the hands of the coin market. Here’s his rejoinder.

The next presidential administration and Congress promise to bring greater regulatory clarity to the ecosystem. The industry will be watching several key areas in 2025: new bills on crypto and stablecoins in particular, a more open attitude to innovation in digital assets, and movement around Bitcoin’s strategic reserve in the US.

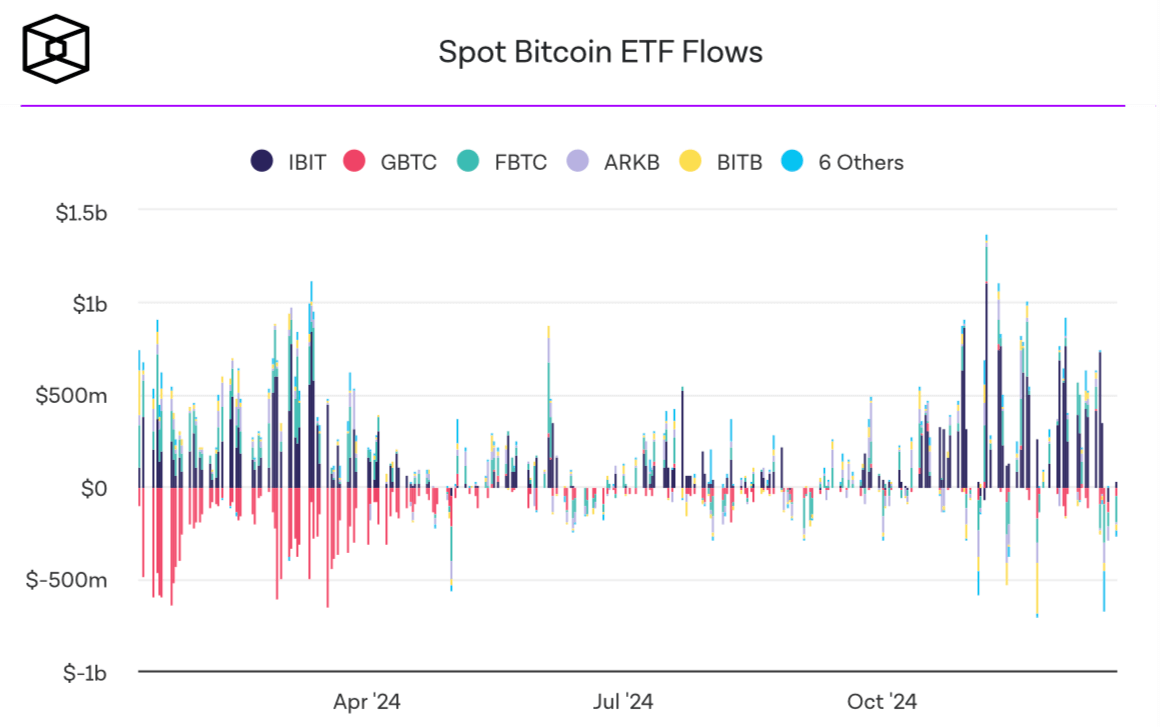

Comparison of Bitcoin and gold inflows adjusted for inflation

The Tax Cuts and Jobs Creation Act, passed in 2017 under Trump, expires at the end of next year. That could pave the way for cryptocurrency-related tax proposals, including a tax clarity bill for digital assets. The latter including being able to clarify that staking rewards should only be taxed when sold, not when the assets accrue.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Could a Solana-based ETF hit the US market by the end of 2025? Nate Geraci believes that such an event is highly likely.

I believe it is highly likely that a Solana-based ETF will be approved by the end of next year. It seems the SEC is already engaging with issuers on this product, which is clearly a positive sign.

The success and precedent of Bitcoin and Efirium spot ETFs along with a more cryptocurrency-friendly regulatory environment will lead to the emergence of SOL ETFs within the next year. This is the opinion shared by Alexander Bloom, CEO of Two Prime Digital Assets.

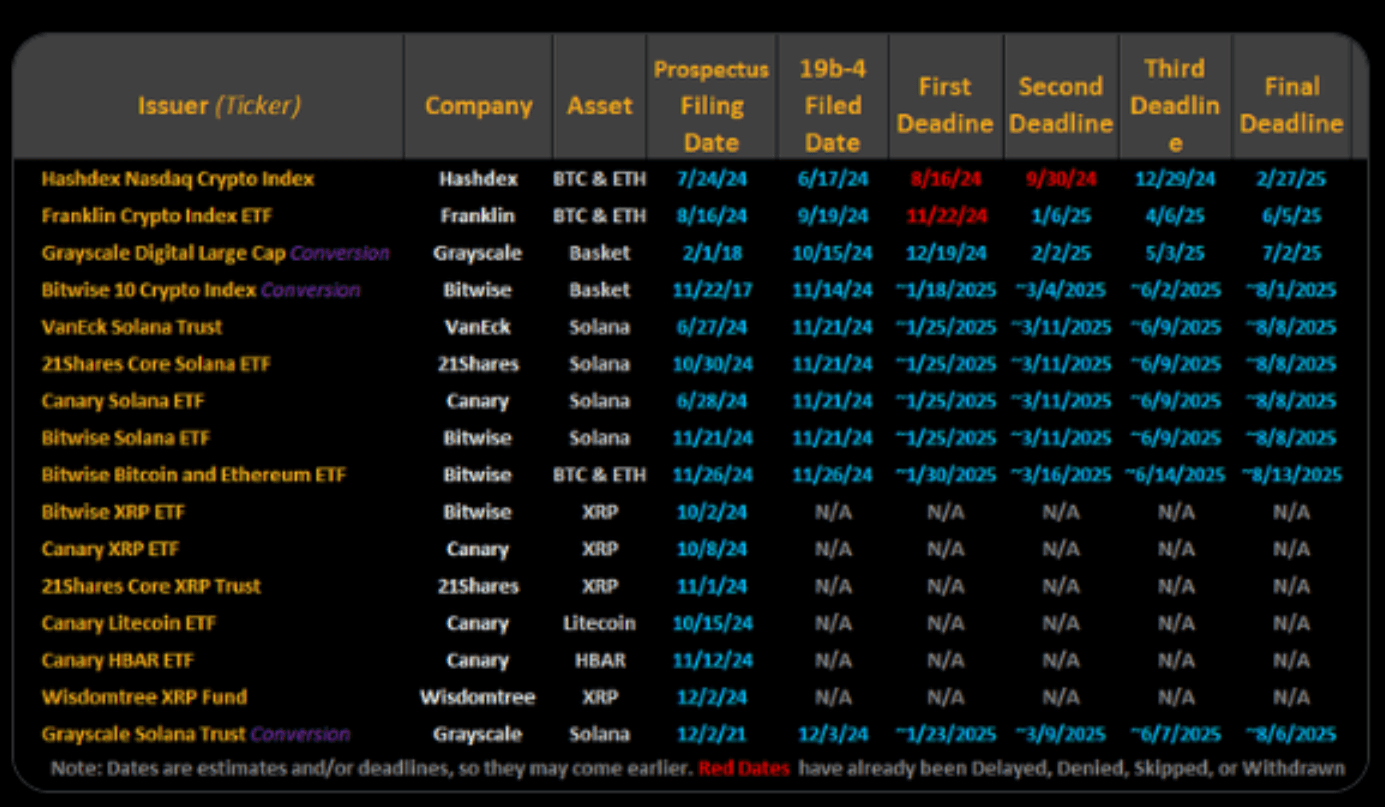

List of current applications for cryptoETFs

However, according to analysts at JPMorgan Bank, the SEC is in a position to require the resolution of lawsuits related to unregistered securities for these assets before approving spot ETFs. This would delay new ETF approvals and require resubmissions that would take additional time to review.

There are currently multiple applications for a host of altcoin-based ETFs, including Solana, XRP and even Hedera, as well as index ETFs from Grayscale and Bitwise. Bloomberg analysts Eric Balchunas and James Seyffarth predict a “wave” of new ETFs – including a combined ETF based on Bitcoin and Etherium, Litecoin and Hedera, as well as spot funds for Solana and XRP.

It looks like 2025 will be a continuation of the success of cryptocurrency ETFs. Still, BTC-based spot exchange traded funds have recorded net inflows of $35.4 billion over the past partial twelve months. And there is no reason for this indicator to decrease on the horizon.

.

Look for more interesting stuff in our crypto chat. Wait for us there to talk in detail about the current situation on the digital asset market.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.